BBVA Investment Banking: A Long-Term Vision

Table of Contents

Strategic Pillars of BBVA Investment Banking's Long-Term Strategy

BBVA's long-term strategy in investment banking rests on three interconnected pillars: sustainable finance, technological innovation, and a global reach facilitated by strategic partnerships. These pillars work in synergy to deliver superior value to clients and contribute to a more responsible and sustainable financial ecosystem.

Focus on Sustainable Finance and ESG Investing

BBVA is deeply committed to integrating Environmental, Social, and Governance (ESG) factors into the core of its investment banking activities. This commitment isn't merely a trend; it's a fundamental shift towards a more responsible and sustainable future. This commitment manifests in several key areas:

- Increased financing for renewable energy projects: BBVA actively seeks to finance projects that contribute to a cleaner energy future, including solar, wind, and geothermal energy initiatives. This aligns with global efforts to combat climate change and transition to a low-carbon economy.

- Supporting businesses with strong ESG profiles: BBVA prioritizes partnerships with companies demonstrating a strong commitment to environmental sustainability, social responsibility, and good governance. This involves rigorous due diligence and assessment of ESG performance.

- Developing innovative financial products tailored to sustainability goals: BBVA is at the forefront of developing innovative financial instruments, such as green bonds and sustainability-linked loans, designed to attract investment in sustainable projects.

- Providing advisory services on ESG integration strategies: BBVA offers expert guidance to companies seeking to integrate ESG considerations into their business strategies and operations, helping them to navigate the complexities of sustainable finance.

This focus on sustainable investment banking, ESG investing, and green finance distinguishes BBVA in the market and attracts clients who share its commitment to a more responsible financial landscape.

Technological Innovation and Digital Transformation

BBVA understands that technological advancement is crucial for maintaining a competitive edge in investment banking. The firm is investing heavily in technology to enhance efficiency, improve risk management, and deliver an exceptional client experience. This commitment is evidenced by:

- Implementation of advanced data analytics for better risk assessment: Sophisticated data analytics tools provide BBVA with enhanced insights into market trends and risk factors, leading to more informed decision-making and reduced risk exposure.

- Development of digital platforms for streamlined transactions: BBVA is continuously developing user-friendly digital platforms to streamline and accelerate transactions, making the investment banking process more efficient and transparent.

- Leveraging artificial intelligence and machine learning for improved decision-making: AI and machine learning algorithms are used to analyze vast datasets, identify patterns, and improve forecasting accuracy, enhancing the overall decision-making process.

This commitment to digital investment banking, Fintech, and AI in finance ensures BBVA remains at the forefront of industry innovation.

Global Reach and Strategic Partnerships

BBVA’s extensive international network provides a significant competitive advantage. The firm maintains a strong presence in key markets across Europe, Latin America, and the United States, allowing it to offer comprehensive global investment banking solutions.

- Strong presence in key markets: This global presence enables BBVA to serve clients with diverse needs and provide seamless cross-border services.

- Strategic alliances with leading financial institutions worldwide: These strategic alliances expand BBVA's reach and expertise, providing clients with access to a broader network of resources and opportunities.

- Providing cross-border investment banking solutions: BBVA excels at facilitating complex cross-border M&A transactions and other international investment banking activities.

This international finance expertise is a cornerstone of BBVA's long-term success.

Client-Centric Approach and Value Proposition

At the heart of BBVA's investment banking strategy is a steadfast commitment to client needs and building long-term partnerships.

Personalized Advisory Services

BBVA provides bespoke investment banking solutions tailored to each client's unique circumstances and long-term objectives. This personalized approach is characterized by:

- Deep industry expertise across various sectors: BBVA's teams possess in-depth knowledge of various industries, enabling them to provide targeted advice and solutions.

- Experienced teams dedicated to client success: Dedicated teams work collaboratively to understand client needs and deliver exceptional results.

- Proactive communication and transparent reporting: BBVA maintains open and transparent communication with clients throughout the investment process.

This commitment to investment banking advisory and M&A advisory, coupled with excellent client relationship management, creates lasting client relationships.

Long-Term Partnerships and Commitment

BBVA prioritizes building enduring partnerships with clients based on trust, mutual respect, and a shared vision for success. This involves:

- Understanding client objectives and long-term strategies: BBVA invests time in deeply understanding its clients' objectives and long-term strategic goals.

- Providing ongoing support and guidance: BBVA provides ongoing support and guidance beyond individual transactions.

- Building lasting partnerships with clients: The goal is to create long-term, mutually beneficial relationships with its clients.

This focus on long-term investment strategy and client partnerships reflects BBVA's dedication to building enduring relationships built on trust and mutual success and fosters relationship banking.

Conclusion

BBVA Investment Banking's long-term vision rests on a foundation of sustainable finance, technological innovation, and a client-centric approach. By focusing on these key pillars, BBVA is positioning itself for continued success in the dynamic global investment banking landscape. Its commitment to ESG principles, digital transformation, and building strong client partnerships demonstrates a dedication to responsible and sustainable growth. To learn more about how BBVA Investment Banking can support your long-term financial objectives, contact us today to explore your investment banking needs and discover how we can help you achieve them. We are committed to providing you with a comprehensive and personalized approach to BBVA Investment Banking.

Featured Posts

-

Bayerns St Pauli Victory Six Point Lead But Room For Improvement In Bundesliga

Apr 25, 2025

Bayerns St Pauli Victory Six Point Lead But Room For Improvement In Bundesliga

Apr 25, 2025 -

Perplexitys Potential Chrome Acquisition A Realistic Scenario If Google Divests

Apr 25, 2025

Perplexitys Potential Chrome Acquisition A Realistic Scenario If Google Divests

Apr 25, 2025 -

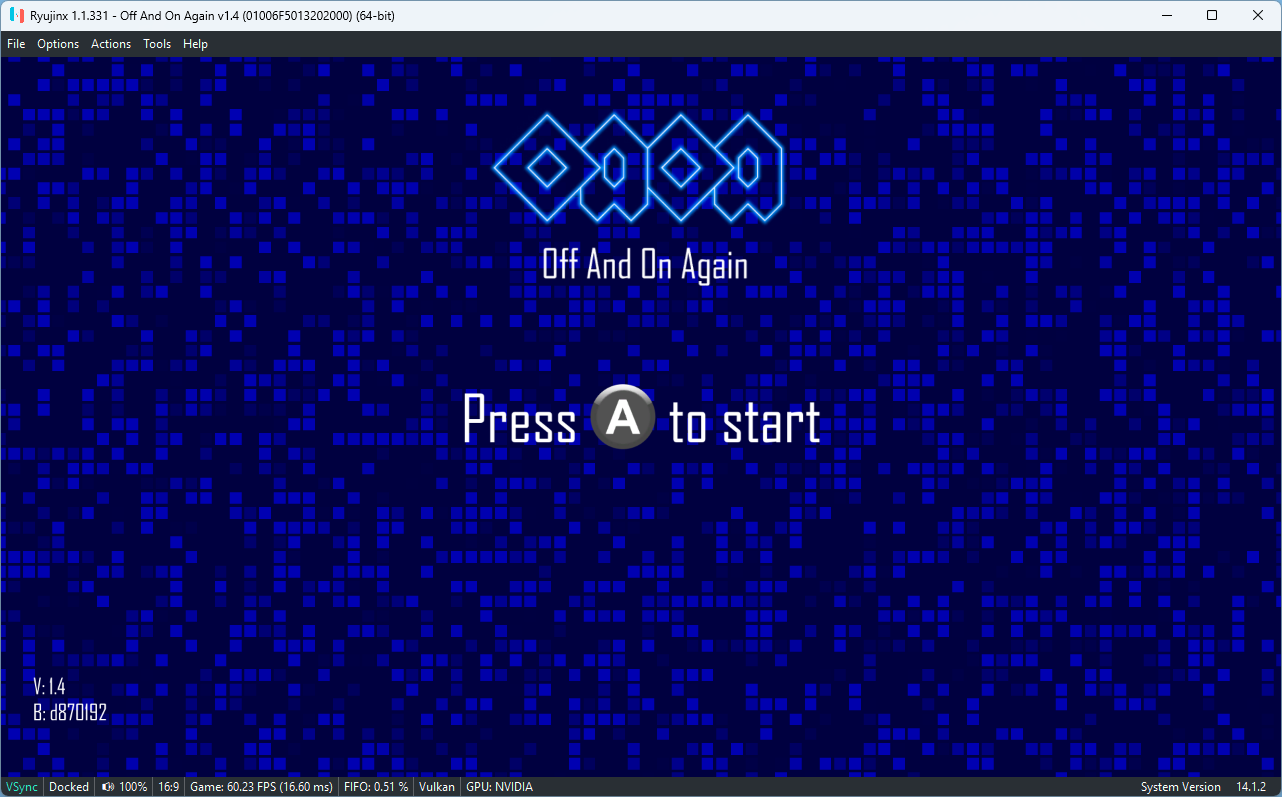

Ryujinx Emulator Shut Down Following Nintendo Contact

Apr 25, 2025

Ryujinx Emulator Shut Down Following Nintendo Contact

Apr 25, 2025 -

Is You Tube Everything Exploring Its Dominance In Online Video

Apr 25, 2025

Is You Tube Everything Exploring Its Dominance In Online Video

Apr 25, 2025 -

Former Charlottesville Meteorologist Faces Felony Sexual Extortion Charges

Apr 25, 2025

Former Charlottesville Meteorologist Faces Felony Sexual Extortion Charges

Apr 25, 2025