Dow Futures Rise: Stock Market Outlook For Today And This Week

Table of Contents

Analyzing Today's Dow Futures Rise

Influence of Economic Indicators

Recent economic data releases play a significant role in shaping the direction of Dow futures. Positive economic indicators generally boost investor confidence, leading to a rise in stock prices. Conversely, negative data can trigger a sell-off. Key economic indicators impacting market sentiment include:

- Inflation Reports: A lower-than-expected inflation rate, signaling easing inflationary pressures, usually supports a positive market outlook. For instance, if the Consumer Price Index (CPI) shows a decrease in inflation, it often results in a positive reaction in the stock market.

- Employment Numbers: Strong employment data, such as a low unemployment rate and robust job growth, reflects a healthy economy and usually fuels optimism in the market, positively influencing Dow futures.

- Consumer Confidence Indices: High consumer confidence indicates strong spending and economic activity, which tends to support market growth and influence Dow futures positively. Conversely, low consumer confidence can indicate a potential slowdown.

Impact of Corporate News

Corporate news significantly impacts individual stocks and, consequently, the overall market. Strong earnings reports from major Dow components often drive up the Dow futures. Conversely, disappointing earnings or negative news surrounding major corporations can lead to a decline.

- Positive Corporate News: A company announcing exceeding profit expectations or a significant technological breakthrough might see a surge in its stock price, positively impacting Dow futures. For example, a positive earnings surprise from a tech giant like Apple could trigger a broader market rally.

- Negative Corporate News: Conversely, a company issuing a profit warning or facing a major legal challenge could lead to a decline in its stock price, potentially pulling down Dow futures. For instance, a scandal involving a major financial institution could negatively affect investor sentiment.

- Mergers and Acquisitions: Major mergers and acquisitions can also significantly impact Dow futures. A successful merger between two large companies could lead to increased investor confidence and boost market sentiment.

Global Market Trends

Global market performance significantly influences US markets, including Dow futures. Positive performance in Asian and European markets often sets a positive tone for the US market opening. Conversely, negative developments in global markets can impact investor sentiment and affect Dow futures.

- Geopolitical Instability: Global events such as geopolitical tensions, wars, or significant political shifts can create uncertainty in the market and impact Dow futures, often leading to increased volatility.

- International Trade Agreements: International trade agreements and their impact on global commerce can significantly influence market sentiment. The signing of a major trade deal might lead to increased optimism, while trade disputes could trigger uncertainty and market corrections.

Stock Market Outlook for This Week

Expected Market Volatility

Predicting market volatility is challenging, but several factors can provide clues. Upcoming events and economic releases often contribute to market fluctuations.

- Central Bank Meetings: Decisions made by central banks regarding interest rates significantly influence market expectations. An anticipated interest rate hike, for example, might cause increased volatility.

- Major Economic Announcements: The release of major economic data, like GDP growth figures or manufacturing indices, can trigger significant market movements. Unexpectedly strong or weak data can lead to increased volatility.

Potential Investment Strategies

The current positive outlook in Dow futures presents both opportunities and challenges for investors. Strategies should be tailored to individual risk tolerance.

- Buying Opportunities: Investors with a higher risk tolerance might consider buying undervalued stocks, particularly if the Dow futures continue their upward trend.

- Risk Management: Diversification is crucial. Investors should spread their investments across different asset classes to mitigate risk. Stop-loss orders can help limit potential losses. Options trading offers further risk management tools.

Key Risks and Opportunities

While the current rise in Dow futures is positive, investors should remain aware of potential risks and opportunities:

- Interest Rate Hikes: Increased interest rates can dampen economic growth and negatively impact stock valuations.

- Geopolitical Uncertainty: Ongoing geopolitical tensions can introduce significant market volatility.

- Undervalued Stocks: The current market environment may present opportunities to acquire undervalued stocks with strong growth potential.

Conclusion

The rise in Dow futures indicates a positive short-term outlook for the stock market. This positive trend is influenced by various factors, including encouraging economic indicators, positive corporate news, and relatively stable global markets. However, investors should remain vigilant about potential risks like interest rate hikes and geopolitical uncertainty. Understanding the interplay of economic indicators, corporate performance, and global trends is crucial for navigating the stock market effectively. To make informed investment decisions, regularly check for updates on Dow futures and utilize reliable financial news sources. Keep monitoring the Dow futures and the broader stock market outlook for further insights and to make well-informed investment choices.

Featured Posts

-

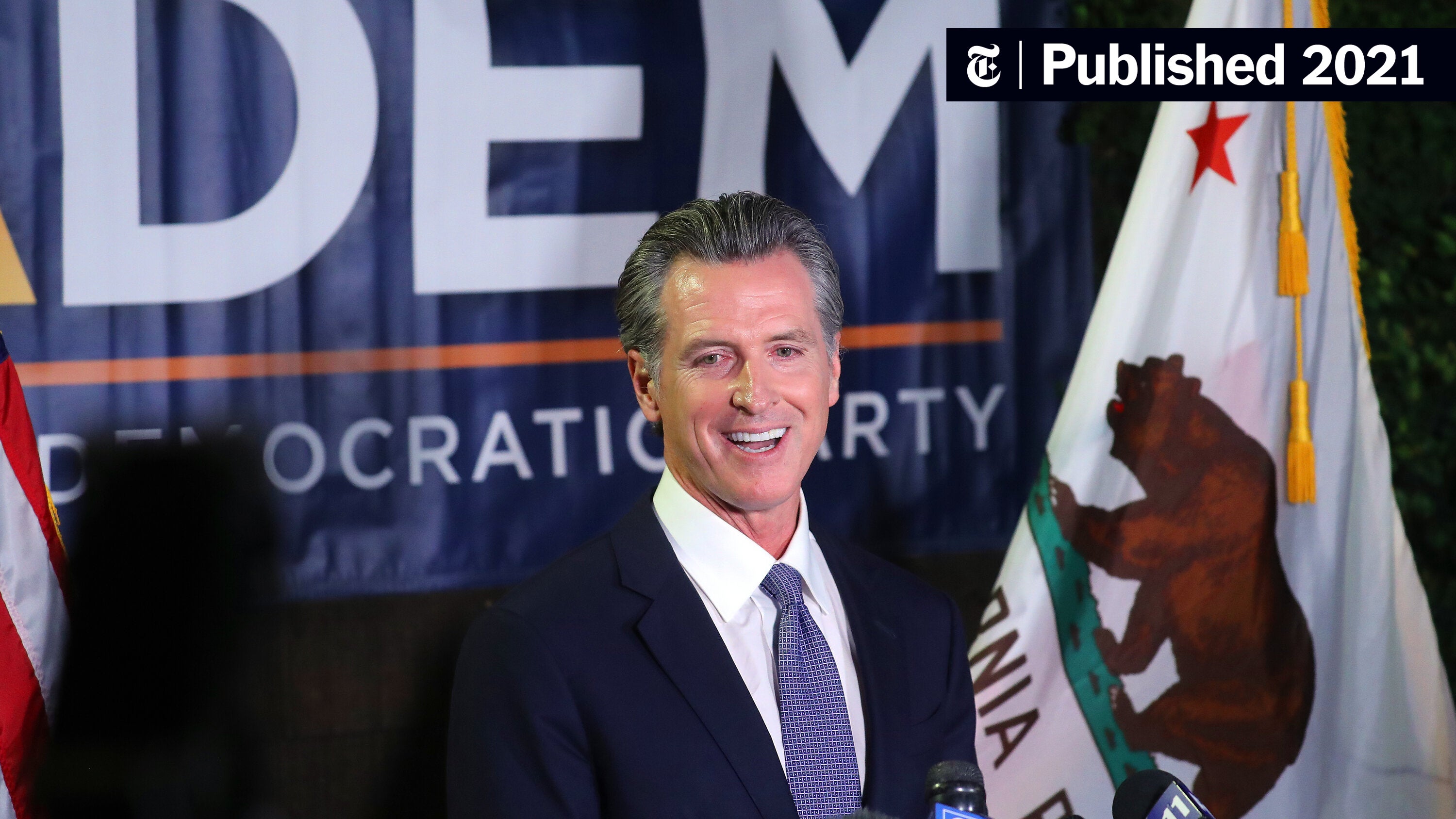

Gavin Newsoms Toxic Democrats Remark A Political Earthquake

Apr 26, 2025

Gavin Newsoms Toxic Democrats Remark A Political Earthquake

Apr 26, 2025 -

The Long Reach Of The White House A Rural Schools Experience 2700 Miles From Dc

Apr 26, 2025

The Long Reach Of The White House A Rural Schools Experience 2700 Miles From Dc

Apr 26, 2025 -

Political Fallout Newsoms Actions Rock The Democratic Party

Apr 26, 2025

Political Fallout Newsoms Actions Rock The Democratic Party

Apr 26, 2025 -

Benson Boone Antes Do Lollapalooza A Ascensao De Uma Estrela Da Musica

Apr 26, 2025

Benson Boone Antes Do Lollapalooza A Ascensao De Uma Estrela Da Musica

Apr 26, 2025 -

Trump Administrations Failed Attempt To Influence European Ai Policy

Apr 26, 2025

Trump Administrations Failed Attempt To Influence European Ai Policy

Apr 26, 2025