Ignoring High Stock Market Valuations: BofA's Rationale

Table of Contents

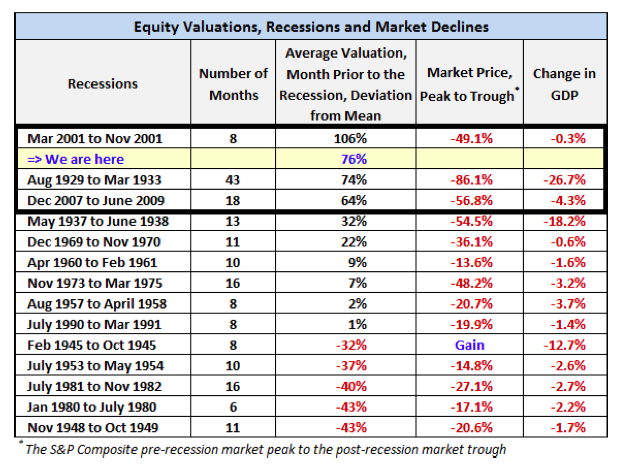

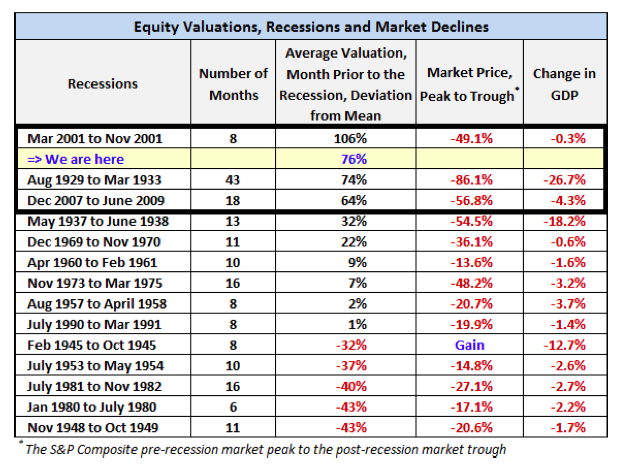

Are high stock market valuations cause for concern? Many investors would instinctively answer yes. However, Bank of America (BofA) offers a compelling counterargument, suggesting reasons to potentially overlook seemingly inflated prices. This article delves into BofA's rationale for ignoring high stock market valuations, examining their perspective on current market conditions and the factors influencing their assessment. We will explore their arguments and consider the potential risks and rewards involved.

BofA's Argument: Low Interest Rates and Continued Growth

BofA's primary argument for potentially ignoring high stock market valuations centers on the interplay between low interest rates and sustained economic growth. They posit that the current environment, characterized by historically low interest rates, makes equities a more attractive investment compared to bonds. This is because low yields on fixed-income instruments reduce the appeal of safer, less volatile options.

- Low interest rates make equities more attractive relative to bonds. With bond yields remaining low, investors are incentivized to seek higher returns in the stock market, even if valuations appear elevated.

- Continued economic growth justifies higher price-to-earnings (P/E) ratios. BofA likely points to continued GDP growth, robust consumer spending, and positive corporate earnings as indicators supporting higher valuations. Strong economic fundamentals can underpin higher stock prices, even if P/E ratios are above historical averages.

- Specific economic indicators BofA might cite include: strong consumer confidence indices, rising corporate profits, and sustained GDP growth above the long-term average.

BofA's argument is supported by recent economic data. For example, (Insert citation and specific data points here, e.g., citing a BofA report or relevant economic statistics from reputable sources such as the Bureau of Economic Analysis or the Federal Reserve). These statistics suggest that the current economic climate can support the current levels of stock market valuations, despite appearing high compared to historical averages.

The Role of Technological Innovation in Justifying High Valuations

BofA likely also considers the significant impact of technological innovation on justifying high stock valuations. They argue that disruptive technologies are creating new avenues for growth and significantly enhancing the future earnings potential of many companies. This "future-proofing" aspect is a key component of their perspective.

- Disruptive technologies leading to higher future earnings potential. The rapid advancements in areas like artificial intelligence, cloud computing, and biotechnology are creating entirely new industries and transforming existing ones, leading to the expectation of significantly higher future earnings.

- Examples of specific technology sectors driving growth: BofA likely highlights the success of companies in the software, e-commerce, and renewable energy sectors, all of which have shown significant growth and high valuations.

- Mention the concept of "future-proofing" businesses. Companies successfully integrating and leveraging these technologies are seen as more resilient and better positioned for long-term growth, justifying higher valuations compared to traditional businesses.

For example, the high valuations of leading technology companies (mention specific examples like Apple, Microsoft, or Google) are, in BofA's view, justified by their innovative capabilities and significant future growth potential. This contrasts with companies in more mature industries, where growth prospects may be more limited.

Addressing the Risk of Overvaluation: BofA's Cautions

While BofA acknowledges the potential risks associated with high stock market valuations, including the possibility of market corrections, they also outline strategies for managing these risks. Their perspective isn't solely bullish; it's a balanced assessment.

- Discussion of potential market corrections. BofA likely acknowledges the inherent volatility of the stock market and the potential for sharp price declines. They may emphasize the cyclical nature of the market and the inevitability of corrections.

- Mention BofA's suggested risk mitigation strategies (diversification, etc.). BofA likely recommends strategies like diversification across different asset classes, sectors, and geographies to mitigate risk. They may also advocate for a long-term investment horizon to weather short-term market fluctuations.

- Highlight any caveats or conditions attached to BofA's optimistic outlook. BofA’s positive outlook is likely contingent on continued economic growth, stable interest rates, and the sustained success of technological innovation. Any significant deviation from these conditions could alter their assessment.

BofA’s approach emphasizes a long-term perspective and careful risk management, acknowledging that even in a favorable environment, potential downsides exist. This balanced approach is key to understanding their rationale.

Alternative Investment Strategies in a High-Valuation Market

In the context of high stock market valuations, BofA might also suggest exploring alternative investment strategies to complement a traditional stock portfolio.

- Examples of alternative assets (e.g., real estate, private equity). These asset classes can offer diversification benefits and potentially different risk-return profiles.

- Advantages and disadvantages of these alternatives. Real estate might offer more stability but with less liquidity, while private equity can provide higher returns but with lower liquidity and less transparency.

- How these strategies can complement a stock market portfolio. A balanced portfolio that incorporates alternative assets can help mitigate overall portfolio risk and potentially enhance returns.

BofA's recommendation of alternative strategies isn't necessarily a suggestion to abandon stocks, but rather a suggestion to consider diversifying investments to manage risk effectively within a high-valuation market environment.

Conclusion: Reassessing the Implications of Ignoring High Stock Market Valuations

BofA's rationale for potentially ignoring high stock market valuations rests on a combination of factors: low interest rates making equities more attractive, continued economic growth supporting higher P/E ratios, and the transformative potential of technological innovation. While acknowledging the inherent risks of high valuations and advocating for risk management strategies like diversification, BofA's perspective suggests a balanced approach that considers both the potential rewards and the necessary precautions.

Understanding BofA's rationale regarding ignoring high stock market valuations is crucial for informed investment decisions. However, this article provides only one perspective. Conduct further research, consider your individual risk tolerance and financial goals, and consult with qualified financial advisors to determine the best course of action for your portfolio. Remember to carefully weigh the potential benefits against the risks before making any investment decisions related to ignoring high stock market valuations.

Featured Posts

-

Pne Fairgrounds Could Host New Whitecaps Stadium Owners Announcement

Apr 27, 2025

Pne Fairgrounds Could Host New Whitecaps Stadium Owners Announcement

Apr 27, 2025 -

Logra Tu Garantia De Gol Con El Metodo De Alberto Ardila Olivares

Apr 27, 2025

Logra Tu Garantia De Gol Con El Metodo De Alberto Ardila Olivares

Apr 27, 2025 -

Pne Group Secures Permits For German Wind And Solar Projects

Apr 27, 2025

Pne Group Secures Permits For German Wind And Solar Projects

Apr 27, 2025 -

Cma Cgms Strategic Investment 440 Million Turkish Logistics Acquisition

Apr 27, 2025

Cma Cgms Strategic Investment 440 Million Turkish Logistics Acquisition

Apr 27, 2025 -

Analysis Of Vaccine Studies Hhss Choice Of David Geier Sparks Debate

Apr 27, 2025

Analysis Of Vaccine Studies Hhss Choice Of David Geier Sparks Debate

Apr 27, 2025