Dollar Gains Ground Against Major Currencies Amid Eased Tensions

Table of Contents

Eased Geopolitical Tensions Boost Dollar Demand

Reduced uncertainty in global markets is a primary driver of the dollar's recent rise. The flight-to-safety phenomenon, where investors seek haven assets during times of turmoil, has seen a significant shift.

Reduced Uncertainty in Global Markets:

- Easing of the Ukraine Conflict: Decreased intensity in the conflict has reduced some global market uncertainty, leading investors to move away from perceived riskier assets and towards the relative safety of the US dollar. This is reflected in reduced volatility in certain commodity markets.

- Trade War De-escalation: While not entirely resolved, some easing of trade tensions between major global powers has contributed to a calmer investment climate, further boosting dollar demand. This renewed confidence reduces the need for investors to hold onto safe-haven assets purely for hedging purposes.

- Data Point Example: (Insert data here if available showing correlation between easing tensions and dollar appreciation, e.g., "A recent study by [Source] indicated a [percentage]% increase in dollar value following a [specific event related to de-escalation].").

Increased Risk Appetite and Investment Flows:

Easing geopolitical tensions often translate to increased investor risk appetite. This means a greater willingness to invest in higher-yielding assets, indirectly benefiting the dollar.

- Shift in Investment Strategies: With less fear of geopolitical shocks, investors are more likely to diversify their portfolios, but the dollar often remains a significant component due to its perceived stability.

- Economic Indicators: Positive economic indicators in the US, discussed further below, also contribute to this increased confidence and drive further investment into dollar-denominated assets.

Stronger US Economic Performance Fuels Dollar Appreciation

A robust US economy is another significant contributor to the dollar's strength. Positive economic data points and the Federal Reserve's monetary policy play crucial roles.

Positive Economic Data and Forecasts:

- GDP Growth: Stronger than expected GDP growth figures signal a healthy and expanding economy, attracting foreign investment and bolstering the dollar's value. (Cite source for GDP data).

- Employment Figures: Low unemployment rates indicate a strong labor market, adding to the positive economic outlook and supporting the dollar. (Cite source for employment data).

- Inflation Data: While inflation remains a concern, signs of easing inflationary pressures can boost investor confidence and contribute to dollar appreciation. (Cite source for inflation data). The market interprets this as a sign of potential future interest rate cuts, yet the dollar still strengthens based on the overall economic outlook.

Federal Reserve Monetary Policy:

The Federal Reserve's monetary policy decisions significantly influence the dollar's value.

- Interest Rate Decisions: Higher interest rates in the US, relative to other major economies, make dollar-denominated assets more attractive to foreign investors seeking higher returns. This increased demand pushes up the dollar's value.

- Monetary Policy Tools: Other tools employed by the Fed, such as quantitative easing or tightening, also impact the dollar's strength, affecting liquidity and investor sentiment.

- Impact of Recent Actions: (Analyze the recent actions of the Fed and their direct influence on the dollar's appreciation).

Weakening of Other Major Currencies Contributes to Dollar's Rise

The dollar's rise is not solely due to its own strength; the relative weakness of other major currencies also plays a part.

Eurozone Economic Slowdown:

The Eurozone's economy faces challenges including high energy costs and persistent inflation. These factors weaken the euro relative to the dollar.

- Energy Crisis Impact: High energy prices stemming from the war in Ukraine negatively impact Eurozone economic growth, decreasing investor confidence and weakening the euro.

- Inflationary Pressures: Persistently high inflation erodes the purchasing power of the euro, making it less attractive compared to the US dollar. (Cite source for Eurozone economic data).

Other Currency-Specific Factors:

Factors specific to other major currencies also contribute to the dollar's relative strength.

- British Pound: (Briefly mention factors affecting the pound's value, such as political uncertainty or economic instability).

- Japanese Yen: (Briefly mention factors affecting the yen's value, such as monetary policy decisions by the Bank of Japan).

Conclusion

The recent Dollar Gains Ground Against Major Currencies are a result of a confluence of factors: eased geopolitical tensions, a robust US economy marked by positive economic indicators, and the relative weakness of other major currencies. These developments have significant implications for global trade, investment strategies, and international business. Understanding the dynamics driving these changes is crucial for navigating the complexities of the global financial landscape.

Key Takeaways: The strengthening dollar presents both opportunities and challenges for businesses and investors alike. Increased export costs for US companies and decreased import costs for others highlight the importance of hedging strategies and careful financial planning.

Call to Action: Stay updated on the latest developments impacting the dollar's strength and how it influences global markets. Understanding the factors driving Dollar Gains Ground Against Major Currencies is crucial for effective financial planning and international business strategies. Regularly monitor currency exchange rates and economic indicators to make informed decisions in this dynamic environment.

Featured Posts

-

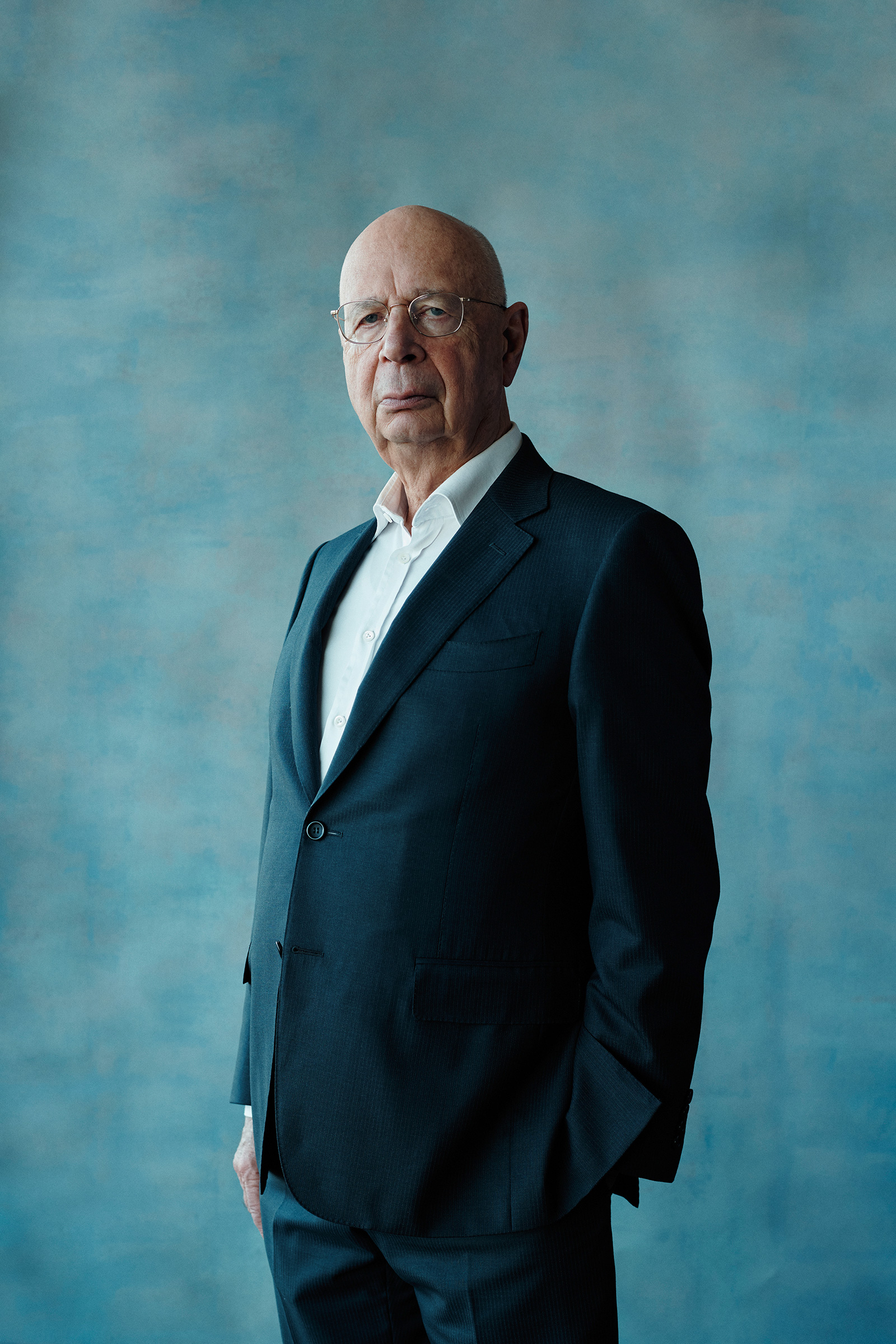

Exclusive Investigation Launched Into World Economic Forum Founder Klaus Schwab

Apr 24, 2025

Exclusive Investigation Launched Into World Economic Forum Founder Klaus Schwab

Apr 24, 2025 -

Hollywood Mourns Sophie Nyweide Mammoth And Noah Actress Passes Away At 24

Apr 24, 2025

Hollywood Mourns Sophie Nyweide Mammoth And Noah Actress Passes Away At 24

Apr 24, 2025 -

John Travoltas Shocking Rotten Tomatoes Record A Deep Dive

Apr 24, 2025

John Travoltas Shocking Rotten Tomatoes Record A Deep Dive

Apr 24, 2025 -

Google Fis 35 Unlimited Plan Is It Right For You

Apr 24, 2025

Google Fis 35 Unlimited Plan Is It Right For You

Apr 24, 2025 -

Teslas Q1 Earnings Sharp Drop Amidst Musks Political Backlash

Apr 24, 2025

Teslas Q1 Earnings Sharp Drop Amidst Musks Political Backlash

Apr 24, 2025