Eni Cuts Costs, Maintains Share Buyback Despite Lower Cash Flow

Table of Contents

Eni's Cost-Cutting Measures

Eni's cost reduction strategy centers on enhancing operational efficiency and streamlining internal processes. This multifaceted approach involves a comprehensive review of all business aspects to identify areas for improvement and maximize resource utilization. The company aims to improve profitability and strengthen its financial position in the long term.

- Reduction in operational expenditure: Eni is actively reducing operational expenditure across its various business units, targeting areas of unnecessary spending without compromising operational effectiveness. This includes careful review of contracts and resource allocation.

- Streamlining administrative processes: Efforts to streamline administrative processes are underway, aiming to reduce overhead costs by leveraging technology and optimizing workflows. This involves identifying and eliminating redundancies.

- Investment in automation and digital technologies: Significant investment in automation and digital technologies is underway to increase efficiency and reduce reliance on manual processes. This represents a commitment to long-term cost savings.

- Renegotiation of contracts with suppliers: Eni is actively renegotiating contracts with its suppliers to secure better pricing and more favorable terms. This ensures cost competitiveness in the market.

- Focus on optimizing capital expenditure: Capital expenditure is being carefully optimized, prioritizing high-return projects and delaying or canceling less promising ventures. This ensures responsible investment of capital.

Maintaining the Share Buyback Program

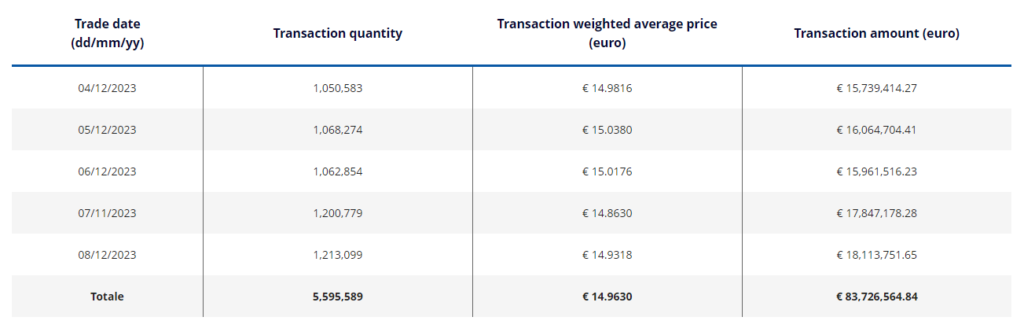

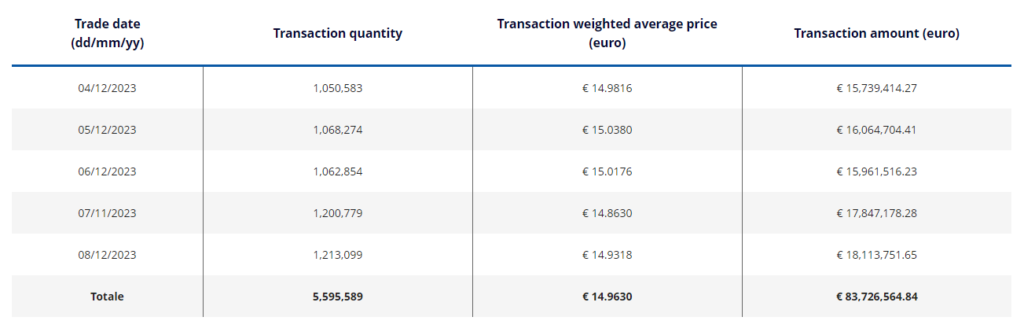

Despite the lower cash flow, Eni's decision to continue its share buyback program, also known as an Eni share repurchase, signals strong confidence in its future prospects and a clear commitment to rewarding shareholders. This strategic choice has several potential interpretations.

- Undervalued stock: The buyback program could indicate Eni believes its stock is currently undervalued in the market, providing a compelling opportunity to repurchase shares at a favorable price.

- Boosting investor confidence: Continuing the buyback program is likely intended to boost investor confidence and potentially drive up the Eni stock price. This demonstrates commitment to shareholder value.

- Managing excess cash: The share buyback program might also serve as a mechanism for managing excess cash, maximizing returns for shareholders in a more direct way than alternative investments.

- Official announcements: Investors should consult official company announcements for details on the buyback program's size, timeline, and specific parameters. This will provide precise information on the program’s execution.

Impact of Lower Cash Flow on Eni's Financials

The decline in Eni's cash flow can be attributed to a variety of factors impacting the global energy market. Understanding these factors is crucial for analyzing Eni's financial performance.

- Fluctuations in global energy prices: Volatility in global energy prices significantly influences Eni's revenue and cash flow. Market conditions play a decisive role in overall performance.

- Geopolitical factors and regulatory changes: Geopolitical instability and regulatory shifts in various markets contribute to uncertainties and impact the company’s overall cash flow.

- Changes in investment strategies and exploration activities: Changes in exploration and production strategies and the associated investment patterns will impact the company’s short-term cash flow.

- Financial statement analysis: A thorough analysis of Eni's financial statements and reports is crucial to understand the reasons for the decrease in cash flow and its impact on the financial health of the company.

Analyst Reactions and Market Response

The market reaction to Eni's cost-cutting measures and its continued share buyback program has been varied, with analysts offering different interpretations and perspectives.

- Expert opinions: Analyst reports provide valuable insight into the effectiveness of Eni's cost-cutting initiatives and the long-term implications of its share buyback decision.

- Impact on Eni stock price: Monitoring Eni's stock price and trading volume provides real-time feedback on the market's response to the company's announcements.

- Comparison with competitors: Comparing Eni's strategies with those of its competitors in the energy sector helps put its decisions into a broader context.

- Long-term implications for investors: Assessing the long-term implications for investors requires careful consideration of multiple factors, including future market conditions and overall business performance.

Conclusion

Eni's decision to cut costs while simultaneously maintaining its Eni share buyback program demonstrates a proactive approach to managing a challenging financial landscape. The commitment to shareholder returns, even with reduced cash flow, underscores confidence in the company's future growth. This strategic balancing act requires careful monitoring and evaluation.

Call to Action: Stay informed on the latest developments concerning Eni's financial strategies and their impact on the Eni share buyback program. Keep an eye on future announcements to understand the long-term implications of Eni’s cost reduction and share repurchase efforts. Monitor the Eni stock price and analyst reports to make informed investment decisions. Understanding the nuances of Eni's financial maneuvering is crucial for investors seeking to capitalize on future opportunities.

Featured Posts

-

Crude Oil Price Trends And Market Insights April 24 2024 Report

Apr 25, 2025

Crude Oil Price Trends And Market Insights April 24 2024 Report

Apr 25, 2025 -

Mgms Long Awaited Japan Casino Resort Begins Construction A 9 Billion Gamble

Apr 25, 2025

Mgms Long Awaited Japan Casino Resort Begins Construction A 9 Billion Gamble

Apr 25, 2025 -

Al Riyadas Gendered History Secular And Religious Influences In Egypt 1820 1936

Apr 25, 2025

Al Riyadas Gendered History Secular And Religious Influences In Egypt 1820 1936

Apr 25, 2025 -

Lotus Eletre 230 000 Price Features And Competition

Apr 25, 2025

Lotus Eletre 230 000 Price Features And Competition

Apr 25, 2025 -

Olivia Rodrigos 2025 Grammys Outfit A Winning Fashion Formula

Apr 25, 2025

Olivia Rodrigos 2025 Grammys Outfit A Winning Fashion Formula

Apr 25, 2025