Private Credit Market Cracks: A Weekly Analysis Of Recent Turmoil

Table of Contents

Rising Interest Rates and Their Impact

Rising interest rates are at the heart of the current turmoil in the private credit market. This has profoundly impacted both borrowers and lenders, creating a domino effect throughout the ecosystem.

Increased Borrowing Costs

The mechanics are straightforward: higher interest rates translate directly into increased borrowing costs for companies reliant on private credit. This significantly impacts profitability, particularly for leveraged transactions.

- Leveraged Buy Outs (LBOs): LBOs, heavily reliant on debt financing, become significantly less attractive and more risky with higher interest rates, potentially impacting returns for private equity firms.

- Private Equity (PE) Returns: The increased cost of debt directly erodes the returns generated by private equity investments, forcing a reassessment of deal valuations and investment strategies.

- Debt Servicing: Borrowers face a heightened challenge in servicing their debt obligations, potentially leading to financial distress and defaults.

Refinancing Challenges

Refinancing existing debt has become exponentially more difficult due to the higher interest rates. This puts immense pressure on companies with maturing debt obligations.

- Refinancing Difficulties: Many companies are finding it impossible to secure refinancing at affordable rates, leaving them vulnerable to default.

- Credit Spreads and Risk Premiums: The increased risk has led to widening credit spreads and higher risk premiums, making it even more expensive to borrow.

- Covenant Breaches: As companies struggle to meet their financial obligations, covenant breaches are becoming more common, further escalating the risk of default.

Increased Defaults and Credit Events

The increased borrowing costs and refinancing difficulties have already resulted in a noticeable uptick in defaults and credit events across various sectors.

Identifying Vulnerable Sectors

Several sectors are particularly vulnerable to defaults in the current climate.

- Real Estate: The commercial real estate sector is facing headwinds due to higher interest rates and softening demand, leading to increased defaults on mortgages and other loans.

- Technology: Technology companies, many of whom have high debt levels and rely heavily on venture capital funding, are also vulnerable to defaults as funding dries up.

- Macroeconomic Factors: Global economic uncertainty and inflation are exacerbating the risks, contributing to increased default rates across multiple sectors.

Impact on Fund Performance

The rise in defaults has had a direct and negative impact on the performance of private credit funds.

- Fund Valuations: Increased defaults translate into lower fund valuations, reducing returns for investors.

- Limited Partner (LP) Losses: Limited partners (LPs) in private credit funds face the prospect of significant losses if defaults continue to rise.

- Loss Mitigation Strategies: Private credit funds are adopting various strategies to mitigate losses, including debt restructuring and distressed asset management.

Shifting Investor Sentiment and Market Liquidity

The turmoil in the private credit market is also significantly impacting investor sentiment and market liquidity.

Reduced Investor Appetite

The increased risk and uncertainty are leading to a reduction in investor appetite for private credit investments.

- Flight to Safety: Investors are shifting capital towards safer assets, reducing the flow of capital into the private credit market.

- Fundraising Challenges: Private credit managers are facing challenges in raising new funds, impacting their ability to make new investments.

Decreased Market Liquidity

The reduced investor appetite has led to a decrease in market liquidity, making it more challenging to buy and sell private credit assets.

- Pricing and Valuation Challenges: Accurate pricing and valuation of private credit assets are becoming more difficult due to the lack of liquidity.

- Widening Bid-Ask Spreads: The bid-ask spreads for private credit assets are widening, reflecting the increased uncertainty and risk.

Conclusion

The private credit market cracks are undeniable, driven by rising interest rates, increased defaults, and shifting investor sentiment. Understanding the complexities of these factors is crucial for navigating the current turmoil. The challenges facing borrowers, lenders, and investors alike are substantial. Navigating private credit market turmoil requires careful analysis and a proactive approach. Analyzing private credit market instability should be a continuous process. Stay informed about the evolving situation by regularly checking for updated analyses and utilizing available resources to effectively mitigate risk and make informed decisions. Understanding the complexities of private credit market cracks requires constant vigilance. Stay updated with our weekly analysis to effectively navigate this turbulent landscape.

Featured Posts

-

Belinda Bencic Back On Top After Becoming A Mother

Apr 27, 2025

Belinda Bencic Back On Top After Becoming A Mother

Apr 27, 2025 -

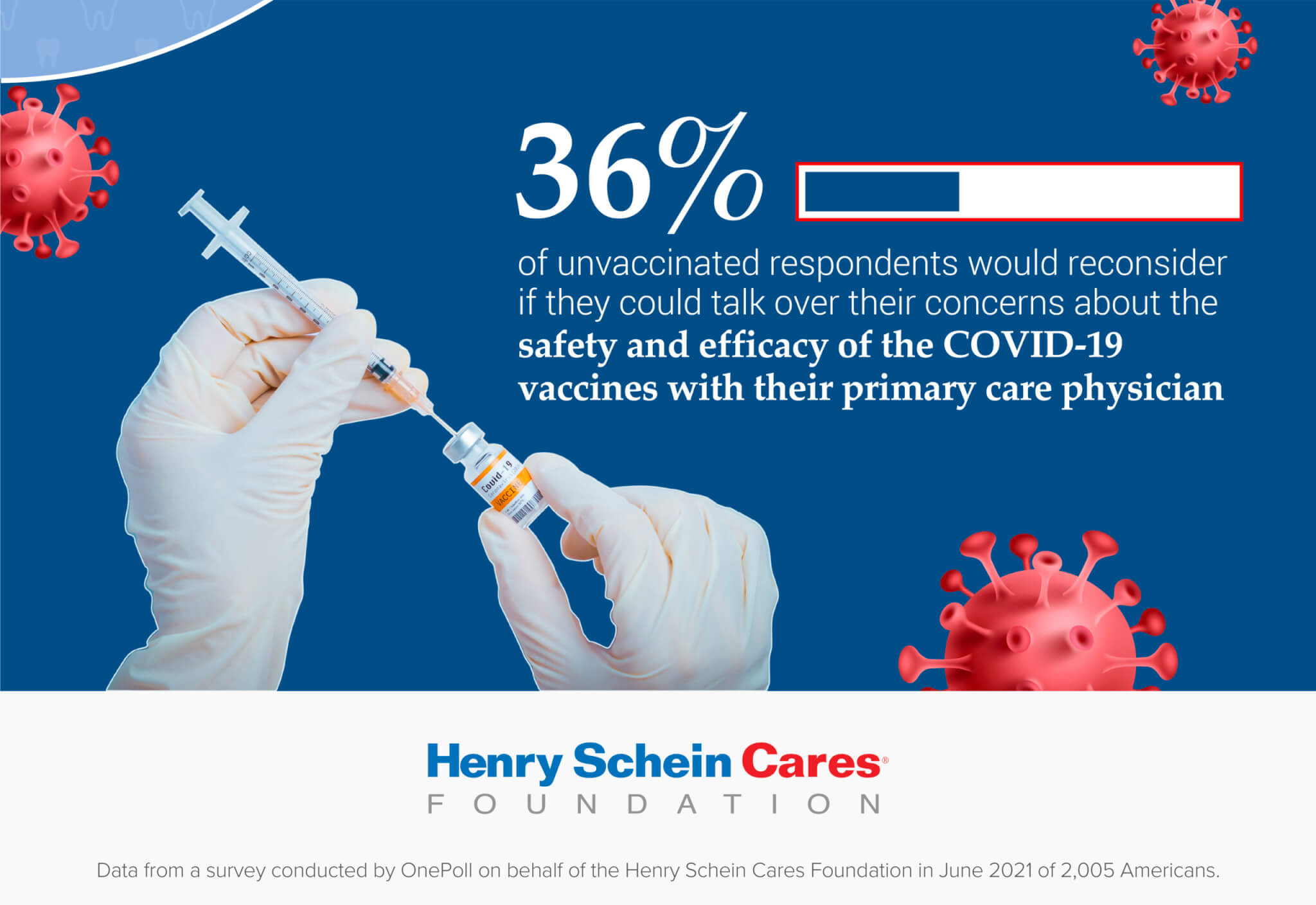

A Critical Opinion On The Cdcs Choice For The New Vaccine Study

Apr 27, 2025

A Critical Opinion On The Cdcs Choice For The New Vaccine Study

Apr 27, 2025 -

A Detour Through Nosferatu The Vampyre A Now Toronto Perspective

Apr 27, 2025

A Detour Through Nosferatu The Vampyre A Now Toronto Perspective

Apr 27, 2025 -

Hhss Controversial Choice Anti Vaccine Advocate To Examine Debunked Autism Vaccine Claims

Apr 27, 2025

Hhss Controversial Choice Anti Vaccine Advocate To Examine Debunked Autism Vaccine Claims

Apr 27, 2025 -

Canadian Election Carney Highlights Trumps Push For Trade Concessions

Apr 27, 2025

Canadian Election Carney Highlights Trumps Push For Trade Concessions

Apr 27, 2025