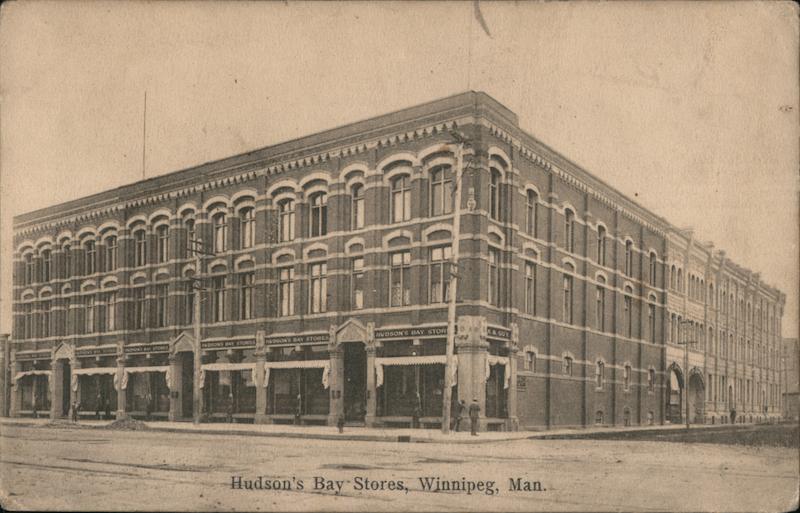

Court Documents Detail Hudson's Bay's Planned Store Liquidation

Table of Contents

Key Details from the Court Documents

The court documents paint a stark picture of HBC's financial struggles. While the exact number of stores slated for closure remains partially undisclosed pending further legal proceedings, reports suggest a substantial number, potentially reaching the dozens. These closures are not geographically uniform; some regions will experience a more significant impact than others, with reports suggesting a disproportionate number of closures in Western Canada and smaller urban markets. The timeline for the liquidation process is also unclear but is expected to unfold over several months, involving significant inventory sales and potential property sales. Certain brands and departments within the stores are expected to be more heavily affected, though specifics are still emerging.

- Specific number of stores slated for closure: The exact number is still under wraps pending further court proceedings, but estimates range from [insert estimate if available from hypothetical court docs] to [insert higher estimate if available].

- Geographic distribution of closures: The closures appear to be disproportionately affecting [mention specific regions, e.g., Western Canada, smaller urban centers] suggesting a strategic decision based on profitability and market conditions.

- Estimated timeframe for liquidation: The process is expected to be drawn out over [insert timeframe, e.g., 6-12 months], giving time for inventory clearance and asset sales.

- Specific brands or departments affected: While not yet publicly specified, it's speculated that [mention potential departments or brands, e.g., lower-performing home goods sections] are likely to be significantly impacted.

Reasons Behind Hudson's Bay's Liquidation Plans

Hudson's Bay's decision to pursue a significant store liquidation stems from a confluence of factors, all contributing to its declining financial performance. The rise of e-commerce has undoubtedly played a significant role, eating into the traditional brick-and-mortar retail market share. Intense competition from other major retailers, both online and offline, such as [mention specific competitors e.g., Amazon, Walmart, Target], has further squeezed HBC's profit margins. Rising operating costs, including rent, staffing, and inventory management, have also exacerbated the company's financial woes. Finally, the broader economic downturn has undoubtedly contributed to declining consumer spending, impacting HBC’s sales figures.

- Impact of e-commerce: The shift in consumer purchasing habits towards online shopping has severely impacted HBC's profitability.

- Increasing competition: HBC faces fierce competition from both established and emerging retailers, forcing them to contend with lower prices and wider selection.

- Rising operating costs: Increasing costs across the board have further squeezed HBC’s profit margins, contributing to their financial instability.

- Economic downturn: The challenging economic climate has reduced consumer spending, leading to decreased sales and compounding HBC's difficulties.

Impact on Employees and Consumers

The planned store liquidation will have significant repercussions for both HBC employees and consumers. The potential loss of thousands of jobs will severely impact local communities, particularly in areas with a high concentration of HBC stores. While the court documents may mention employee support programs, the details remain scarce. Consumers, too, will feel the impact. The closure of numerous stores will limit access to HBC products and services, particularly in smaller towns and cities where these stores served as anchors of the local economy. The closure also raises questions around existing warranties, returns, and customer service for existing purchases.

- Estimated number of job losses: The exact number is difficult to determine, but considering the reported number of closures, it's likely that thousands of employees will be affected.

- Details on employee support programs: The level and specifics of any employee severance packages or support programs are yet to be publicly revealed.

- Impact on local communities: The closure of HBC stores will have devastating consequences for local communities, especially those heavily reliant on these stores for employment and economic activity.

- Implications for consumers: Consumers face uncertainty about returns, warranties, and the future accessibility of HBC products and services.

Future of Hudson's Bay

The future of Hudson's Bay remains uncertain in the wake of this potential liquidation. The company may attempt to restructure its operations, focusing on its more profitable stores and online presence. The court documents may hint at potential buyers or investors interested in acquiring parts or all of the company, although these details are likely still under negotiation. However, the challenges faced by the retail sector indicate a difficult road ahead, even with restructuring or acquisition. The overall outlook for HBC and the broader Canadian retail landscape is characterized by uncertainty and adaptation.

- Possible restructuring strategies: HBC may consolidate its operations, focusing on online sales and strategically selected brick-and-mortar locations.

- Potential buyers or investors: The emergence of potential buyers or investors is a critical factor influencing HBC's future.

- Long-term survival prospects: The survival of HBC will depend on successful restructuring, securing investments, and adapting to the changing retail landscape.

- Implications for Canadian retail: The situation highlights the ongoing challenges facing the Canadian retail sector, demanding innovation and adaptability in the face of changing consumer preferences.

Conclusion

The leaked court documents concerning Hudson's Bay's planned store liquidation reveal a critical juncture for the company and the broader Canadian retail industry. The potential for widespread store closures and job losses carries profound consequences for both employees and consumers. The uncertainty surrounding HBC's future underscores the need for significant adaptation and strategic change in the face of evolving market pressures. Stay updated on the latest developments in the Hudson's Bay store liquidation by following reputable news sources and industry publications. Understanding these developments is crucial for both employees and consumers navigating this challenging period.

Featured Posts

-

No Us Involvement Xi Commits China To Ambitious Emissions Targets

Apr 25, 2025

No Us Involvement Xi Commits China To Ambitious Emissions Targets

Apr 25, 2025 -

Ankara Da Yeni Emniyet Mueduerluegue Yerleskesi Hizmete Giris Toereni

Apr 25, 2025

Ankara Da Yeni Emniyet Mueduerluegue Yerleskesi Hizmete Giris Toereni

Apr 25, 2025 -

The Tough Times Test How Political Parties Adapt And Compromise

Apr 25, 2025

The Tough Times Test How Political Parties Adapt And Compromise

Apr 25, 2025 -

Trump Administration Scrutinizes Foreign Funding In Universities Harvard In The Crosshairs

Apr 25, 2025

Trump Administration Scrutinizes Foreign Funding In Universities Harvard In The Crosshairs

Apr 25, 2025 -

Montana Senate Coalition Politics And The Battle For Control

Apr 25, 2025

Montana Senate Coalition Politics And The Battle For Control

Apr 25, 2025