Cantor's $3 Billion Crypto SPAC Deal: Tether And SoftBank Involvement

Table of Contents

Cantor Fitzgerald's Strategic Move into Crypto

Cantor Fitzgerald, a renowned global financial services firm with a rich history in trading and brokerage, is traditionally known for its expertise in fixed income, equities, and other traditional financial instruments. However, the firm's foray into the cryptocurrency market through this massive SPAC deal demonstrates a keen understanding of the industry's explosive growth potential and its transformative technological advancements. This strategic move is not just about diversification; it's about positioning Cantor Fitzgerald at the forefront of the next generation of finance.

The potential benefits for Cantor Fitzgerald are multifaceted:

- Diversification of investment portfolio: Expanding beyond traditional assets mitigates risk and opens avenues for higher returns.

- Access to new markets and customer base: The cryptocurrency market presents a vast, untapped potential for growth and customer acquisition.

- Enhancement of technological capabilities: The acquisition provides access to cutting-edge blockchain technology and expertise.

- Potential for high returns on investment: The cryptocurrency market's volatility, while presenting risks, also offers significant potential for substantial returns.

Tether's Role and Significance

Tether, the leading stablecoin pegged to the US dollar, plays a crucial role in this deal. Its massive market capitalization and widespread use within the cryptocurrency ecosystem make its involvement highly significant. For Tether, this partnership offers a significant boost to legitimacy within the traditional financial world, potentially leading to increased adoption and trust.

However, Tether's participation also carries inherent risks:

- Increased legitimacy for Tether in the traditional financial world: This collaboration could help alleviate concerns about Tether's reserves and transparency.

- Potential for increased Tether adoption: The deal could accelerate the integration of Tether into mainstream financial systems.

- Enhanced stability and trust in the crypto market: The involvement of a reputable firm like Cantor Fitzgerald may help to stabilize the volatile crypto market.

- Concerns about Tether's reserves and transparency: Regulatory scrutiny remains a significant concern, and any negative developments could negatively impact the deal.

SoftBank's Investment and Strategic Rationale

SoftBank, a prominent technology investor with a history of bold investments in emerging technologies, including previous ventures in the cryptocurrency space, brings a wealth of experience and capital to the table. Its participation in this $3 billion deal aligns with its strategy of capitalizing on disruptive technological advancements and high-growth markets.

SoftBank's motivations are likely driven by several factors:

- Diversification of SoftBank's investment portfolio: Adding exposure to the cryptocurrency market further diversifies their already vast investment portfolio.

- Capitalizing on the growth potential of the cryptocurrency market: SoftBank recognizes the enormous potential for growth and profitability within the crypto sector.

- Access to cutting-edge technologies in the blockchain space: The deal provides access to innovative blockchain technologies and expertise.

- Long-term strategic partnership with Cantor Fitzgerald: This collaboration sets the stage for a potentially fruitful, long-term partnership.

Market Implications and Future Outlook

Cantor Fitzgerald's $3 billion crypto SPAC deal is likely to have profound implications for the broader cryptocurrency market. It signals a significant increase in institutional investment, potentially leading to greater mainstream adoption and increased competition among crypto companies. The deal also highlights the growing acceptance of cryptocurrencies by established financial players.

However, challenges remain:

- Increased institutional investment in crypto: This deal is likely to inspire other institutional investors to enter the crypto market.

- Greater mainstream adoption of cryptocurrencies: Increased legitimacy could accelerate the adoption of cryptocurrencies by the general public.

- Increased competition among crypto companies: The deal will increase competition and pressure other players in the crypto space.

- Potential for increased regulatory oversight: Increased institutional involvement may attract greater regulatory scrutiny.

Conclusion

Cantor Fitzgerald's $3 billion crypto SPAC deal, with the significant involvement of Tether and SoftBank, marks a pivotal moment in the history of cryptocurrency. This strategic move signals a major shift towards institutional adoption and mainstream acceptance of cryptocurrencies. The long-term implications for both the cryptocurrency market and the traditional financial sector remain to be seen, but this deal undoubtedly sets the stage for an exciting future. Stay informed about developments related to Cantor Fitzgerald's crypto ventures, Tether's involvement in the financial market, and SoftBank's strategic investments. Further research into cryptocurrency SPAC deals and similar market events will be crucial for understanding the evolving landscape of digital finance.

Featured Posts

-

India Market Buzz Niftys Bullish Run Fueled By Positive Trends

Apr 24, 2025

India Market Buzz Niftys Bullish Run Fueled By Positive Trends

Apr 24, 2025 -

Ryujinx Emulator Development Halted Nintendo Contact Confirmed

Apr 24, 2025

Ryujinx Emulator Development Halted Nintendo Contact Confirmed

Apr 24, 2025 -

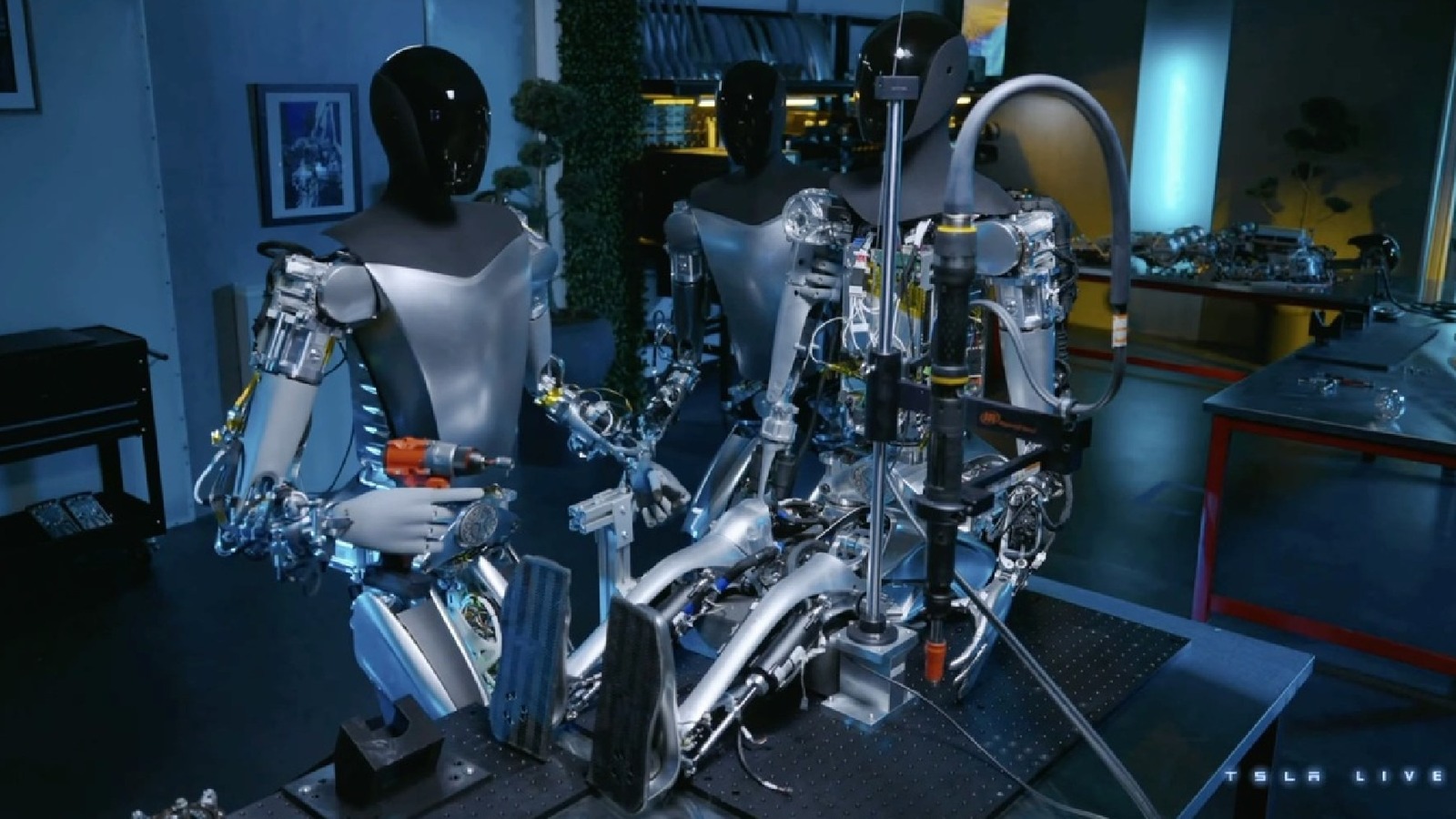

Teslas Optimus Robot Navigating The Complexities Of Chinas Rare Earth Market

Apr 24, 2025

Teslas Optimus Robot Navigating The Complexities Of Chinas Rare Earth Market

Apr 24, 2025 -

Nba All Star Weekend Herros 3 Point Triumph And Cavs Skills Challenge Domination

Apr 24, 2025

Nba All Star Weekend Herros 3 Point Triumph And Cavs Skills Challenge Domination

Apr 24, 2025 -

Turning Trash To Treasure An Ai Powered Poop Podcast From Mundane Documents

Apr 24, 2025

Turning Trash To Treasure An Ai Powered Poop Podcast From Mundane Documents

Apr 24, 2025