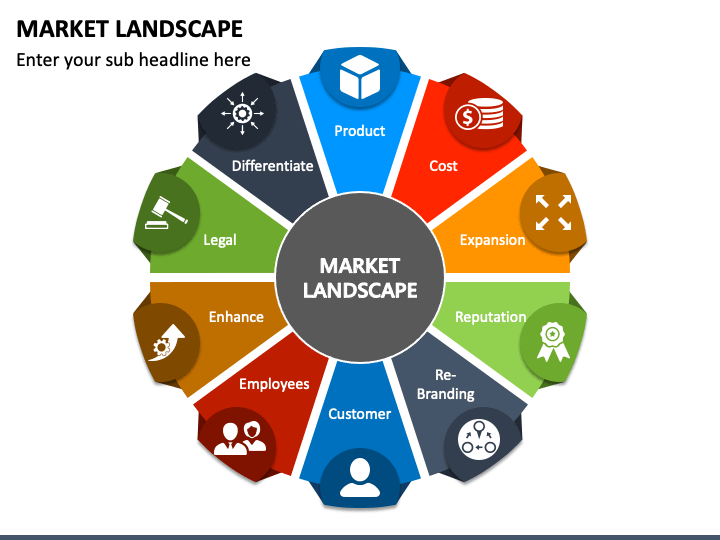

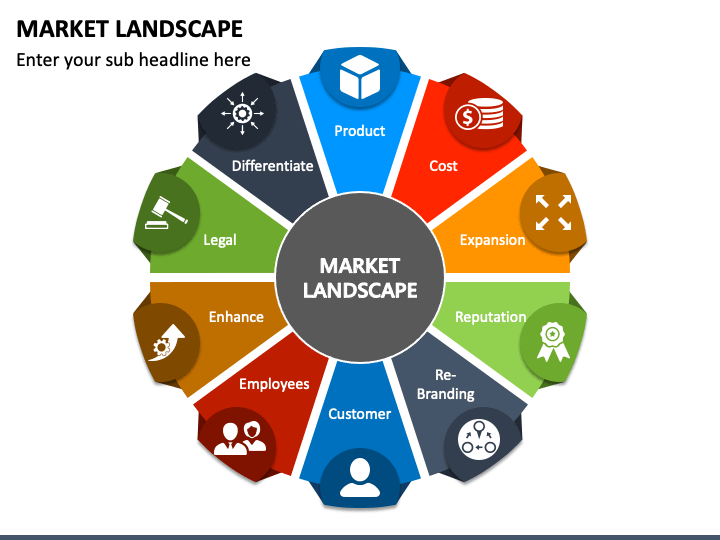

Canadian Condo Investment: A Shifting Market Landscape

Table of Contents

Current Market Conditions and Trends in Canadian Condo Investment

The Canadian condo market is far from monolithic; its performance varies significantly across regions. Understanding these nuances is crucial for successful Canadian condo investment.

Interest Rate Impacts on Condo Prices

Interest rate fluctuations significantly impact condo affordability and investor demand. The Bank of Canada's recent interest rate hikes have:

- Increased borrowing costs: Making mortgages more expensive and reducing the purchasing power of buyers.

- Reduced buyer purchasing power: Leading to decreased demand and potential price corrections in some areas.

- Created a more cautious market: Investors are proceeding with more caution, waiting for market stability.

Data from the Canadian Real Estate Association (CREA) shows a correlation between interest rate changes and condo price adjustments, though the impact varies depending on location and market segment.

Supply and Demand Dynamics

The supply and demand dynamics in the Canadian condo market are highly localized.

- Oversupply in certain areas: Cities like Calgary and Edmonton have seen an increase in condo inventory, leading to price competition.

- High demand in others: Toronto and Vancouver continue to experience strong demand, particularly for well-located, high-quality condos.

- Regional variations in market performance: Atlantic Canada, for example, shows a different dynamic compared to the major urban centers.

Analyzing regional market reports is essential for identifying opportunities in specific cities and regions.

Rental Market Performance

The rental market plays a significant role in Canadian condo investment.

- Average rental yields: Vary depending on location and condo features, ranging from 3% to 7% or more in prime locations.

- Factors influencing rental income: Location, proximity to amenities (transit, schools, employment hubs), building amenities (gym, parking), and unit size and condition significantly impact rental income.

- Vacancy rates: Fluctuate with market conditions, impacting rental income potential.

Careful market research, including examining vacancy rates and rental listings, is crucial before investing.

Factors Influencing Canadian Condo Investment Decisions

Making informed decisions about Canadian condo investments requires a careful consideration of several key factors.

Location, Location, Location

The importance of location cannot be overstated in real estate investment, especially in the Canadian condo market.

- Proximity to employment centers: Condos near major employment hubs tend to command higher rents and appreciation.

- Transportation hubs: Easy access to public transportation increases the desirability of a condo.

- Amenities: Proximity to shops, restaurants, parks, and entertainment venues enhances property value and rental appeal.

- Future development plans: Understanding future development plans in a neighbourhood can indicate potential for growth or decline.

Thorough research into a neighbourhood’s long-term prospects is crucial.

Condo Building Quality and Amenities

Building quality and amenities directly impact property value and rental appeal.

- Building age: Newer buildings often have lower maintenance costs and modern features.

- Maintenance fees: High maintenance fees can reduce profitability. Careful review of condo corporation financials is essential.

- Security features: Security features are attractive to renters and increase property value.

- On-site amenities: Amenities like gyms, pools, and parking increase rental appeal and property value.

Tax Implications and Investment Strategies

Understanding the tax implications of Canadian condo investment is crucial for maximizing returns.

- Capital gains tax: Profits from the sale of a condo are subject to capital gains tax.

- Rental income tax deductions: Expenses related to rental income, such as mortgage interest and property taxes, can be deducted.

- Potential tax benefits for registered accounts: Investing in condos through registered accounts like RRSPs and TFSAs offers tax advantages.

Seeking professional tax advice is recommended to optimize your tax strategy.

Navigating Risks in the Canadian Condo Investment Market

While Canadian condo investment offers potential rewards, it's essential to acknowledge the risks.

Market Volatility and Price Fluctuations

The Canadian real estate market, including condos, is subject to volatility.

- Economic downturns: Economic downturns can lead to decreased demand and price corrections.

- Interest rate hikes: Rising interest rates can reduce affordability and impact investor demand.

- Unexpected market corrections: Unforeseen events can affect market prices.

Diversification and a long-term investment strategy can help mitigate these risks.

Potential for Negative Cash Flow

Negative cash flow is a possibility, particularly during periods of low occupancy or high maintenance fees.

- Strategies for mitigating negative cash flow: Optimizing rental rates, effectively managing expenses, and maintaining a strong tenant occupancy rate are crucial.

- Emergency fund: It's crucial to have an emergency fund to handle unforeseen expenses.

Due Diligence and Professional Advice

Thorough due diligence and professional advice are vital before investing in Canadian condos.

- Property inspection: A thorough inspection can reveal potential problems.

- Legal review: Reviewing all legal documents with a legal professional is recommended.

- Financial planning consultation: A financial advisor can help develop a suitable investment strategy.

Conclusion

The Canadian condo investment market presents a dynamic landscape with opportunities and challenges. Understanding current market trends, influencing factors, and potential risks is crucial for successful investing. Conduct thorough research, consider regional variations, and seek professional advice to make informed decisions. Start your journey into smart Canadian condo investment today!

Featured Posts

-

Wigan And Leigh College Students Shine At Flower Show

Apr 25, 2025

Wigan And Leigh College Students Shine At Flower Show

Apr 25, 2025 -

Ftc Launches Investigation Into Open Ai And Chat Gpt

Apr 25, 2025

Ftc Launches Investigation Into Open Ai And Chat Gpt

Apr 25, 2025 -

Godzilla Vs Kong 2 New Hero Confirmed

Apr 25, 2025

Godzilla Vs Kong 2 New Hero Confirmed

Apr 25, 2025 -

Canberra Marathon Bob Fickels 40th Race

Apr 25, 2025

Canberra Marathon Bob Fickels 40th Race

Apr 25, 2025 -

Case Study Renault Trumps Tariffs And The Challenges Of Global Automotive Trade

Apr 25, 2025

Case Study Renault Trumps Tariffs And The Challenges Of Global Automotive Trade

Apr 25, 2025