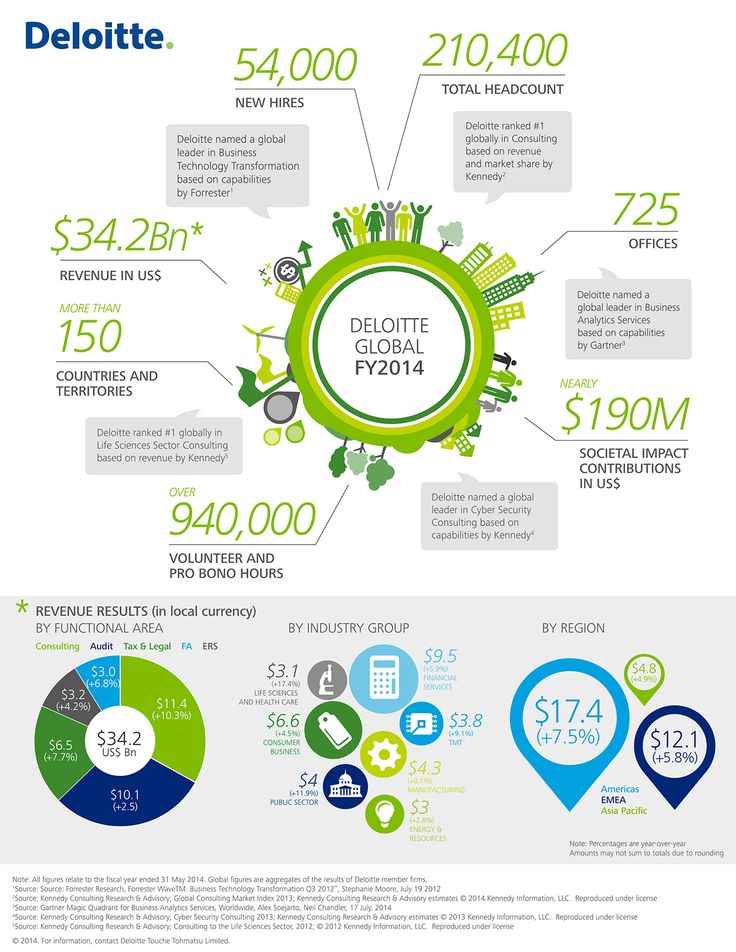

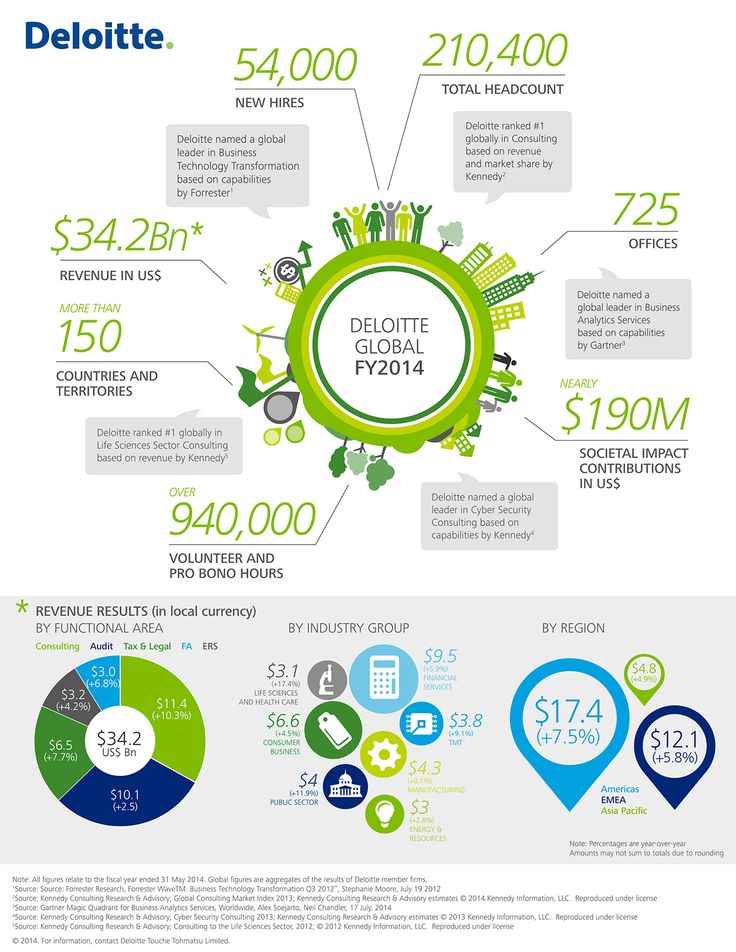

Considerable US Growth Slowdown Predicted By Deloitte

Table of Contents

Key Factors Contributing to the Predicted US Growth Slowdown

Several interconnected factors are contributing to Deloitte's prediction of a considerable US economic slowdown. Understanding these factors is crucial for businesses to prepare for the challenges ahead.

Inflationary Pressures and Rising Interest Rates

The Federal Reserve's aggressive interest rate hikes, aimed at curbing inflation, are significantly impacting the US economy. This monetary policy tightening, while intended to stabilize prices, has several unintended consequences.

- Increased borrowing costs for businesses: Higher interest rates make it more expensive for businesses to borrow money for investments, expansion, and operations, hindering growth and potentially leading to layoffs.

- Reduced consumer discretionary spending: As borrowing becomes more expensive, consumers reduce their spending on non-essential goods and services, impacting retail sales and other consumer-facing businesses. This decreased consumer spending contributes directly to the anticipated US growth slowdown.

- Potential for a recessionary environment: The combination of reduced consumer spending and increased borrowing costs creates a significant risk of a recession, further exacerbating the US economic slowdown.

- Impact on housing market due to higher mortgage rates: Higher interest rates directly translate to higher mortgage rates, cooling down the already slowing housing market and impacting related industries like construction and real estate.

Global Economic Uncertainty

External factors beyond the Federal Reserve's control are also contributing to the predicted US growth slowdown. Geopolitical instability and global economic uncertainty add layers of complexity.

- Energy price volatility: The war in Ukraine and related sanctions have created significant volatility in energy prices, increasing input costs for businesses and impacting consumer spending.

- Disruptions to global trade: Supply chain disruptions, exacerbated by geopolitical tensions and other factors, continue to hamper economic growth. Businesses face difficulties sourcing raw materials and distributing finished goods, impacting profitability and increasing uncertainty.

- Increased uncertainty for businesses operating internationally: Global economic instability creates uncertainty for businesses operating internationally, affecting their supply chains, revenue streams, and overall market stability.

- Impact on commodity prices: The global uncertainty and supply chain disruptions have had a dramatic impact on commodity prices, increasing input costs for many industries and further contributing to inflationary pressures.

Weakening Consumer Confidence

High inflation and rising interest rates are eroding consumer confidence, leading to a decrease in spending and a shift in consumer behavior. This weakening consumer confidence is a key driver of the projected US economic slowdown.

- Reduced consumer purchasing power: High inflation reduces the purchasing power of consumers, forcing them to cut back on spending.

- Increased savings rate: Consumers are increasingly prioritizing saving money in response to economic uncertainty, further reducing consumer spending.

- Shift in consumer spending priorities: Consumers are shifting their spending priorities towards essential goods and services, reducing spending on discretionary items.

- Impact on retail sales and service industries: The decrease in consumer spending significantly impacts retail sales and various service industries heavily reliant on consumer discretionary spending.

Impact on Different Sectors of the US Economy

The predicted US growth slowdown will not impact all sectors equally. Some industries will be more vulnerable than others.

Manufacturing and Technology

The manufacturing and technology sectors are particularly sensitive to global economic uncertainty and supply chain disruptions.

- Potential for reduced production and investment: Uncertainty in the global economy may lead to reduced production and investment in these sectors.

- Increased competition for resources: Companies may face increased competition for resources, affecting profitability and potentially leading to job losses.

- Impact on employment in these sectors: The slowdown could translate into reduced hiring or even layoffs in the manufacturing and technology sectors.

Real Estate and Construction

The rising interest rates are significantly impacting the real estate and construction sectors.

- Decreased demand for new homes: Higher mortgage rates are leading to a decline in demand for new homes.

- Reduced construction activity: The decrease in demand is translating into reduced construction activity, impacting related businesses.

- Impact on related industries (e.g., furniture, appliances): The slowdown in the housing market ripples through related industries.

Retail and Consumer Services

The retail and consumer services sectors are expected to experience a significant decline in consumer spending due to reduced purchasing power and economic uncertainty.

- Reduced sales revenue: Businesses will likely see reduced sales revenue as consumers cut back on spending.

- Increased pressure on profit margins: The combination of reduced sales and increased input costs puts considerable pressure on profit margins.

- Need for cost-cutting measures: To survive, businesses in this sector will need to implement cost-cutting measures to maintain profitability.

Strategies for Businesses to Navigate the US Growth Slowdown

Businesses need to adopt proactive strategies to navigate the challenges posed by the predicted US growth slowdown.

Cost Optimization and Efficiency

Implementing cost-cutting measures and streamlining operations is crucial for survival.

- Reviewing and renegotiating contracts: Businesses should review all contracts to identify areas for cost savings.

- Optimizing supply chain management: Efficient supply chain management can significantly reduce costs and improve efficiency.

- Implementing automation technologies: Automation can reduce labor costs and improve efficiency.

- Reducing operational expenses: Businesses need to carefully examine all operational expenses and identify areas for reduction.

Diversification and Risk Management

Diversifying revenue streams and implementing robust risk management strategies is vital.

- Exploring new markets and customer segments: Businesses should explore new markets and customer segments to reduce reliance on a single market.

- Hedging against currency fluctuations and commodity price increases: Hedging strategies can help mitigate the impact of currency fluctuations and commodity price increases.

- Implementing robust risk management strategies: Proactive risk management planning can help businesses prepare for and mitigate potential challenges.

Strategic Planning and Adaptability

Adaptability and strategic planning are crucial for navigating economic uncertainty.

- Forecasting future demand and adjusting production accordingly: Accurate demand forecasting is crucial for adjusting production levels to meet market needs.

- Investing in research and development to innovate and stay competitive: Innovation is key to staying competitive in a challenging economic environment.

- Developing a flexible workforce capable of adapting to change: A flexible workforce can adapt more readily to changing market conditions.

Conclusion

Deloitte's prediction of a considerable US growth slowdown necessitates a proactive response from businesses. By understanding the key factors driving this slowdown and implementing effective strategies to mitigate the risks, businesses can position themselves for success in the challenging economic climate ahead. Ignoring the potential impact of this US economic slowdown could have severe repercussions. Don't wait – start planning your strategy to navigate the predicted US growth slowdown today.

Featured Posts

-

Belinda Bencic Campeona Nueve Meses Despues Del Parto

Apr 27, 2025

Belinda Bencic Campeona Nueve Meses Despues Del Parto

Apr 27, 2025 -

Top Picks Free Movies And Shows Available On Kanopy

Apr 27, 2025

Top Picks Free Movies And Shows Available On Kanopy

Apr 27, 2025 -

The Cdcs Vaccine Study Hire A Question Of Credibility And Public Health

Apr 27, 2025

The Cdcs Vaccine Study Hire A Question Of Credibility And Public Health

Apr 27, 2025 -

Couples Alaskan Adventure Ariana Biermann And Her Boyfriend Explore The Wild

Apr 27, 2025

Couples Alaskan Adventure Ariana Biermann And Her Boyfriend Explore The Wild

Apr 27, 2025 -

Concerns Raised Over Hhss Appointment Of Anti Vaccine Activist To Examine Debunked Claims

Apr 27, 2025

Concerns Raised Over Hhss Appointment Of Anti Vaccine Activist To Examine Debunked Claims

Apr 27, 2025