Canadian Project Delayed: Dow Cites Market Volatility

Table of Contents

Dow Chemical's Statement and Market Volatility Explanation

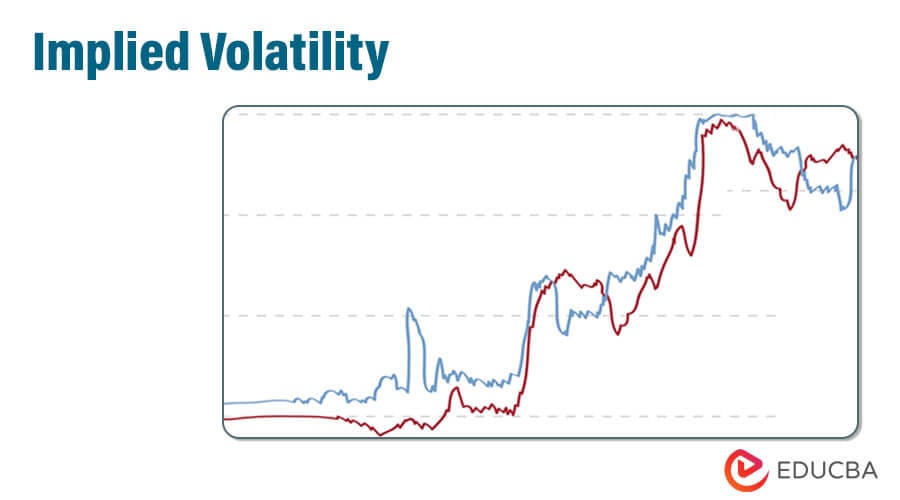

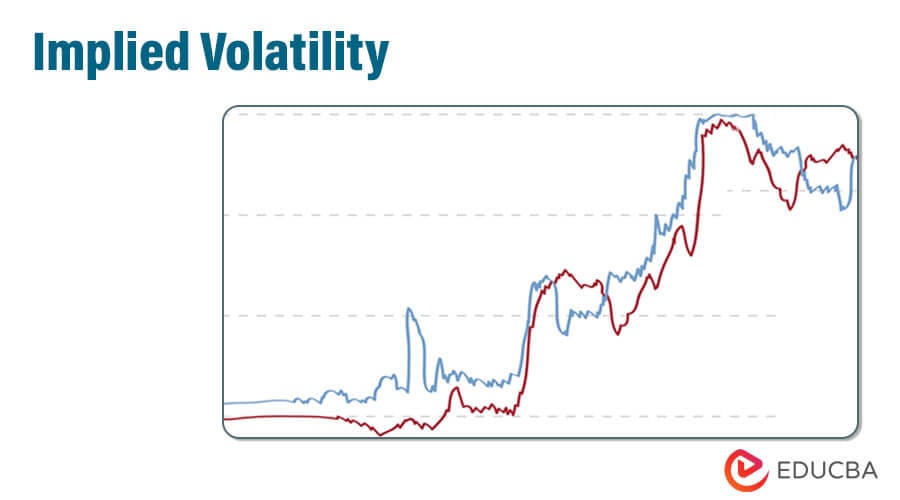

Dow Chemical's official statement attributed the delay to "unforeseen and significant market volatility impacting project financing." While the company didn't release specific financial details, analysts suggest several contributing factors. The statement highlighted concerns over fluctuating lithium prices, rising interest rates, and persistent inflation, all creating an uncertain investment climate.

- Specific examples of market fluctuations affecting the project: Lithium prices, a key driver for the project's profitability, have experienced significant swings in the past year, impacting the project's projected return on investment (ROI). The rising interest rates increased the cost of borrowing, making project financing more expensive. High inflation further eroded profit margins.

- Impact of global events on investment decisions: Geopolitical instability and the ongoing war in Ukraine have also contributed to global market uncertainty, influencing Dow's risk assessment and ultimately leading to the delay.

- Analysis of Dow's financial reports to support claims: While Dow hasn't explicitly linked the delay to specific figures in their financial reports, a review of their Q[Quarter] 2023 earnings call transcripts reveals concerns about macroeconomic headwinds and a more cautious approach to capital expenditures.

Impact on the Canadian Economy

The delay of the Northern Lights Lithium Project carries significant potential economic repercussions for Canada. The project was expected to create numerous jobs, generate substantial government revenue through taxes and royalties, and contribute significantly to Canada's GDP. Its postponement will likely lead to:

- Job losses: Estimates suggest the delay could result in the loss of over 500 direct and indirect jobs during the construction phase, and potentially hundreds more in related industries.

- Reduced government revenue: The provincial and federal governments will miss out on anticipated tax revenue and royalties, impacting their budgets and potentially delaying other infrastructure projects.

- Supply chain disruptions: The project's delay could disrupt the supply chain for lithium, a crucial component in the production of electric vehicle batteries, impacting Canada's burgeoning EV sector.

- Long-term consequences for economic growth: The project's delayed contribution to Canada's GDP could negatively affect overall economic growth in the long term.

Implications for Future Canadian Projects and Investment

The delay of the Northern Lights Lithium Project sends a cautionary signal to potential investors considering large-scale projects in Canada. It raises concerns about:

- Investor confidence: The delay could negatively impact investor confidence in the Canadian resource sector, making it harder to attract future foreign direct investment (FDI).

- Potential changes in investment strategies by multinational corporations: Multinational corporations may adopt more conservative investment strategies, focusing on projects with lower risk profiles and shorter timelines.

- Government initiatives to mitigate the impact and encourage investment: The Canadian government may need to review its investment policies and regulatory frameworks to address the challenges of market volatility and attract long-term investment in resource development projects.

Alternative Financing and Risk Mitigation Strategies

To mitigate the risks associated with market volatility and ensure the success of future Canadian projects, exploring alternative financing options and robust risk management strategies is crucial.

- Examples of alternative financing models: Public-private partnerships (PPPs) can distribute risk and leverage the expertise of both public and private sectors. Project-specific financing, tailored to the risks associated with the commodity, can also minimize vulnerability.

- Strategies for hedging against market risk: Employing hedging strategies to mitigate price volatility for key inputs (like lithium) is essential. Insurance products specifically designed to cover market risk can also be explored.

- Role of government support and insurance programs: Government support through loan guarantees, tax incentives, and insurance programs could enhance investor confidence and reduce the perceived risk associated with these large-scale endeavors.

Conclusion

The delay of the Northern Lights Lithium Project highlights the vulnerability of large-scale resource projects to market volatility and underscores the need for robust risk management strategies in Canadian project development. The potential economic impacts—job losses, reduced government revenue, and supply chain disruptions—are significant. This delay emphasizes the importance of proactive planning, diversified financing, and effective risk mitigation strategies. Understanding these challenges is crucial for investors and the Canadian government to ensure future projects proceed smoothly. Learn more about managing risk in mining projects in Canada by [link to relevant resource - e.g., a government website].

Featured Posts

-

Hhs Hires Vaccine Skeptic David Geiers Role In Vaccine Study Analysis

Apr 27, 2025

Hhs Hires Vaccine Skeptic David Geiers Role In Vaccine Study Analysis

Apr 27, 2025 -

Green Bay Packers Two 2025 International Game Opportunities

Apr 27, 2025

Green Bay Packers Two 2025 International Game Opportunities

Apr 27, 2025 -

Belinda Bencic Reaches Abu Dhabi Open Final

Apr 27, 2025

Belinda Bencic Reaches Abu Dhabi Open Final

Apr 27, 2025 -

Cma Cgms Strategic Investment 440 Million Turkish Logistics Acquisition

Apr 27, 2025

Cma Cgms Strategic Investment 440 Million Turkish Logistics Acquisition

Apr 27, 2025 -

Ariana Grandes Hair And Tattoo Makeover The Role Of Professional Experts

Apr 27, 2025

Ariana Grandes Hair And Tattoo Makeover The Role Of Professional Experts

Apr 27, 2025