Private Credit Jobs: 5 Do's And Don'ts To Get Hired

Table of Contents

5 Do's to Land Your Dream Private Credit Job

Do 1: Network Strategically

Building a strong network is paramount in the private credit industry. Don't underestimate the power of personal connections in securing a private credit career.

- Build relationships with professionals in private credit firms: Attend industry events, connect with people on LinkedIn, and engage in informational interviews.

- Attend industry conferences and events: SuperReturn, ACG conferences, and smaller, niche events provide invaluable networking opportunities. These events offer chances to learn about private credit investment strategies and connect with key players in the field.

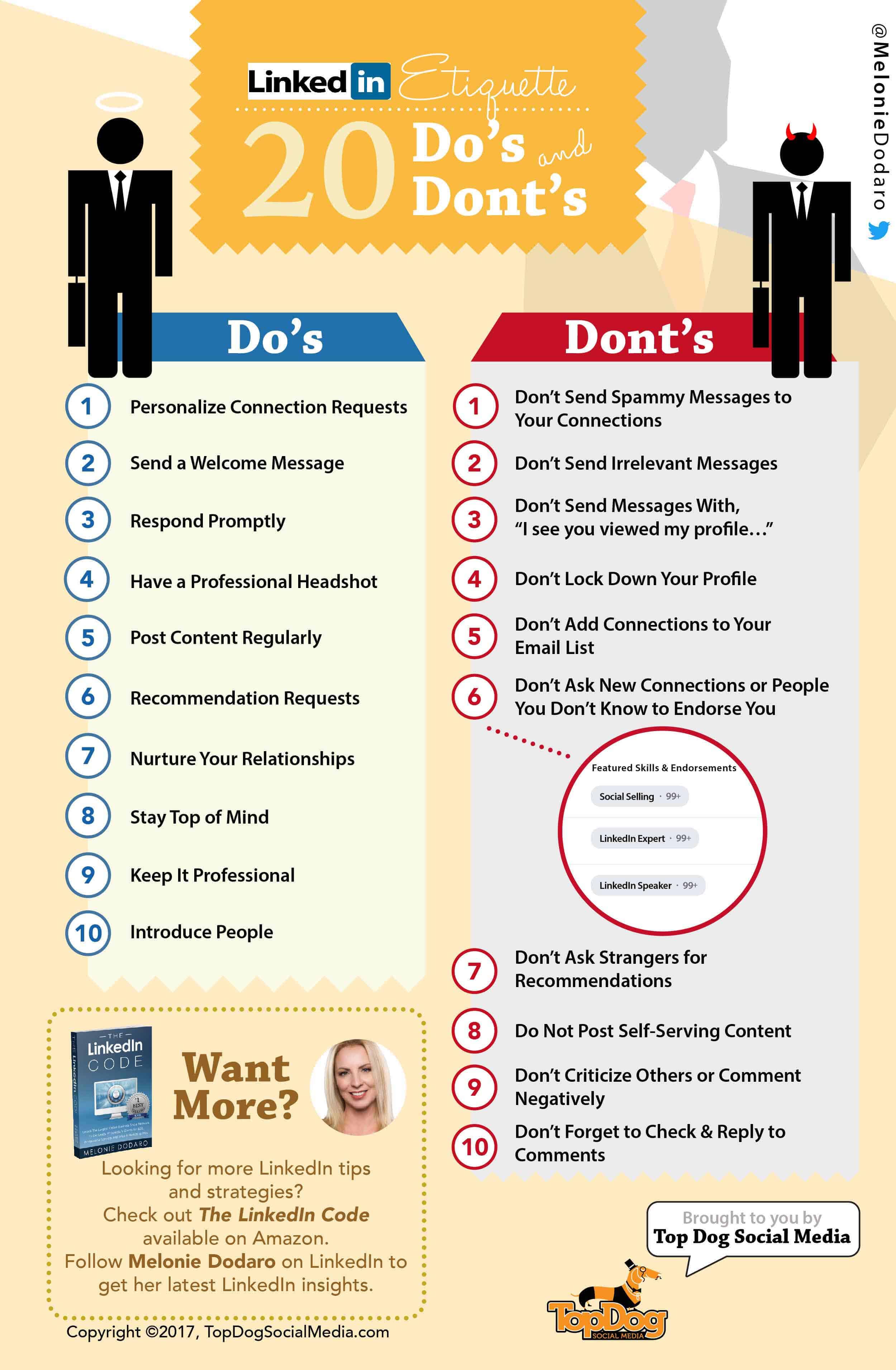

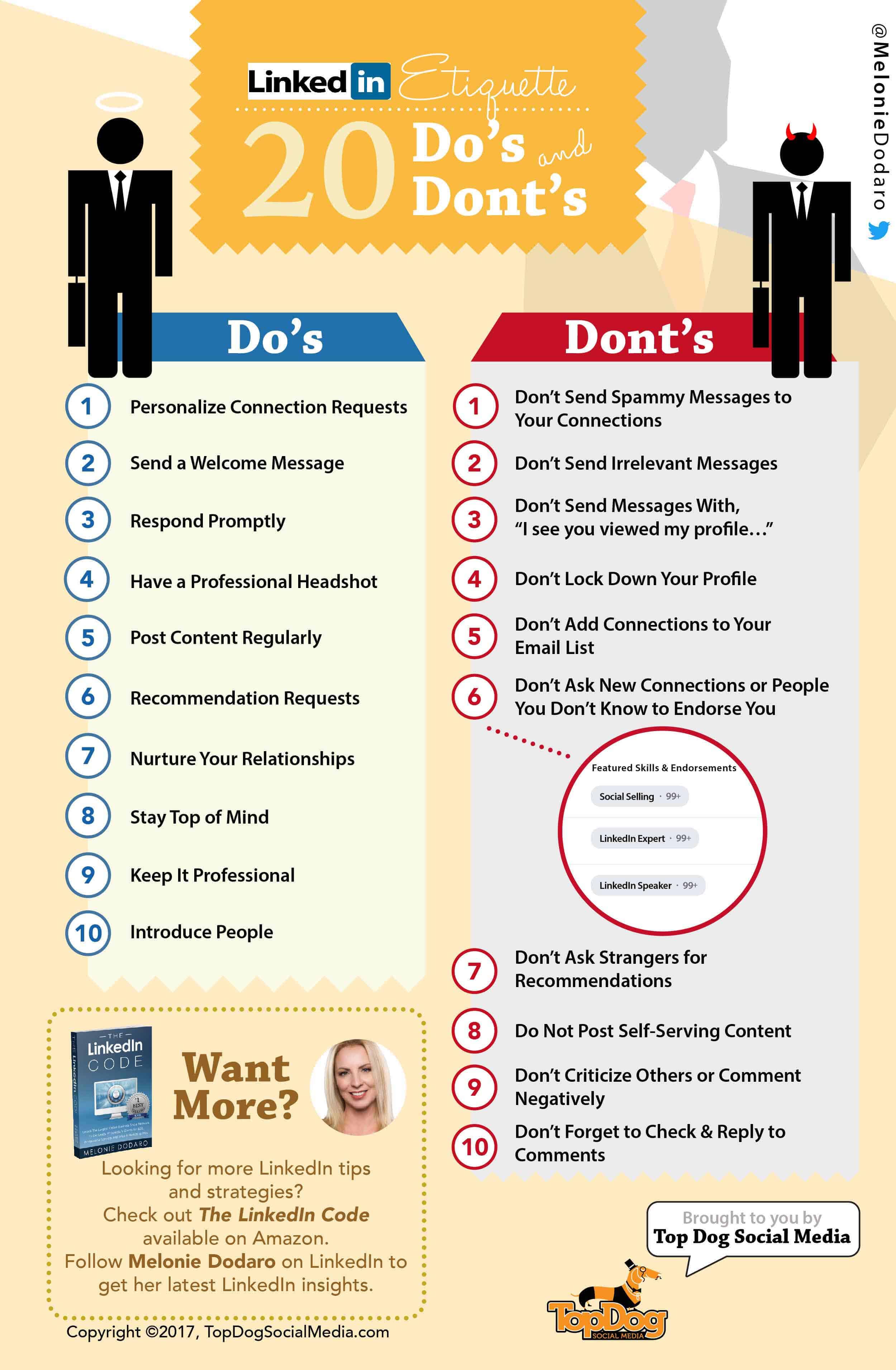

- Leverage LinkedIn effectively: Connect with recruiters specializing in finance jobs, specifically those focusing on private credit and alternative credit. Engage with their posts and share relevant content to increase your visibility.

- Participate in private credit-focused online forums and groups: Engage in discussions, share your knowledge, and learn from others in the field. This can lead to unexpected connections and opportunities.

- Informational interviews are key: Reach out to professionals in your target firms for informational interviews. These conversations allow you to learn about the company culture, specific roles, and gain valuable insights into the private credit landscape.

Do 2: Tailor Your Resume and Cover Letter

Your resume and cover letter are your first impression. Make them count by highlighting your relevant experience and skills for each private credit job application.

- Highlight relevant skills: Emphasize financial modeling, credit analysis, underwriting, and any experience in leveraged finance, distressed debt, or mezzanine financing.

- Quantify your accomplishments: Use data and measurable results to demonstrate the impact of your work. For example, instead of saying "Improved efficiency," say "Improved efficiency by 15%, resulting in $X cost savings."

- Showcase experience in specific areas: Tailor your resume to highlight experience directly relevant to the specific private credit job description.

- Use keywords: Incorporate keywords relevant to private credit roles, such as "due diligence," "portfolio management," "asset-based lending," and "private debt strategies."

- Tailor to each job description: Don't use a generic resume and cover letter. Each application should be customized to address the specific requirements and responsibilities of the target role.

Do 3: Master the Interview Process

The interview process for private credit jobs is rigorous. Preparation is crucial to demonstrate your skills and knowledge.

- Practice behavioral interview questions (STAR method): Use the STAR method (Situation, Task, Action, Result) to structure your answers and showcase your problem-solving abilities.

- Demonstrate your understanding of financial markets and credit cycles: Stay updated on current market trends and economic conditions to showcase your expertise.

- Prepare insightful questions to ask: Asking thoughtful questions demonstrates your initiative and interest in the role and the firm. Research the firm's investment strategy and recent transactions beforehand.

- Research the firm thoroughly: Understanding their investment strategy, portfolio companies, and recent transactions is crucial.

- Dress professionally and maintain confident body language: First impressions matter. Project confidence and professionalism throughout the interview.

Do 4: Showcase Specialized Skills

In the competitive world of private credit, specialized skills set you apart.

- Highlight proficiency in financial modeling software: Demonstrate expertise in Excel, Bloomberg Terminal, and other relevant software.

- Demonstrate expertise in credit analysis and risk assessment: Showcase your ability to analyze financial statements, assess credit risk, and make informed investment decisions.

- Showcase understanding of legal and regulatory frameworks: Demonstrate knowledge of the legal and regulatory landscape pertaining to private lending.

- Consider obtaining relevant certifications: The CFA (Chartered Financial Analyst) and CAIA (Chartered Alternative Investment Analyst) charters can significantly enhance your credentials.

- Emphasize experience in portfolio management or deal structuring: Highlight any experience in these critical areas of private credit investing.

Do 5: Follow Up Effectively

Following up after interviews is often overlooked, but it's a crucial step.

- Send a thank-you note: Reiterate your interest and highlight key points from the conversation.

- Follow up with recruiters and hiring managers: Follow up within a reasonable timeframe, showing your persistent interest.

- Maintain professional communication: Keep your communication concise, professional, and respectful.

- Show persistence without being overly aggressive: Find a balance between showing interest and respecting the hiring process.

- Express continued interest: Re-emphasize your enthusiasm for the opportunity and the firm.

5 Don'ts When Applying for Private Credit Jobs

Don't 1: Neglect Networking

Networking is not optional in this field.

- Don't rely solely on online job boards: Networking is far more effective in securing private credit jobs.

- Don't underestimate the power of personal connections: Relationships are key to unlocking opportunities.

- Don't be afraid to reach out: Proactively network with professionals in the industry, even if you don't have a direct connection.

Don't 2: Submit a Generic Resume/Cover Letter

Your application materials need to be tailored to each specific opportunity.

- Don't send the same resume and cover letter: Customize each application to reflect the specific requirements of the role.

- Don't fail to highlight relevant skills and accomplishments: Focus on the skills and experience most relevant to the specific job description.

- Don't use clichés or generic statements: Make your application materials stand out with compelling and specific details.

Don't 3: Underprepare for Interviews

Thorough preparation is essential for success.

- Don't go into an interview without researching the firm and interviewers: Show you’ve done your homework.

- Don't fail to prepare answers to common behavioral interview questions: Practice your responses and use the STAR method.

- Don't be unprepared to discuss your salary expectations: Research industry standards and have a realistic range in mind.

Don't 4: Overlook Skill Development

Continuous learning is crucial in the dynamic world of finance.

- Don't underestimate the importance of continuing education: Stay updated on industry trends and best practices.

- Don't ignore opportunities to improve your skills: Actively seek ways to enhance your financial modeling and credit analysis skills.

- Don't neglect staying updated on industry trends: Read industry publications, attend webinars, and engage in continuous learning.

Don't 5: Fail to Follow Up

Following up demonstrates your genuine interest and initiative.

- Don't assume you'll hear back without following up: Proactive follow-up increases your chances of success.

- Don't be passive: Show initiative and express your continued interest in the position.

- Don't be discouraged if you don't hear back immediately: The hiring process can take time; maintain professionalism and persistence.

Conclusion

Securing a private credit job requires a strategic and proactive approach. By following these five "do's" and avoiding the five "don'ts," you can significantly increase your chances of landing your dream role in the exciting world of private credit. Remember to leverage your network, tailor your application materials, master the interview process, and persistently follow up. Start your journey towards a successful private credit career today! Begin your search for private credit jobs now and unlock your potential in this dynamic field.

Featured Posts

-

Chinas Economy Assessing The Risk Of Increased Tariffs On Exports

Apr 22, 2025

Chinas Economy Assessing The Risk Of Increased Tariffs On Exports

Apr 22, 2025 -

High Stock Valuations And Investor Concerns A Bof A Analysis

Apr 22, 2025

High Stock Valuations And Investor Concerns A Bof A Analysis

Apr 22, 2025 -

Saudi Aramco Invests In Chinas Byd For Ev Technology Exploration

Apr 22, 2025

Saudi Aramco Invests In Chinas Byd For Ev Technology Exploration

Apr 22, 2025 -

Activision Blizzard Acquisition Ftc Launches Appeal

Apr 22, 2025

Activision Blizzard Acquisition Ftc Launches Appeal

Apr 22, 2025 -

Russias Aerial Assault On Ukraine Us Peace Plan Amidst Deadly Barrage

Apr 22, 2025

Russias Aerial Assault On Ukraine Us Peace Plan Amidst Deadly Barrage

Apr 22, 2025