Assessing The Economic Impact Of Election Promises: Deficit Risks And Slowdown Scenarios

Table of Contents

Analyzing the Fiscal Implications of Election Promises

Scrutinizing the financial feasibility of election promises is paramount. Unrealistic proposals, often made to garner votes, can lead to unsustainable levels of government debt and spiraling budget deficits. This reckless approach undermines long-term economic stability and shifts the burden to future generations.

Identifying Potential Budgetary Shortfalls

Many election promises place significant strain on national budgets. Common culprits include:

- Increased social spending: Expanding welfare programs, while laudable in intent, requires significant funding.

- Tax cuts without offsetting measures: Reducing taxes without identifying alternative revenue streams creates a budgetary hole.

- Ambitious infrastructure projects: While essential for growth, large-scale infrastructure projects demand substantial upfront investment.

History is replete with examples of election promises leading to significant budget deficits. For instance, [Insert example of a country and specific policy]. To predict potential shortfalls, economists employ sophisticated fiscal responsibility models, analyzing projected revenue and expenditure under different policy scenarios.

The Impact of Increased Public Debt

High public debt carries severe consequences. It can lead to:

- Higher interest rates: Governments with high debt levels face higher borrowing costs, impacting future budgets.

- Reduced investor confidence: High debt raises concerns about a nation's ability to repay, potentially scaring away foreign investors.

- Potential sovereign debt crises: In extreme cases, high debt can lead to a country defaulting on its loans, causing economic turmoil.

Furthermore, increased government borrowing crowds out private investment, meaning less capital is available for businesses to expand and create jobs. The long-term sustainability of policies promising significant increases in spending without corresponding increases in revenue needs careful consideration.

Evaluating the Macroeconomic Risks of Election Promises

Certain election promises can significantly negatively impact macroeconomic indicators such as economic growth, inflation, and employment. A thorough evaluation is crucial to understand the potential ripple effects.

Assessing the Potential for Economic Slowdown

Several scenarios can lead to economic slowdown after an election:

- Protectionist trade policies: Tariffs and trade barriers can disrupt global supply chains and reduce overall economic output.

- Excessive regulation: Overly burdensome regulations can stifle business activity and innovation.

- Unfunded tax cuts: These can reduce government revenue, leading to reduced public spending and lower economic growth.

Such policies can negatively impact foreign investment and investor confidence, leading to capital flight. Increased government spending, if not managed carefully, can also fuel inflationary pressures.

Analyzing the Impact on Key Economic Sectors

Analyzing the sector-specific impact is crucial. For example:

- Agriculture: Subsidy promises can boost agricultural output, but might distort markets and harm export competitiveness.

- Manufacturing: Protectionist policies might shield domestic manufacturers but could raise prices for consumers.

- Services: Deregulation might boost the service sector, but might lead to job losses in some segments.

Each policy proposal needs a careful evaluation of its potential impact on job creation or losses, considering both direct and indirect effects, and a detailed analysis of the distributional effects – who benefits and who loses.

Methods for Responsible Policy Assessment

Independent economic analysis of election promises is critical for responsible governance. Non-partisan organizations and think tanks play a vital role in providing objective assessments. They can analyze proposals using robust methodologies and offer valuable insights to voters and policymakers alike.

Utilizing Economic Modeling and Forecasting

Econometric models, using complex statistical techniques, can predict the impact of different policies. However, it's vital to remember that these models have limitations, and uncertainty is inherent in economic forecasting. Results must be interpreted cautiously, considering underlying assumptions and potential unforeseen factors.

Transparency and Data Accessibility

Transparency in government budgeting and policy proposals is fundamental. Open access to relevant economic data allows for informed public debate and scrutiny of election promises. This fosters accountability and strengthens democratic processes.

Assessing the Economic Impact of Election Promises – A Call to Action

This article has highlighted the potential risks associated with poorly planned election promises, emphasizing the importance of careful economic analysis before implementing large-scale policy changes. Budgetary shortfalls, increased public debt, economic slowdowns, and negative impacts on key sectors are all potential outcomes of unrealistic pledges. We urge you to critically evaluate election promises, focusing on both deficit risks and slowdown scenarios. Demand responsible governance by actively engaging in discussions about the economic impact of election promises. Learn to assess the economic impact of election promises yourself by utilizing the resources provided by independent economic research organizations. Your informed participation is crucial for a financially sustainable and economically prosperous future.

Featured Posts

-

Cowboys Draft Insider Reveals Surprising Players To Track

Apr 25, 2025

Cowboys Draft Insider Reveals Surprising Players To Track

Apr 25, 2025 -

2025 Nfl Draft Profile Texas Wr Matthew Golden

Apr 25, 2025

2025 Nfl Draft Profile Texas Wr Matthew Golden

Apr 25, 2025 -

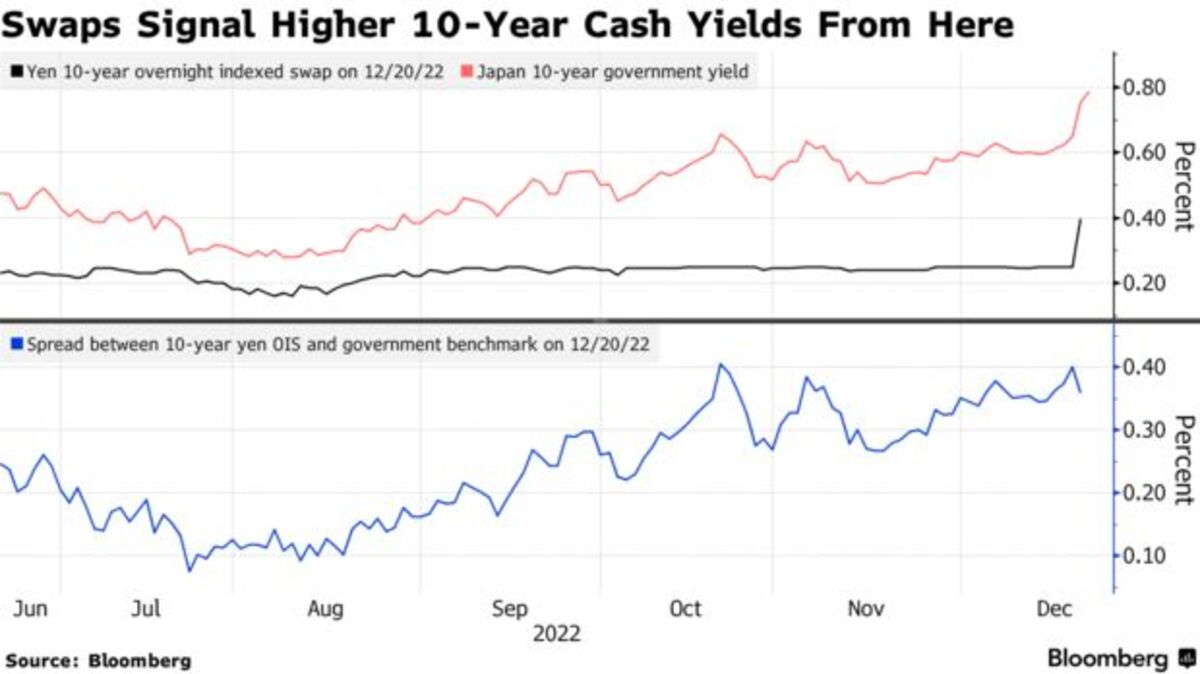

Swaps Suggest Foreigner Bets On Japans Extended Yield Rebound

Apr 25, 2025

Swaps Suggest Foreigner Bets On Japans Extended Yield Rebound

Apr 25, 2025 -

Ashton Jeanty And The Chicago Bears A Deeper Look At The Potential Acquisition

Apr 25, 2025

Ashton Jeanty And The Chicago Bears A Deeper Look At The Potential Acquisition

Apr 25, 2025 -

Impact Of Tariffs A Montreal Guitar Makers Struggle

Apr 25, 2025

Impact Of Tariffs A Montreal Guitar Makers Struggle

Apr 25, 2025