China's Oil Trade: A Pivot From The US To Canada

Table of Contents

Declining US-China Relations and its Impact on Energy Trade

Increased trade disputes and political tensions between the US and China have created uncertainty and instability in their energy relationship, significantly impacting China's oil trade.

Geopolitical Tensions

- Tariffs on energy products: Imposition of tariffs on oil and related products has increased the cost of US crude for Chinese importers.

- Sanctions: The threat and imposition of sanctions create uncertainty and risk in the long-term stability of US-China energy trade.

- Diplomatic disagreements: Strained diplomatic relations often translate into obstacles to smooth energy trade and negotiations.

These tensions have made US oil supplies less predictable and more expensive for China, prompting a search for alternative sources. The 2018 trade war, for instance, significantly disrupted established energy trade patterns and highlighted the vulnerability of relying on a single major supplier. The resulting uncertainty pushed China to diversify its energy portfolio.

Diversification Strategy

China's pursuit of energy security necessitates a diversified import portfolio to mitigate risks.

- Reduced reliance on a single source: Diversification minimizes vulnerability to geopolitical instability and supply disruptions affecting a single country.

- Price negotiation leverage: Access to multiple suppliers provides China with greater leverage in negotiating prices and securing favorable terms.

This diversification strategy is a cornerstone of China's long-term energy security policy, aiming for stability and resilience against external shocks impacting its oil trade.

The Allure of Canadian Crude Oil

Canada has emerged as an increasingly attractive oil supplier for China, due to several key factors.

High-Quality Crude

Canadian oil, especially from the Alberta oil sands, offers a high-quality, heavy crude oil that meets China's refining needs.

- Specific properties: Canadian heavy crude possesses unique characteristics suitable for certain refining processes and the production of specific petroleum products.

- Refinery compatibility: Chinese refineries have invested in upgrading their facilities to efficiently process this type of heavy crude.

Advancements in coking and hydrocracking technologies in Chinese refineries have made the processing of Canadian heavy crude more efficient and economically viable, boosting the appeal of this oil trade.

Expanding Pipeline Capacity

Increased investment in pipeline infrastructure, notably the Trans Mountain pipeline expansion, significantly enhances Canada's ability to export oil to Asia.

- Trans Mountain Pipeline: This pipeline plays a crucial role in transporting Canadian crude to the Pacific coast for export to Asian markets, including China.

- Other pipeline projects: Further pipeline development and expansion projects are underway, further increasing Canada's export capacity and bolstering this oil trade.

The expansion of pipeline capacity reduces transportation bottlenecks, making Canadian crude more competitive in the global market and enabling a significant increase in exports to China.

Favorable Trade Agreements

Existing and potential future trade agreements between China and Canada further facilitate the growth of oil trade.

- Existing agreements: While no specific bilateral oil trade agreement exists, broader trade agreements reduce general barriers to commerce.

- Potential future agreements: Future negotiations could include provisions specifically addressing energy trade, streamlining processes and enhancing cooperation.

These agreements simplify customs procedures, reduce tariffs, and promote a more favorable investment climate, fostering stronger economic ties and enhancing bilateral oil trade.

Challenges and Opportunities

Despite the promising growth of China-Canada oil trade, several challenges and opportunities remain.

Environmental Concerns

Concerns about the environmental impact of oil sands extraction and transportation pose a challenge.

- Oil sands production: Environmental concerns related to greenhouse gas emissions and habitat disruption from oil sands extraction need to be addressed.

- Carbon capture and storage (CCS): Investing in and implementing CCS technologies can help mitigate some of the environmental impacts.

Addressing environmental concerns through sustainable practices and technological advancements is critical for the long-term sustainability of this oil trade.

Transportation Costs

The geographical distance between Canada and China necessitates efficient and cost-effective transportation.

- Transportation methods: Oil is transported via pipelines to the West Coast, and then by tankers to China.

- Shipping logistics: Optimizing shipping routes and vessel utilization is crucial for minimizing transportation costs.

Finding innovative solutions to optimize logistics and reduce transportation costs will be vital for ensuring the competitiveness of Canadian crude in the Chinese market.

Conclusion

The shift in China's oil trade towards Canada represents a significant development in the global energy landscape. Driven by geopolitical factors, the desire for energy security, and the high quality of Canadian crude, this pivot offers both economic and strategic benefits for both nations. While challenges remain, particularly concerning environmental issues and transportation costs, the future of China-Canada oil trade appears promising. To stay abreast of the evolving dynamics in this crucial relationship, continue to follow developments in China's oil import strategies and the expansion of Canadian oil exports. Understanding the complexities of China's oil trade, including its evolving relationship with Canada, is crucial for navigating the future of global energy markets.

Featured Posts

-

Roberts On World Series One Key Hit Changed Everything

Apr 23, 2025

Roberts On World Series One Key Hit Changed Everything

Apr 23, 2025 -

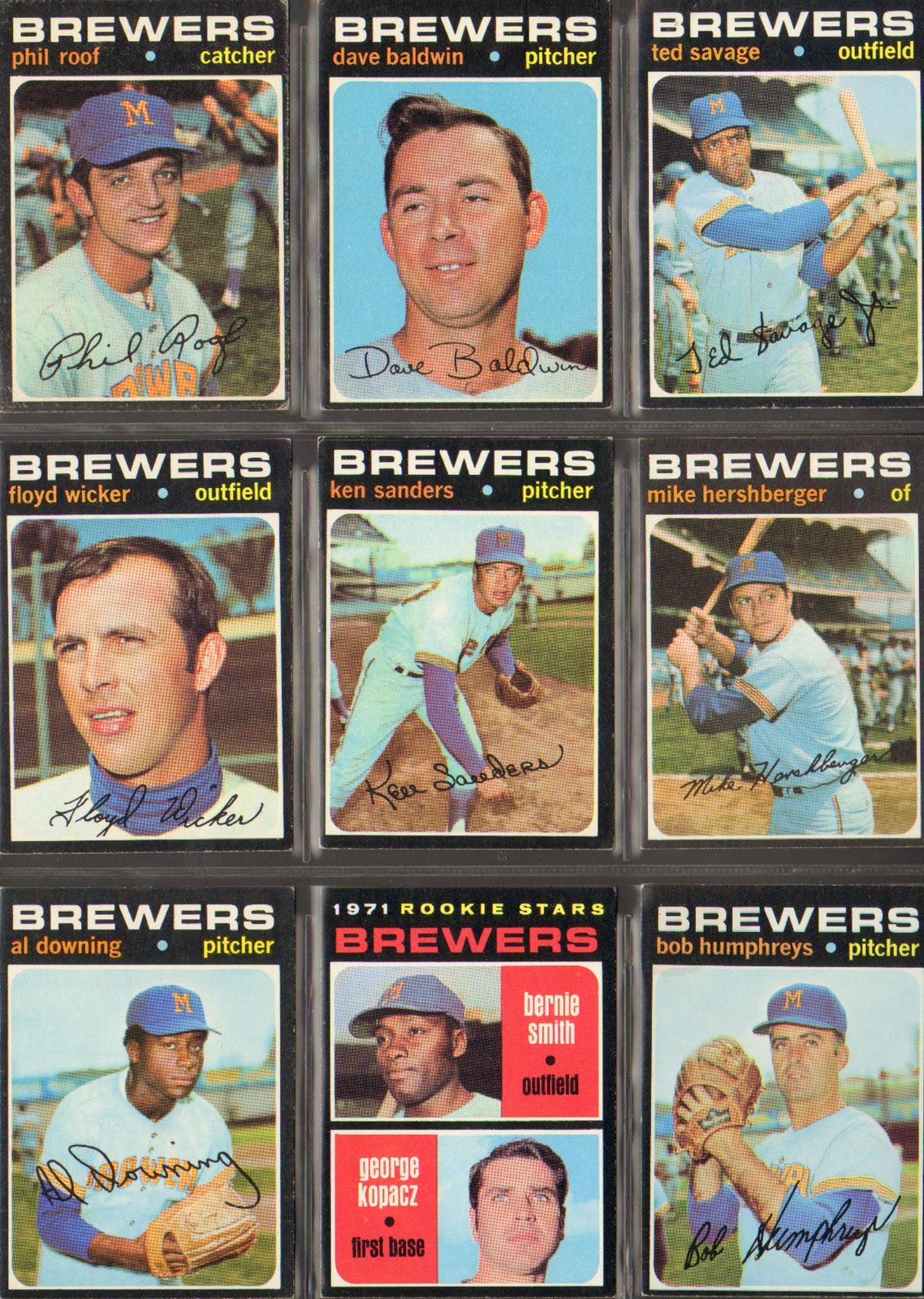

Nine Stolen Bases Milwaukee Brewers Set New Record

Apr 23, 2025

Nine Stolen Bases Milwaukee Brewers Set New Record

Apr 23, 2025 -

Analyzing Michael Lorenzens Fielding And Defensive Skills

Apr 23, 2025

Analyzing Michael Lorenzens Fielding And Defensive Skills

Apr 23, 2025 -

Netflix Outperforming Big Tech And Attracting Tariff Seeking Investors

Apr 23, 2025

Netflix Outperforming Big Tech And Attracting Tariff Seeking Investors

Apr 23, 2025 -

8 2 Brewers Win Jackson Chourios Two Home Run Display

Apr 23, 2025

8 2 Brewers Win Jackson Chourios Two Home Run Display

Apr 23, 2025