Mercer International Inc. Reports Q4 2024 Earnings And $0.075 Dividend

Table of Contents

Q4 2024 Earnings Results: A Detailed Look

Mercer International's Q4 2024 earnings showcased robust financial health. Analyzing the Mercer International Q4 revenue, profit, and key performance indicators (KPIs) provides a clear picture of the company's performance.

-

Revenue: Mercer International reported Q4 2024 revenue of [Insert Actual Revenue Figure Here], representing a [Insert Percentage]% increase compared to Q4 2023 revenue of [Insert Q4 2023 Revenue Figure Here]. This significant growth is attributable to [Explain reasons for revenue growth, e.g., increased demand for pulp, higher selling prices, successful cost-cutting measures].

-

Net Income and EPS: The company's net income for Q4 2024 reached [Insert Actual Net Income Figure Here], resulting in earnings per share (EPS) of [Insert Actual EPS Figure Here]. This compares favorably to Q4 2023's net income of [Insert Q4 2023 Net Income Figure Here] and EPS of [Insert Q4 2023 EPS Figure Here].

-

Operating Margin and Return on Equity: Mercer International's operating margin for Q4 2024 was [Insert Actual Operating Margin Figure Here]%, showcasing improved operational efficiency. The return on equity (ROE) stood at [Insert Actual ROE Figure Here]%, indicating strong profitability relative to shareholder investment. These figures exceeded analyst expectations, further strengthening investor confidence.

-

Cost Structure: The company's focus on streamlining operations and optimizing its cost structure contributed significantly to the improved profitability. [Explain specific cost-saving measures implemented by the company]. This strategic approach underscores Mercer International's commitment to maintaining a competitive edge within the pulp and paper industry.

The $0.075 Dividend: Implications for Investors

The announcement of a $0.075 dividend per share is a significant positive for Mercer International investors. This Mercer International dividend demonstrates the company's confidence in its future performance and its commitment to shareholder returns.

-

Dividend Yield: Based on the current stock price of [Insert Current Stock Price Here], the dividend yield is approximately [Calculate and Insert Dividend Yield Here]%. This provides investors with a competitive return on their investment.

-

Dividend Payout Ratio: The dividend payout ratio is [Insert Payout Ratio Here]%, indicating the sustainability of the dividend policy. This conservative approach suggests that Mercer International is prioritizing both growth and shareholder returns.

-

Shareholder Returns: This dividend payout significantly contributes to overall shareholder returns, rewarding investors for their continued support and trust in the company. This commitment to shareholder value reinforces Mercer International's position as an attractive investment.

Market Outlook and Future Projections for Mercer International

The future looks promising for Mercer International, with several factors contributing to positive future growth prospects. The pulp and paper market outlook remains positive, driven by [mention specific market drivers such as increased demand from packaging, construction, and hygiene sectors].

-

Pulp and Paper Market Outlook: The global pulp and paper market is expected to experience [mention growth rate predictions]. Mercer International is well-positioned to capitalize on this growth due to [explain reasons, e.g., its diversified product portfolio, strategic geographic locations, and efficient operations].

-

Future Growth Prospects: Mercer International's future growth is expected to be driven by [mention specific initiatives, e.g., expansion projects, new product lines, technological advancements]. These initiatives are projected to enhance the company's market share and overall profitability.

-

Competitive Landscape: Mercer International maintains a strong competitive position within the pulp and paper industry due to [explain reasons, e.g., its operational efficiency, sustainable practices, and strong customer relationships]. The company's strategic focus on innovation and operational excellence will be key to sustaining this competitive advantage.

Conclusion

Mercer International's Q4 2024 earnings report reflects strong financial performance, bolstered by impressive revenue growth and a substantial $0.075 per share dividend. The results highlight the company's resilient position within the pulp and paper sector and suggest a positive outlook. The announced Mercer International dividend reinforces the company's commitment to delivering value to shareholders. Understanding the implications of the Mercer International Q4 2024 earnings and dividend is crucial for any investor considering this stock.

Call to Action: Stay updated on Mercer International's financial performance and future developments by regularly visiting their investor relations page and following their financial news releases. Analyze the Mercer International Q4 2024 earnings and dividend to inform your investment decisions. Understanding the company's performance is key to making informed investment choices regarding Mercer International stock.

Featured Posts

-

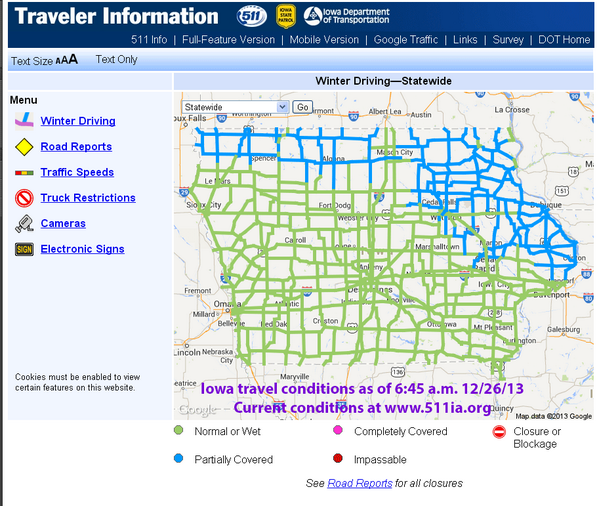

Oklahoma City Road Conditions Ice And Snow Cause Multiple Vehicle Collisions

Apr 25, 2025

Oklahoma City Road Conditions Ice And Snow Cause Multiple Vehicle Collisions

Apr 25, 2025 -

David Paynes Digital Exclusive Predicting Okc Metro Ice And Snow

Apr 25, 2025

David Paynes Digital Exclusive Predicting Okc Metro Ice And Snow

Apr 25, 2025 -

Analiz Zayav Trampa Pro Viynu V Ukrayini

Apr 25, 2025

Analiz Zayav Trampa Pro Viynu V Ukrayini

Apr 25, 2025 -

2025 Nfl Draft Scouting Texas Wide Receiver Matthew Golden

Apr 25, 2025

2025 Nfl Draft Scouting Texas Wide Receiver Matthew Golden

Apr 25, 2025 -

Spider Man 4 The Ultimate Casting Choice Has Marvel Fans In A Frenzy

Apr 25, 2025

Spider Man 4 The Ultimate Casting Choice Has Marvel Fans In A Frenzy

Apr 25, 2025