Private Credit Market Instability: Examining The Pre-Crisis Cracks

Table of Contents

Opaque Deal Structures and Lack of Transparency

The private nature of many credit deals hindered proper risk assessment and market oversight, contributing significantly to private credit market instability. This lack of transparency created fertile ground for systemic risk.

Complex Securitizations

The complexity of securitized products obscured the true underlying risks, making it difficult to accurately price and assess the potential for losses. This opacity fueled the growth of private credit market instability.

- Difficulty in understanding the composition of the underlying assets: The intricate layering of assets within securitizations made it challenging to determine the true creditworthiness of the underlying loans. Investors often lacked sufficient information to assess the risk accurately.

- Lack of standardized reporting and data transparency: The absence of standardized reporting requirements prevented a clear picture of the overall market risk. This lack of transparency made it difficult to identify emerging vulnerabilities in the private credit market.

- Reliance on ratings agencies with potential conflicts of interest: Ratings agencies, often facing conflicts of interest, played a significant role in assessing the risk of complex securitizations. Their ratings, sometimes inaccurate, contributed to the mispricing of risk and the build-up of private credit market instability.

- Increased susceptibility to information asymmetry and moral hazard: Information asymmetry, where some parties have more information than others, combined with moral hazard, where one party takes on excessive risk knowing someone else will bear the cost, amplified the vulnerabilities within the private credit market.

Limited Regulatory Scrutiny

The less regulated nature of private credit compared to public markets allowed for practices that might have been flagged in a more heavily regulated environment, exacerbating private credit market instability.

- Reduced oversight and enforcement capabilities: The lack of robust regulatory oversight meant that potentially risky practices went unchecked, leading to the accumulation of systemic risk.

- Absence of robust stress testing requirements: The absence of stringent stress testing requirements meant that lenders and investors were not adequately prepared for economic downturns. This lack of preparedness contributed significantly to the instability of the private credit market.

- Insufficient capital requirements to absorb potential losses: Insufficient capital buffers meant that lenders and investors lacked the resources to absorb losses when defaults occurred. This amplified the impact of losses and contributed to wider instability.

- Potential for regulatory arbitrage and loopholes: The less stringent regulatory environment provided opportunities for regulatory arbitrage, where lenders exploited loopholes to avoid stricter regulations. This avoidance of regulations increased the vulnerability of the private credit market.

Procyclical Lending Practices and Herding Behavior

During periods of economic expansion, excessive risk-taking and herd mentality amplified vulnerabilities, leading to substantial private credit market instability.

Increased Leverage and Risk Appetite

The pursuit of higher returns led to increased leverage and a tolerance for higher-risk investments. This fueled a dangerous cycle of risk-taking.

- Reduced loan underwriting standards: In a booming economy, lenders often lowered their underwriting standards, accepting riskier borrowers.

- Increased reliance on collateral value, ignoring fundamental creditworthiness: Lenders placed too much emphasis on collateral value, overlooking the fundamental creditworthiness of borrowers, creating a false sense of security.

- Competition among lenders driving down pricing and increasing risk: Intense competition among lenders to secure deals led to lower pricing and increased risk-taking, creating a feedback loop that amplified private credit market instability.

Contagion Effects and Liquidity Mismatches

The interconnectedness of borrowers and lenders amplified the impact of defaults and created liquidity crises, further destabilizing the private credit market.

- Limited diversification of portfolios: Concentrated portfolios increased the risk of contagion, where defaults spread rapidly throughout the system.

- Dependence on short-term funding for long-term investments: A mismatch between the short-term nature of funding and the long-term nature of investments created significant liquidity vulnerabilities.

- Rapid withdrawal of funding during periods of stress: During economic downturns, lenders quickly withdrew funding, exacerbating the liquidity crisis and contributing to widespread defaults.

Valuation Challenges and Market Illiquidity

Difficulty in accurately assessing the value of private credit assets exacerbated instability in the private credit market.

Lack of Liquid Secondary Markets

The absence of active secondary markets for many private credit instruments hindered price discovery and liquidity.

- Difficulty in exiting investments quickly during market downturns: The lack of liquid secondary markets meant that investors struggled to exit their positions quickly during market downturns, leading to forced sales at depressed prices.

- Increased price volatility due to limited trading activity: Limited trading activity amplified price volatility, making it difficult for investors to accurately assess the value of their investments.

- Potential for fire sales and further price declines: Forced sales, or "fire sales," during market stress further depressed prices, creating a downward spiral.

Subjective Valuation Methods

Reliance on subjective valuation methods increased the potential for mispricing and overvaluation.

- Lack of consistent and comparable valuation metrics: The lack of standardized valuation metrics made it difficult to compare the value of private credit assets across different funds and portfolios.

- Potential for biases and conflicts of interest in valuation processes: Subjective valuations were susceptible to bias and conflicts of interest, leading to inaccurate assessments of value.

- Difficulty in aggregating and comparing valuations across different funds: The lack of standardization hindered the aggregation and comparison of valuations, making it difficult to assess overall market risk.

Conclusion

The instability in the private credit market prior to past crises stemmed from a combination of opaque deal structures, procyclical lending practices, and valuation challenges. Addressing these issues requires increased transparency, strengthened regulation, and a more robust understanding of risk. Greater scrutiny of complex securitizations, improved regulatory oversight, and the development of more liquid secondary markets are essential steps to prevent future crises. Investors, regulators, and policymakers must work together to foster a more stable and resilient private credit market. Further research into the dynamics of private credit market instability and the development of early warning signals are crucial for mitigating future risks and ensuring the long-term health of this important sector of the financial system.

Featured Posts

-

Broadcoms V Mware Acquisition At And T Highlights Extreme Cost Increase

Apr 27, 2025

Broadcoms V Mware Acquisition At And T Highlights Extreme Cost Increase

Apr 27, 2025 -

Detour Now Torontos Review Of Nosferatu The Vampyre

Apr 27, 2025

Detour Now Torontos Review Of Nosferatu The Vampyre

Apr 27, 2025 -

Major Acquisition Cma Cgm Acquires Turkish Logistics Company For 440 Million

Apr 27, 2025

Major Acquisition Cma Cgm Acquires Turkish Logistics Company For 440 Million

Apr 27, 2025 -

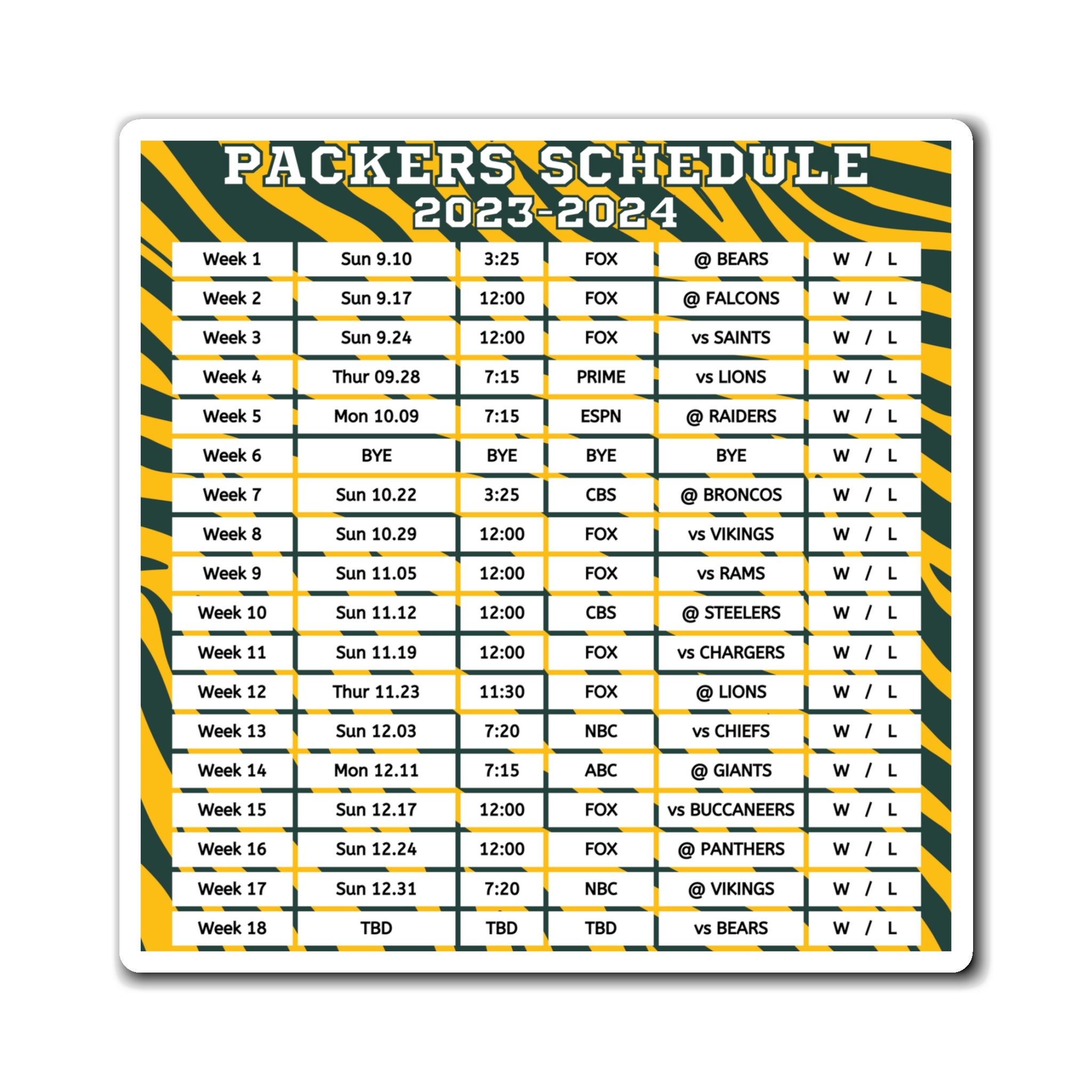

2025 International Games The Green Bay Packers Potential Schedule

Apr 27, 2025

2025 International Games The Green Bay Packers Potential Schedule

Apr 27, 2025 -

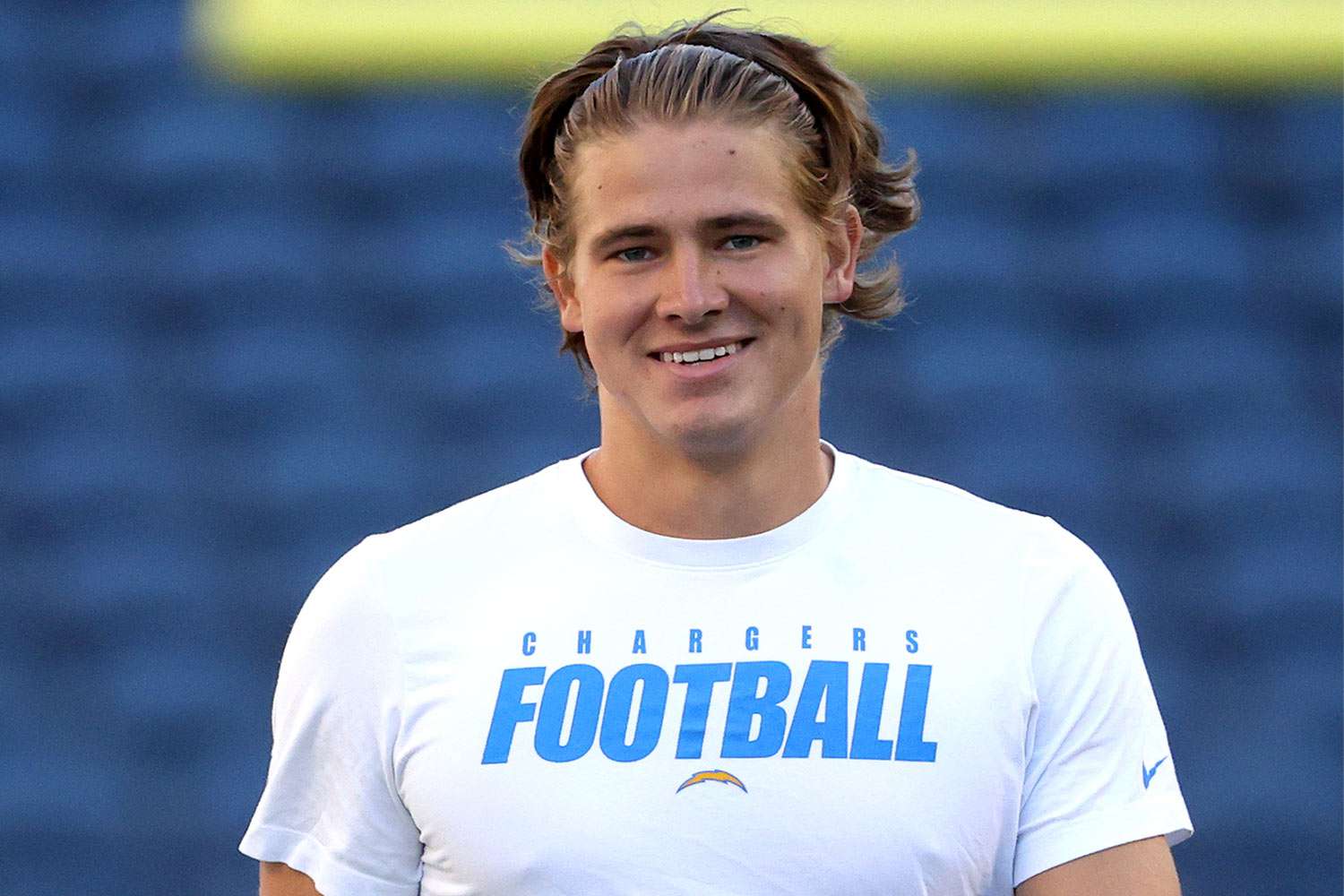

Brazil Bound Justin Herbert And The Chargers 2025 Opener

Apr 27, 2025

Brazil Bound Justin Herbert And The Chargers 2025 Opener

Apr 27, 2025

Latest Posts

-

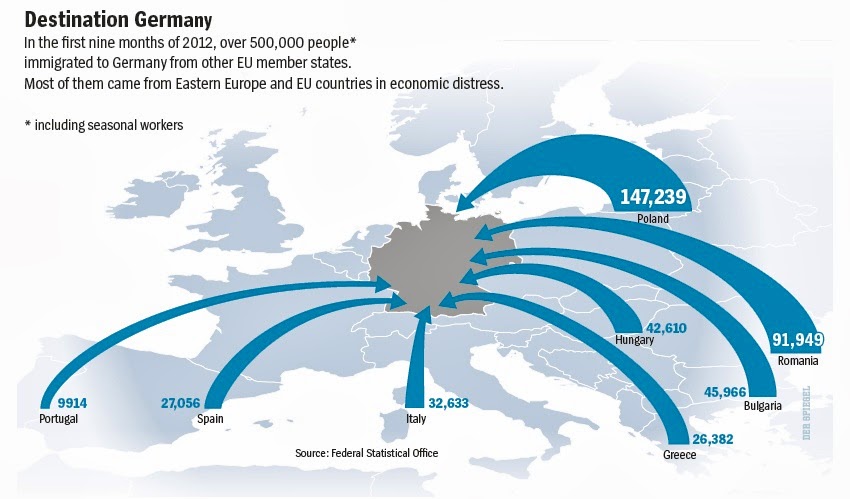

Post Covid Migration To Germany Impact Of Strengthened Border Security

Apr 29, 2025

Post Covid Migration To Germany Impact Of Strengthened Border Security

Apr 29, 2025 -

Germanys Stricter Border Controls Migration Numbers At Post Covid Low

Apr 29, 2025

Germanys Stricter Border Controls Migration Numbers At Post Covid Low

Apr 29, 2025 -

Arson Investigation Georgian Man Detained In Germany Following Wifes Burning

Apr 29, 2025

Arson Investigation Georgian Man Detained In Germany Following Wifes Burning

Apr 29, 2025 -

Georgian Husband Arrested Wife Seriously Injured In Germany Fire

Apr 29, 2025

Georgian Husband Arrested Wife Seriously Injured In Germany Fire

Apr 29, 2025 -

German Police Arrest Georgian Man After Wifes Arson Attack

Apr 29, 2025

German Police Arrest Georgian Man After Wifes Arson Attack

Apr 29, 2025