Are High Stock Valuations Justified? BofA's Analysis

Table of Contents

BofA's Key Arguments Supporting High Valuations

BofA's analysis points to several factors that could justify the current high stock valuations. Understanding these arguments is crucial for investors seeking to determine if the market is overvalued or if these valuations reflect underlying economic strength.

Strong Corporate Earnings and Profitability

BofA highlights robust corporate earnings growth as a primary justification for high stock valuations. Companies across various sectors have demonstrated impressive profitability, driven by several key factors.

- Increased productivity: Technological advancements and streamlined operations have led to significant increases in productivity, allowing companies to produce more with fewer resources.

- Efficient cost management: Many companies have implemented effective cost-cutting measures, boosting profit margins.

- Strong pricing power: Companies in strong market positions have been able to increase prices without significantly impacting demand, further contributing to higher profit margins.

These factors directly impact valuation multiples. Higher earnings lead to higher price-to-earnings (P/E) ratios, a key metric used to assess whether a stock is overvalued or undervalued. BofA's analysis likely incorporates data showing a correlation between these improved fundamentals and the current elevated valuations. The strength of these earnings, however, needs to be considered against the backdrop of macroeconomic trends and potential future slowdowns.

Low Interest Rates and Abundant Liquidity

Low interest rates have played a significant role in supporting high stock valuations. These low rates reduce the cost of borrowing for companies, stimulating investment and expansion. This increased investment fuels economic growth, which, in turn, supports higher stock prices.

- Impact on discounted cash flow models: Lower discount rates used in discounted cash flow (DCF) models, a common valuation method, lead to higher present values of future cash flows, thus justifying higher stock prices.

- Increased investor appetite for riskier assets: With low returns on safer investments like bonds, investors are often more willing to take on more risk in search of higher returns, pushing up demand (and prices) for equities.

BofA's perspective likely emphasizes the interconnectedness of low interest rates and elevated stock valuations. The plentiful liquidity in the market, fueled by both governmental and corporate actions, further increases the buying power of investors.

Technological Innovation and Growth Sectors

Technological innovation is a key driver of growth in specific sectors, contributing significantly to overall market valuation. BofA's analysis likely emphasizes the role of technology and other high-growth sectors in justifying current valuations.

- Examples of high-growth sectors: Technology, healthcare, renewable energy, and certain segments of the consumer discretionary sector are exhibiting robust growth and attracting significant investor interest.

- Their contribution to overall market valuation: These high-growth sectors, with their often-high P/E ratios reflecting future growth potential, significantly influence the overall market's valuation metrics.

The argument here centers on the expectation of future earnings growth. High P/E ratios in these sectors are often justified by the belief that future earnings will significantly exceed current levels, making today's valuations appear reasonable. However, it is important to assess how realistic these expectations are, given the inherent volatility of these sectors.

BofA's Cautions and Potential Risks Associated with High Valuations

While BofA may present arguments supporting high stock valuations, they likely also highlight potential risks and cautions. Understanding these concerns is critical for investors to manage their risk appropriately.

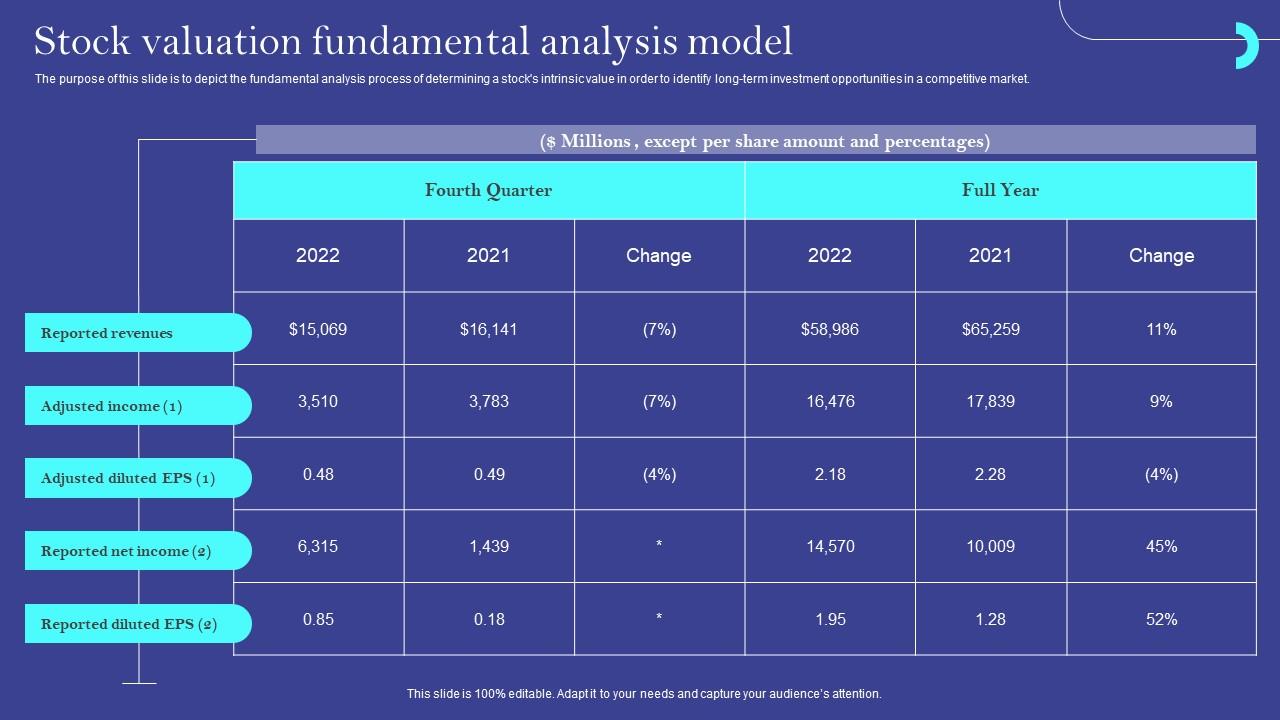

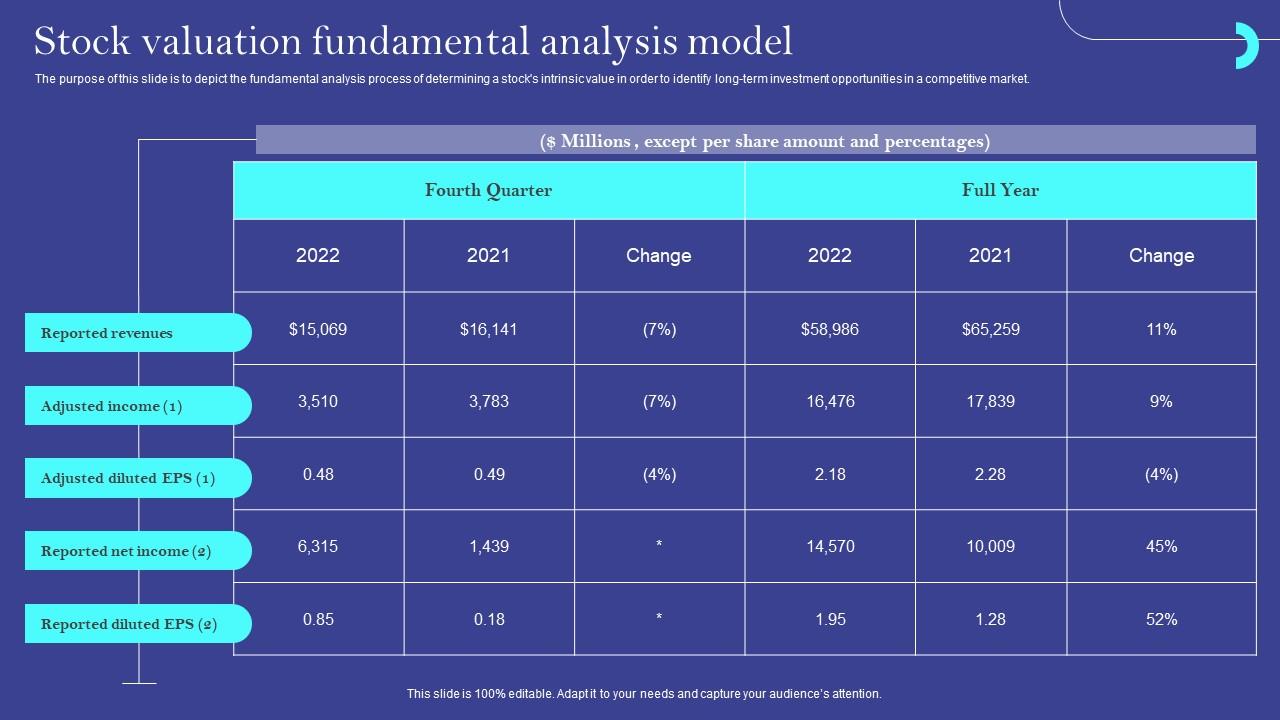

Valuation Multiples Compared to Historical Averages

BofA's analysis likely compares current valuation multiples to historical averages. This comparison is crucial to determine if current valuations are truly justified or represent a potential bubble.

- Specific valuation metrics: Key metrics like the P/E ratio, price-to-sales ratio (P/S), and price-to-book ratio (P/B) will be compared to their historical averages across different market cycles.

- Comparison to previous market cycles: BofA's analysis will likely draw parallels with past market cycles, identifying potential similarities and differences.

Significant deviations from historical averages can suggest overvaluation. However, it is important to remember that past performance is not necessarily indicative of future results, and the current economic environment may differ significantly from those of previous cycles.

Geopolitical and Economic Uncertainties

Geopolitical and economic uncertainties can significantly impact market stability and investor sentiment, posing risks to high stock valuations.

- Examples of geopolitical risks: Trade wars, political instability, and international conflicts can create volatility and negatively impact investor confidence.

- Economic headwinds: Inflation, recessionary fears, and supply chain disruptions are all potential headwinds that could dampen economic growth and lead to lower corporate earnings.

These uncertainties can cause rapid corrections in the market, potentially leading to a significant decline in stock prices, even if underlying valuations were previously justified by strong earnings and low interest rates.

Inflationary Pressures and Rising Interest Rates

The potential for rising interest rates presents a substantial risk to high stock valuations. Higher interest rates increase the cost of borrowing for companies, potentially reducing investment and slowing economic growth.

- Impact on corporate borrowing costs: Increased borrowing costs can squeeze profit margins and reduce corporate profitability.

- Potential for reduced investor demand for equities: Higher interest rates make bonds and other fixed-income investments more attractive, potentially diverting funds away from the stock market.

BofA’s analysis would likely model the impact of various interest rate scenarios on different valuation metrics, highlighting the sensitivity of stock prices to changes in monetary policy.

Conclusion

BofA's analysis likely presents a balanced view, highlighting both the factors supporting and those potentially undermining current high stock valuations. While strong corporate earnings, low interest rates, and technological innovation provide a foundation for high valuations, significant risks remain. The comparison of current valuation multiples to historical averages, coupled with the consideration of geopolitical and economic uncertainties, and the potential impact of rising interest rates and inflationary pressures, paint a complex picture. Investors need to adopt a nuanced approach, carefully considering the interplay of these factors.

Call to Action: While BofA's analysis provides valuable insights into high stock valuations, it's crucial to remember that this is just one perspective. Continuously monitor market trends, conduct your own thorough due diligence, and adjust your investment strategy accordingly. Don't solely rely on any single analysis – understanding the nuances of stock market valuation requires ongoing research and a careful assessment of your own risk tolerance. Stay informed about future analyses and updates from BofA and other financial institutions to refine your understanding of the current market dynamics and make informed decisions about your investments.

Featured Posts

-

You Tube The Center Of Online Video

Apr 25, 2025

You Tube The Center Of Online Video

Apr 25, 2025 -

Zavershenie Rossiysko Ukrainskoy Voyny Slozhneyshaya Zadacha Dlya Trampa Foreign Policy

Apr 25, 2025

Zavershenie Rossiysko Ukrainskoy Voyny Slozhneyshaya Zadacha Dlya Trampa Foreign Policy

Apr 25, 2025 -

Quiet Confidante Usha Vance Finds Fame In India

Apr 25, 2025

Quiet Confidante Usha Vance Finds Fame In India

Apr 25, 2025 -

Stagecoach 2025 Your Guide To Country Roots Pop Surprises And Big Desert Nights

Apr 25, 2025

Stagecoach 2025 Your Guide To Country Roots Pop Surprises And Big Desert Nights

Apr 25, 2025 -

The Rise Of Disaster Betting Analyzing The Market Around The Los Angeles Wildfires

Apr 25, 2025

The Rise Of Disaster Betting Analyzing The Market Around The Los Angeles Wildfires

Apr 25, 2025