BMW And Porsche's China Challenges: A Growing Trend Among Automakers

Table of Contents

Intensifying Competition from Domestic Brands

The rise of powerful domestic Chinese auto brands is significantly impacting established players like BMW and Porsche. Brands such as BYD, NIO, and Xpeng are rapidly gaining market share, presenting a formidable challenge to foreign luxury car manufacturers. These Chinese auto brands leverage competitive pricing, advanced technology, particularly in electric vehicles (EVs), and a deep understanding of Chinese consumer preferences to gain a strong foothold in the market.

- Increased market share of Chinese EV brands: Domestic brands are aggressively capturing market share in the booming EV sector, leaving international players scrambling to catch up.

- Aggressive pricing strategies by domestic competitors: Chinese automakers often offer vehicles with comparable features at significantly lower price points than their international counterparts.

- Development of sophisticated technology and features tailored to the Chinese market: Domestic brands are innovating rapidly, developing technologies and features specifically designed to appeal to Chinese consumers. This includes advanced driver-assistance systems (ADAS), connected car features, and customized in-car entertainment.

- Stronger brand loyalty among Chinese consumers towards domestic brands: A growing sense of national pride is driving increased loyalty towards homegrown brands, posing a significant challenge to foreign automakers seeking to build brand recognition and loyalty.

Navigating the Complex Regulatory Landscape

China's automotive regulatory environment is notoriously complex and dynamic, presenting significant hurdles for foreign automakers like BMW and Porsche. Navigating import restrictions, stringent emission standards (like those related to CAFC – Corporate Average Fuel Consumption), and ever-changing government policies requires substantial resources and expertise. The constant evolution of these regulations necessitates continuous adaptation and significant investment in compliance.

- Stricter emission standards and fuel efficiency requirements: Meeting increasingly stringent environmental regulations adds to the cost and complexity of manufacturing and importing vehicles into China.

- Complex import procedures and tariffs affecting profitability: High import tariffs and intricate customs procedures can significantly impact profitability for foreign automakers.

- Need for significant investment in compliance and lobbying efforts: Foreign automakers must invest heavily in compliance teams and lobbyists to navigate the regulatory landscape effectively.

- Uncertainty surrounding future policy changes and their impact: The unpredictable nature of Chinese automotive policy creates uncertainty and adds another layer of complexity to long-term planning.

Supply Chain Disruptions and Economic Uncertainty

Global supply chain disruptions, exacerbated by the COVID-19 pandemic and geopolitical tensions, have significantly impacted the ability of automakers to meet demand in China. The semiconductor shortage, for example, has severely constrained production capacity across the industry. Furthermore, concerns about an economic slowdown in China add to the overall uncertainty facing foreign automakers.

- Global chip shortage impacting production capacity: The ongoing semiconductor shortage continues to hinder vehicle production, leading to delays and impacting sales targets.

- Disruptions to logistics and transportation networks: Pandemic-related disruptions to global logistics and transportation networks have caused delays and increased costs.

- Increased raw material costs and price volatility: Fluctuations in raw material prices add to the cost pressures faced by automakers, impacting profitability.

- Uncertainty regarding future economic growth in China: Concerns about slower economic growth in China create uncertainty and hesitation among consumers and investors alike.

The Rise of Electric Vehicles and the Need for Adaptation

The explosive growth of the electric vehicle (EV) market in China demands significant investments in EV technology and infrastructure. While BMW (with models like the BMW iX) and Porsche (with the Porsche Taycan) are investing heavily in their EV lineups, they face intense competition from domestic brands that have established themselves as leaders in the EV sector. Adapting to this rapidly evolving market requires significant investment in R&D, charging infrastructure, and a deep understanding of Chinese consumer preferences regarding EVs.

Conclusion

The Chinese automotive market presents undeniable challenges for luxury brands like BMW and Porsche. Intense competition from domestic brands, a complex regulatory landscape, and persistent global supply chain issues create a volatile and demanding environment. Successfully navigating these challenges necessitates significant investment, strategic adaptation, and a nuanced understanding of the Chinese market. Automakers must embrace innovation, particularly in electric vehicle technology, and tailor their strategies to meet the specific preferences and demands of Chinese consumers to maintain their competitiveness. Understanding the intricacies of BMW and Porsche's China challenges is crucial for any automaker aiming for success in this dynamic and pivotal market. Ignoring these challenges risks losing significant market share in this key region.

Featured Posts

-

Why Jennifer Aniston And Chelsea Handler Ended Their Close Friendship

Apr 26, 2025

Why Jennifer Aniston And Chelsea Handler Ended Their Close Friendship

Apr 26, 2025 -

Benson Boone Photos I Heart Radio Music Awards 2025 Outfit

Apr 26, 2025

Benson Boone Photos I Heart Radio Music Awards 2025 Outfit

Apr 26, 2025 -

Covid 19 Pandemic Lab Owner Admits To Falsifying Test Results

Apr 26, 2025

Covid 19 Pandemic Lab Owner Admits To Falsifying Test Results

Apr 26, 2025 -

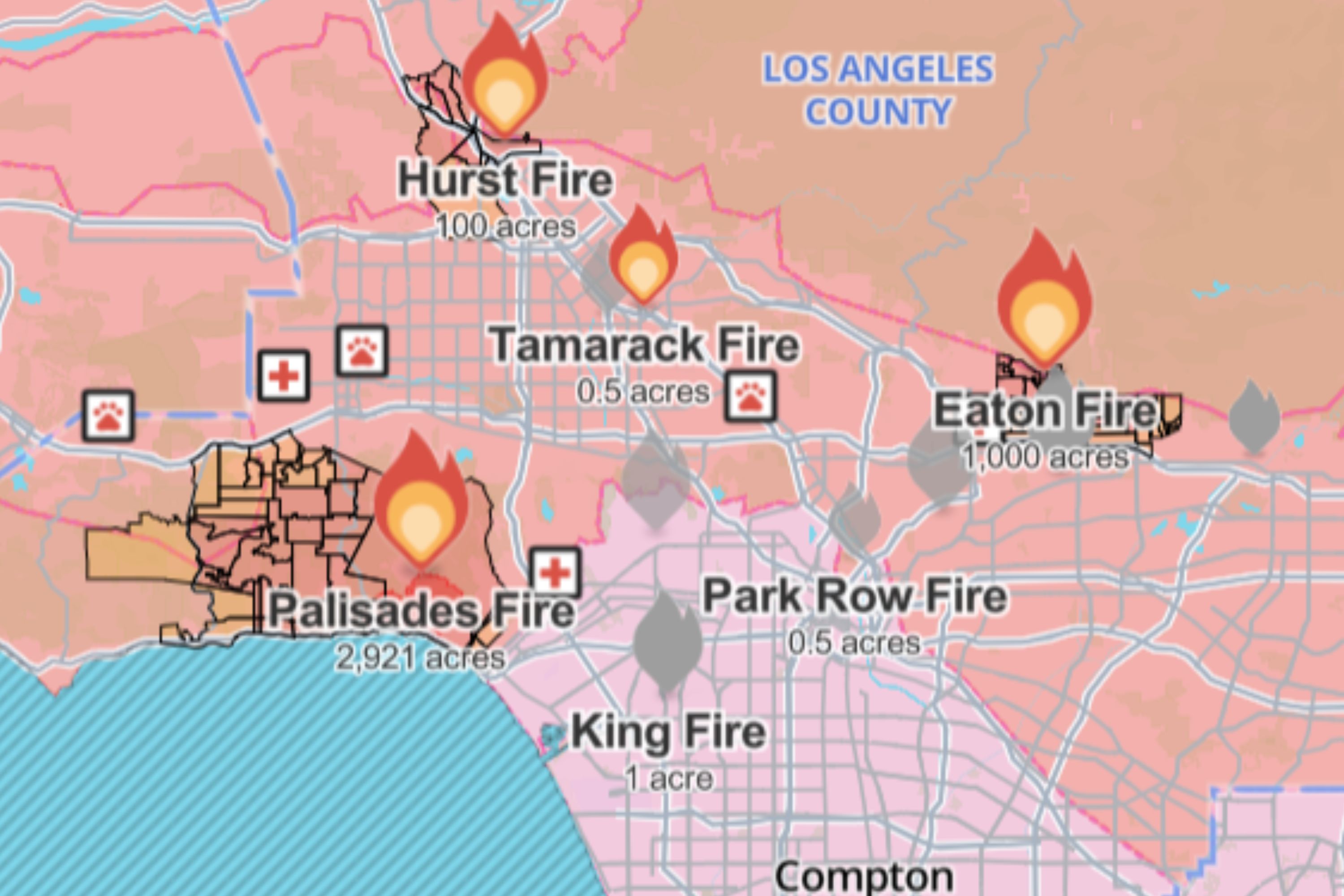

Los Angeles Palisades Fire A Comprehensive List Of Celebrity Home Losses

Apr 26, 2025

Los Angeles Palisades Fire A Comprehensive List Of Celebrity Home Losses

Apr 26, 2025 -

20 140

Apr 26, 2025

20 140

Apr 26, 2025