Crack The Code: 5 Do's And Don'ts To Secure A Private Credit Role

Table of Contents

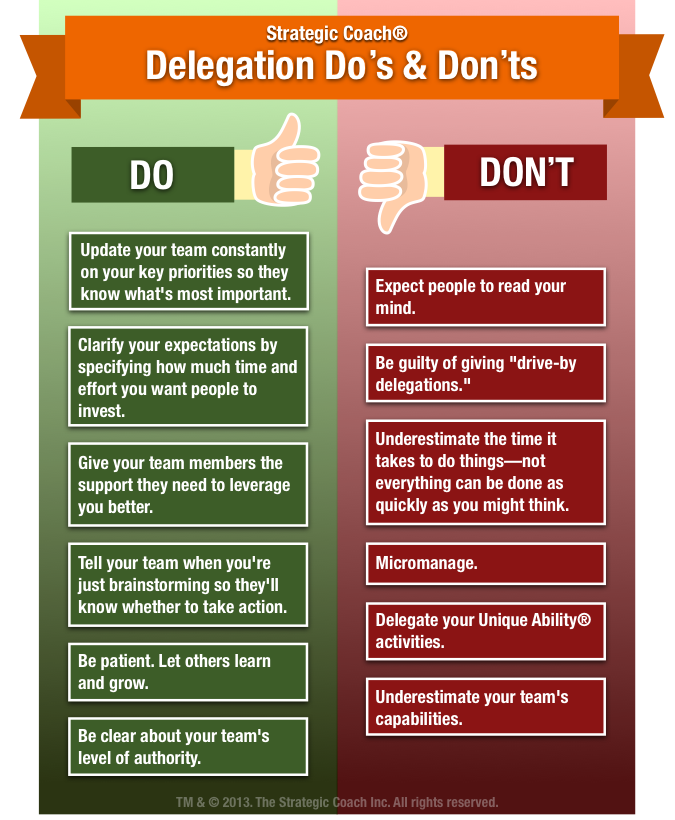

5 Do's to Secure Your Dream Private Credit Role

Do #1: Master the Fundamentals of Private Credit

A deep understanding of private credit markets is paramount. This goes beyond basic finance; you need to grasp the nuances of direct lending, fund investing, and the various financial instruments involved. This includes understanding the intricacies of different private credit debt structures—senior, subordinated, and mezzanine—and their associated risks and rewards.

- Deep understanding of credit analysis: Mastering credit scoring, financial ratios, and cash flow analysis is non-negotiable.

- Strong grasp of financial modeling: Proficiency in building and interpreting complex financial models is crucial for evaluating investment opportunities.

- Familiarity with legal documentation: Understanding loan agreements, security documents, and other legal aspects is essential for mitigating risk.

- Knowledge of different types of private credit debt: You need to be comfortable analyzing and comparing senior secured debt, subordinated debt, and mezzanine financing.

Do #2: Network Strategically within the Private Credit Industry

Networking is not just about collecting business cards; it's about building genuine relationships. Attending industry events, connecting with professionals on LinkedIn, and conducting informational interviews are all crucial steps.

- Attend industry conferences: These provide unparalleled networking opportunities and insights into market trends.

- Connect with professionals on LinkedIn: Actively engage with professionals in private credit, share relevant content, and participate in industry discussions.

- Informational interviews: Reach out to professionals for informational interviews to learn about their experiences and gain valuable insights.

- Join relevant professional organizations: Membership in organizations like the Alternative Credit Council can provide valuable connections and resources.

Do #3: Showcase Relevant Skills and Experience on Your Resume & Cover Letter

Tailoring your resume and cover letter to each specific private credit job application is crucial. Generic applications are easily overlooked.

- Quantifiable achievements: Highlight your accomplishments with specific numbers and data to demonstrate your impact.

- Keywords relevant to private credit job descriptions: Use keywords from the job description to improve the chances of your application being noticed by Applicant Tracking Systems (ATS).

- Highlight transferable skills: Emphasize skills like financial modeling, analytical skills, and due diligence—even if gained in different industries.

- Strong storytelling and concise writing: Make your resume and cover letter engaging and easy to read, showcasing your personality and passion.

Do #4: Ace the Private Credit Interview

Thorough preparation is key to acing the interview. Expect both behavioral questions (assessing your soft skills) and technical questions (testing your knowledge of private credit).

- Practice your answers to common interview questions: Prepare for questions about your experience, skills, and career goals.

- Research the firm and the interviewers: Demonstrate your genuine interest by researching the firm's investment strategies and the interviewers' backgrounds.

- Prepare insightful questions to ask the interviewer: Asking thoughtful questions shows your engagement and initiative.

- Demonstrate your understanding of private credit markets: Be prepared to discuss current market trends and your perspectives on investment opportunities.

Do #5: Build a Strong Online Presence

Your online presence reflects your professionalism. A strong LinkedIn profile, showcasing relevant projects or work samples, is essential.

- Strong LinkedIn profile with relevant keywords and experience: Optimize your profile with keywords relevant to private credit jobs and highlight your key accomplishments.

- Showcase any relevant projects or work samples: If possible, share your work to demonstrate your capabilities.

- Maintain a professional online reputation: Ensure your social media profiles reflect a professional image.

5 Don'ts to Avoid When Pursuing a Private Credit Role

Don't #1: Neglect Fundamental Financial Skills

A solid foundation in accounting, finance, and financial modeling is non-negotiable. Gaps in your knowledge will significantly hinder your chances.

- Avoid gaps in your financial knowledge: Continuously seek opportunities to expand your financial knowledge and skills.

- Continuous learning and skill development: Stay updated on industry trends and best practices through professional development courses and certifications.

- Focus on building a solid foundation in accounting and finance: Ensure you have a strong grasp of core financial concepts.

Don't #2: Underestimate the Importance of Networking

Relying solely on online applications is a mistake. Actively building relationships within the private credit industry is critical.

- Don't rely solely on online applications: Networking significantly increases your chances of finding opportunities.

- Don't be afraid to reach out to professionals: Informational interviews and networking events can open doors to unexpected opportunities.

- Don't neglect building relationships: Nurture your connections and maintain a strong professional network.

Don't #3: Submit Generic Applications

Each application should be tailored to the specific job and firm. Generic applications demonstrate a lack of interest and effort.

- Avoid generic cover letters and resumes: Customize your application materials to highlight the skills and experience relevant to each specific role.

- Highlight relevant experiences for each role: Focus on the experiences and skills that align with the specific requirements of the job description.

- Demonstrate genuine interest in the specific firm and its strategies: Research the firm thoroughly and demonstrate your understanding of its investment approach.

Don't #4: Underprepare for Interviews

Thorough preparation is essential. Winging it will likely result in a less-than-stellar performance.

- Don't wing it: Practice your answers and prepare for both behavioral and technical questions.

- Don't underestimate the technical aspects of the interview: Be prepared to discuss complex financial concepts and demonstrate your analytical skills.

- Don't forget to research the firm and interviewer: Showing genuine interest and understanding of the firm and the interviewer will significantly enhance your performance.

Don't #5: Ignore the Importance of a Professional Online Presence

Your online presence is your digital first impression. An unprofessional online presence can significantly damage your chances.

- Keep your social media professional: Review your online profiles and remove any content that could be perceived as unprofessional.

- Proofread everything: Ensure all your online materials are free of grammatical errors and typos.

- Maintain a consistent online brand: Present a consistent and professional image across all your online platforms.

Crack the Code to Your Private Credit Career

Securing a private credit role requires a strategic blend of expertise, networking, and professional presentation. By mastering the fundamentals of private credit, networking effectively, and showcasing your skills and experience through tailored applications and a strong online presence, you can significantly increase your chances of landing your dream private credit job. Use these do's and don'ts to navigate your private credit job search and unlock your private credit career. Don't delay – start building your private credit career today by utilizing these tips and pursuing available private debt opportunities!

Featured Posts

-

Examining The Liberal Platform Is It Right For You William Watson

Apr 24, 2025

Examining The Liberal Platform Is It Right For You William Watson

Apr 24, 2025 -

The Growing Market For Betting On Natural Disasters The Case Of The Los Angeles Wildfires

Apr 24, 2025

The Growing Market For Betting On Natural Disasters The Case Of The Los Angeles Wildfires

Apr 24, 2025 -

Blue Origin Scraps Rocket Launch Due To Subsystem Issue

Apr 24, 2025

Blue Origin Scraps Rocket Launch Due To Subsystem Issue

Apr 24, 2025 -

Years Of Shark Tourism End In Tragedy At Israeli Beach Swimmer Vanishes Body Discovered

Apr 24, 2025

Years Of Shark Tourism End In Tragedy At Israeli Beach Swimmer Vanishes Body Discovered

Apr 24, 2025 -

Increased Rent In La After Fires Is Price Gouging To Blame

Apr 24, 2025

Increased Rent In La After Fires Is Price Gouging To Blame

Apr 24, 2025