Are Stock Investors Bracing For More Market Losses?

Table of Contents

Inflation's Grip on Stock Market Performance

Inflation's persistent upward pressure significantly impacts stock market performance. A strong correlation exists between rising inflation and decreased stock market valuations. When inflation increases, several negative consequences ripple through the economy and affect company profitability.

- Higher production costs: Increased prices for raw materials, energy, and labor directly reduce corporate profit margins. Businesses often struggle to pass these increased costs entirely onto consumers, leading to squeezed profits.

- Reduced consumer purchasing power: As inflation erodes the value of money, consumers have less disposable income, leading to decreased demand for goods and services. This reduced demand further impacts corporate revenues and profitability.

- Central bank response: To combat inflation, central banks typically raise interest rates. This, as we will explore further, has its own set of consequences for the stock market.

The Consumer Price Index (CPI) is a key indicator of inflation. Sustained high CPI figures, as witnessed recently in many countries, directly translate to pressure on stock valuations. For example, a CPI increase of 5% means that goods and services cost 5% more than the previous year, impacting both corporate bottom lines and consumer spending power.

The Impact of Interest Rate Hikes on Stock Valuation

Central banks' response to inflation – raising interest rates – creates another headwind for the stock market. Higher interest rates increase borrowing costs for businesses and investors, impacting several aspects of the market.

- Higher interest rates increase the cost of debt financing: Companies rely on debt to fund operations and expansion. Higher interest rates make borrowing more expensive, reducing profitability and potentially hindering growth.

- Investors may shift funds from stocks to bonds seeking higher yields: Bonds become more attractive when interest rates rise, offering higher returns with lower risk. This capital shift away from equities can depress stock prices.

- Decreased stock valuations: The increased cost of borrowing and the shift in investor preference toward bonds combine to lower the overall valuation of stocks.

Recent interest rate decisions by the Federal Reserve and other central banks globally underscore this trend. Aggressive rate hikes, while aiming to control inflation, simultaneously exert downward pressure on stock prices.

Geopolitical Uncertainty and its Influence on Investor Sentiment

Geopolitical instability plays a significant role in driving market fluctuations and shaping investor sentiment. Unpredictable global events inject uncertainty into economic forecasts, impacting investor confidence and risk appetite.

- Geopolitical risks create uncertainty about future economic conditions: Wars, political instability, and trade disputes disrupt global supply chains and create uncertainty about future economic growth.

- Investors may become more risk-averse and reduce their stock holdings: In uncertain times, investors tend to shift toward safer assets, reducing their exposure to riskier investments like stocks.

- Market volatility increases due to unpredictable events: Sudden geopolitical events can trigger significant and rapid price swings in the stock market, creating a volatile environment.

The ongoing war in Ukraine, for instance, has significantly impacted energy prices and global supply chains, creating uncertainty and contributing to market volatility. Similarly, escalating tensions between major global powers can trigger significant market reactions.

Analyzing Investor Behavior and Sentiment Indicators

Understanding investor behavior and sentiment is crucial to anticipating market movements. Several indicators provide insights into investor expectations and potential future trends.

- Increased VIX (Volatility Index): A high VIX indicates increased market volatility and fear among investors, suggesting potential for further market decline.

- Pessimistic investor surveys: Surveys gauging investor confidence and outlook can provide insights into overall market sentiment. Negative surveys indicate a pessimistic outlook and potential for further losses.

- Decreased market breadth: Market breadth, which measures the number of stocks participating in a market rally or decline, provides insights into the strength or weakness of the market. A decrease in market breadth suggests a weakening market.

Analyzing these indicators in conjunction with other economic data provides a more comprehensive picture of market dynamics and investor sentiment.

Conclusion: Are Stock Investors Right to be Concerned? A Call to Action

The analysis reveals that stock investors have valid reasons for concern. Inflation, interest rate hikes, geopolitical uncertainties, and pessimistic investor sentiment indicators all point towards potential for further market losses. While a complete market crash isn't guaranteed, the confluence of these factors creates a challenging investment environment.

So, are stock investors bracing for more market losses? Based on the current data and trends, the answer is a cautious yes. However, it is important to maintain perspective. While short-term market fluctuations are inevitable, a long-term investment strategy incorporating diversification and risk management is crucial.

Stay informed on the latest market developments and learn more about managing risk in your portfolio. Understanding the factors contributing to market losses can empower you to make informed investment decisions. Consider consulting with a financial advisor to develop a personalized investment strategy suited to your risk tolerance and financial goals. Don't let fear paralyze you; instead, use this knowledge to navigate market uncertainty effectively.

Featured Posts

-

Strategic Location Planning A Guide To The Countrys Emerging Business Hotspots

Apr 22, 2025

Strategic Location Planning A Guide To The Countrys Emerging Business Hotspots

Apr 22, 2025 -

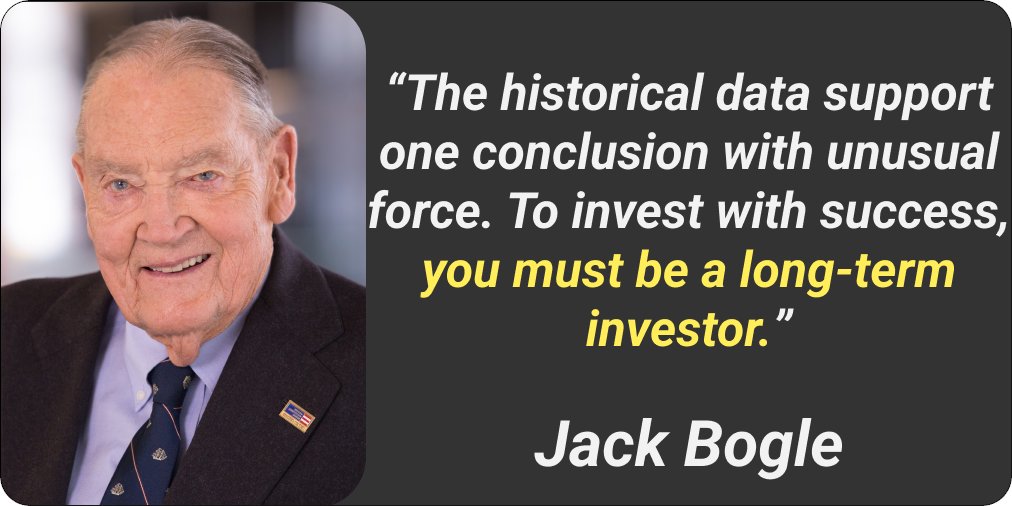

Harvard Faces 1 Billion Funding Cut Exclusive Report On Trump Administrations Ire

Apr 22, 2025

Harvard Faces 1 Billion Funding Cut Exclusive Report On Trump Administrations Ire

Apr 22, 2025 -

Pan Nordic Military Cooperation Analyzing Swedens Armored Strength And Finlands Manpower

Apr 22, 2025

Pan Nordic Military Cooperation Analyzing Swedens Armored Strength And Finlands Manpower

Apr 22, 2025 -

Ohio Train Derailment Toxic Chemical Lingering In Buildings For Months

Apr 22, 2025

Ohio Train Derailment Toxic Chemical Lingering In Buildings For Months

Apr 22, 2025 -

Aramco And Byd Join Forces To Advance Electric Vehicle Technology

Apr 22, 2025

Aramco And Byd Join Forces To Advance Electric Vehicle Technology

Apr 22, 2025