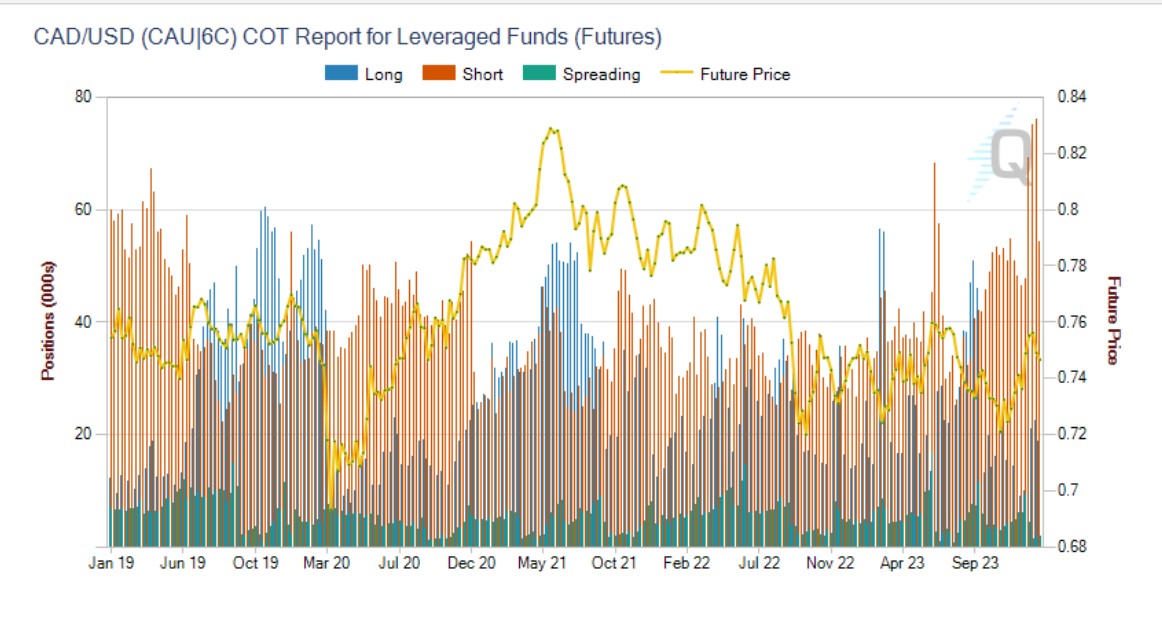

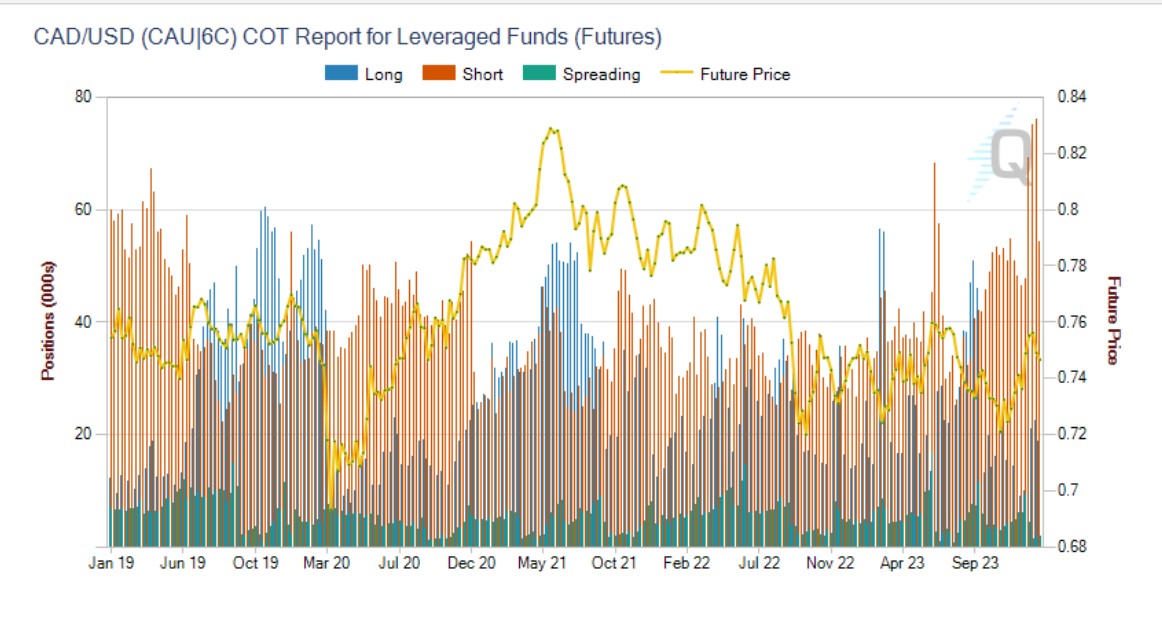

Canadian Dollar Weakness Against Major Currencies

Table of Contents

Impact of Commodity Prices on the CAD

The Canadian economy is heavily reliant on the export of commodities, particularly oil, natural gas, and lumber. Therefore, the Canadian dollar's value is strongly correlated with the prices of these resources. Fluctuations in global commodity markets directly impact the Canadian economy and, consequently, the CAD's exchange rate. When global demand for these commodities is high, their prices rise, leading to increased Canadian exports and a stronger CAD. Conversely, a decrease in global demand or a drop in commodity prices weakens the Canadian dollar.

For example, a sharp decline in oil prices, a major Canadian export, directly translates to reduced revenue for energy companies and a weakened CAD. Conversely, periods of robust global economic growth frequently lead to increased demand for raw materials, boosting commodity prices and strengthening the Canadian dollar.

- Lower oil prices weaken the CAD. Reduced energy sector revenues diminish the demand for the Canadian dollar.

- Increased demand for Canadian resources strengthens the CAD. Higher commodity prices boost export earnings and increase demand for the CAD.

- Global economic slowdown impacting commodity demand weakens the CAD. A global recession can significantly depress commodity prices, leading to CAD weakness.

Recent examples include the impact of the COVID-19 pandemic on oil prices, which caused a significant dip in the CAD, and the subsequent recovery fueled by increased global demand. Keeping a close eye on commodity price forecasts is crucial for understanding potential future fluctuations in the Canadian dollar.

Influence of Interest Rate Differentials

Interest rate differentials between Canada and other major economies significantly influence currency exchange rates. The Bank of Canada's monetary policy plays a crucial role in determining domestic interest rates. When the Bank of Canada raises interest rates, it makes Canadian investments more attractive to foreign investors seeking higher returns. This increased demand for the CAD leads to its appreciation. Conversely, lower interest rates relative to other countries can make the CAD less attractive, leading to its depreciation.

A comparison of Canadian interest rates with those of the US Federal Reserve or the European Central Bank (ECB) often reveals the dynamics at play. For instance, if Canadian interest rates are significantly higher than those in the US, investors might shift funds to Canada, increasing demand for the CAD and strengthening it.

- Higher interest rates in Canada attract foreign investment, strengthening the CAD. Higher returns incentivize investors to buy CAD.

- Lower interest rates compared to other countries weaken the CAD. Lower returns make the CAD less attractive to foreign investors.

- Interest rate expectations play a crucial role in currency movements. Market anticipations of future interest rate changes significantly impact the CAD's value.

Geopolitical Factors and Their Role

Geopolitical events, such as trade wars, political instability, and international conflicts, significantly impact investor sentiment and currency markets. Uncertainty created by these events often leads to increased volatility in the CAD. For instance, trade tensions between Canada and major trading partners can negatively affect Canadian exports and weaken the Canadian dollar. Political instability within Canada or in key global markets can also create uncertainty and cause fluctuations.

- Trade tensions with major trading partners weaken the CAD. Trade disputes disrupt export flows and reduce demand for the CAD.

- Global political uncertainty increases volatility in the CAD. Uncertainty leads to increased risk aversion among investors.

- Positive geopolitical developments can strengthen the CAD. Improved global stability and reduced uncertainty often support the CAD.

Implications of Canadian Dollar Weakness

A weak Canadian dollar has both positive and negative implications for various stakeholders. Canadian businesses, particularly exporters, benefit from increased competitiveness in global markets as their goods and services become cheaper for international buyers. However, importers face higher costs for imported goods, potentially leading to increased prices for consumers.

Consumers might experience higher prices for imported goods, but conversely, they may find international travel and purchases of foreign goods relatively cheaper. Foreign investors may find Canadian assets more attractive due to the potential for higher returns when converting back to their home currency.

- Benefits for Canadian exporters. Increased international competitiveness boosts export volumes and revenue.

- Challenges for Canadian importers. Higher import costs can squeeze profit margins and lead to increased consumer prices.

- Impact on tourism and travel. A weak CAD makes travel abroad more expensive for Canadians but attracts more foreign tourists.

- Attractiveness of Canadian assets for foreign investors. A weak CAD makes Canadian investments relatively cheaper for foreign investors.

Conclusion: Navigating the Fluctuations of the Canadian Dollar

The Canadian dollar's value is influenced by a complex interplay of factors, including commodity prices, interest rate differentials, and geopolitical events. Understanding these factors is essential for navigating the fluctuations in the CAD and mitigating potential risks. Canadian dollar weakness presents both challenges and opportunities for various stakeholders. By monitoring key economic indicators, staying informed about global events, and possibly employing hedging strategies, individuals and businesses can better position themselves to manage the risks associated with Canadian dollar volatility. Continue to monitor economic news and utilize resources from the Bank of Canada and reputable financial institutions to better understand and prepare for future fluctuations in Canadian dollar weakness.

Featured Posts

-

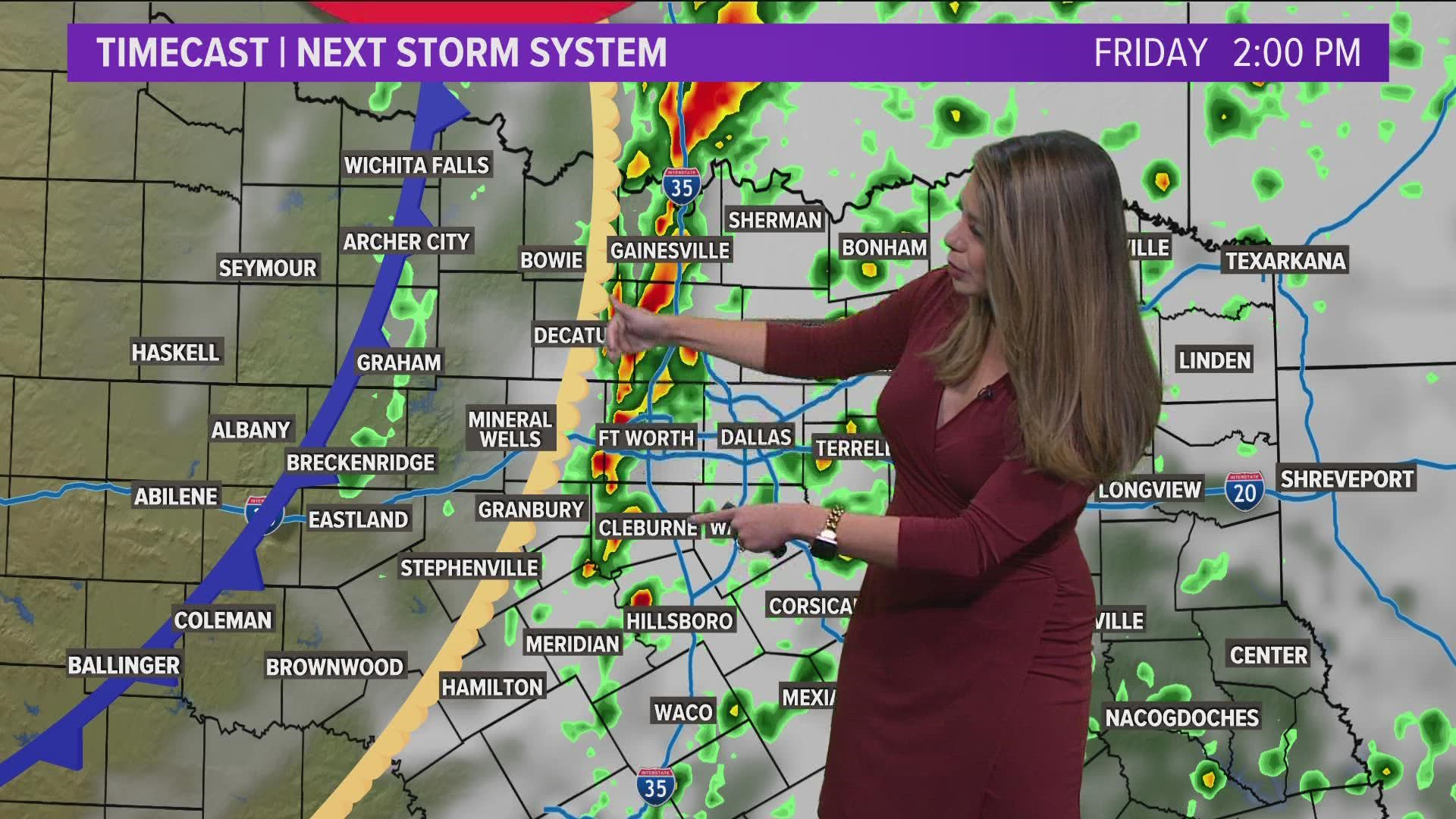

Okc Winter Weather Digital Exclusive Forecast From David Payne

Apr 25, 2025

Okc Winter Weather Digital Exclusive Forecast From David Payne

Apr 25, 2025 -

Remember Monday The Uks Eurovision 2025 Song Contest Entry

Apr 25, 2025

Remember Monday The Uks Eurovision 2025 Song Contest Entry

Apr 25, 2025 -

Cool Sculpting Complications Linda Evangelistas Personal Account Of Scars And Healing

Apr 25, 2025

Cool Sculpting Complications Linda Evangelistas Personal Account Of Scars And Healing

Apr 25, 2025 -

Caso Arrayanes Oferta De G 1 250 Millones Por Homicidio Culposo

Apr 25, 2025

Caso Arrayanes Oferta De G 1 250 Millones Por Homicidio Culposo

Apr 25, 2025 -

Winter Weather Timeline Planning And Preparation Guide

Apr 25, 2025

Winter Weather Timeline Planning And Preparation Guide

Apr 25, 2025