BofA Reassures Investors: Why Current Stock Market Valuations Aren't A Threat

Table of Contents

BofA's Perspective on Current Market Conditions

BofA's analysis rests on several key pillars supporting their view that current stock market valuations are justifiable.

Strong Corporate Earnings and Revenue Growth

Despite persistent economic headwinds, BofA highlights robust corporate performance. Many major companies have reported strong earnings reports, exceeding expectations and demonstrating continued revenue growth. This indicates underlying strength in the economy and supports the current valuation levels.

- Example 1: [Insert example of a company with strong recent earnings, e.g., "Tech giant XYZ Corp. recently reported a 20% increase in quarterly earnings, surpassing analyst predictions."]

- Example 2: [Insert another example, e.g., "Retail giant ABC Co. demonstrated strong resilience, with revenue growth driven by robust consumer spending."]

- These strong earnings reports suggest that companies are efficiently managing challenges and continuing to deliver value, bolstering the argument for higher stock market valuations. Robust corporate earnings and sustained revenue growth are key indicators of a healthy market.

Long-Term Growth Potential and Innovation

BofA emphasizes the importance of long-term growth prospects and the role of technological innovation in shaping future market performance. Several sectors, such as technology, renewable energy, and biotechnology, show significant innovation and immense future potential. These factors, BofA argues, justify higher valuations, reflecting the expected future growth trajectory.

- Emerging Technologies: The rapid advancements in artificial intelligence, cloud computing, and other emerging technologies are creating significant long-term growth opportunities.

- Sustainable Investing: The growing focus on environmental, social, and governance (ESG) factors is driving investment in sustainable and responsible businesses, further fueling market growth.

- These factors contribute to a positive market outlook, suggesting that current valuations are not overinflated when considered against the backdrop of long-term growth potential and technological innovation.

Inflationary Pressures and Interest Rate Hikes

BofA acknowledges the inflationary pressures and the Federal Reserve's response through interest rate hikes. However, they argue that these factors, while impacting valuations to some extent, are not necessarily a reason for widespread panic. BofA suggests that monetary policy adjustments are necessary to control inflation and maintain long-term economic stability. Investors, they suggest, should adopt appropriate risk management strategies to navigate these challenges.

- Diversification: BofA recommends diversifying investment portfolios to mitigate risk associated with inflation and interest rate fluctuations.

- Value Investing: Focusing on undervalued companies with strong fundamentals can offer protection against market corrections.

- While acknowledging the impact of inflation and interest rates, BofA maintains that a balanced approach to investing can still yield positive returns despite these market realities.

Addressing Investor Concerns about Overvaluation

Concerns regarding overvaluation are common during periods of market growth. BofA addresses these concerns using several arguments.

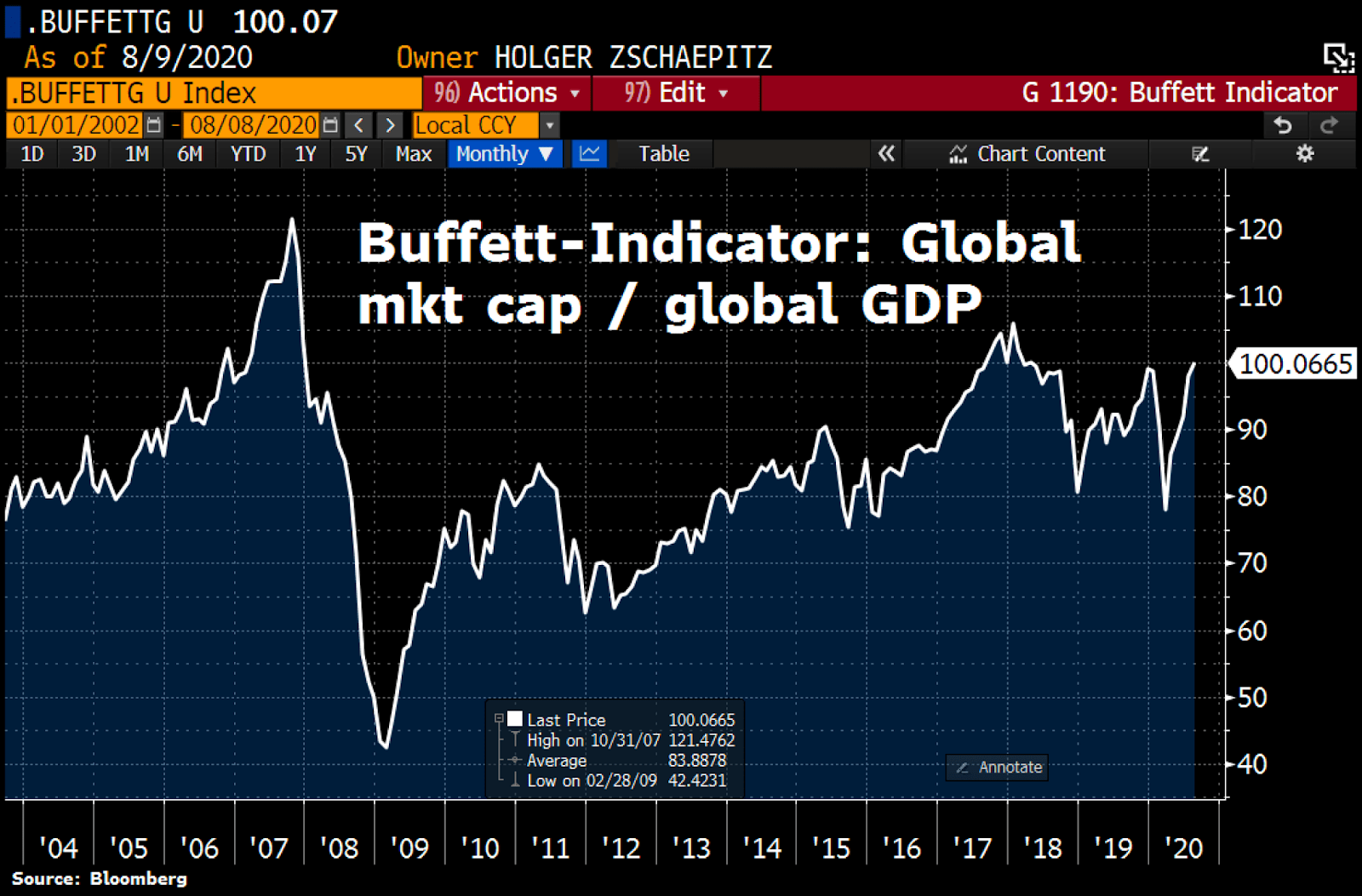

Comparison to Historical Valuations

BofA argues that while current valuations may seem high, they are not unprecedentedly so when compared to historical valuations. Data points showing price-to-earnings ratios (P/E ratios) and market capitalization relative to historical data are often cited to support this claim.

- Context is Key: It is crucial to remember that historical data analysis alone cannot fully predict future market performance. Comparing current market conditions to those of previous eras requires nuanced consideration.

- Economic Shifts: Significant economic shifts, technological advancements, and geopolitical factors can dramatically alter the landscape of market valuations.

- While historical data provides a valuable context, relying solely on it for valuation assessments can be misleading.

The Role of Low Interest Rates and Quantitative Easing

BofA acknowledges the impact of loose monetary policy, including low interest rates and quantitative easing, on supporting higher valuations. Low interest rates reduce the cost of borrowing for companies, fueling investment and growth. However, BofA also addresses potential risks associated with this approach, warning of potential inflationary pressures and the importance of monitoring monetary policy closely.

- Monetary Policy Changes: Changes in monetary policy can significantly affect valuations. Investors need to stay informed about the central bank's actions and their potential impact on the market.

- Risk Assessment: A thorough risk assessment is essential to understand the potential downsides of loose monetary policy.

- BofA emphasizes the importance of a balanced understanding of the benefits and risks associated with the current monetary policy environment.

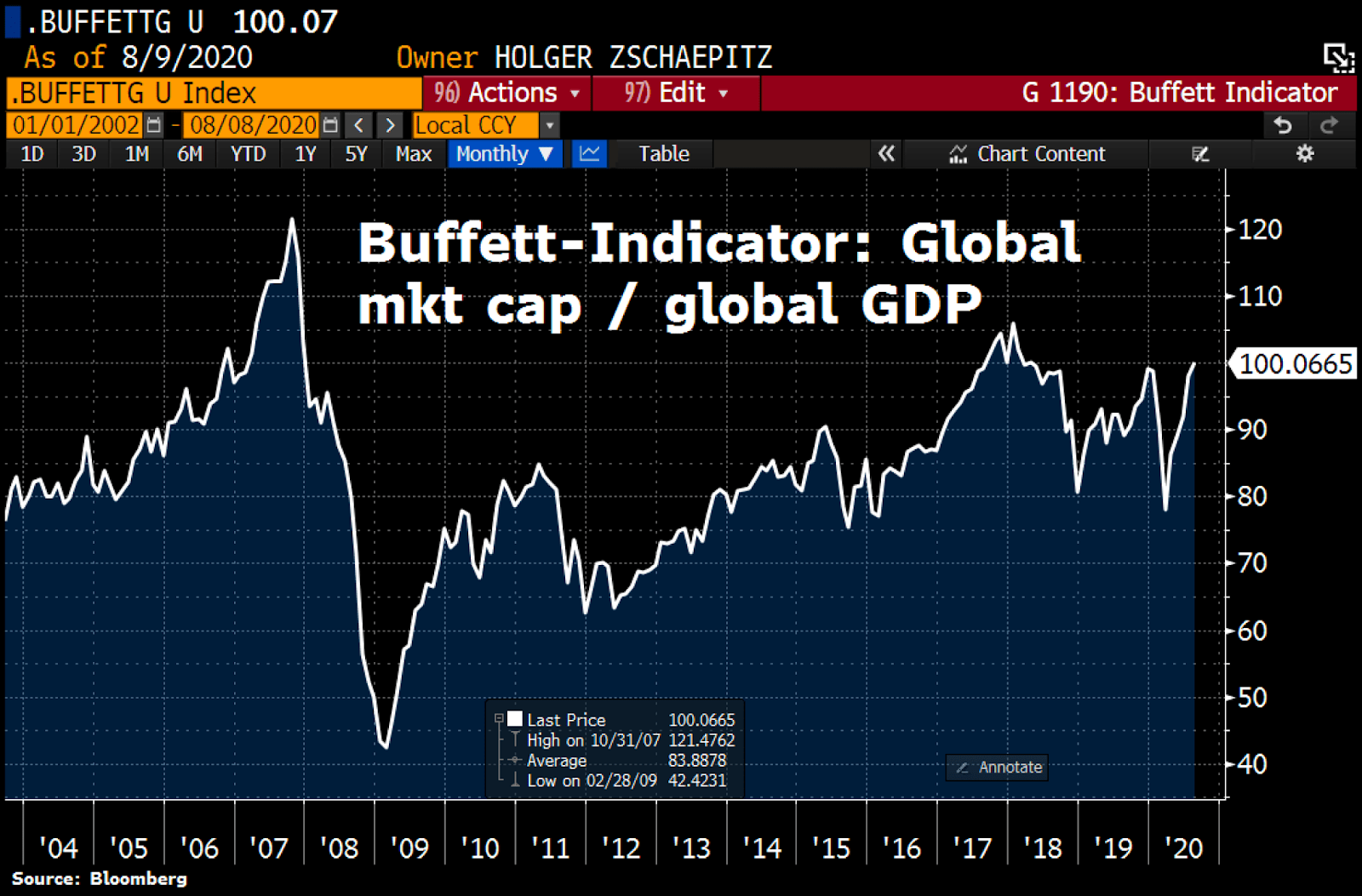

Geopolitical Factors and Market Uncertainty

Geopolitical factors and market uncertainty undeniably influence stock market valuations. BofA acknowledges these challenges, outlining how geopolitical risks such as trade wars, conflicts, and global economic slowdown can impact market sentiment. They emphasize that a realistic assessment of geopolitical factors is vital in navigating market uncertainty.

- Risk Management Strategies: Investors need to incorporate geopolitical factors into their risk management strategies.

- Diversification: Diversification across different asset classes and geographies can reduce exposure to specific geopolitical risks.

- BofA advocates for a well-informed approach, acknowledging the impact of geopolitical factors while emphasizing the importance of sound risk assessment and diversification.

Conclusion: BofA's Reassuring Message and Investing Wisely

BofA's message centers on the idea that while market volatility and uncertainty exist, current stock market valuations aren't necessarily a threat. Strong corporate earnings, long-term growth potential, and innovation in various sectors support their perspective. While acknowledging inflationary pressures, interest rate hikes, and geopolitical risks, BofA argues that a well-informed and balanced approach to investing, incorporating robust risk management strategies, can still lead to positive returns. Remember to always conduct your own thorough research and make informed investment decisions based on your risk tolerance and financial goals. Consider BofA's perspective on stock market valuation as one valuable viewpoint among many, but don't rely solely on it. For further reading on this topic, consider exploring [Link to relevant BofA reports, if available]. Make informed investment decisions, and remember to diversify your portfolio appropriately.

Featured Posts

-

Can China And Canada Build A Strategic Partnership To Challenge Us Policies

Apr 25, 2025

Can China And Canada Build A Strategic Partnership To Challenge Us Policies

Apr 25, 2025 -

Nhung Buc Anh Voi Trang Diem Tham Du Tiec Buffet

Apr 25, 2025

Nhung Buc Anh Voi Trang Diem Tham Du Tiec Buffet

Apr 25, 2025 -

American Sports Car Market Renaults Challenges Under Trumps Tariffs

Apr 25, 2025

American Sports Car Market Renaults Challenges Under Trumps Tariffs

Apr 25, 2025 -

Stagecoach Festival 2025 Your Comprehensive Guide

Apr 25, 2025

Stagecoach Festival 2025 Your Comprehensive Guide

Apr 25, 2025 -

Retegui Analisis De Sus Estadisticas Y Aspiraciones A La Bota De Oro

Apr 25, 2025

Retegui Analisis De Sus Estadisticas Y Aspiraciones A La Bota De Oro

Apr 25, 2025