Is The U.S. Dollar Headed For Its Worst Presidential First 100 Days Since Nixon?

Table of Contents

Economic Indicators and Potential for Dollar Weakness

Several key economic indicators point towards potential weakness in the U.S. dollar during the crucial initial 100 days.

Inflation and Interest Rates

Inflation remains stubbornly high, forcing the Federal Reserve to implement aggressive interest rate hikes. While aiming to curb inflation, these hikes can simultaneously strengthen the dollar in the short term by attracting foreign investment seeking higher returns. However, overly aggressive rate hikes risk triggering a recession, potentially weakening the dollar in the long run.

- Current inflation figures: Inflation remains significantly above the Federal Reserve's target rate.

- Projected inflation: Forecasts vary, but many experts predict inflation will remain elevated for some time.

- Federal Reserve policy changes: The Fed is closely monitoring economic data and adjusting its monetary policy accordingly.

- Impact of interest rate hikes on the dollar: The immediate impact is usually dollar strengthening, but long-term effects are complex and uncertain.

Global Economic Uncertainty

Geopolitical instability, ongoing supply chain disruptions, and the fluctuating strength of other major currencies like the Euro and Yen all contribute to the uncertainty surrounding the U.S. dollar's trajectory. The war in Ukraine, for instance, continues to significantly impact global energy markets and supply chains, contributing to inflationary pressures.

- Specific geopolitical events: The war in Ukraine, rising tensions in the South China Sea, and other global conflicts create economic uncertainty.

- Ongoing supply chain problems: Disruptions continue to impact production and pricing across various sectors.

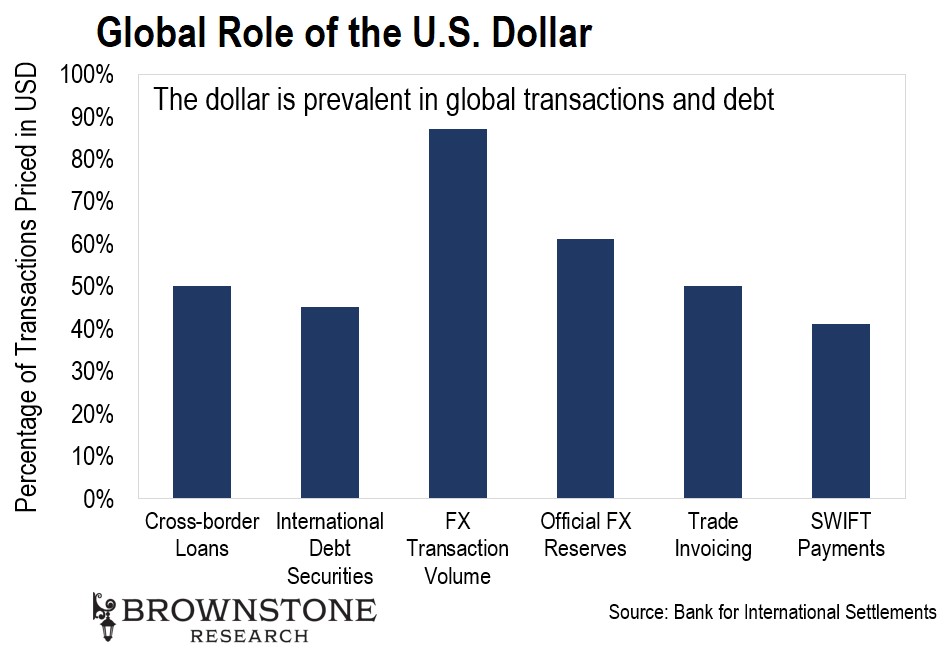

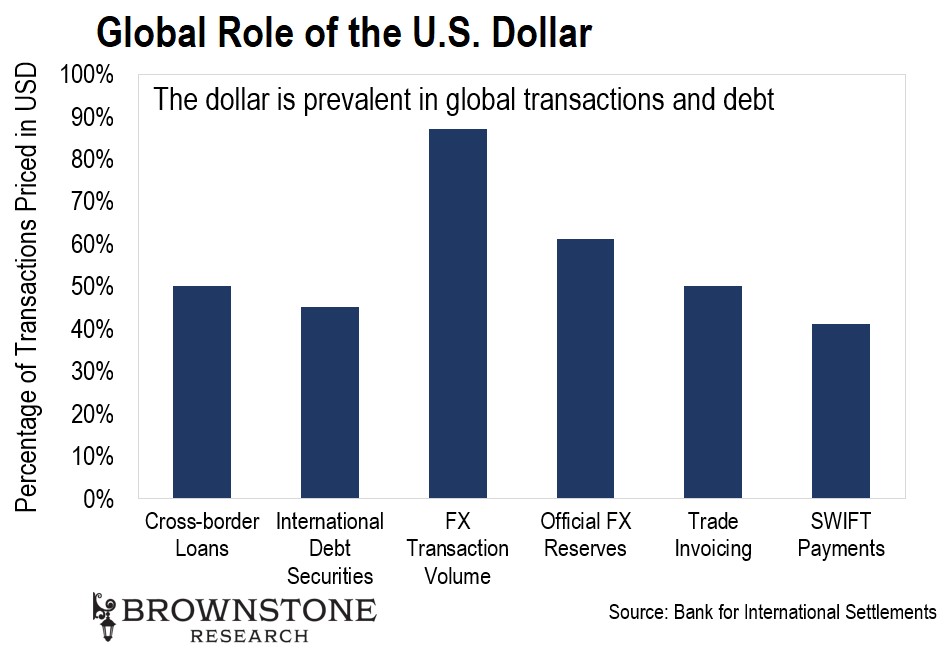

- Comparative analysis of other major currencies: The relative strength of other global currencies influences the value of the U.S. dollar.

Government Spending and Debt

High levels of government spending and a burgeoning national debt exert downward pressure on the dollar's value and credit rating. Concerns about the sustainability of the national debt can erode investor confidence and lead to capital flight, weakening the currency.

- Current national debt levels: The U.S. national debt is at historically high levels.

- Projected budget deficits: Future budget deficits are projected to remain substantial.

- Potential impact of government spending on inflation and the dollar: Increased government spending can fuel inflation, leading to a weaker dollar.

Historical Parallels to the Nixon Administration

Drawing parallels between the current situation and the Nixon administration is crucial for understanding the potential volatility of the U.S. dollar.

Nixon's Economic Policies and their Impact

President Nixon's economic policies, particularly the closing of the gold window in 1971, had a profound and lasting impact on the global monetary system and the U.S. dollar. This move effectively ended the Bretton Woods system, ushering in an era of floating exchange rates and increased currency volatility.

- Key economic policies of the Nixon administration: These included wage and price controls, devaluation of the dollar, and closing the gold window.

- The impact of closing the gold window: This decision ended the dollar's convertibility to gold, leading to significant changes in the international monetary system.

- Long-term consequences for the dollar: The dollar's role as the world's reserve currency was significantly altered, leading to periods of both strength and weakness.

Comparing Current and Past Economic Conditions

While there are clear differences between the economic landscape of the early 1970s and today, certain parallels exist. Both periods feature high inflation, albeit potentially driven by different factors. The level of national debt is also a point of similarity, although the exact composition and scale differ.

- Comparison of inflation rates: Inflation rates in both periods were/are significantly elevated compared to historical averages.

- Interest rates: Interest rates were also high in the Nixon era.

- Global economic situations: Both periods featured significant global economic uncertainty.

- Government debt levels: High government debt levels are a common thread between the two eras.

Expert Opinions and Predictions

Analyzing expert opinions is crucial for gaining a comprehensive understanding of the potential trajectory of the U.S. dollar.

Views from Economists and Financial Analysts

Economists and financial analysts offer diverse perspectives on the future of the U.S. dollar. Some predict a period of continued weakness, citing persistent inflation and global uncertainty. Others remain optimistic about the dollar's long-term resilience, highlighting its role as a safe haven asset.

- Quotes or summaries of opinions from several experts: A range of predictions and viewpoints should be included.

- Range of predictions and differing viewpoints: Highlight the divergence of expert opinions to present a balanced perspective.

Market Sentiment and Investor Confidence

Market sentiment and investor confidence significantly influence the dollar's value. Negative sentiment can lead to capital flight and a weaker dollar, while positive sentiment can attract investment and strengthen the currency.

- Trends in stock markets: Stock market trends can be an indicator of investor confidence.

- Foreign exchange markets: The foreign exchange market reflects real-time trading of the dollar against other currencies.

- Investor behavior: Investor behavior, including their allocation of assets, significantly impacts currency movements.

Conclusion

The potential for the U.S. dollar to experience its worst presidential first 100 days since Nixon is a serious possibility, driven by a confluence of factors including high inflation, global economic uncertainty, and high levels of government debt. While historical parallels to the Nixon era offer valuable context, the current situation also presents unique challenges and opportunities. The contrasting opinions of leading economists and fluctuating market sentiment underscore the inherent uncertainty surrounding the dollar's future. Stay informed on the potential for the U.S. dollar to experience its most challenging first 100 days since Nixon—its trajectory will significantly impact the global economy. Understanding the intricacies of this critical period is crucial for navigating the complex economic landscape ahead. The future of the U.S. dollar remains a compelling and dynamic story that demands our continued attention.

Featured Posts

-

Gpu Prices Out Of Control Whats Driving The Cost Increase

Apr 28, 2025

Gpu Prices Out Of Control Whats Driving The Cost Increase

Apr 28, 2025 -

Unrivaled Mets Rival Dominant Starting Pitcher Performance

Apr 28, 2025

Unrivaled Mets Rival Dominant Starting Pitcher Performance

Apr 28, 2025 -

The Latest Between Richard Jefferson And Shaquille O Neal A Recent Exchange

Apr 28, 2025

The Latest Between Richard Jefferson And Shaquille O Neal A Recent Exchange

Apr 28, 2025 -

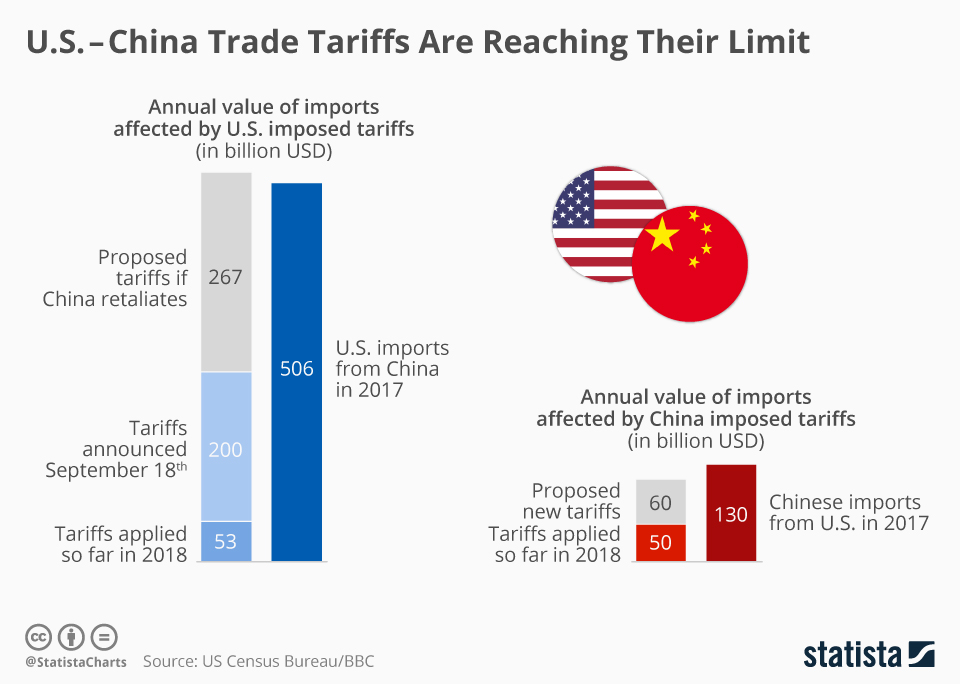

Us China Trade Partial Tariff Relief For American Products

Apr 28, 2025

Us China Trade Partial Tariff Relief For American Products

Apr 28, 2025 -

Exploring Monstrous Beauty Feminist Revisions Of Chinoiserie In The Metropolitan Museum Of Art

Apr 28, 2025

Exploring Monstrous Beauty Feminist Revisions Of Chinoiserie In The Metropolitan Museum Of Art

Apr 28, 2025