Private Credit's Widening Cracks: Assessing The Pre-Turmoil Landscape

Table of Contents

Rising Interest Rates and Funding Pressures

The rapid rise in interest rates has significantly impacted the private credit market, creating substantial funding pressures and reducing liquidity. This section explores the consequences of this shift for private credit funds and leveraged buyouts (LBOs).

Reduced Liquidity in the Private Credit Market

The increased cost of borrowing has drastically reduced the availability of funding for private credit funds. This liquidity crunch stems from several factors:

- Decreased availability of bank loans and other traditional funding sources: Banks, facing their own regulatory pressures and economic uncertainty, are less willing to lend to private credit funds, tightening credit conditions.

- Higher cost of borrowing impacting fund returns and investor appetite: The increased interest rates directly translate to higher borrowing costs for private credit funds, squeezing profit margins and potentially lowering returns for investors. This makes private credit less attractive compared to other investment options.

- Increased pressure on fund managers to refinance existing debt at higher rates: Funds with existing debt face the challenge of refinancing at significantly higher rates, potentially impacting their financial stability and ability to meet their obligations. This refinancing risk is a key vulnerability in the current environment.

Impact on Leveraged Buyouts (LBOs)

The higher cost of debt is profoundly impacting the leveraged buyout (LBO) market, a cornerstone of private credit activity.

- Increased scrutiny by lenders on deal structuring and financial projections: Lenders are now more cautious, demanding more rigorous due diligence and stronger financial projections before approving LBO financing.

- Higher hurdle rates required for LBOs to be financially viable: The increased cost of debt necessitates higher returns for LBOs to be successful, making fewer deals financially feasible. This leads to a slowdown in deal activity.

- Potential for distressed deals and defaults as debt burdens become unsustainable: Companies burdened with high levels of debt from LBOs may struggle to service their obligations in a rising interest rate environment, potentially leading to defaults and distressed situations. This increases the risk profile of the private credit market.

Concerns Around Credit Quality and Portfolio Performance

The current economic climate and rising interest rates are raising serious concerns about the credit quality and performance of private credit portfolios.

Increased Defaults and Rising Non-Performing Loans

The combination of economic slowdown and higher interest rates is creating a perfect storm for increased defaults and non-performing loans (NPLs) within private credit portfolios.

- Vulnerability of companies with high levels of debt and weak cash flows: Companies with already stretched balance sheets are particularly vulnerable to rising interest rates and economic headwinds.

- Increased pressure on fund managers to manage and potentially write down assets: Fund managers face the difficult task of managing distressed assets and potentially writing down the value of their investments, impacting overall portfolio performance.

- Potential for contagion effects as defaults in one part of the market impact others: Defaults in one area of the private credit market can trigger a domino effect, impacting other borrowers and lenders.

Valuation Challenges and Transparency Issues

The lack of standardized valuation methods and transparency in the private credit market adds another layer of complexity in assessing the true health of portfolios.

- Difficulty in comparing performance across different funds and strategies: Inconsistent valuation methods make it difficult to accurately compare the performance of different private credit funds.

- Potential for mispricing and overvaluation of assets in a stressed environment: The opaque nature of the market increases the risk of mispricing and overvaluation, particularly during periods of stress.

- Increased regulatory scrutiny and calls for greater transparency: Regulatory bodies are increasingly calling for more transparency and standardized valuation methods to mitigate risks and protect investors.

Regulatory Scrutiny and Evolving Landscape

Increased regulatory oversight and the need for adaptation are shaping the future of the private credit market.

Increased Regulatory Oversight and Compliance Costs

Regulatory authorities are intensifying their scrutiny of the private credit market to mitigate systemic risk. This translates into higher compliance costs for fund managers.

- Greater focus on risk management practices and stress testing: Regulators are demanding more robust risk management frameworks and stress testing methodologies.

- Enhanced reporting requirements and disclosures: More frequent and detailed reporting is required to provide greater transparency and visibility into fund performance and risk profiles.

- Potential for stricter capital requirements and leverage limits: Regulators may impose stricter capital requirements and leverage limits to enhance the stability of the private credit market.

Adapting to Changing Market Conditions

The private credit industry needs to proactively adapt to the changing environment to maintain investor confidence.

- Focus on investments with lower risk profiles and stronger fundamentals: A shift towards investments with lower risk profiles and stronger financial fundamentals is necessary to mitigate the impact of economic uncertainty.

- Development of more sophisticated risk models and stress testing methodologies: Fund managers need to adopt more advanced risk models and stress-testing methodologies to accurately assess and manage their risk exposure.

- Adoption of improved valuation practices and transparency standards: Improved valuation practices and greater transparency are essential to build trust and attract investors.

Conclusion

The private credit market, once considered a safe haven, is facing significant headwinds. Rising interest rates, concerns about credit quality, and increasing regulatory scrutiny are all contributing to the widening cracks in this asset class. Understanding these pre-turmoil vulnerabilities is crucial for investors and market participants alike. To navigate this evolving landscape successfully, a proactive approach to risk management, enhanced transparency, and a focus on resilient investment strategies is paramount. Careful analysis of the evolving landscape of private credit and its emerging risks is essential for making informed investment decisions. Don't ignore the warning signs; stay informed about the potential risks associated with private credit investments.

Featured Posts

-

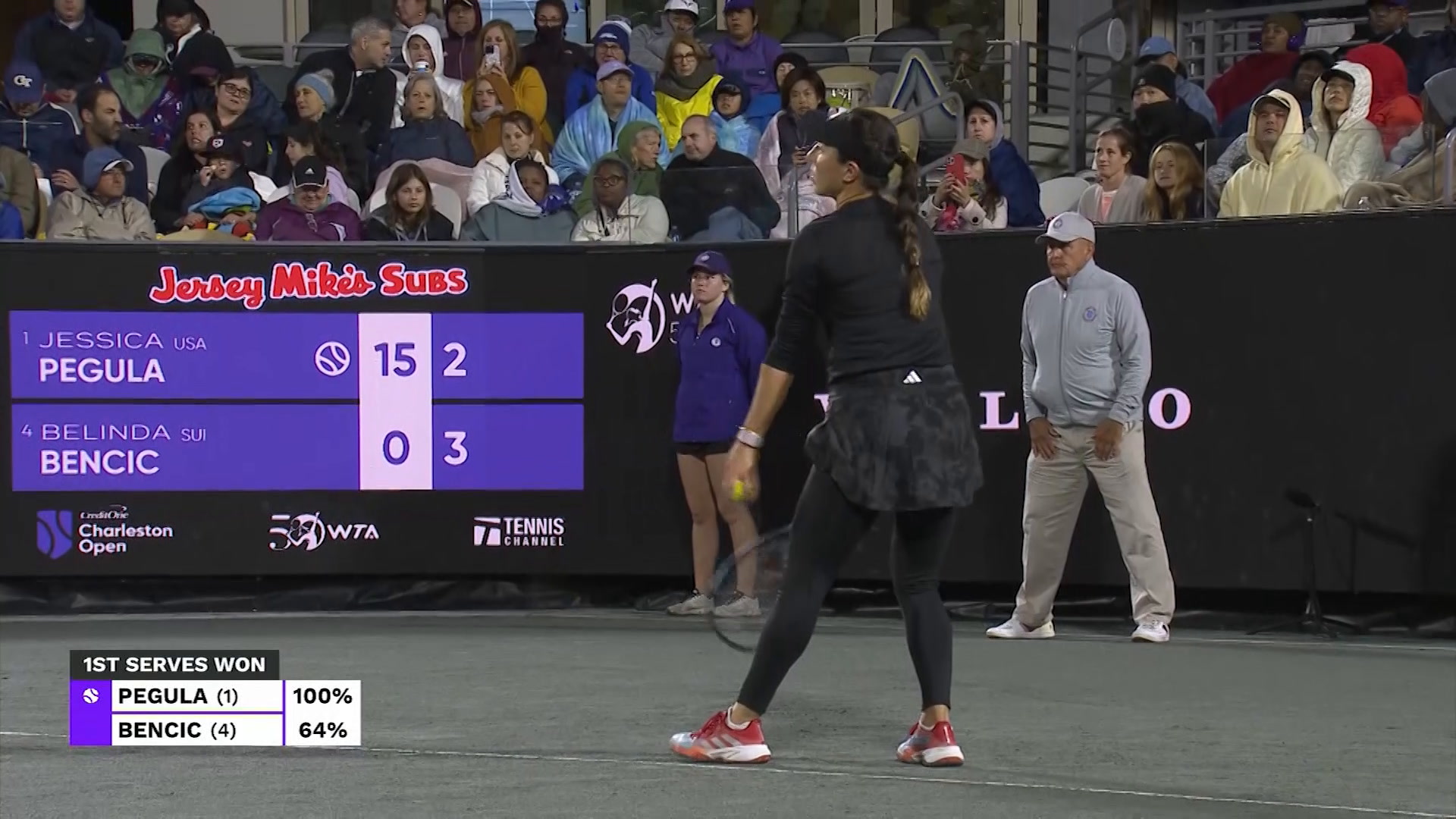

Pegula Defeats Collins To Win Charleston Title

Apr 27, 2025

Pegula Defeats Collins To Win Charleston Title

Apr 27, 2025 -

Auto Dealerships Increase Pressure Against Mandatory Ev Adoption

Apr 27, 2025

Auto Dealerships Increase Pressure Against Mandatory Ev Adoption

Apr 27, 2025 -

Hair And Tattoo Makeovers Learning From Ariana Grandes Professional Choices

Apr 27, 2025

Hair And Tattoo Makeovers Learning From Ariana Grandes Professional Choices

Apr 27, 2025 -

Vaccine Skeptic Leads Federal Autism Immunization Study A Troubling Appointment

Apr 27, 2025

Vaccine Skeptic Leads Federal Autism Immunization Study A Troubling Appointment

Apr 27, 2025 -

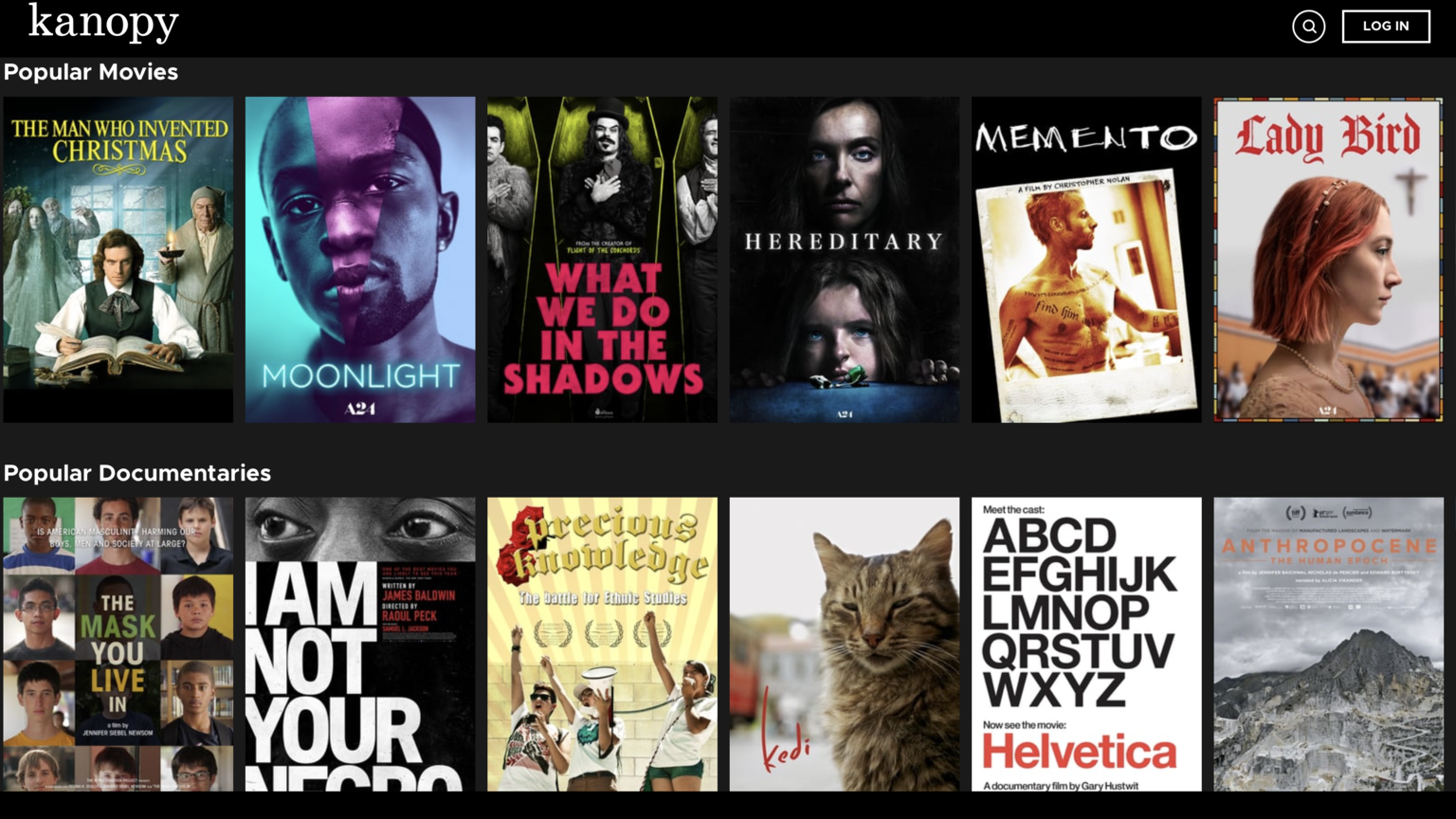

Movies And Shows To Watch On Kanopy Your Free Streaming Guide

Apr 27, 2025

Movies And Shows To Watch On Kanopy Your Free Streaming Guide

Apr 27, 2025