Navigate The Private Credit Boom: 5 Key Do's And Don'ts For Job Seekers

Table of Contents

Do: Target Niche Private Credit Roles

The private credit market is diverse, encompassing direct lending, mezzanine financing, distressed debt, real estate credit, and more. Don't try to be a jack-of-all-trades; instead, focus your efforts on a specific niche.

Understand the Sub-Sectors:

The key to securing private credit jobs lies in specialization. Understanding the nuances of each sub-sector is crucial.

- Research specific private credit firms and their investment strategies. Look beyond the big names; many smaller, specialized firms offer unique opportunities.

- Tailor your resume and cover letter to highlight relevant experience. Use keywords relevant to the specific job description and the firm's investment focus.

- Network within specific sub-sectors. Attend industry events focused on your chosen area of expertise.

Leverage Specialized Skills:

Highlighting specific skills is critical in the competitive landscape of private credit jobs.

- Showcase proficiency in relevant software (e.g., Bloomberg Terminal, Argus). These tools are essential in private credit analysis and should be highlighted.

- Quantify your achievements whenever possible. Instead of saying "improved efficiency," say "improved efficiency by 15% through process optimization."

- Emphasize skills transferable from related fields (e.g., banking, asset management). Even if your experience isn't directly in private credit, relevant skills are valuable. For example, experience in credit underwriting in a bank is highly transferable.

Don't: Neglect Networking in Private Credit

Private credit is a relationship-driven industry. Building your network is paramount to securing private credit jobs.

The Power of Connections:

Networking is essential for accessing unadvertised roles and gaining valuable insights.

- Leverage LinkedIn to connect with professionals in private credit. Actively engage with industry professionals, sharing relevant articles and participating in discussions.

- Attend industry conferences and workshops. These events provide excellent networking opportunities and a chance to learn about the latest trends.

- Participate in online forums and discussions. Engage with industry experts and potential employers on relevant platforms.

Underestimate Informational Interviews:

Informational interviews are invaluable for gaining insights and making connections.

- Research the individuals you contact before reaching out. Demonstrate genuine interest in their work and expertise.

- Show genuine interest in their work and experience. Ask thoughtful questions and actively listen to their responses.

- Express gratitude for their time and offer to reciprocate. Networking is a two-way street; offer to help others when possible.

Do: Highlight Relevant Experience, Even if Indirect

While direct private credit experience is advantageous, transferable skills are highly valuable.

Transferable Skills Matter:

Your background in related fields can significantly strengthen your application for private credit jobs.

- Focus on your analytical skills, financial modeling expertise, and problem-solving abilities. These are core competencies in private credit.

- Showcase your ability to work independently and as part of a team. Private credit roles often require both independent work and collaborative team efforts.

- Quantify your contributions and achievements in previous roles. Use metrics to demonstrate the impact you made in past positions.

Showcase Strong Financial Acumen:

Demonstrate your understanding of financial statements, valuations, and risk assessment.

- Include relevant coursework, certifications (e.g., CFA, CAIA), or projects in your resume. Highlight your financial expertise.

- Highlight your proficiency in financial modeling and analysis techniques. This is a critical skill in private credit.

- Be prepared to discuss complex financial concepts during interviews. Practice explaining these concepts clearly and concisely.

Don't: Underprepare for Private Credit Interviews

Private credit interviews are rigorous and demand thorough preparation.

Technical Proficiency is Key:

Expect in-depth questions on financial modeling, credit analysis, and market dynamics.

- Familiarize yourself with common private credit interview questions. Research typical questions and prepare thoughtful answers.

- Practice your responses and refine your storytelling abilities. Use the STAR method (Situation, Task, Action, Result) to structure your answers.

- Prepare for case studies by working through practice examples. Many interviews involve case studies to assess your analytical skills.

Neglecting Market Research:

Demonstrate your understanding of current market trends, key players, and relevant legislation.

- Stay up-to-date on industry news and publications. Follow leading private credit publications and news sources.

- Understand the competitive landscape and the different types of private credit funds. Research different fund strategies and their investment approaches.

- Be prepared to discuss your investment philosophy and risk tolerance. Show you understand the risks involved in private credit investing.

Do: Craft a Compelling Narrative

Your application materials should tell a compelling story that highlights your qualifications for private credit jobs.

Tell Your Story:

Go beyond simply listing your accomplishments; connect them to your aspirations.

- Clearly articulate your career goals and aspirations within the private credit industry. Show your long-term commitment to the field.

- Showcase your passion for the field and your understanding of its challenges and opportunities. Demonstrate enthusiasm and a deep understanding of the industry.

- Connect your experiences to the specific requirements of the roles you are targeting. Tailor your narrative to each specific job application.

Emphasize Long-Term Career Aspirations:

Show you're not just looking for a job, but a career in private credit.

- Research the firm's culture and values and align your aspirations with their vision. Show you've done your homework and understand the firm.

- Show a genuine interest in the firm and its investment strategy. Demonstrate your understanding of their investment philosophy and how you can contribute.

- Express your enthusiasm for contributing to the firm’s success. Highlight your commitment to teamwork and the firm's overall success.

Conclusion:

Landing a job in the booming private credit market requires a strategic and informed approach. By following these do's and don'ts, you can significantly increase your chances of success. Remember to target niche roles, leverage your network, highlight relevant skills, thoroughly prepare for interviews, and craft a compelling narrative that showcases your passion and expertise in private credit. Don't delay – start your job search in the dynamic world of private credit jobs today!

Featured Posts

-

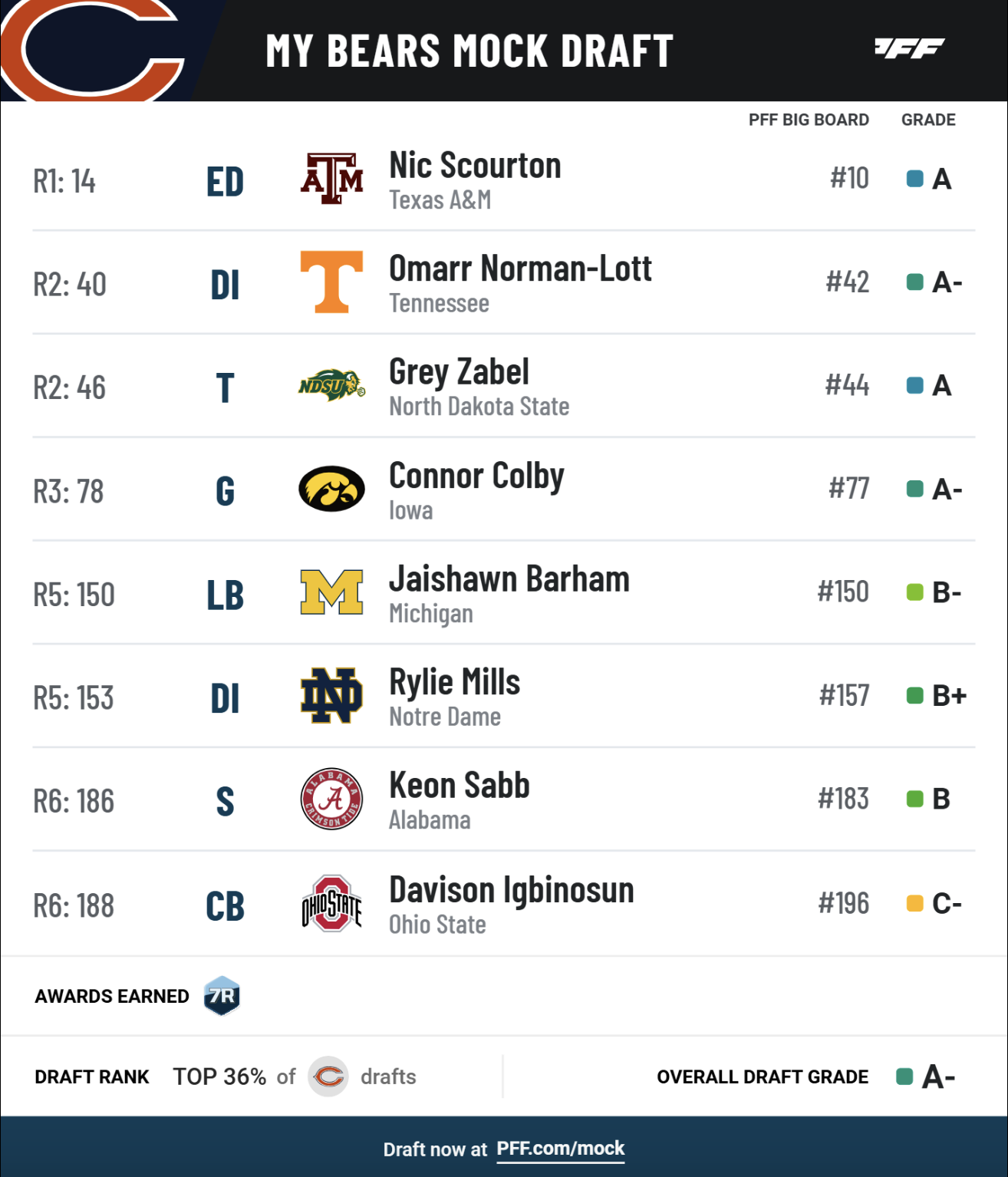

Is Ashton Jeanty The Chicago Bears Next Draft Pick In 2025

Apr 25, 2025

Is Ashton Jeanty The Chicago Bears Next Draft Pick In 2025

Apr 25, 2025 -

Trumps Sharp Criticism Of Putin Following Kyiv Attacks

Apr 25, 2025

Trumps Sharp Criticism Of Putin Following Kyiv Attacks

Apr 25, 2025 -

The Nintendo Switch 2 Preorder Situation What Happened And Whats Next

Apr 25, 2025

The Nintendo Switch 2 Preorder Situation What Happened And Whats Next

Apr 25, 2025 -

A Shoppers Guide To Europe 10 Top Choices

Apr 25, 2025

A Shoppers Guide To Europe 10 Top Choices

Apr 25, 2025 -

Denver Broncos Super Bowl Hopes Hinge On Ashton Jeantys Impact

Apr 25, 2025

Denver Broncos Super Bowl Hopes Hinge On Ashton Jeantys Impact

Apr 25, 2025