Bank Of Canada Holds Rates: What Economists Say (FP Video)

Table of Contents

The Bank of Canada's recent decision to hold interest rates has sent ripples through the Canadian financial landscape. This unexpected move, following months of speculation about further increases, has prompted a wave of analysis and diverse reactions from leading economists. This article delves into their analyses, exploring the reasoning behind the Bank's decision and its potential impact on inflation, the Canadian dollar, and overall economic growth. We'll also highlight key takeaways from a Financial Post video discussing the experts' viewpoints, offering valuable insights into this crucial economic moment.

Reasons Behind the Bank of Canada's Decision to Hold Rates

The Bank of Canada's decision to hold rates wasn't made in a vacuum. Several factors contributed to this choice, creating a complex economic picture.

Inflationary Pressures

The current inflation rate remains a key concern. While recent data suggests a slight cooling, it's not yet at the Bank of Canada's 2% target.

- Recent CPI data: The Consumer Price Index (CPI) has shown a decrease in recent months, but the rate of decline may not be fast enough to meet the Bank's expectations.

- Core inflation: Core inflation, which excludes volatile items like food and energy, continues to remain stubbornly elevated, indicating underlying inflationary pressures.

- Bank of Canada's perspective: The Bank likely views the current inflation rate as still too high to warrant further rate hikes immediately, preferring to assess the impact of previous increases and observe the trajectory of both headline and core inflation before making any further decisions.

Economic Growth Concerns

The Canadian economy is facing a confluence of challenges that might influence monetary policy decisions.

- GDP growth: While GDP growth has shown some resilience, there are concerns about its sustainability in the face of global uncertainties.

- Employment figures: The unemployment rate has remained relatively low, indicating a strong labor market. However, potential economic slowdown could significantly impact future employment.

- Recession risk: The threat of a global recession remains a significant concern, potentially impacting Canadian exports and overall economic activity. This is a major factor the Bank has to consider before making further rate adjustments.

Housing Market Impact

Interest rates have a profound effect on the Canadian housing market, a key driver of the economy.

- Affordability concerns: Higher interest rates significantly impact mortgage affordability, potentially cooling an already overheated market in some regions.

- Impact on home sales and prices: Rising interest rates usually lead to decreased home sales and a potential slowdown in price appreciation, or even corrections in certain overvalued segments.

- Potential for a market correction: The Bank may be considering a potential housing market correction as it weighs further rate increases. A sharp correction could negatively impact consumer confidence and economic growth.

Economists' Reactions and Diverging Opinions

The Bank of Canada's decision has triggered a wide range of reactions from economists, highlighting the complexity of the current economic climate.

Hawkish vs. Dovish Views

Economists are split between two main camps:

- Hawkish views: Some economists, adopting a hawkish stance, argue that further rate hikes are necessary to tame inflation decisively, emphasizing the risks of allowing inflation to become entrenched. They point to persistent core inflation and global economic factors as reasons for continued tightening.

- Dovish views: Others, taking a dovish approach, believe that the current rate is sufficient and that further increases could unnecessarily stifle economic growth, risking a recession. They argue that the impact of previous rate hikes is still working its way through the economy. The FP video features interviews with economists representing both these perspectives, offering valuable contrasting insights.

Impact on the Canadian Dollar

The Bank of Canada's decision significantly influences the Canadian dollar (CAD).

- Potential for appreciation or depreciation: Depending on market sentiment following the announcement, the Canadian dollar could appreciate or depreciate against other major currencies.

- Factors influencing the CAD's value: Factors such as investor confidence, global economic conditions, and the relative strength of other currencies all play a role in determining the CAD's exchange rate. The differing economist viewpoints directly impact predictions for the CAD's future performance.

Looking Ahead: Implications for the Canadian Economy

Predicting the future is challenging, but analyzing expert opinions and economic indicators can help us outline potential scenarios.

Potential Scenarios

The Canadian economy faces several potential pathways:

- Soft landing: A scenario where inflation gradually decreases without triggering a significant economic downturn. This is the most optimistic outlook.

- Recession: A period of economic decline characterized by falling GDP, rising unemployment, and reduced consumer spending. This is a risk the Bank is actively trying to avoid.

- Sustained inflation: A scenario where inflation remains elevated, potentially requiring even more aggressive monetary policy measures in the future. This is the least desirable outcome.

Conclusion:

The Bank of Canada's decision to hold interest rates has created a complex situation, with economists expressing diverse opinions on the future trajectory of monetary policy. While concerns remain regarding inflation and economic growth, the prevailing uncertainty emphasizes the need for continuous monitoring of key economic indicators like the CPI, GDP growth, and the housing market's performance. The Financial Post video provides crucial insights into this evolving scenario, showcasing the differing perspectives and analyses of leading economists.

Call to Action: Stay informed about the evolving situation by watching the full Financial Post video on the Bank of Canada's decision and the expert commentary. Understanding the Bank of Canada's interest rate decisions is crucial for navigating the Canadian economic landscape. Follow the link [insert link here] to learn more about the Bank of Canada's interest rate policy and its impact on your financial decisions.

Featured Posts

-

La Fires Landlords Accused Of Price Gouging Amid Crisis

Apr 22, 2025

La Fires Landlords Accused Of Price Gouging Amid Crisis

Apr 22, 2025 -

White House Cocaine Incident Secret Service Concludes Investigation

Apr 22, 2025

White House Cocaine Incident Secret Service Concludes Investigation

Apr 22, 2025 -

Remembering Pope Francis His Vision For A More Compassionate Church

Apr 22, 2025

Remembering Pope Francis His Vision For A More Compassionate Church

Apr 22, 2025 -

Razer Blade 16 2025 Review Performance Design And Value Assessment Of The Ultra Portable Gaming Laptop

Apr 22, 2025

Razer Blade 16 2025 Review Performance Design And Value Assessment Of The Ultra Portable Gaming Laptop

Apr 22, 2025 -

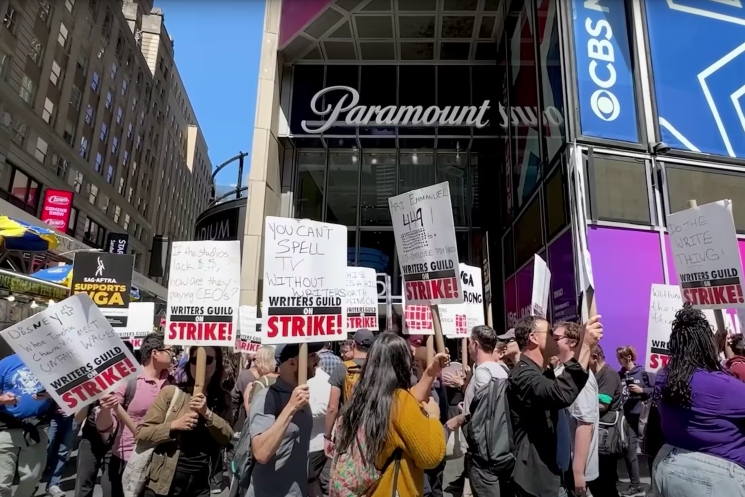

Hollywood Strike Actors Join Writers Bringing Production To A Halt

Apr 22, 2025

Hollywood Strike Actors Join Writers Bringing Production To A Halt

Apr 22, 2025