ECB Official Holzmann On The Anti-Inflationary Impact Of Trump Tariffs

Table of Contents

Holzmann's Arguments: Analyzing the Impact of Trump Tariffs on Eurozone Inflation

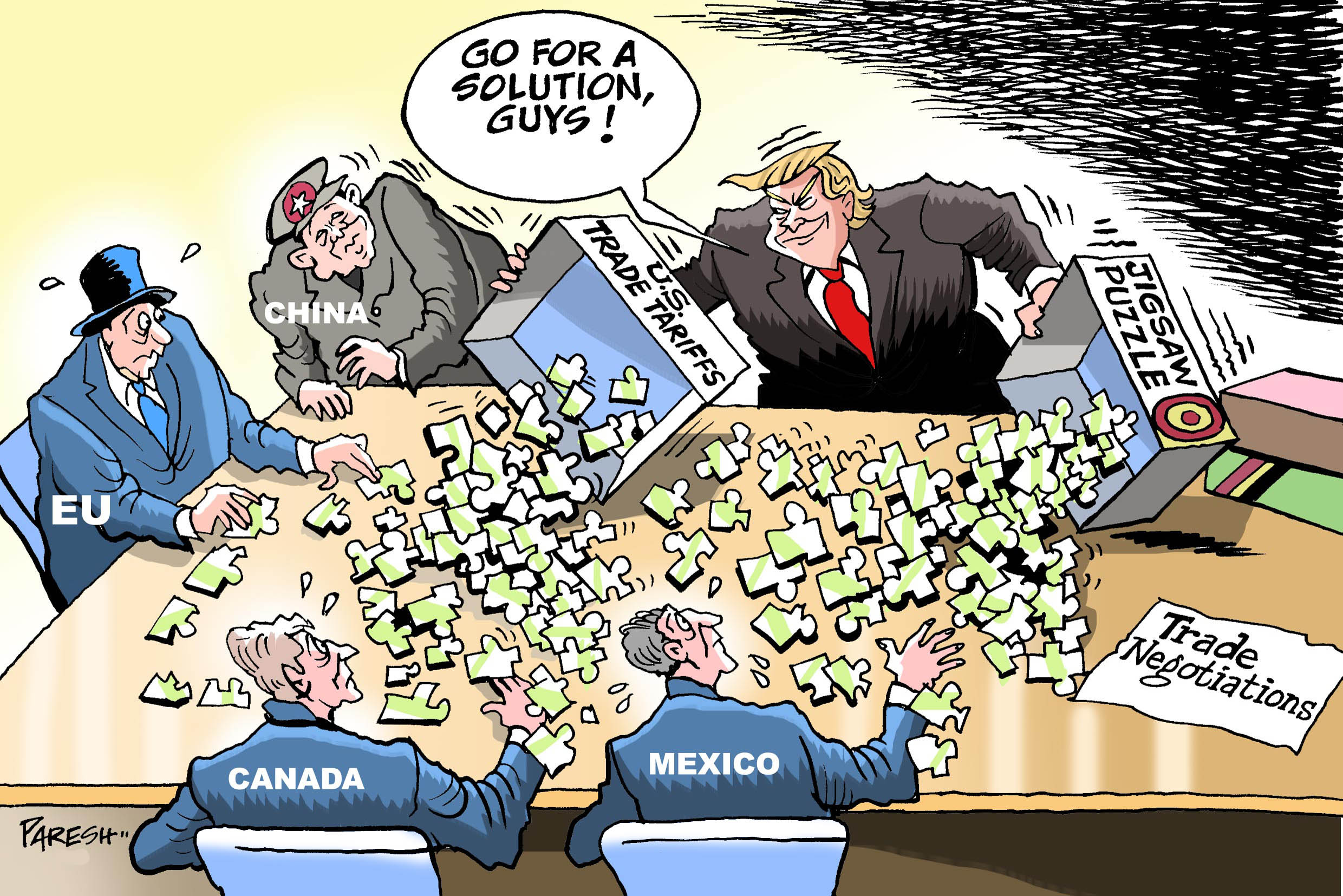

Robert Holzmann, a prominent member of the European Central Bank's Governing Council, has offered a compelling, albeit controversial, perspective on the influence of US tariffs imposed during the Trump administration on Eurozone inflation. His analysis suggests that these tariffs, while disruptive, may have exerted a subtle anti-inflationary pressure.

Holzmann's argument hinges on several key mechanisms:

- Reduced Demand for Imported Goods: The tariffs increased the price of US goods within the Eurozone, leading to reduced consumer demand. This decreased demand, in turn, could have put downward pressure on prices, particularly for those goods directly affected by the tariffs.

- Increased Competition Among Domestic Producers: Faced with reduced demand for imported goods, domestic Eurozone producers may have intensified competition, leading to lower prices to maintain market share. This increased competition acted as a price-suppressing force within the Eurozone.

- Supply Chain Disruptions Leading to Temporary Price Adjustments: The trade war disrupted global supply chains, causing temporary shortages and price fluctuations. However, in some cases, these disruptions might have resulted in lower overall prices for certain goods in the short term due to decreased availability.

While direct empirical evidence linking Trump's tariffs to lower Eurozone inflation is complex to isolate, Holzmann’s analysis points to these indirect mechanisms as potential contributors to price stability. Further research is needed to quantify the precise impact.

Counterarguments and Alternative Perspectives

While Holzmann's analysis provides a unique perspective, it's crucial to acknowledge counterarguments and alternative viewpoints. Critics argue that focusing solely on the anti-inflationary aspects ignores the potentially significant negative consequences of the Trump tariffs.

Key criticisms include:

- Retaliatory Tariffs Impacting Eurozone Exports: The trade war wasn't one-sided. Retaliatory tariffs imposed by other countries, including China, negatively impacted Eurozone exports, potentially offsetting any anti-inflationary effects from reduced import demand.

- Increased Prices of Imported Goods due to Supply Chain Disruptions: While some argue that supply chain disruptions led to lower prices, it's equally plausible that they caused increased prices for many goods due to shortages and logistical complexities. This would be a pro-inflationary effect.

- Negative Impacts on Economic Growth: The overall economic uncertainty created by the trade war could have hindered Eurozone economic growth, potentially indirectly impacting inflation through reduced consumer spending and investment.

The debate remains open, and economists continue to analyze the complex interplay between trade policies and inflation, with different models yielding varying results.

The Broader Context: Global Trade and Inflationary Pressures

Understanding Holzmann's analysis requires placing it within the larger context of global trade relations and inflationary pressures. Trump's trade policies were part of a broader shift towards protectionism, impacting global trade dynamics significantly. These policies contributed to increased uncertainty in global markets, affecting investment decisions and commodity prices.

The interplay between global trade and inflation is multifaceted:

- Globalization, prior to the Trump tariffs, generally contributed to lower inflation through increased competition and access to cheaper goods.

- Protectionist policies, like those implemented by the Trump administration, can disrupt these dynamics, potentially leading to both higher and lower prices depending on the specific goods and the responsiveness of supply chains.

- The interaction between domestic monetary policy and international trade policy is crucial. The ECB's response to inflationary or deflationary pressures arising from trade disputes is a critical element.

Implications for ECB Policy

Holzmann's perspective on the anti-inflationary impact of Trump tariffs, however nuanced, has implications for ECB monetary policy decisions. If a significant portion of the price stability observed during this period can be attributed to the trade war, this alters the assessment of underlying inflationary pressures.

The implications include:

- Potential adjustments to interest rate decisions: If the ECB misjudges the impact of trade policies on inflation, it could lead to inappropriate monetary policy responses, potentially exacerbating economic instability.

- Refined inflation targeting strategies: The experience underscores the need for sophisticated models that account for the complexities of global trade and their interactions with monetary policy instruments.

- Increased focus on supply-side factors in inflation analysis: The debate highlights the importance of considering supply-side shocks and the role of global trade in shaping price dynamics.

Conclusion: The Lasting Legacy of Trump Tariffs on Eurozone Inflation – A Holzmann Perspective

In conclusion, Robert Holzmann's analysis of the impact of Trump tariffs on Eurozone inflation presents a fascinating, though debated, perspective. While his arguments suggest a potential, albeit indirect, anti-inflationary effect through reduced demand and increased domestic competition, counterarguments highlight the broader economic risks and complexities of trade wars. The lasting legacy of these tariffs on inflation remains a subject of ongoing research and debate. The uncertainties surrounding the relationship between protectionist trade policies and Eurozone inflation underscore the need for careful consideration of these factors in future ECB monetary policy decisions. To further understand the complexities of this issue, explore Robert Holzmann's publications on the anti-inflationary impact of Trump tariffs and contribute to the ongoing discussion surrounding the interaction between trade policy and inflation.

Featured Posts

-

Doj Pushes For 7 Year Sentence For George Santos In Extensive Fraud Case

Apr 26, 2025

Doj Pushes For 7 Year Sentence For George Santos In Extensive Fraud Case

Apr 26, 2025 -

The Countrys Business Landscape Identifying Key Growth Areas

Apr 26, 2025

The Countrys Business Landscape Identifying Key Growth Areas

Apr 26, 2025 -

Hollywood Shut Down Wga And Sag Aftra Strike Impacts Film And Television

Apr 26, 2025

Hollywood Shut Down Wga And Sag Aftra Strike Impacts Film And Television

Apr 26, 2025 -

Thaksins Return Implications For Us Thai Trade Relations And Tariff Negotiations

Apr 26, 2025

Thaksins Return Implications For Us Thai Trade Relations And Tariff Negotiations

Apr 26, 2025 -

Peiling Wijst Uit 59 Steunt Het Nederlandse Koningshuis

Apr 26, 2025

Peiling Wijst Uit 59 Steunt Het Nederlandse Koningshuis

Apr 26, 2025

Latest Posts

-

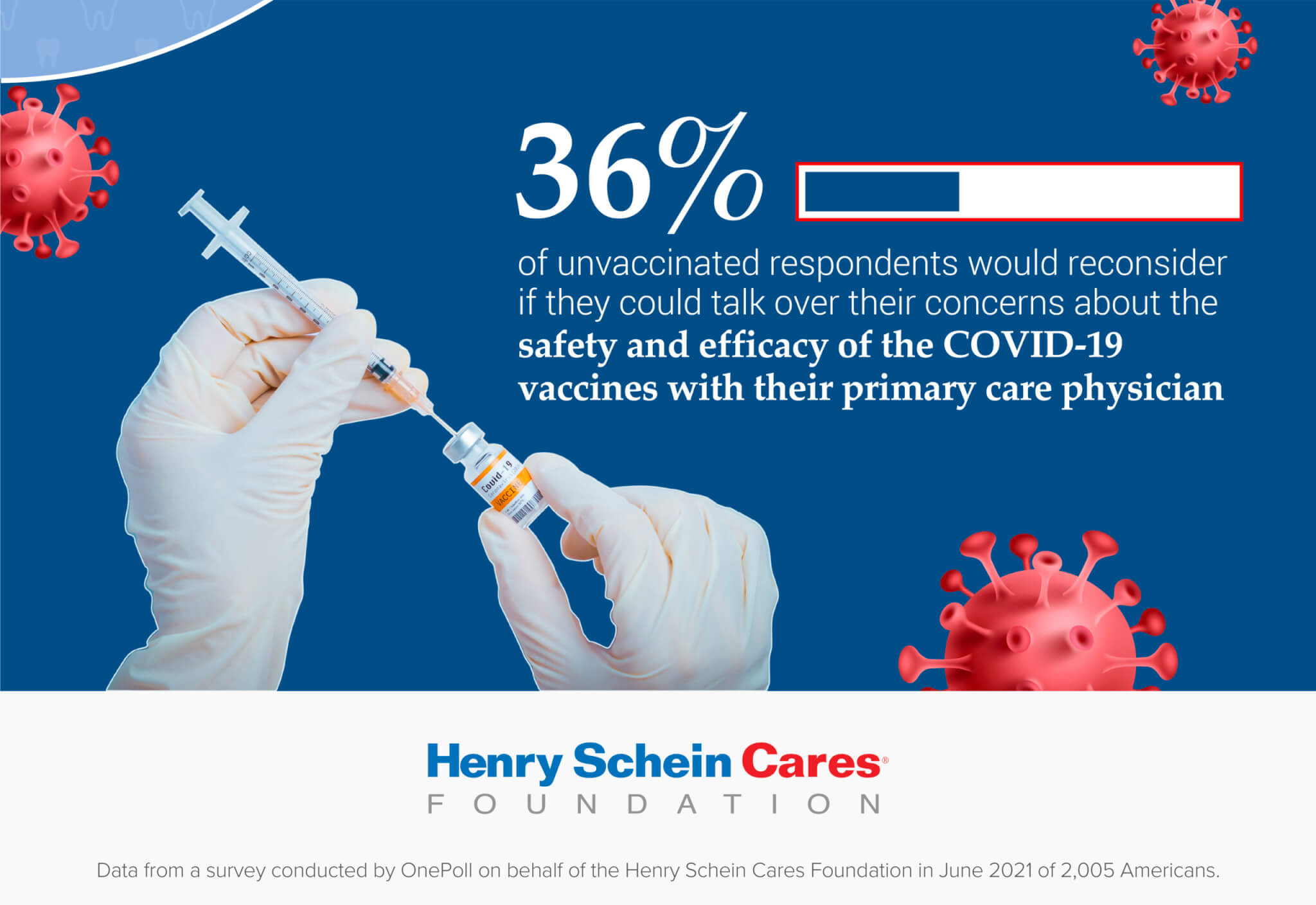

Vaccine Study Review Hhs Appoints Controversial Figure David Geier

Apr 27, 2025

Vaccine Study Review Hhs Appoints Controversial Figure David Geier

Apr 27, 2025 -

A Critical Opinion On The Cdcs Choice For The New Vaccine Study

Apr 27, 2025

A Critical Opinion On The Cdcs Choice For The New Vaccine Study

Apr 27, 2025 -

David Geiers Appointment To Analyze Vaccine Studies An Hhs Controversy

Apr 27, 2025

David Geiers Appointment To Analyze Vaccine Studies An Hhs Controversy

Apr 27, 2025 -

Analysis Discredited Misinformation Agent Hired For Cdc Vaccine Study

Apr 27, 2025

Analysis Discredited Misinformation Agent Hired For Cdc Vaccine Study

Apr 27, 2025 -

Hhs Hires Vaccine Skeptic David Geiers Role In Vaccine Study Analysis

Apr 27, 2025

Hhs Hires Vaccine Skeptic David Geiers Role In Vaccine Study Analysis

Apr 27, 2025