Exclusive Access: A Side Hustle Trading Stakes In Elon Musk's Private Companies

Table of Contents

Understanding the Market for Stakes in Elon Musk's Private Companies

The allure of investing in Elon Musk's ventures stems from the potential for extraordinary returns. Let's break down what makes this market so attractive and challenging.

The Appeal of Private Equity in High-Growth Companies

Private equity investments offer a compelling alternative to the public markets. The potential for significant returns is far higher, especially in early-stage high-growth companies.

- Higher potential ROI: Investing early allows you to capitalize on exponential growth before a company goes public, leading to potentially massive returns on your initial investment.

- Limited liquidity: This is a double-edged sword. While you can't easily cash out, it also means that shares aren't diluted as frequently as in public companies.

- Examples of success: Numerous tech companies, from early Facebook investors to those who backed Google, have reaped immense rewards through private equity investments.

Identifying Opportunities: SpaceX, The Boring Company, Neuralink, and Beyond

Elon Musk's portfolio of private ventures presents a unique set of investment opportunities.

- SpaceX: Revolutionizing space exploration and aiming for Mars colonization. Its valuation is estimated to be in the tens of billions, though precise figures are not publicly released. Securing a stake requires significant capital and connections.

- The Boring Company: Focused on innovative tunnel construction for high-speed transportation. While its valuation remains undisclosed, the potential for disrupting urban transportation is immense.

- Neuralink: Developing brain-computer interfaces with potentially transformative implications for medicine and technology. Again, securing investment here is extremely challenging due to the highly exclusive nature of the funding rounds.

Accessing investment opportunities in these companies is exceptionally difficult. It often requires pre-existing relationships with venture capitalists or significant personal wealth to participate in funding rounds.

Navigating the Complexities of Private Company Investment

Investing in private companies, especially those as high-profile as Elon Musk's, presents unique challenges.

Accessing Investment Opportunities

Gaining access to these exclusive investment opportunities is a significant hurdle.

- Private Equity Firms and Angel Investors: These are the primary channels for accessing private company investment rounds. These firms often require substantial investment commitments and due diligence.

- Accreditation and High Net Worth: You'll typically need to meet stringent accreditation requirements demonstrating significant financial assets and investment experience.

- Secondary Markets: A more accessible, albeit riskier, route involves purchasing stakes from existing investors through secondary markets. This requires careful vetting of sellers and deals.

Understanding the Risks

Investing in private companies is inherently risky, particularly in the volatile tech sector.

- Liquidity Risk: Your investment might be illiquid for years, even decades, depending on the company’s timeline for an IPO or acquisition.

- Market Risk: The tech sector is known for its booms and busts. External factors can significantly impact a private company's valuation.

- Company-Specific Risks: Each company faces unique risks, including regulatory hurdles, technological setbacks, or competition. Neuralink, for example, faces significant ethical and regulatory challenges.

Strategies for Successful Trading of Stakes

Successfully navigating this complex market demands a strategic approach.

Due Diligence and Research

Thorough research is paramount before investing in any private company.

- Financial Statements: While not always publicly available, obtaining and analyzing available financial data is essential.

- Management Team: Assess the experience and track record of the leadership team. Elon Musk’s reputation adds a layer of complexity; while his vision is compelling, his track record also includes significant risk.

- Competitive Landscape: Understand the competitive environment and the company’s ability to maintain a competitive edge.

Diversification and Risk Management

Diversification is key to mitigating risk in any investment portfolio.

- Don't put all your eggs in one basket: Spread your investments across different companies and asset classes.

- Risk Management Strategies: Utilize techniques like stop-loss orders (where applicable) and hedging to protect against potential losses.

Finding Reliable Information and Advisors

Relying on credible sources and expert guidance is crucial.

- Networking: Building relationships within the investment community can provide access to valuable information and opportunities.

- Financial Advisors: Seek advice from experienced financial advisors specializing in private equity and high-risk investments.

Conclusion

Trading stakes in Elon Musk's private companies presents a unique high-risk, high-reward side hustle. Success requires meticulous due diligence, a strong understanding of the market, and a sophisticated risk management strategy. Access to these opportunities is often limited to accredited investors with significant capital, but understanding the landscape is crucial for anyone considering such investments.

Call to Action: While investing in Elon Musk's private companies may not be accessible to everyone, learning about the intricacies of this unique investment landscape can enhance your overall financial literacy and understanding of high-growth private equity. Further research into private equity and high-risk investments is recommended before considering this type of side hustle.

Featured Posts

-

The Smelliest Member Of Congress George Santos Weighs In

Apr 26, 2025

The Smelliest Member Of Congress George Santos Weighs In

Apr 26, 2025 -

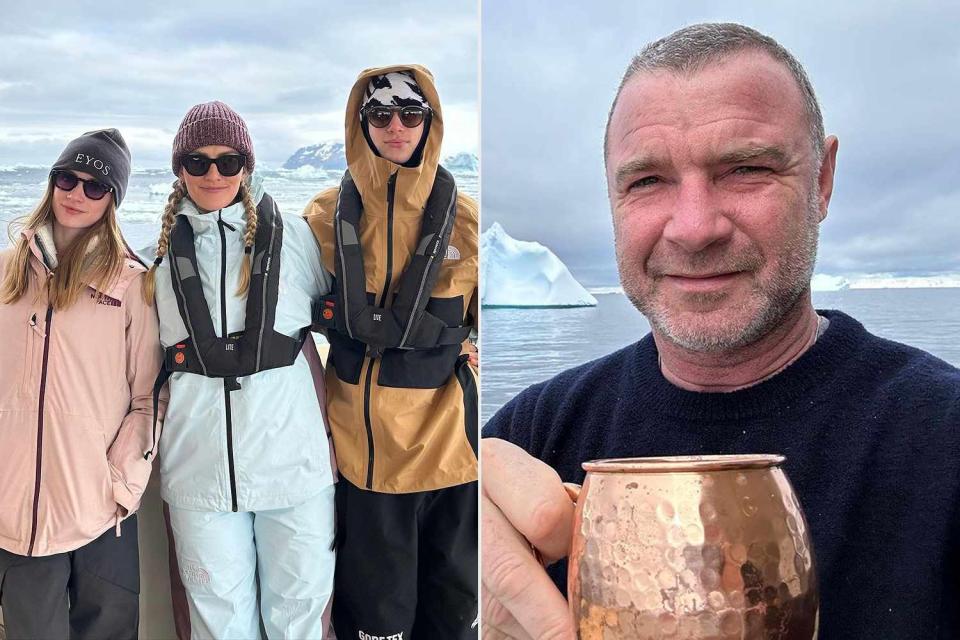

Liev Schreiber Addresses Nepo Baby Claims After Daughters Paris Fashion Show

Apr 26, 2025

Liev Schreiber Addresses Nepo Baby Claims After Daughters Paris Fashion Show

Apr 26, 2025 -

White House Cocaine Investigation Secret Service Concludes Inquiry

Apr 26, 2025

White House Cocaine Investigation Secret Service Concludes Inquiry

Apr 26, 2025 -

Gavin Newsoms Political Earthquake A Major Blow To His Own Party

Apr 26, 2025

Gavin Newsoms Political Earthquake A Major Blow To His Own Party

Apr 26, 2025 -

Stricter Security Protocols Implemented For Ajax And Az Alkmaar Fixture

Apr 26, 2025

Stricter Security Protocols Implemented For Ajax And Az Alkmaar Fixture

Apr 26, 2025