Are High Stock Market Valuations A Worry? BofA Says No.

Table of Contents

BofA's Rationale for Dismissing High Valuation Concerns

BofA's assessment of high stock market valuations isn't a blanket dismissal of risk. Instead, their analysis points to several key factors that temper concerns.

Low Interest Rates as a Supporting Factor

Historically low interest rates play a significant role in justifying higher Price-to-Earnings (P/E) ratios. Lower interest rates decrease the discount rate used in discounted cash flow (DCF) valuations. This means future earnings are worth more today, leading to higher valuations.

- Lower discount rate: A lower discount rate increases the present value of future cash flows, justifying higher stock prices.

- Quantitative easing (QE): Central banks' QE programs injected massive liquidity into the market, further pushing down interest rates and supporting higher valuations.

- Impact on P/E ratios: Lower interest rates allow companies to justify higher P/E multiples, as investors are willing to pay more for future earnings growth.

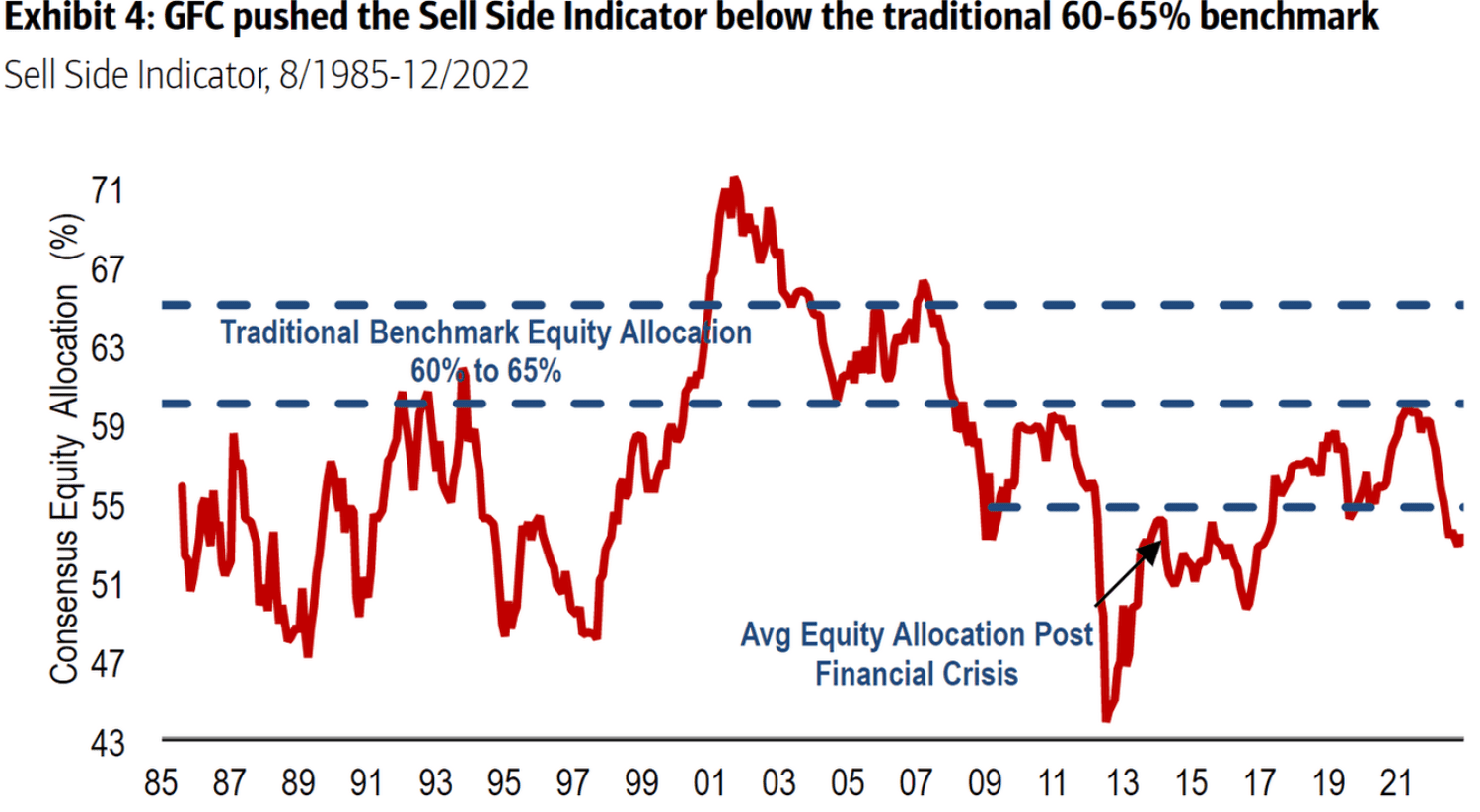

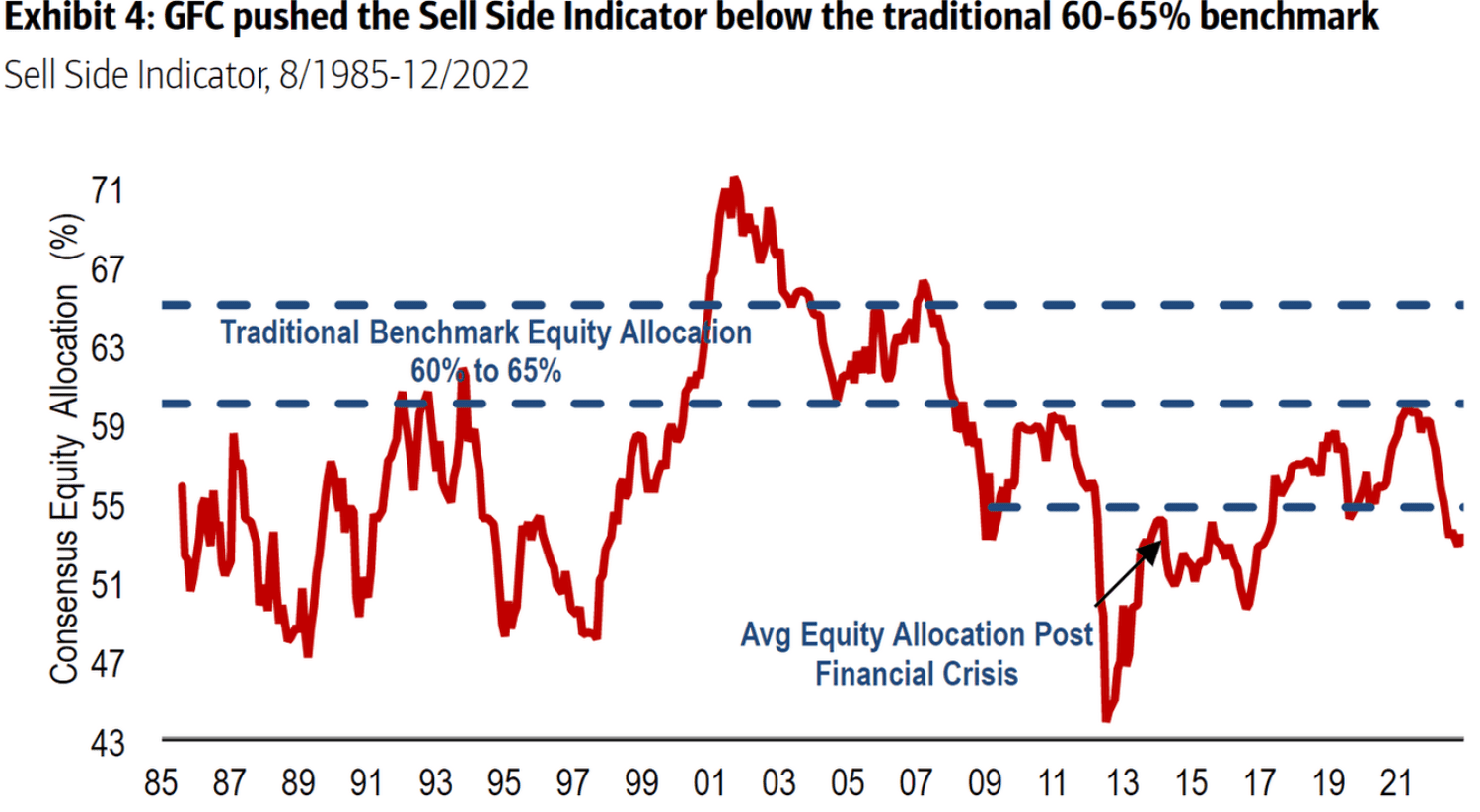

The BofA report cites data showing a strong historical correlation between low interest rates and higher market valuations, supporting their argument. While specific data points may vary over time, the underlying principle remains consistent.

Strong Corporate Earnings Growth

Robust corporate earnings growth is another pillar supporting BofA's view. Many sectors have demonstrated impressive earnings growth, contributing to the current market valuation.

- Technology sector: Tech companies continue to show strong revenue and earnings growth, fueled by digital transformation and cloud computing.

- Healthcare sector: Pharmaceutical and biotechnology companies benefit from aging populations and advancements in medical technology.

- Energy sector: Increased energy demand and production have boosted the earnings of energy companies.

BofA's analysis likely included specific examples of high-performing companies within these sectors, demonstrating the strength of earnings growth as a support for current valuations. Visualizing this growth with charts and graphs would further strengthen the argument.

Long-Term Growth Potential

BofA's analysis likely emphasizes the long-term growth potential of the economy, suggesting that current high stock market valuations are justified by future prospects.

- Technological advancements: Breakthroughs in AI, biotechnology, and renewable energy could drive significant economic growth.

- Infrastructure spending: Government investments in infrastructure projects can stimulate economic activity and boost corporate earnings.

- Global economic recovery: Continued recovery from the pandemic could lead to sustained economic growth and higher corporate profits.

Expert quotes from the BofA report emphasizing this long-term growth potential would significantly enhance the credibility of their argument.

Counterarguments and Potential Risks

While BofA presents a case for dismissing immediate concerns, acknowledging counterarguments and potential risks is crucial for a balanced assessment of high stock market valuations.

Valuation Metrics beyond P/E Ratios

Relying solely on P/E ratios can be misleading. Other valuation metrics offer a more comprehensive picture.

- Price-to-Sales (P/S) ratio: This compares a company's market capitalization to its revenue. It's useful for valuing companies with negative earnings.

- Price-to-Book (P/B) ratio: This compares a company's market capitalization to its book value (assets minus liabilities). It's useful for valuing asset-heavy companies.

These alternative metrics may paint a different picture of valuation, highlighting potential overvaluation in certain sectors or individual companies.

Market Volatility and Correction Potential

Despite BofA's optimistic outlook, the possibility of market corrections remains. Several factors could trigger a downturn.

- Rising interest rates: Increased interest rates can dampen economic growth and reduce corporate earnings, leading to lower stock prices.

- Geopolitical uncertainty: Global political instability or unexpected events can significantly impact market sentiment.

- Inflationary pressures: High inflation erodes purchasing power and can lead to decreased consumer spending and corporate profits.

Historical examples of market corrections and their causes can illustrate the potential for volatility, even in seemingly stable markets.

Inflationary Pressures

Inflation poses a significant risk to high stock market valuations.

- Reduced corporate profitability: High inflation can squeeze profit margins if companies cannot pass increased costs onto consumers.

- Increased interest rates: Central banks often raise interest rates to combat inflation, potentially leading to lower stock prices.

- Decreased consumer spending: High inflation reduces consumer purchasing power, potentially slowing economic growth.

Data on inflation rates and their correlation with market performance are crucial to understanding this risk.

Developing a Prudent Investment Strategy in a High-Valuation Market

Navigating a market with high stock market valuations requires a cautious yet proactive investment strategy.

Diversification

Diversification across asset classes and sectors is crucial to mitigate risk.

- Asset classes: Include stocks, bonds, real estate, and other alternative investments in your portfolio.

- Sectors: Don't concentrate your investments in a single sector; diversify across various industries to reduce exposure to sector-specific risks.

Diversification helps reduce the overall volatility of your portfolio.

Long-Term Perspective

Maintaining a long-term investment horizon is essential for weathering short-term market fluctuations.

- Time horizon: Focus on long-term growth rather than short-term market movements.

- Value investing: Identify undervalued companies with strong fundamentals and hold them for the long term.

Short-term market dips don't always reflect long-term value; many successful companies have experienced temporary setbacks.

Careful Stock Selection

Thorough due diligence and fundamental analysis are crucial before investing in any company.

- Financial health: Analyze a company's financial statements to assess its profitability, debt levels, and cash flow.

- Management quality: Evaluate the competence and integrity of the management team.

- Competitive landscape: Assess the company's competitive position and its ability to maintain market share.

Careful stock selection improves the odds of investing in companies with strong long-term growth potential.

Conclusion: Navigating High Stock Market Valuations – A Balanced Approach

Understanding the complexities of high stock market valuations is crucial for making informed investment decisions. BofA's analysis highlights the importance of considering factors such as low interest rates and strong corporate earnings growth. However, counterarguments emphasizing valuation metrics beyond P/E ratios, market volatility potential, and inflationary pressures underscore the need for a balanced approach. While high stock market valuations present risks, they aren't necessarily a reason for panic. Don't hesitate to seek professional advice to navigate the current market environment and develop a strategy that aligns with your financial goals. Remember, a well-diversified portfolio and a long-term perspective are key to successfully navigating high stock market valuations and achieving your investment objectives.

Featured Posts

-

Nfl Draft 2024 First Round In Green Bay

Apr 26, 2025

Nfl Draft 2024 First Round In Green Bay

Apr 26, 2025 -

Hues Dong Duong Hotel A New Addition To The Fusion Portfolio

Apr 26, 2025

Hues Dong Duong Hotel A New Addition To The Fusion Portfolio

Apr 26, 2025 -

Trump Envoy Witkoffs Moscow Arrival Interfax Report Details

Apr 26, 2025

Trump Envoy Witkoffs Moscow Arrival Interfax Report Details

Apr 26, 2025 -

Jennifer Aniston And Chelsea Handler The Real Reason Behind Their Falling Out

Apr 26, 2025

Jennifer Aniston And Chelsea Handler The Real Reason Behind Their Falling Out

Apr 26, 2025 -

Mission Impossible Dead Reckonings Omission Of Two Sequels

Apr 26, 2025

Mission Impossible Dead Reckonings Omission Of Two Sequels

Apr 26, 2025