Australian Election 2024: Goldman Sachs' Fiscal Policy Analysis

Table of Contents

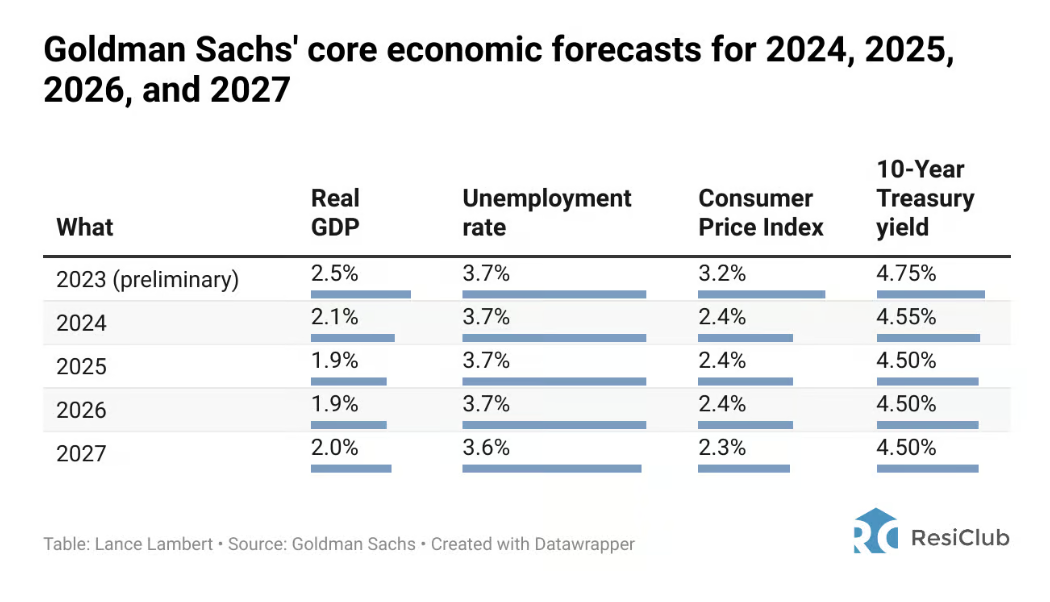

Goldman Sachs' Key Economic Forecasts for Post-Election Australia

Goldman Sachs' pre-election analysis provides a crucial lens through which to view the potential economic landscape post-2024. Their forecasts encompass several key economic indicators, offering valuable insights into the potential trajectory of the Australian economy under different governing parties.

-

Projected GDP Growth Rates: Goldman Sachs' models predict varying GDP growth rates depending on which party forms government. A Coalition victory might see a focus on tax cuts stimulating short-term growth, while a Labor victory could prioritize government spending on infrastructure projects, leading to potentially slower, but more sustainable long-term growth. Understanding these nuances is key to navigating the post-election economic climate.

-

Inflation and RBA Response: The Reserve Bank of Australia's (RBA) response to inflation is a critical factor in Goldman Sachs' analysis. Their projections suggest that depending on the fiscal policies implemented by the winning party, the RBA might need to maintain or even increase interest rates to control inflation. High inflation could negatively impact consumer spending and overall economic growth.

-

Unemployment Figures: Goldman Sachs' modelling suggests differing impacts on unemployment under various policy scenarios. Policies focusing on job creation and skills development could lead to lower unemployment rates, while others might inadvertently hinder job growth. Understanding these potential outcomes is vital for workforce planning and policy debates.

-

Interest Rate Trajectory: Interest rates are a key determinant of investment and borrowing costs. Goldman Sachs' projections offer insights into how interest rates are likely to move in response to the election outcome and subsequent government policies. Higher interest rates can impact business investment and consumer spending.

-

Australian Dollar Movement: The Australian dollar's value is sensitive to global economic conditions and domestic policy decisions. Goldman Sachs' analysis anticipates potential fluctuations in the Australian dollar's value based on the election results and the perceived stability of the new government's economic policies. This is a critical factor for businesses involved in international trade.

Analysis of Proposed Fiscal Policies of Major Parties

A key element of Goldman Sachs' analysis focuses on the fiscal policy platforms of the major political parties: the Coalition and Labor. This comparison highlights the differing approaches to managing the Australian economy.

-

Summary of Key Proposals: The Coalition typically advocates for lower taxes and reduced government spending, aiming to stimulate private sector growth. Labor, conversely, often proposes increased government investment in infrastructure, education, and healthcare, potentially leading to higher levels of government debt.

-

Fiscal Sustainability Assessment: Goldman Sachs evaluates the long-term fiscal sustainability of each party's plan, assessing their impact on the national debt and budget deficit. This analysis considers the potential long-term consequences of each party's approach to government spending and revenue generation.

-

Impact of Proposed Tax Policies: A crucial aspect of the analysis examines the projected impact of proposed tax policies on different income brackets and industries. This helps to understand who might benefit or be negatively affected by the policies of each party.

-

Government Spending Across Sectors: Goldman Sachs' analysis details the projected changes in government spending across various sectors, such as healthcare, education, and infrastructure, under each party's plan. This provides valuable insights into the potential priorities of each government.

-

Managing National Debt and Deficit: The parties’ approaches to managing the national debt and the budget deficit are central to Goldman Sachs’ analysis. Their assessment highlights the potential risks and benefits of each approach, considering factors like economic growth and interest rate sensitivity.

Potential Impact on Australian Businesses and Investors

Goldman Sachs' analysis provides crucial insights into how the election outcome might affect Australian businesses and investors. Understanding these potential impacts allows for proactive planning and informed decision-making.

-

Impact on Business Confidence and Investment: Goldman Sachs assesses the likely impact of each party's policies on business confidence and investment decisions. A stable and predictable economic environment is generally viewed positively by businesses.

-

Consequences for the Australian Stock Market: The potential consequences for the Australian stock market are a key area of Goldman Sachs' analysis. Their projections help investors to anticipate potential market movements and adjust their portfolios accordingly.

-

Market Volatility Expectations: Goldman Sachs assesses the likely level of market volatility expected in the lead-up to and following the election. This is important for managing investment risk.

-

Recommendations for Businesses and Investors: Based on their analysis, Goldman Sachs offers recommendations for businesses and investors to navigate the post-election economic climate. This practical guidance helps decision-makers to make informed choices.

Goldman Sachs' Risk Assessment

Goldman Sachs' analysis doesn't just provide predictions; it also undertakes a thorough risk assessment. This critical component highlights potential challenges and uncertainties associated with each party’s proposed policies. Their assessment carefully weighs political risks, stemming from policy implementation challenges and potential shifts in government priorities, alongside economic risks, such as the impact on inflation, unemployment, and growth. The level of uncertainty surrounding each party’s proposals is also a critical factor in their risk assessment.

Conclusion

This article has explored Goldman Sachs' fiscal policy analysis regarding the Australian Election 2024, covering key economic forecasts, party policy comparisons, and potential impacts on businesses and investors. Goldman Sachs' assessment provides valuable insights for understanding the potential economic ramifications of the upcoming election. Understanding the potential economic implications of the Australian Election 2024 is vital for informed decision-making. Stay informed by regularly reviewing expert analyses like Goldman Sachs' fiscal policy reports to make informed decisions about your investments and future planning. Continue to follow our updates on the Australian Election 2024 for further analysis and insights into this crucial election.

Featured Posts

-

Viyna V Ukrayini Analiz Zayav Trampa

Apr 25, 2025

Viyna V Ukrayini Analiz Zayav Trampa

Apr 25, 2025 -

Desain Meja Rias Modern Minimalis 2025 Panduan Lengkap

Apr 25, 2025

Desain Meja Rias Modern Minimalis 2025 Panduan Lengkap

Apr 25, 2025 -

Analiz Zayav Trampa Pro Viynu V Ukrayini

Apr 25, 2025

Analiz Zayav Trampa Pro Viynu V Ukrayini

Apr 25, 2025 -

Is Betting On Natural Disasters Like The Los Angeles Wildfires The New Normal

Apr 25, 2025

Is Betting On Natural Disasters Like The Los Angeles Wildfires The New Normal

Apr 25, 2025 -

Lower Cash Flow Leads Eni To Cut Costs Maintain Share Repurchases

Apr 25, 2025

Lower Cash Flow Leads Eni To Cut Costs Maintain Share Repurchases

Apr 25, 2025