Colgate (CL) Sales And Profit Decline Amidst $200 Million Tariff Increase

Table of Contents

The $200 Million Tariff Increase: A Deep Dive

The recent surge in tariffs has dealt a significant blow to Colgate's bottom line. Understanding the breakdown of this impact is crucial to assessing the company's future prospects.

Breakdown of Tariff Impact on Colgate's Products:

The $200 million tariff increase hasn't impacted all Colgate products equally. Specific product lines have been disproportionately affected:

- Toothpaste: Tariffs have increased production costs for several Colgate toothpaste lines by an estimated 8-12%, depending on the specific formulation and ingredients sourced internationally. This is particularly impactful in regions heavily reliant on imported raw materials.

- Toothbrushes: Similarly, the cost of manufacturing toothbrushes has risen due to tariffs on imported bristles and plastic components, leading to a price increase of approximately 5-7%.

- Oral Care Accessories: Other oral care products, such as mouthwash and floss, have also experienced increased costs due to tariffs on imported ingredients and packaging.

These tariff increases primarily affect Colgate's operations in regions like Europe and certain parts of Asia, where a significant portion of their products are imported. The disruption to Colgate's supply chain is also a factor, leading to increased logistical costs and potential delays.

Colgate's Response to the Tariff Increase:

Faced with this significant challenge, Colgate has implemented several strategies to mitigate the negative effects of the tariffs:

- Price Adjustments: Colgate has adjusted prices on certain products to offset increased costs. However, the extent of these adjustments varies by region and product, balancing the need to maintain profitability with the risk of impacting consumer demand.

- Cost-Cutting Measures: The company is actively pursuing various cost-cutting measures, focusing on operational efficiencies and streamlining its supply chain to reduce expenses. This includes exploring alternative sourcing options for raw materials.

- Strategic Sourcing: Colgate is actively seeking alternative suppliers and manufacturing locations to reduce reliance on tariff-affected regions. This is a long-term strategy that requires significant investment and time to fully implement.

While these measures are underway, their effectiveness in fully offsetting the tariff impact remains to be seen. Colgate's management has acknowledged the challenges publicly, emphasizing their commitment to navigating these headwinds.

Impact on Colgate's Sales and Profitability

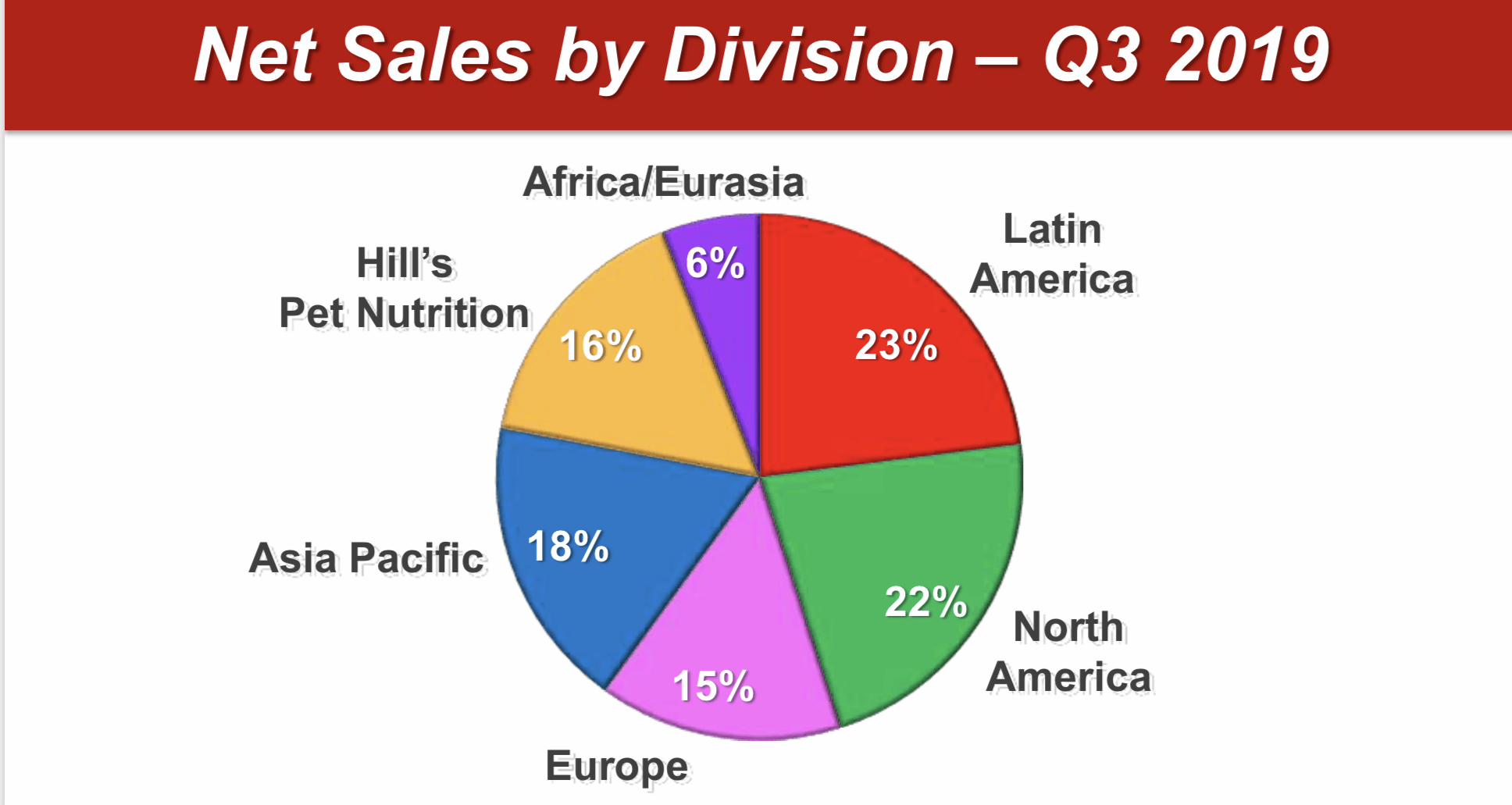

The $200 million tariff increase has demonstrably impacted Colgate's financial performance.

Financial Performance Analysis:

Analyzing Colgate's recent quarterly reports reveals a concerning trend:

- Sales Decline: Revenue growth has slowed significantly compared to previous years, with a noticeable decline in sales volume in certain key markets. This can be directly linked to increased product prices due to tariffs and reduced consumer purchasing power.

- Profit Decline: Net income has experienced a considerable decrease, reflecting the higher production costs and reduced sales volume. The impact is clearly visible in the company's financial statements. [Insert relevant chart or graph here showing sales and profit decline.]

These figures underscore the severe impact of the tariffs on Colgate's bottom line and indicate a need for robust strategies to counter these challenges.

Impact on Investor Sentiment:

The decline in Colgate's sales and profit has understandably impacted investor sentiment. The company's stock price has experienced a downturn since the tariff increase was announced.

- Stock Price Volatility: Colgate's stock price has shown increased volatility, reflecting the uncertainty surrounding the long-term effects of the tariffs.

- Analyst Predictions: Financial analysts are divided on Colgate's future prospects, with some downgrading their recommendations due to the current challenges.

- Investor Concerns: Investors are increasingly concerned about the company's ability to effectively mitigate the tariff impact and maintain profitability in the face of these headwinds.

Long-Term Implications for Colgate and the Consumer Goods Industry

The implications of this situation extend beyond Colgate's immediate financial performance.

Future Outlook for Colgate:

Colgate's long-term success depends on its ability to adapt and innovate:

- Innovation and New Products: Investing in research and development to create innovative products and expand into new segments of the oral care market is crucial.

- Market Diversification: Expanding into new geographic markets and diversifying its product portfolio can reduce reliance on tariff-sensitive regions.

- Supply Chain Resilience: Building a more resilient and diversified supply chain is paramount to mitigate future tariff risks.

These strategies, while demanding significant investment, are essential for Colgate to maintain its competitive edge and long-term growth.

Wider Impact on the Consumer Goods Sector:

The impact of rising tariffs extends beyond Colgate, affecting the entire consumer goods industry:

- Increased Costs: Many consumer goods companies face similar challenges due to increased import costs, potentially leading to widespread price increases.

- Reduced Consumer Spending: Higher prices for everyday goods can reduce consumer spending and negatively affect overall economic growth.

- Global Trade Tensions: Rising tariffs contribute to increased global trade tensions, creating uncertainty and instability for businesses operating internationally.

Consumer Behavior and Price Sensitivity:

Consumers are becoming increasingly price-sensitive:

- Demand Elasticity: The extent to which Colgate's sales are affected by price increases is a key factor determining their future profitability.

- Brand Loyalty: Colgate's strong brand loyalty can help mitigate some of the negative impact of price increases.

- Competitive Landscape: Intense competition in the oral care market means that price increases could drive consumers to switch to cheaper alternatives.

Conclusion

The $200 million tariff increase has undeniably had a significant negative impact on Colgate's (CL) sales and profits. The company's response, while proactive, faces challenges in fully offsetting the effects. The long-term implications for Colgate and the broader consumer goods industry are substantial, emphasizing the need for adaptability, innovation, and strategic diversification. The consequences highlight the vulnerabilities of businesses heavily reliant on global supply chains in the face of fluctuating trade policies. Stay updated on the latest developments concerning Colgate (CL) and the evolving impact of tariffs on its financial performance. Continue to monitor Colgate (CL) stock and its response to the ongoing tariff challenges, keeping a close eye on financial news sources and company announcements for further insights.

Featured Posts

-

Solve Todays Nyt Spelling Bee March 25th 387 Hints And Answers

Apr 26, 2025

Solve Todays Nyt Spelling Bee March 25th 387 Hints And Answers

Apr 26, 2025 -

Trump Doubts Ukraines Nato Prospects Implications And Reactions

Apr 26, 2025

Trump Doubts Ukraines Nato Prospects Implications And Reactions

Apr 26, 2025 -

Mv Callaway Parker Verrets Successful Delivery To Ptc

Apr 26, 2025

Mv Callaway Parker Verrets Successful Delivery To Ptc

Apr 26, 2025 -

Vingegaards Tour De France Focus After Concussion Recovery

Apr 26, 2025

Vingegaards Tour De France Focus After Concussion Recovery

Apr 26, 2025 -

Lady Olive And The German U Boat Uncovering A Lost Chapter Of History

Apr 26, 2025

Lady Olive And The German U Boat Uncovering A Lost Chapter Of History

Apr 26, 2025