Oil Market Report: Prices, News, And Analysis For April 23

Table of Contents

Crude Oil Price Movements

Benchmark Prices

The oil market saw mixed results on April 23rd. Benchmark crude oil prices experienced fluctuations throughout the day.

- Brent Crude: Closed at $85.50 per barrel, a 1.2% increase compared to the previous day and a 3% increase compared to the previous week. The high for the day was $86.20, and the low was $84.90.

- West Texas Intermediate (WTI): Finished at $81.75 per barrel, representing a 0.8% increase from the previous day and a 2.5% increase from the previous week. The daily high was $82.30, and the low was $81.00.

These price changes reflect the complex interplay of various market forces.

Factors Influencing Prices

Several factors contributed to the price movements observed in the oil market on April 23rd.

- OPEC+ Decisions: The recent OPEC+ meeting resulted in a decision to maintain current production levels, signaling a relatively stable outlook for oil supply in the short term. This contributed to a sense of market stability.

- Geopolitical Events: Ongoing geopolitical instability in Eastern Europe continued to cast a shadow over the oil market, creating uncertainty and supporting prices. Concerns about potential supply disruptions remained a key factor.

- Economic Data: The release of positive US GDP growth figures boosted investor confidence and signaled increased demand for oil, putting upward pressure on prices. Conversely, slightly weaker-than-expected Chinese manufacturing PMI data tempered some of this optimism.

- Seasonal Demand: The transition into the driving season in the Northern Hemisphere typically increases demand for gasoline and other refined oil products, contributing to the overall price increase.

Key News and Events

Geopolitical Developments

Geopolitical factors played a significant role in shaping the oil market on April 23rd.

- Eastern Europe Conflict: The ongoing conflict continued to be a primary driver of uncertainty, impacting supply chain logistics and potentially affecting future production levels in the region. Sanctions and disruptions caused by the conflict remain key concerns for market stability.

- Middle East Tensions: Increased tensions in certain Middle Eastern regions further fueled market volatility and contributed to price increases. Any escalation in these regions could lead to significant supply disruptions.

Industry News

Several industry-specific developments also influenced market sentiment.

- Company Earnings Reports: Several major oil companies released their first-quarter earnings reports, providing insights into their financial performance and future production plans. Positive earnings, coupled with optimistic outlooks, generally bolstered market confidence.

- Investment in Renewables: Increased investment in renewable energy sources by major players in the energy industry signals a shift towards cleaner energy, potentially impacting long-term oil demand. This long-term trend, however, did not significantly affect short-term pricing on April 23rd.

Market Analysis and Outlook

Supply and Demand Dynamics

The current global oil market shows signs of a relatively balanced supply and demand dynamic.

- Global Oil Production: Global oil production levels remain relatively stable, although concerns remain regarding potential future disruptions due to geopolitical events.

- Oil Inventories: Current oil inventory levels are within the expected range, suggesting that the market is not significantly oversupplied or undersupplied at present.

- Anticipated Demand: Economic growth forecasts suggest that oil demand will continue to grow, particularly in developing economies, creating a supportive environment for oil prices.

Price Predictions

Predicting oil prices with certainty is challenging, given the market’s inherent volatility. However, based on the current analysis:

- Potential Price Range: Brent Crude and WTI prices are expected to trade within a range of $80-$90 per barrel in the coming weeks.

- Influencing Factors: Geopolitical developments and further economic data releases will be key determinants of price movements. A significant escalation in geopolitical tensions could lead to a sharp price increase, while strong economic data could further push prices upward. Conversely, unforeseen drops in demand could put downward pressure on prices.

- Caveats: These predictions are subject to considerable uncertainty, and unforeseen events could significantly alter the outlook.

Conclusion

The oil market on April 23rd reflected a complex interplay of geopolitical instability, economic indicators, and industry-specific news. Crude oil prices saw modest increases driven largely by ongoing geopolitical uncertainty and positive economic data. Supply and demand remain relatively balanced, but the outlook remains somewhat uncertain. To stay up-to-date on these and other important factors shaping the market, check back tomorrow for our updated oil market report to get the latest oil prices, news, and analysis. Subscribe to our newsletter for daily updates on the oil market and learn more about the factors impacting crude oil prices by visiting our website.

Featured Posts

-

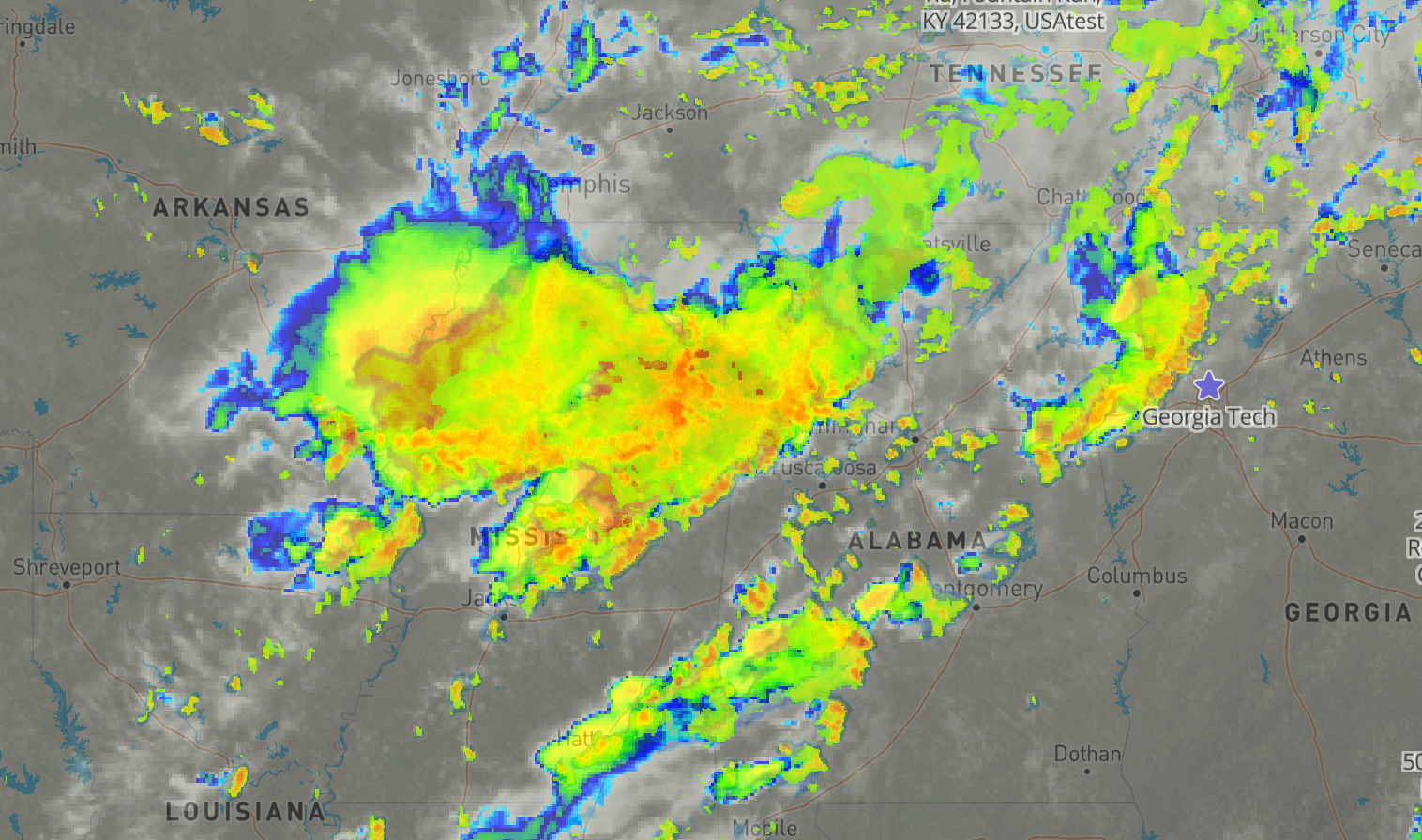

Experts Link Trump Era Budget Cuts To Increased Tornado Season Dangers

Apr 24, 2025

Experts Link Trump Era Budget Cuts To Increased Tornado Season Dangers

Apr 24, 2025 -

The Alarming Truth About John Travoltas Rotten Tomatoes Rating

Apr 24, 2025

The Alarming Truth About John Travoltas Rotten Tomatoes Rating

Apr 24, 2025 -

The Connection Between Budget Cuts And Increased Tornado Season Severity

Apr 24, 2025

The Connection Between Budget Cuts And Increased Tornado Season Severity

Apr 24, 2025 -

Tensions Rise South Carolina Voter Challenges Rep Nancy Mace

Apr 24, 2025

Tensions Rise South Carolina Voter Challenges Rep Nancy Mace

Apr 24, 2025 -

The Bold And The Beautiful Recap April 3 Liams Health Crisis Following A Major Fallout With Bill

Apr 24, 2025

The Bold And The Beautiful Recap April 3 Liams Health Crisis Following A Major Fallout With Bill

Apr 24, 2025