Are High Stock Market Valuations A Concern? BofA Weighs In

Table of Contents

Keywords: High stock market valuations, stock market valuation, BofA, Bank of America, market analysis, investment strategy, stock market risk, valuation metrics, P/E ratio, price-to-book ratio, market outlook, economic outlook.

Are soaring stock market valuations a cause for concern? With markets reaching record highs, many investors are questioning whether current prices are sustainable. Bank of America (BofA), a leading financial institution, has recently offered valuable insights into the complexities of today's market, providing an expert perspective on high stock market valuations. This article explores BofA's analysis, examining key valuation metrics and considering the potential implications for investors.

BofA's Stance on Current Stock Market Valuations

BofA's stance on current stock market valuations has often been nuanced, reflecting the inherent complexities of the market. While they haven't issued a blanket "bullish," "bearish," or "neutral" statement, their reports generally express a cautious optimism. Their analysis often emphasizes the need for a balanced approach, acknowledging both the potential for continued growth and the risks associated with elevated valuations. Specific quotes and data points from BofA reports would need to be referenced based on the most current publications. However, we can summarize their general approach:

- Summary of BofA's key arguments: BofA's analysis typically incorporates a range of factors, including macroeconomic indicators, corporate earnings, and investor sentiment, to arrive at its assessment. They usually stress the importance of considering the long-term picture and not reacting solely to short-term market fluctuations.

- Specific sectors highlighted: BofA's reports often highlight specific sectors that appear overvalued or undervalued relative to their intrinsic worth. For instance, some technology sectors might be seen as overvalued due to high growth expectations, while others, such as certain energy sectors, may be deemed undervalued based on their current performance and future projections.

- Relevant economic indicators: BofA uses a variety of economic indicators, such as interest rates, inflation rates, and GDP growth, in its analysis. These indicators help provide context to market valuations and offer insights into the potential trajectory of economic growth. High inflation, for example, can impact future earnings expectations and thus influence stock valuations.

Key Valuation Metrics Analyzed by BofA

BofA's analysis likely utilizes several key valuation metrics to assess whether the market is overvalued. Understanding these metrics is crucial for investors to interpret BofA’s findings and form their own informed opinions.

- Price-to-Earnings Ratio (P/E): This metric compares a company's stock price to its earnings per share (EPS). A high P/E ratio might suggest that a stock is overvalued relative to its earnings, while a low P/E ratio could indicate undervaluation. The formula is:

P/E Ratio = Market Value per Share / Earnings per Share. - Price-to-Book Ratio (P/B): This ratio compares a company's market capitalization to its book value (assets minus liabilities). A high P/B ratio could suggest the market is placing a premium on the company's future prospects. The formula is:

P/B Ratio = Market Price per Share / Book Value per Share. - Price-to-Sales Ratio (P/S): This ratio compares a company's market capitalization to its revenue. It is often used for companies with negative earnings. A high P/S ratio suggests that investors are paying a high price for each dollar of sales. The formula is:

P/S Ratio = Market Capitalization / Revenue.

Historical comparisons of these ratios are vital for context. A high P/E ratio, for instance, might be acceptable if it's within the historical range for that company or sector and supported by robust growth projections. However, if the P/E is significantly above historical averages, it might raise concerns about overvaluation.

Potential Risks Associated with High Stock Market Valuations

Investing in a market with high valuations comes with inherent risks. While potential for future growth exists, several scenarios could negatively impact investors:

- Risk of decreased returns or losses: High valuations often imply limited future upside potential. If the market experiences a correction, investors in overvalued assets could face significant losses.

- Increased market volatility: Markets with high valuations tend to be more volatile, meaning price swings can be larger and more frequent. This heightened volatility adds to the overall risk for investors.

- Impact of rising interest rates: Rising interest rates can negatively impact stock valuations, especially for growth stocks which rely on future earnings discounted back at a higher rate.

Opportunities Despite High Valuations

Despite the risks associated with high stock market valuations, opportunities still exist for savvy investors:

- Investment strategies: Value investing, focusing on companies trading below their intrinsic value, can be a viable strategy in a market with high overall valuations. Growth investing, while riskier in a highly valued market, still presents opportunities in sectors poised for significant expansion.

- Strong potential sectors: Certain sectors may offer better prospects than others, even in a generally overvalued market. Thorough research is crucial to identify these sectors.

- Diversification: Diversifying investments across asset classes and sectors is paramount to mitigating risk. This strategy reduces the impact of potential losses in any one area.

Conclusion

BofA's analysis of high stock market valuations reflects a cautious but not necessarily bearish outlook. While acknowledging the potential risks associated with elevated prices, their reports also highlight potential opportunities for investors who adopt a balanced and well-informed approach. Understanding valuation metrics like P/E, P/B, and P/S ratios is essential for navigating this complex environment. The key takeaway is the need for careful risk management, strategic diversification, and a thorough understanding of macroeconomic indicators. Stay informed about the ongoing debate on high stock market valuations and develop a sound investment strategy that aligns with your risk tolerance and financial goals. Consider consulting with a financial advisor for personalized guidance.

Featured Posts

-

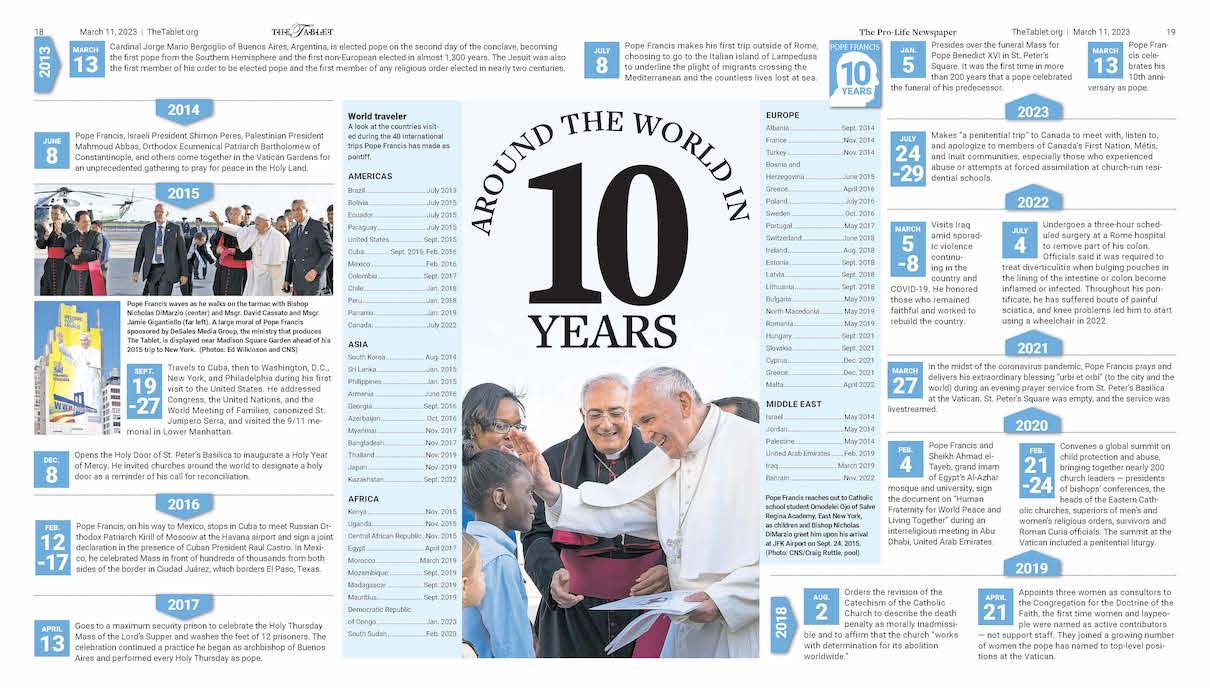

Death Of Pope Francis Remembering A Transformative Papacy

Apr 22, 2025

Death Of Pope Francis Remembering A Transformative Papacy

Apr 22, 2025 -

Official Confirmation Pope Francis Dies At Age 88

Apr 22, 2025

Official Confirmation Pope Francis Dies At Age 88

Apr 22, 2025 -

Broadcoms Proposed V Mware Price Hike A 1 050 Cost Surge For At And T

Apr 22, 2025

Broadcoms Proposed V Mware Price Hike A 1 050 Cost Surge For At And T

Apr 22, 2025 -

Ohio Train Derailment Toxic Chemical Lingering In Buildings For Months

Apr 22, 2025

Ohio Train Derailment Toxic Chemical Lingering In Buildings For Months

Apr 22, 2025 -

Vehicle Subsystem Issue Causes Blue Origin Launch Cancellation

Apr 22, 2025

Vehicle Subsystem Issue Causes Blue Origin Launch Cancellation

Apr 22, 2025