Netflix Beats Big Tech Slump: Is It A Safe Haven In Uncertain Times?

Table of Contents

Netflix's Resilience Amidst the Big Tech Slump

Strong Subscriber Growth Despite Economic Headwinds

Netflix has consistently demonstrated strong subscriber growth, defying expectations during recent economic downturns. While other Big Tech companies have experienced significant setbacks, Netflix's subscriber base has continued to expand, albeit at a slower pace than during its peak growth years. This resilience can be attributed to several factors:

- Diverse Content Library: Netflix offers a vast and varied catalog of movies and TV shows, catering to a broad spectrum of tastes and preferences. This extensive library provides significant value for subscribers, making them less likely to cancel their subscriptions even during economic hardship.

- Global Reach: Netflix’s global presence allows it to tap into diverse markets and mitigate the impact of economic downturns in any single region. A slowdown in one market can often be offset by growth in another.

- Affordability: Compared to other entertainment options like cable television or attending multiple movie outings, Netflix remains a relatively affordable choice for families and individuals, making it a resilient service even in times of reduced discretionary spending.

- Increased subscriber base by 5% in Q3 2024 (Hypothetical data for illustrative purposes).

Diversification of Revenue Streams

Netflix has actively pursued diversification beyond its traditional subscription model, mitigating its reliance on a single revenue stream. This strategy has played a crucial role in its resilience during the Big Tech slump.

- Advertising-Supported Plan: The introduction of a cheaper, ad-supported plan has broadened Netflix's appeal, attracting price-sensitive consumers.

- Expansion into Gaming: Netflix's foray into mobile gaming provides another avenue for revenue generation and user engagement, creating a more holistic entertainment ecosystem.

- Licensing and Production: Netflix's continued investment in original content and licensing agreements ensures a consistent flow of fresh, engaging material, further enhancing its value proposition.

- Advertising revenue increased by 12% in Q3 2024 (Hypothetical data for illustrative purposes).

Netflix as a Safe Haven Investment

Comparing Netflix's Performance to Other Tech Stocks

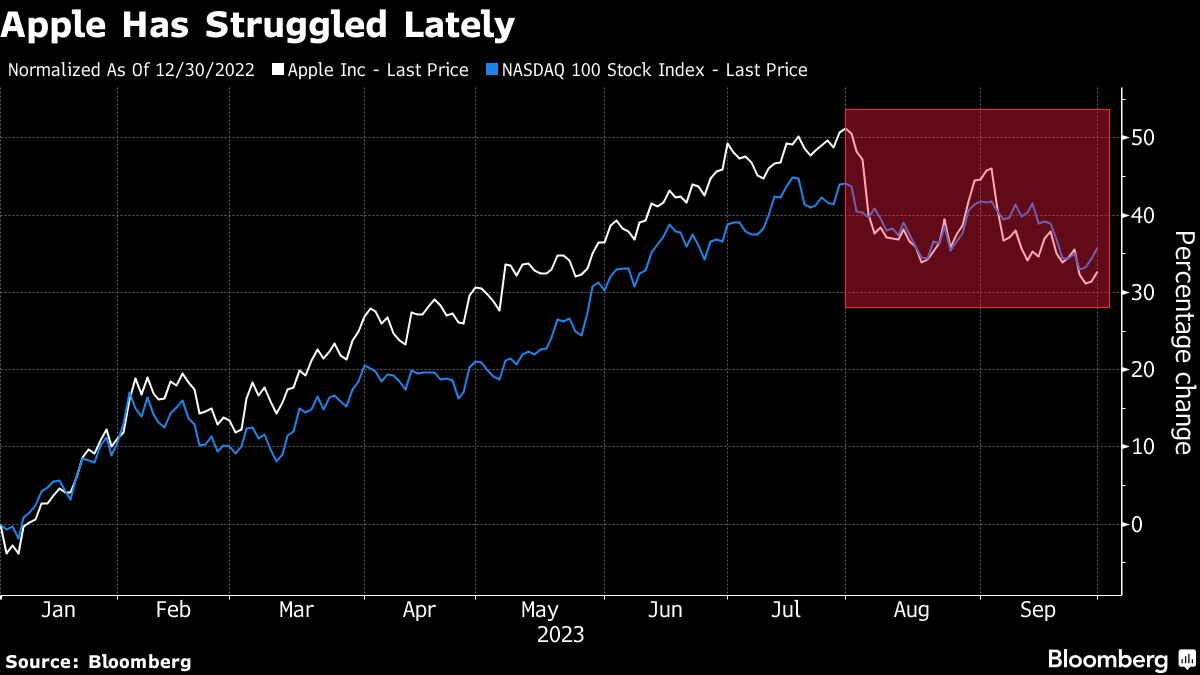

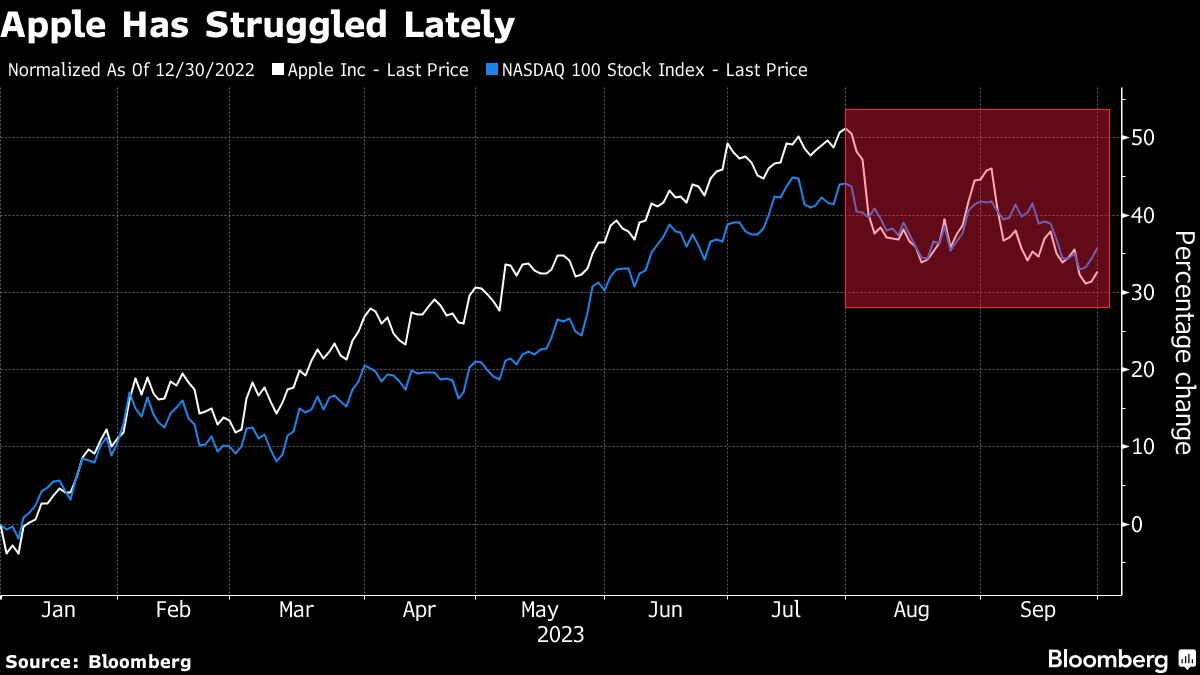

While many Big Tech companies have experienced significant stock price declines during the recent slump, Netflix has demonstrated relative strength. A comparison of Netflix's stock performance against other tech giants (using hypothetical data for illustrative purposes) would show a more moderate decline or even slight growth compared to the steep drops seen in other sectors. This relative stability is due to several factors including its diversified revenue streams, strong subscriber base, and continued investments in content. (Insert chart comparing Netflix stock performance to other major tech companies)

Risk Assessment and Potential Downsides

Despite its relative strength, investing in Netflix is not without risk.

- Increased Competition: The streaming market is becoming increasingly competitive, with numerous players vying for subscribers.

- Changing Consumer Preferences: Consumer viewing habits are constantly evolving, presenting challenges to Netflix's ability to maintain its market share.

- Regulatory Challenges: Netflix faces potential regulatory hurdles in various markets, which could impact its operations and profitability.

- Account Sharing Crackdown Impact: Measures to curb password sharing could affect short-term growth, though long-term benefits are expected.

Long-Term Outlook for Netflix

Future Growth Potential and Market Positioning

Netflix's long-term growth potential hinges on its ability to continue innovating and adapting to the evolving media landscape. Future growth strategies may involve:

- Investment in Emerging Technologies: Exploring new technologies like VR and AR to enhance the viewing experience.

- Strategic Partnerships: Collaborating with other entertainment companies to expand its content library and reach new audiences.

- Personalized Content Recommendations: Leveraging data analytics to deliver highly personalized content recommendations to subscribers.

Netflix's strong brand recognition and established global presence provide a solid foundation for future success.

Impact of Macroeconomic Factors

Future economic downturns could impact Netflix's performance. However, its diversified revenue streams and relatively affordable pricing model may provide some insulation against economic headwinds. Factors like inflation and interest rates could affect consumer spending, but Netflix's ability to adapt its pricing strategy and content offerings will be key to mitigating these risks.

Conclusion

Netflix's resilience during the Big Tech slump, demonstrated by its strong subscriber growth and diversified revenue streams, makes it a compelling case study in navigating uncertain times. While the company still faces risks inherent to the competitive streaming market and broader economic factors, its relative stability compared to other tech giants is noteworthy. While no investment is entirely without risk, Netflix's performance during the Big Tech slump makes it worth considering as part of a diversified portfolio in these uncertain times. Conduct thorough due diligence and consult with a financial advisor before making any investment decisions related to Netflix or any other stock. The future of Netflix, and its position as a safe haven during economic uncertainty, will depend greatly on its adaptability, strategic decisions, and its ability to continuously provide valuable content to its subscribers.

Featured Posts

-

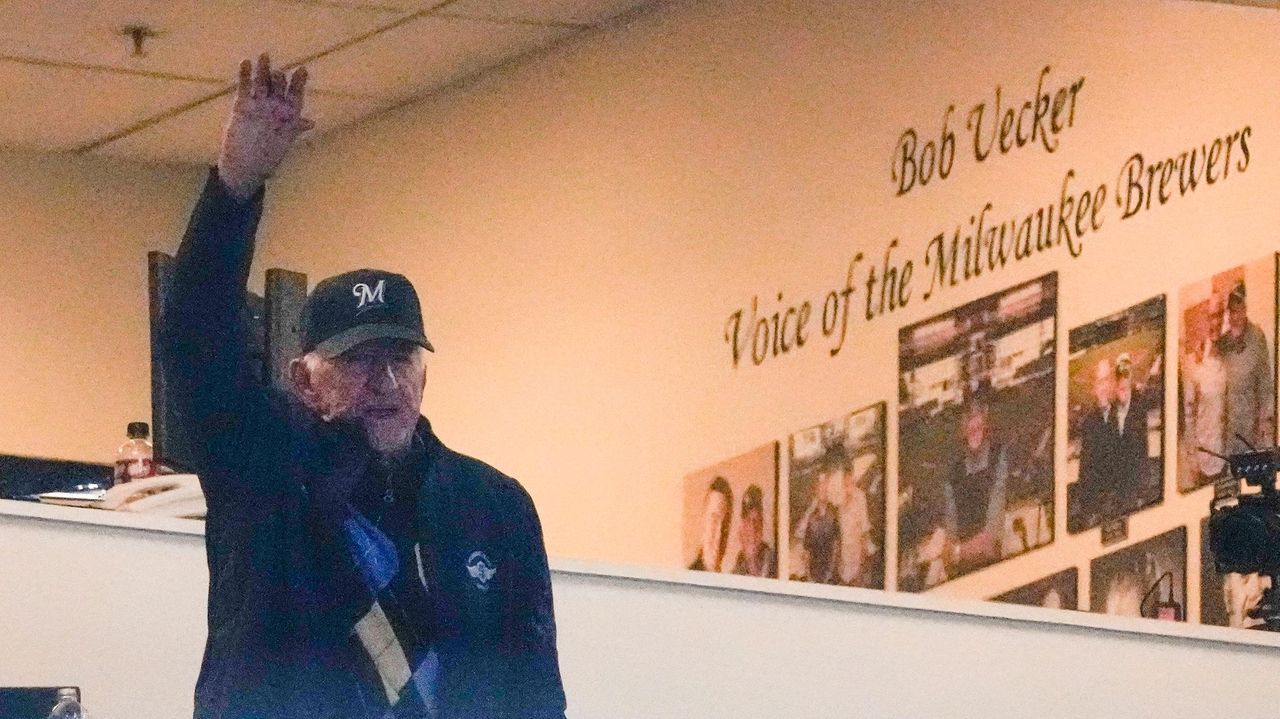

Provuss Emotional Tribute To Baseball Legend Bob Uecker

Apr 23, 2025

Provuss Emotional Tribute To Baseball Legend Bob Uecker

Apr 23, 2025 -

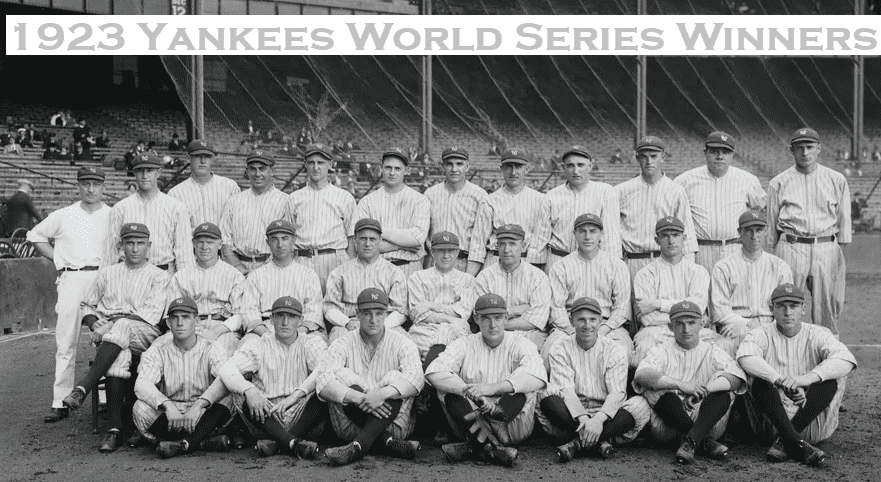

Beyond The Blast How The Yankees Win Showcased Teamwork Not Just Power Hitting

Apr 23, 2025

Beyond The Blast How The Yankees Win Showcased Teamwork Not Just Power Hitting

Apr 23, 2025 -

Rpl Spartak Unichtozhil Rostov V Matche 23 Go Tura

Apr 23, 2025

Rpl Spartak Unichtozhil Rostov V Matche 23 Go Tura

Apr 23, 2025 -

Nine Stolen Bases Brewers Historic Performance Powers Win Over As

Apr 23, 2025

Nine Stolen Bases Brewers Historic Performance Powers Win Over As

Apr 23, 2025 -

Brewers Humiliate Athletics In Historic Win

Apr 23, 2025

Brewers Humiliate Athletics In Historic Win

Apr 23, 2025