New Routes To Global Markets: Investment Trends Among India's Elite

Table of Contents

Geographical Diversification: Beyond Traditional Havens

The investment strategies of India's elite are increasingly characterized by a move away from traditional investment havens like the US and Europe. This reflects a sophisticated understanding of risk mitigation and the pursuit of higher growth potential.

Increased Interest in Emerging Markets

There's a notable shift towards emerging economies in Asia, Africa, and Latin America. This strategic diversification is driven by:

- Higher Growth Potential: Emerging markets often offer significantly higher rates of economic growth compared to developed nations, leading to potentially greater returns on investment.

- Diversification Benefits: Investing in geographically diverse markets reduces overall portfolio risk. A downturn in one region is less likely to impact investments in others.

Examples of countries attracting significant Indian investment include:

- Vietnam: Strong economic growth and a young, dynamic population.

- Indonesia: Large and growing consumer market with significant infrastructure development.

- Kenya: A rapidly developing technology hub in East Africa.

- Brazil: Opportunities in agriculture, infrastructure, and renewable energy.

This expansion of "India's Global Investments" into diverse emerging markets demonstrates a proactive approach to portfolio management.

Strategic Investments in Developed Markets

While emerging markets are gaining prominence, established economies continue to attract significant Indian investment, particularly in sectors with high-growth potential.

- Technology: Indian HNWIs are heavily invested in technology companies, particularly in areas like AI, fintech, and cloud computing.

- Healthcare: The global healthcare sector is experiencing robust growth, attracting investment in pharmaceuticals, medical technology, and healthcare services.

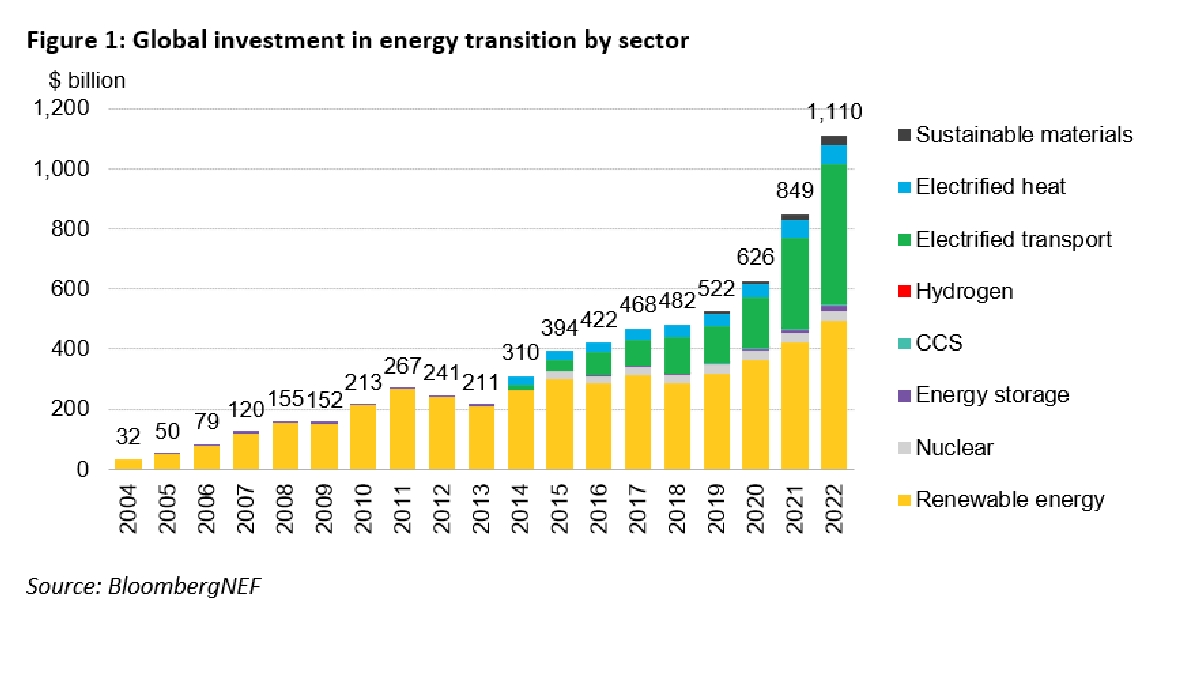

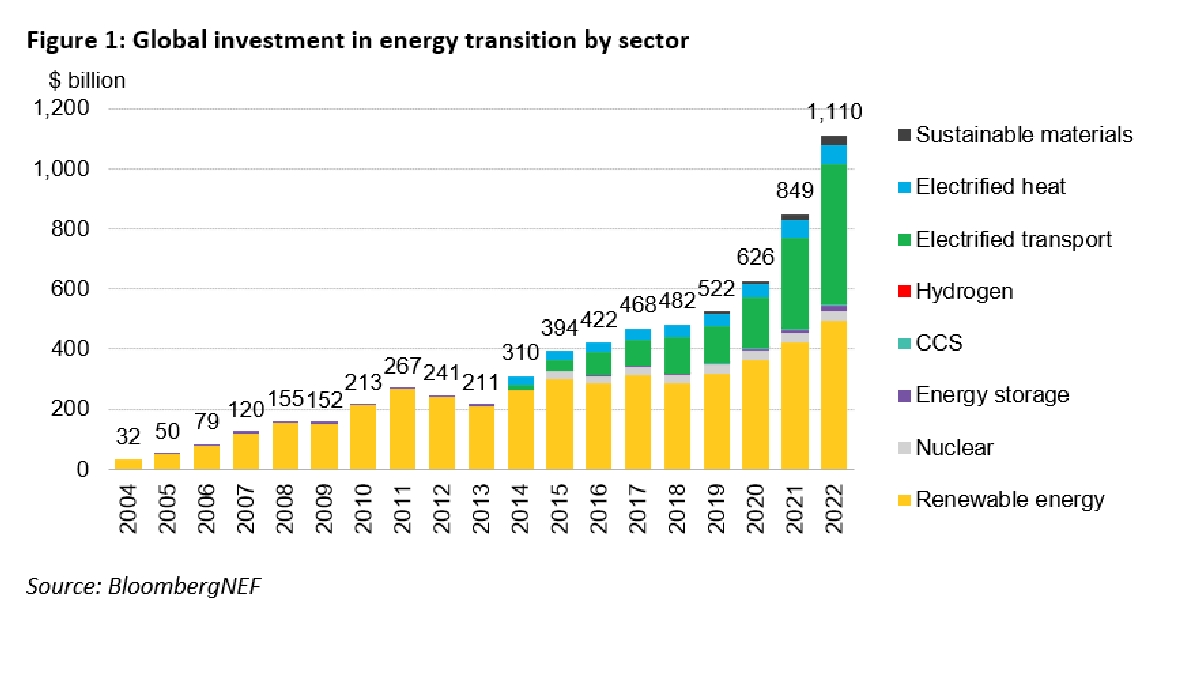

- Renewable Energy: The transition to sustainable energy is driving substantial investment in solar, wind, and other renewable energy sources.

Strategies employed for market entry often involve:

- Mergers & Acquisitions: Acquiring established companies to gain immediate market access and expertise.

- Joint Ventures: Partnering with local companies to leverage their knowledge and networks.

These "Global Market Entry Strategies" highlight the sophisticated approach of Indian investors in navigating developed markets. This contributes significantly to "International Portfolio Diversification".

Asset Class Preferences: A Shift Towards Alternatives

The investment choices of India's elite are also evolving, showcasing a growing preference for alternative investment classes offering potentially higher returns and greater diversification.

The Rise of Private Equity and Venture Capital

Private equity and venture capital are gaining significant traction amongst Indian HNWIs. This is due to:

- Growth Potential: These investments offer the potential for significantly higher returns compared to traditional asset classes.

- Diversification: They provide diversification beyond publicly traded stocks and bonds.

Successful investments in private equity and venture capital include:

- Investments in Indian startups that have achieved global success.

- Participation in global private equity funds focusing on specific sectors.

This increased interest in "Alternative Investments India," "Private Equity India," and "Venture Capital India" signals a shift towards higher-risk, higher-reward investment strategies.

Growing Appetite for Real Estate and Infrastructure

Global real estate and infrastructure projects are attracting increasing investment from Indian HNWIs.

- Real Estate: Popular destinations include the US, UK, Canada, and Australia, driven by factors like stable markets and potential for capital appreciation.

- Infrastructure: Investment in global infrastructure projects, particularly in renewable energy and transportation, offers both financial returns and positive social impact.

This interest in "Global Real Estate Investment" and "International Infrastructure Investment" reflects a long-term investment perspective and a focus on tangible assets.

Technology's Role in Shaping Investment Decisions

Technology is fundamentally altering how India's elite approach global investment.

Fintech and the Democratization of Global Investing

Fintech platforms are making global investing more accessible and efficient:

- Ease of Access: Online platforms provide convenient access to a wider range of investment opportunities.

- Transparency: Improved transparency and information availability empower investors to make informed decisions.

Examples of Fintech platforms used by Indian investors include globally recognized robo-advisors and international brokerage platforms. This increased use of "Digital Investment Platforms India" and "Global Investment Technology" is revolutionizing investment strategies.

Data Analytics and Investment Strategies

Data analytics and AI are playing an increasingly crucial role in investment decision-making:

- Risk Assessment: Advanced analytics tools help assess risk more accurately, leading to better portfolio management.

- Opportunity Identification: AI algorithms can identify potentially lucrative investment opportunities that may be missed by traditional methods.

This adoption of "Investment Analytics" and "AI in Investment" reflects a data-driven approach to investment management, optimizing "Data-Driven Investment Strategies".

Conclusion

The "Investment Trends Among India's Elite" reveal a dynamic shift towards geographical diversification, alternative asset classes, and technology-driven strategies. India's HNWIs are increasingly venturing beyond traditional markets, embracing higher-risk, higher-reward opportunities, and leveraging technology to enhance their investment decision-making. These trends are not only reshaping individual portfolios but also significantly influencing global investment landscapes. To stay ahead in this evolving environment, exploring the intricacies of "Investment Trends Among India's Elite" and engaging with experienced financial advisors is crucial. Consider consulting with a global investment specialist to optimize your global investment strategy and capitalize on these emerging opportunities.

Featured Posts

-

Harrogate Spring Flower Shows 2024 Return Starting April 24th

Apr 25, 2025

Harrogate Spring Flower Shows 2024 Return Starting April 24th

Apr 25, 2025 -

Navigating The Complexities Of The Chinese Auto Market Lessons From Bmw And Porsche

Apr 25, 2025

Navigating The Complexities Of The Chinese Auto Market Lessons From Bmw And Porsche

Apr 25, 2025 -

Rick Astley On Liverpool First Place In His Heart And Why

Apr 25, 2025

Rick Astley On Liverpool First Place In His Heart And Why

Apr 25, 2025 -

Mir Na Dnepre Put K Stabilnosti I Sotrudnichestvu

Apr 25, 2025

Mir Na Dnepre Put K Stabilnosti I Sotrudnichestvu

Apr 25, 2025 -

Harvard And Foreign Funding Examining The Trump Administrations Scrutiny

Apr 25, 2025

Harvard And Foreign Funding Examining The Trump Administrations Scrutiny

Apr 25, 2025