Market Volatility: Dow Futures And China's Economic Measures In Focus

Table of Contents

Understanding Current Market Volatility

Factors Contributing to Market Uncertainty

Market volatility refers to the rate and extent of the changes in market prices. High volatility means prices are changing rapidly and significantly, creating uncertainty and risk for investors. This uncertainty can stem from various factors, significantly impacting investment returns and overall market stability. Several key factors are currently contributing to this market uncertainty:

- Geopolitical tensions: Ongoing conflicts and international relations significantly impact investor confidence and market stability. The war in Ukraine, for example, has created significant ripple effects across global markets.

- Inflation concerns: Persistent inflation erodes purchasing power and forces central banks to raise interest rates, potentially slowing economic growth and impacting market valuations. High inflation is a significant driver of current market volatility.

- Interest rate hikes: Central banks globally are raising interest rates to combat inflation. This increases borrowing costs for businesses and consumers, potentially leading to economic slowdowns and impacting market sentiment.

- Supply chain disruptions: Global supply chains remain fragile, leading to shortages, higher prices, and uncertainty for businesses. These disruptions contribute to inflationary pressures and market volatility.

- China's economic slowdown: China's economic growth has slowed, impacting global demand and commodity prices. This slowdown has significant implications for global markets due to China's size and importance in the global economy.

The volatility index (VIX), often referred to as the "fear gauge," measures market volatility based on S&P 500 index options. A high VIX indicates high volatility and investor anxiety (risk-off sentiment), while a low VIX suggests calmer markets and increased risk appetite (risk-on sentiment).

The Role of Dow Futures in Reflecting Market Sentiment

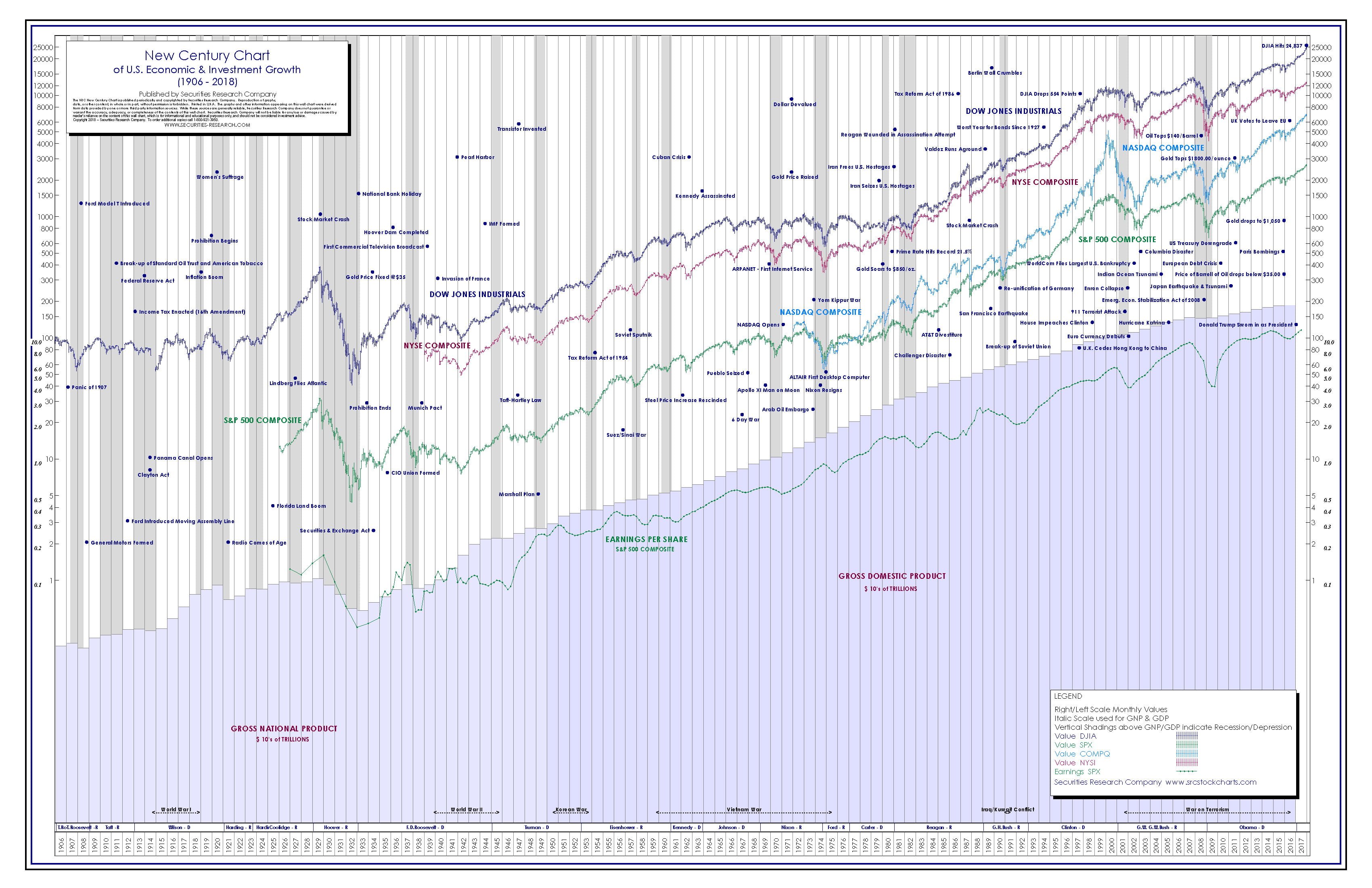

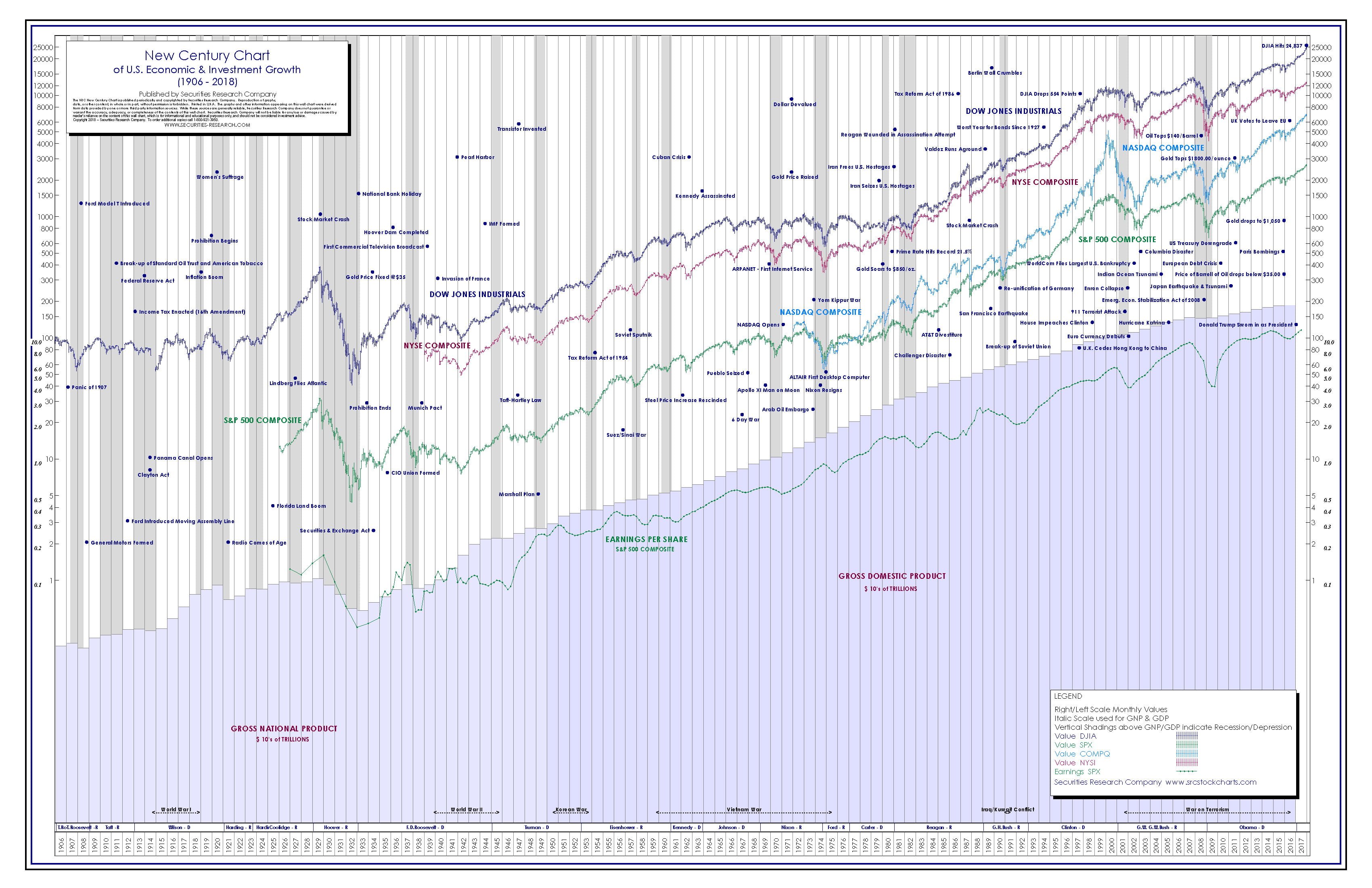

Dow futures are contracts obligating the buyer to purchase the Dow Jones Industrial Average (DJIA) at a predetermined price on a future date. They act as a leading indicator of market sentiment, offering insights into the expected direction of the broader market. Changes in Dow futures contracts reflect investor expectations and anxieties regarding the performance of the DJIA and, by extension, the overall US economy.

Technical analysis, a method of evaluating securities by analyzing statistics generated by market activity, such as past prices and volume, is frequently used to interpret Dow futures charts. Traders use chart patterns and indicators to predict future price movements, which are directly influenced by market volatility.

China's Economic Measures and Their Global Impact

Analyzing China's Recent Economic Policies

The Chinese government has implemented various economic policies recently, including stimulus packages aimed at boosting infrastructure spending and measures to address challenges in the property sector. These policies are designed to stimulate growth and stabilize the economy. However, their effectiveness and overall impact remain to be seen. The challenges faced by the Chinese economy, such as high debt levels and a struggling property market, have far-reaching global consequences.

The Ripple Effect on Global Markets

China's economic performance significantly influences global supply chains, commodity prices, and international trade. A slowdown in the Chinese economy reduces demand for raw materials and manufactured goods, impacting commodity prices and affecting businesses globally. This interdependence creates a ripple effect, transmitting volatility across international markets. The correlation between China's economic indicators (GDP growth, industrial production, etc.) and global market volatility is strong, highlighting the interconnected nature of the global economy.

Interplay Between Dow Futures and China's Economic Actions

Correlation and Causation

There's a clear correlation between movements in Dow futures and developments in the Chinese economy. A slowdown in China tends to negatively impact investor sentiment, leading to declines in Dow futures. However, establishing direct causation is more complex. While China's economic performance is a significant factor influencing global market sentiment, other factors, such as geopolitical events and interest rate changes, also play crucial roles. Data analysis and econometric modeling are necessary to further investigate the relationship between these two variables and unravel the intricate web of cause and effect.

Strategies for Navigating Market Volatility

Navigating market volatility requires a proactive approach to risk management. Investors can employ several strategies to mitigate risk during periods of heightened uncertainty:

- Diversification: Spreading investments across different asset classes reduces exposure to the risk associated with any single asset.

- Hedging strategies: Utilizing financial instruments, such as options or futures contracts, to offset potential losses.

- Risk management techniques: Employing stop-loss orders and other risk management techniques to limit potential losses.

It is crucial to seek professional financial advice tailored to your specific investment goals and risk tolerance.

Conclusion

Market volatility is currently influenced by a complex interplay of factors, including the performance of Dow futures and the impact of China's economic policies. The interconnectedness of these elements underscores the global nature of financial markets. Understanding these dynamics is critical for investors. Key takeaways include the significant impact of geopolitical tensions, inflation, and supply chain disruptions on market volatility, coupled with the crucial role China's economic health plays in shaping global market sentiment.

Stay ahead of the curve by understanding market volatility and its drivers. Mastering market volatility starts with understanding the interplay between Dow futures and global economic factors. To further enhance your knowledge, explore resources on Dow futures trading strategies and analyses of China's economic outlook. Informed investment decisions are crucial in navigating this complex market environment.

Featured Posts

-

Ajaxs Home Loss To Frankfurt Complicates Europa League Chances

Apr 26, 2025

Ajaxs Home Loss To Frankfurt Complicates Europa League Chances

Apr 26, 2025 -

Rethinking Middle Management Their Vital Role In Company Growth And Employee Development

Apr 26, 2025

Rethinking Middle Management Their Vital Role In Company Growth And Employee Development

Apr 26, 2025 -

Will Gavin Newsoms Podcast Hurt His Political Career Charlie Kirk Weighs In

Apr 26, 2025

Will Gavin Newsoms Podcast Hurt His Political Career Charlie Kirk Weighs In

Apr 26, 2025 -

Major Delays On Anzac Bridge Due To Vehicle Collision

Apr 26, 2025

Major Delays On Anzac Bridge Due To Vehicle Collision

Apr 26, 2025 -

Deion Sanders Coaching Impact How It Affects Shedeur Sanders Nfl Prospects

Apr 26, 2025

Deion Sanders Coaching Impact How It Affects Shedeur Sanders Nfl Prospects

Apr 26, 2025