Pause On Diversity And Climate Reporting: Canadian Regulators Respond To Backlash

Table of Contents

The New Diversity and Climate Reporting Requirements

The Canadian government, through various regulatory bodies like the Office of the Superintendent of Financial Institutions (OSFI) and the Canadian Securities Administrators (CSA), has introduced new requirements for Canadian companies to disclose information related to diversity and climate change. These regulations aim to increase transparency and accountability regarding environmental sustainability and equitable representation within organizations.

-

Specific details of diversity reporting requirements: These include data on gender representation at all levels of the organization, board diversity encompassing ethnicity, Indigenous representation, and other aspects of diversity and inclusion. Specific metrics and reporting frameworks are being developed.

-

Specific details of climate reporting requirements: Companies are expected to disclose their greenhouse gas (GHG) emissions, climate-related risks and opportunities, and strategies for mitigating climate change. This includes aligning with international frameworks like the Task Force on Climate-related Financial Disclosures (TCFD).

-

Target companies/industries affected: The regulations primarily target publicly traded companies and large, privately held corporations, with potential expansion to smaller businesses in the future. Specific sectors like finance, energy, and resources are initially under greater scrutiny.

-

Timeline for implementation: The original timelines varied depending on the specific regulation and the reporting entity, creating some of the initial confusion and complexity. The “pause” has temporarily halted the implementation of these timelines.

The Backlash and the Call for a Pause

The introduction of these new reporting requirements has been met with significant backlash from various businesses and industry groups. Concerns have been raised regarding the cost and complexity of compliance, particularly for smaller businesses and those with limited resources dedicated to ESG (Environmental, Social, and Governance) reporting.

-

Quotes from industry leaders expressing concerns: Several CEOs and industry association representatives have publicly voiced concerns about the lack of clarity, the significant costs associated with data collection and reporting, and the potential for inconsistencies in reporting methodologies.

-

Specific examples of challenges faced by businesses in complying: Many companies cite the difficulty in collecting accurate and reliable diversity data, particularly concerning ethnicity and Indigenous representation. Additionally, the complexities of measuring and reporting Scope 3 emissions (indirect emissions from value chains) present significant challenges.

-

Concerns regarding data accuracy and reliability: There are valid concerns about the quality and comparability of reported data, particularly given variations in data collection methods and methodologies.

-

Discussion of the potential for increased regulatory burden: The cumulative effect of numerous reporting requirements from different agencies is creating a significant regulatory burden for companies, potentially diverting resources away from core business activities.

Arguments For and Against the Pause

The call for a pause on these regulations has sparked a debate with valid arguments on both sides.

Pro-Pause Arguments: Proponents of the pause argue that it is necessary to address the concerns raised by businesses. A pause allows for clarification of reporting requirements, improved guidance on data collection methodologies, and increased feasibility for compliance. This would help prevent unintended consequences, such as inaccurate reporting or a disproportionate impact on smaller businesses.

Anti-Pause Arguments: Conversely, opponents of the pause emphasize the importance of transparency, accountability, and the long-term benefits of improved corporate governance and environmental responsibility. They argue that delaying the implementation of these regulations could undermine investor confidence and hinder progress towards a more sustainable and equitable economy.

Regulatory Response and Next Steps

In response to the backlash, the Canadian regulators have announced a temporary pause on the full implementation of the new diversity and climate reporting requirements. This pause is intended to allow for further consultations with businesses and stakeholders.

-

Specific actions taken by the regulators in response to criticism: The regulators have committed to reviewing the current regulations, seeking feedback from industry, and potentially making adjustments to ensure clarity and feasibility.

-

Timeline for any planned revisions or consultations: Specific timelines for consultations and revisions are still being determined, but the regulators have committed to a transparent and iterative process.

-

Potential changes to the regulations based on feedback: Expected changes include improved guidance on data collection, clarification of reporting requirements, and potentially adjustments to the timeline for implementation.

-

Impact on future reporting deadlines: The pause has resulted in a postponement of the original reporting deadlines, providing businesses with more time to prepare.

The Future of Diversity and Climate Reporting in Canada

The pause on diversity and climate reporting marks a significant development in the Canadian regulatory landscape. The long-term implications are still unfolding, but several potential scenarios exist.

-

Possible scenarios for the future of these regulations: The regulations may be revised to be more practical and less burdensome, potentially resulting in a more effective and widely accepted framework. Alternatively, the pause may be extended, or the regulations could be significantly altered or even withdrawn.

-

The potential influence of international standards and best practices: Harmonizing Canadian standards with international best practices will be crucial for ensuring comparability and reducing compliance complexity. The International Sustainability Standards Board (ISSB) will undoubtedly play a significant role.

-

The impact on investor confidence and corporate sustainability: The eventual outcome of this situation will profoundly impact investor confidence and corporate sustainability efforts. A well-designed, practical reporting framework is essential for attracting investment and driving positive change.

Conclusion

The pause on diversity and climate reporting in Canada reflects a complex interplay between the need for greater transparency and accountability and the practical challenges faced by businesses. The regulators' response, while positive, underscores the need for continued dialogue and collaboration to ensure effective and feasible regulations. Stay informed on the developments surrounding diversity and climate reporting in Canada. Continue to monitor regulatory updates and participate in consultations to ensure effective and feasible regulations are implemented for a sustainable and equitable future. The future of Canadian diversity and climate reporting requires careful consideration and collaborative effort.

Featured Posts

-

Two Jewish Heroes Revealed A Wwii Photos Hidden Narrative

Apr 25, 2025

Two Jewish Heroes Revealed A Wwii Photos Hidden Narrative

Apr 25, 2025 -

Ankara Emniyet Mueduerluegue Nuen Yeni Yerleskesi Acildi

Apr 25, 2025

Ankara Emniyet Mueduerluegue Nuen Yeni Yerleskesi Acildi

Apr 25, 2025 -

Databricks To Hire Hundreds In India Fueling The Ai Revolution

Apr 25, 2025

Databricks To Hire Hundreds In India Fueling The Ai Revolution

Apr 25, 2025 -

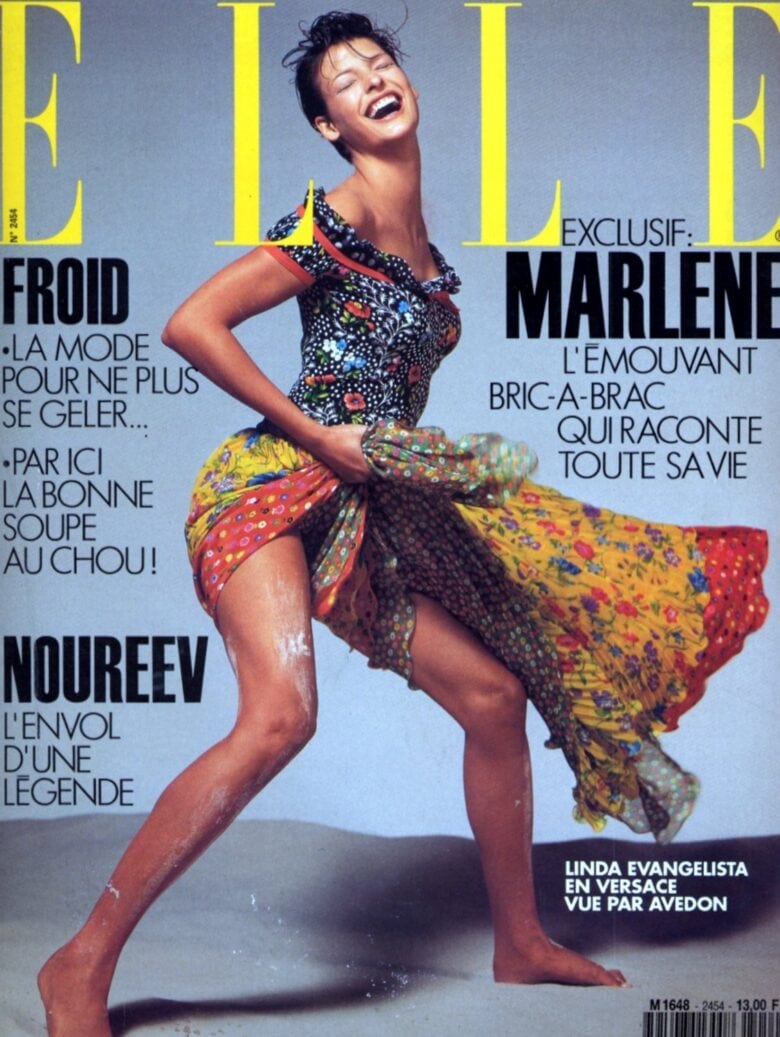

Cool Sculpting Complications Linda Evangelistas Personal Account Of Scars And Healing

Apr 25, 2025

Cool Sculpting Complications Linda Evangelistas Personal Account Of Scars And Healing

Apr 25, 2025 -

Wedding Day Feud Bride Vs Bridesmaids Makeup

Apr 25, 2025

Wedding Day Feud Bride Vs Bridesmaids Makeup

Apr 25, 2025