Bank Of Canada Rate Cuts On The Horizon? Grim Retail Data Suggests So

Table of Contents

Weak Retail Sales: A Key Indicator of Economic Slowdown

Retail sales serve as a crucial leading economic indicator, reflecting consumer confidence and overall economic health. A decline in retail sales often foreshadows a broader economic slowdown. The latest data from Statistics Canada reveals a concerning trend. Retail sales experienced a significant drop in [insert month and year], marking a [insert percentage]% decline compared to the previous month. This follows a [mention previous month's performance, e.g., already weak performance] and is considerably lower than forecasts.

- Specific percentage decline in retail sales: [Insert precise percentage from Statistics Canada data]

- Mention affected retail sectors: The decline was particularly sharp in sectors like clothing, furniture, and electronics, indicating weakened consumer demand across various segments.

- Comparison to previous periods and forecasts: This represents a [describe the significance of the decline, e.g., the steepest monthly drop in several years] and falls far short of the [mention the forecasted growth percentage] predicted by economists.

This "retail sales decline" underscores a weakening in consumer spending, a key driver of the Canadian economy. This weak economic data casts a long shadow over the overall economic outlook.

Inflationary Pressures Easing: Providing Room for Rate Cuts

While a weakening economy is a concern, easing inflationary pressures might provide the Bank of Canada with the leeway to consider rate cuts. Canada's inflation rate currently sits at [insert current inflation rate, citing source], down from a peak of [insert peak inflation rate]. This downward trend brings the rate closer to the Bank of Canada's target of [insert Bank of Canada inflation target].

- Current inflation rate and its comparison to the Bank of Canada's target: The current rate is [describe the relationship between current and target inflation rate, e.g., significantly closer to] the Bank of Canada's target, indicating progress in controlling inflation.

- Analysis of factors contributing to the easing of inflation: Factors contributing to this easing include [list contributing factors, e.g., cooling global energy prices, easing supply chain constraints].

- Mention potential future inflation projections: Most analysts predict inflation will continue to [predict future inflation trend, e.g., moderate] in the coming months.

This decrease in "inflationary pressures" reduces the urgency for continued monetary policy tightening, potentially opening the door for Bank of Canada rate cuts.

Market Expectations and Analyst Predictions Regarding Bank of Canada Rate Cuts

Market sentiment regarding future interest rate changes is cautiously optimistic, with many anticipating rate cuts. Several prominent financial analysts and economists predict a reduction in interest rates in the coming months. [Insert quote from a reputable financial analyst].

- Mention the range of predicted rate cut sizes: Predictions range from a [insert range, e.g., 25 to 50 basis point] cut at the next monetary policy announcement.

- Highlight differing opinions among analysts and the reasons behind them: However, some analysts remain cautious, citing potential risks associated with easing monetary policy too quickly. Their concerns often center on the possibility of reigniting inflation or creating asset bubbles.

- Refer to relevant financial news sources: Major financial news outlets like the [mention sources like Globe and Mail, Financial Post etc.] are reporting similar sentiments, highlighting growing expectations of Bank of Canada rate cuts.

These "interest rate expectations" are largely shaped by the weak retail sales data and the easing inflationary pressures.

Potential Risks and Uncertainties Associated with Rate Cuts

While a rate cut might stimulate economic activity, it also carries potential risks. Easing monetary policy too aggressively could reignite inflationary pressures or contribute to asset bubbles, particularly in the housing market.

- Explain the potential for renewed inflation after a rate cut: Lower interest rates could boost consumer spending and investment, potentially leading to renewed inflationary pressure if supply-side constraints persist.

- Discuss the risk of asset bubbles in the housing market or stock market: Lower borrowing costs could further inflate already high asset prices, increasing the risk of a correction.

- Highlight other economic uncertainties that could influence the Bank of Canada's decision: Global economic uncertainty and geopolitical risks also add layers of complexity to the Bank of Canada's decision-making process. These "monetary policy risks" necessitate careful consideration.

These "economic risks" are significant factors that the Bank of Canada will undoubtedly weigh carefully before making any decisions on interest rates.

Bank of Canada Rate Cuts: What to Expect Next

The evidence strongly suggests that a Bank of Canada rate cut is a real possibility. The weak retail sales data, coupled with easing inflationary pressures, creates a compelling case for easing monetary policy. However, the potential risks associated with rate cuts cannot be overlooked. The importance of monitoring the retail sales data and its implications for the broader Canadian economy cannot be overstated.

Stay tuned for further updates on Bank of Canada rate cuts and their impact on the Canadian economy. Follow our blog for the latest insights and analysis on interest rate changes and their effects on your finances. Understanding these "interest rate decisions" is crucial for navigating the current economic climate.

Featured Posts

-

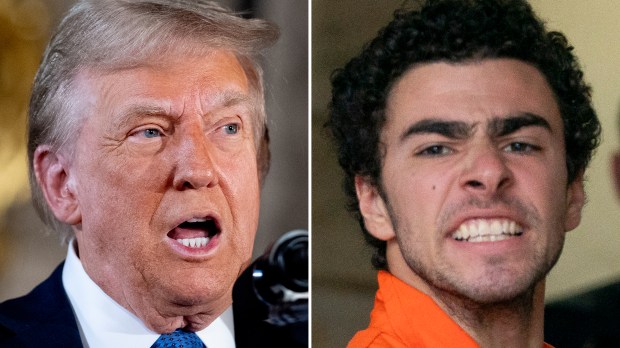

Supporters Of Luigi Mangione Their Perspectives And Priorities

Apr 28, 2025

Supporters Of Luigi Mangione Their Perspectives And Priorities

Apr 28, 2025 -

2000 Yankees Diary Entry A Hard Fought Win Against Kansas City

Apr 28, 2025

2000 Yankees Diary Entry A Hard Fought Win Against Kansas City

Apr 28, 2025 -

Mets Option Deniel Nunez To Syracuse Megill Returns To Rotation

Apr 28, 2025

Mets Option Deniel Nunez To Syracuse Megill Returns To Rotation

Apr 28, 2025 -

Espn News Le Bron James Response To Richard Jeffersons Remarks

Apr 28, 2025

Espn News Le Bron James Response To Richard Jeffersons Remarks

Apr 28, 2025 -

The Future Of The Red Sox Espns 2025 Season Forecast

Apr 28, 2025

The Future Of The Red Sox Espns 2025 Season Forecast

Apr 28, 2025