Canadian Dollar: A Mixed Bag Against Global Currencies

Table of Contents

Impact of Commodity Prices on the Canadian Dollar

Canada's economy is significantly reliant on commodity exports. Oil and natural gas, in particular, play a dominant role, making the Canadian dollar highly sensitive to global commodity price fluctuations. The relationship between commodity prices and the CAD's exchange rate is largely direct: higher prices generally lead to CAD appreciation, while lower prices weaken the Loonie.

- Oil price increases often lead to CAD appreciation. A surge in global oil demand, for instance, typically boosts Canadian oil exports and strengthens the CAD. Conversely, a drop in oil prices can significantly hurt the Canadian economy and weaken the CAD.

- Declines in natural gas prices can negatively affect the CAD. Similar to oil, fluctuations in the global natural gas market have a direct impact on the Canadian dollar's value. A prolonged period of low natural gas prices can put downward pressure on the CAD.

- Diversification of the Canadian economy is lessening but still significant reliance on commodities. While Canada is striving to diversify its economy, its heavy reliance on resource extraction continues to make the CAD vulnerable to commodity price volatility.

- Other commodities like gold and lumber also play a role. Though less significant than oil and gas, fluctuations in the prices of other Canadian exports like gold and lumber can also influence the CAD's exchange rate.

Influence of Interest Rate Differentials

Interest rate differentials between Canada and other major economies, particularly the US, are a major determinant of the CAD's exchange rate. The Bank of Canada's monetary policy plays a crucial role here. Higher interest rates in Canada relative to other countries make the CAD more attractive to foreign investors seeking higher returns. This increased demand for the CAD strengthens its value.

- Bank of Canada's monetary policy decisions are crucial. Interest rate hikes by the Bank of Canada generally lead to CAD appreciation, while rate cuts can trigger depreciation.

- Comparison of Canadian interest rates with US Federal Reserve rates is key. The interest rate differential between Canada and the US is particularly significant, given the close economic ties between the two countries.

- Higher Canadian rates attract foreign investment. Investors often move their capital to countries offering higher interest rates, increasing demand for the CAD.

- Lower rates can lead to capital outflow and CAD depreciation. Conversely, lower Canadian interest rates can lead to capital outflow and a weakening of the CAD.

Geopolitical Factors and Global Economic Uncertainty

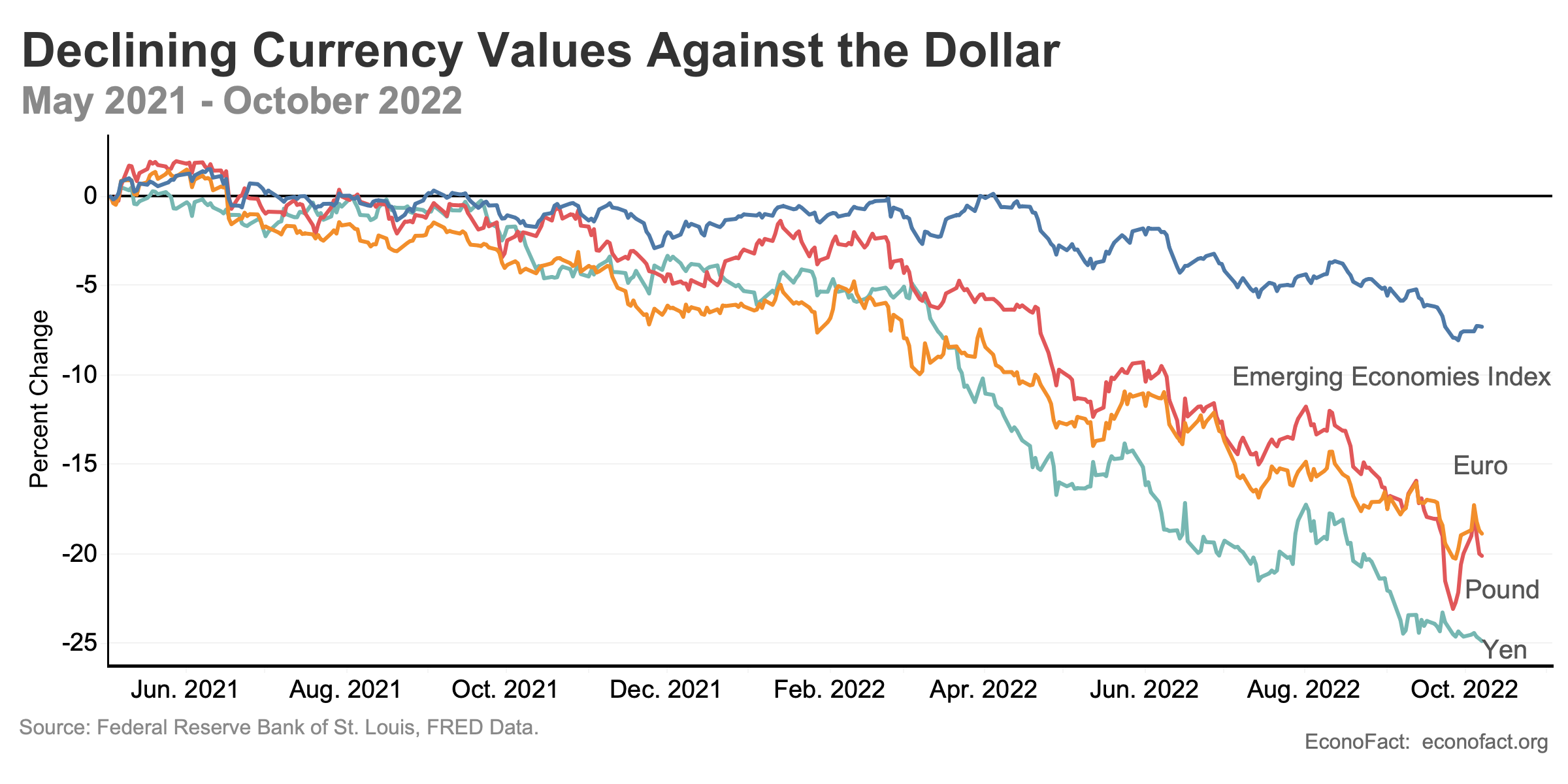

Global events exert a powerful influence on the Canadian dollar. Geopolitical risks, trade wars, global economic slowdowns, and even the possibility of a recession, can all significantly impact the CAD's value. During times of uncertainty, investors often seek safe-haven currencies like the US dollar, leading to a weakening of the CAD.

- Global economic uncertainty often leads to CAD depreciation. Concerns about a global recession, for example, can cause investors to pull money out of riskier assets, including the CAD.

- US dollar strength often correlates with CAD weakness. The USD often serves as a safe-haven currency, so its strength frequently coincides with a weakening CAD.

- Geopolitical events (e.g., wars, political instability) can cause volatility. Unexpected geopolitical events can create significant volatility in the forex market, impacting the CAD's value.

- Trade disputes can impact Canadian exports and the CAD. Trade wars or protectionist measures can negatively affect Canadian exports, weakening the CAD.

The Role of the US Dollar

The USD's strength or weakness is intrinsically linked to the CAD's performance. A strong USD typically puts downward pressure on the CAD, while a weak USD tends to support its value. Understanding the factors influencing the USD, such as US economic growth, the US dollar index, and Federal Reserve policy, is crucial for accurate CAD forecasting. The correlation between CAD and USD is strong, and monitoring the USD is essential for understanding CAD movements.

Conclusion

The Canadian dollar's exchange rate is a complex tapestry woven from commodity prices, interest rate differentials, and the ever-shifting landscape of global economics and geopolitics. Navigating this complexity requires a keen understanding of these interconnected factors. By monitoring commodity prices, interest rate decisions from the Bank of Canada and the Federal Reserve, and global economic events, you can better predict and manage your exposure to CAD fluctuations. Stay informed about the latest developments affecting the Canadian dollar and its exchange rate to effectively manage your financial exposure to currency fluctuations. Understanding the intricacies of the Canadian dollar exchange rate is key to making informed financial decisions.

Featured Posts

-

John Travoltas Miami Steakhouse Adventure A Pulp Fiction Inspired Feast

Apr 24, 2025

John Travoltas Miami Steakhouse Adventure A Pulp Fiction Inspired Feast

Apr 24, 2025 -

Months After Ohio Train Derailment Toxic Chemical Residues Found In Buildings

Apr 24, 2025

Months After Ohio Train Derailment Toxic Chemical Residues Found In Buildings

Apr 24, 2025 -

Faa Investigates Las Vegas Airport Collision Risks

Apr 24, 2025

Faa Investigates Las Vegas Airport Collision Risks

Apr 24, 2025 -

Exclusive High Rollers John Travolta Action Movie Poster And Photo Preview

Apr 24, 2025

Exclusive High Rollers John Travolta Action Movie Poster And Photo Preview

Apr 24, 2025 -

Deportation Flights A New Revenue Stream For A Budget Airline

Apr 24, 2025

Deportation Flights A New Revenue Stream For A Budget Airline

Apr 24, 2025