KRW/USD Exchange Rate: Trump's Criticism And The Potential For A Stronger Won

Table of Contents

Historical Context of the KRW/USD Exchange Rate

The KRW/USD exchange rate reflects the complex interplay of economic and political factors affecting both South Korea and the United States. Analyzing its historical trajectory provides valuable insights into potential future movements. The South Korean Won (KRW) has experienced significant fluctuations against the US Dollar (USD) throughout history.

-

Pre-Trump era fluctuations and their causes: Prior to the Trump administration, the KRW/USD exchange rate was influenced by factors such as global economic crises (e.g., the Asian Financial Crisis of 1997-98), changes in global interest rates, and South Korea's trade balance. Periods of strong economic growth in South Korea often correlated with a stronger Won, while global recessions or trade deficits typically weakened it. Currency trading strategies during this period relied heavily on fundamental analysis of these macroeconomic indicators.

-

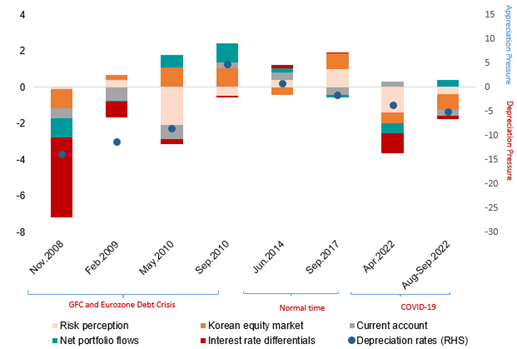

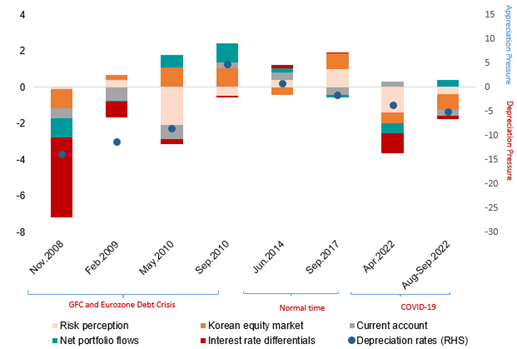

Impact of global events on the KRW/USD: Global events, such as the 2008 financial crisis and the European debt crisis, significantly impacted the KRW/USD exchange rate, causing periods of high volatility and uncertainty in the foreign exchange market. These events highlighted the interconnectedness of global economies and the sensitivity of the KRW/USD to international developments.

-

Long-term trends in the exchange rate: Over the long term, the KRW/USD exchange rate has exhibited a general trend of depreciation against the USD, though this has been punctuated by periods of appreciation. Analyzing charts showing this long-term trend helps identify cyclical patterns and potential turning points.

(Insert relevant chart illustrating historical KRW/USD exchange rate fluctuations here)

Trump's Criticism and its Impact on the KRW/USD Exchange Rate

During his presidency, Donald Trump repeatedly criticized South Korea's currency practices, accusing the country of currency manipulation to gain an unfair trade advantage. These accusations, often made via Twitter, directly impacted market sentiment and led to significant volatility in the KRW/USD exchange rate.

-

Specific statements made by Trump regarding the KRW/USD: Trump's statements often linked the KRW/USD exchange rate to trade imbalances between the US and South Korea, framing a stronger Won as detrimental to American interests. These pronouncements created considerable political risk.

-

Market reactions to these statements: Markets reacted swiftly to Trump's pronouncements, often leading to immediate drops in the value of the Won against the dollar. This volatility highlighted the significant influence of political rhetoric on currency trading and the importance of monitoring geopolitical factors.

-

Analysis of the impact on South Korea's economy: The uncertainty created by Trump's criticisms negatively affected investor confidence and potentially hampered South Korea's economic growth. The threat of a trade war added to the pressure on the KRW/USD exchange rate. Keywords like "trade war" and "currency manipulation" became central to discussions surrounding the KRW/USD.

Factors Contributing to a Potential Stronger Won

Several factors could contribute to a stronger Won against the US dollar in the future.

-

Economic growth in South Korea: Continued robust economic growth in South Korea, driven by technological innovation, exports, and domestic consumption, would likely support a stronger KRW.

-

Increased foreign investment: Higher levels of foreign direct investment (FDI) flowing into South Korea, attracted by its dynamic economy and skilled workforce, would increase demand for the Won, pushing its value upwards.

-

Changes in US monetary policy: A shift towards tighter monetary policy in the US, such as higher interest rates, could strengthen the USD relative to other currencies, including the KRW. Conversely, looser US monetary policy could weaken the USD and strengthen the KRW.

-

Global economic shifts: Global economic shifts, such as a rapid recovery in global demand or a weakening of the US dollar due to global factors, could lead to a stronger Won.

Analyzing South Korea's Economic Fundamentals

Analyzing key economic indicators is crucial for predicting future KRW/USD movements.

-

Current account balance: A consistently positive current account balance indicates a strong trade surplus, supporting a stronger Won.

-

GDP growth: Strong GDP growth signals a healthy economy, attracting investment and strengthening the currency.

-

Inflation rates: Lower inflation rates in South Korea relative to the US could make the Won more attractive to investors.

-

Interest rate differentials: Higher interest rates in South Korea compared to the US could attract foreign capital, boosting demand for the Won.

Risks and Uncertainties Affecting the KRW/USD Exchange Rate

Despite the potential for a stronger Won, several risks and uncertainties could impact the KRW/USD exchange rate.

-

Geopolitical risks in the region (North Korea): Geopolitical tensions on the Korean peninsula, particularly those related to North Korea, create uncertainty and can significantly influence the KRW/USD exchange rate.

-

Global economic slowdown: A global economic slowdown or recession could negatively impact South Korea's export-oriented economy, weakening the Won.

-

Changes in US-South Korea trade relations: Future shifts in US-South Korea trade relations could introduce volatility into the KRW/USD exchange rate.

-

Unexpected policy shifts by either government: Unexpected policy changes by either the South Korean or US government could trigger significant fluctuations in the KRW/USD.

Conclusion

The KRW/USD exchange rate has a rich history marked by volatility influenced by both economic and political factors. While Trump's criticisms created significant uncertainty and impacted the KRW/USD, a variety of factors, including South Korea's economic fundamentals and global economic trends, will ultimately determine future exchange rate movements. Understanding these intertwined forces is vital for navigating this dynamic market. Stay informed about the latest developments in the KRW/USD exchange rate to make informed decisions regarding currency trading and investments. Understanding the historical context and the interplay of economic and political factors is crucial for navigating the complexities of the KRW/USD exchange rate. Continue monitoring this important indicator of the global economy.

Featured Posts

-

Convicted Cardinals Demand Shakes Vatican Conclave Showdown Looms

Apr 25, 2025

Convicted Cardinals Demand Shakes Vatican Conclave Showdown Looms

Apr 25, 2025 -

Above The Law Morning Docket 02 04 25 Legal News Summary

Apr 25, 2025

Above The Law Morning Docket 02 04 25 Legal News Summary

Apr 25, 2025 -

Harvard And Foreign Funding Examining The Trump Administrations Scrutiny

Apr 25, 2025

Harvard And Foreign Funding Examining The Trump Administrations Scrutiny

Apr 25, 2025 -

Okc March Concerts Your Guide To Big Name Shows And Tickets

Apr 25, 2025

Okc March Concerts Your Guide To Big Name Shows And Tickets

Apr 25, 2025 -

Comfortable Bayern Win Harry Kane Scores Twice Against Werder Bremen

Apr 25, 2025

Comfortable Bayern Win Harry Kane Scores Twice Against Werder Bremen

Apr 25, 2025