Are High Stock Market Valuations A Concern? BofA Says No.

Table of Contents

Keywords: High stock market valuations, stock market valuation, BofA, Bank of America, market valuation, stock market outlook, investment strategy, market analysis, high stock prices, stock market concerns.

The recent surge in stock prices has led many investors to question whether current high stock market valuations represent a significant risk. Concerns about a potential market correction are certainly understandable, especially when looking at traditional valuation metrics. However, Bank of America (BofA), a major financial institution, offers a contrasting perspective. This article will delve into BofA's analysis, examining the factors contributing to their optimistic outlook and addressing the concerns surrounding these high valuations. We'll explore why BofA believes the current market isn't overvalued and what factors support their seemingly bullish stance.

BofA's Rationale for Dismissing Valuation Concerns

BofA's optimistic outlook on high stock market valuations isn't based on blind faith; it stems from a detailed analysis of several key factors. Their argument rests on a confluence of economic indicators and long-term trends.

Strong Corporate Earnings Growth

BofA's analysis points to robust corporate earnings growth as a primary justification for their positive view. They highlight the impressive performance of many companies across various sectors, exceeding expectations and projecting continued strong growth.

- Examples of companies exceeding expectations: Many technology giants, as well as companies in the consumer staples and healthcare sectors, have reported significantly higher-than-projected earnings, indicating strong underlying economic strength.

- Projected future earnings growth: BofA cites a projected 15% increase in S&P 500 earnings for the next year, fueled by continued economic expansion and strong consumer spending. This projected growth significantly offsets concerns about high stock prices.

- Impact of economic factors on earnings: The ongoing economic recovery, coupled with supportive government policies, has contributed significantly to this robust earnings growth, bolstering the argument against overvaluation. This positive economic environment continues to fuel expansion and profitability.

Low Interest Rates and Ample Liquidity

The prevailing environment of low interest rates and ample liquidity plays a significant role in supporting higher stock valuations, according to BofA. This monetary policy has had a profound impact on investor behavior and corporate investment strategies.

- Impact of quantitative easing: Years of quantitative easing have injected significant liquidity into the market, making capital readily available for investment, pushing up stock prices.

- Low borrowing costs for companies: Low interest rates allow companies to borrow money at historically low costs, facilitating expansion, investments, and stock buybacks, which further inflate stock valuations.

- Investor behavior in a low-interest-rate environment: With low returns on traditional fixed-income investments, investors have flocked to the stock market in search of higher yields, driving up demand and, consequently, prices. This increased demand supports higher stock market valuations.

Technological Innovation and Growth Sectors

Technological innovation and the growth of emerging industries are key drivers of current stock market valuations, a factor BofA heavily emphasizes in its analysis. These dynamic sectors often command higher valuations due to their perceived future growth potential.

- Examples of high-growth tech sectors: Artificial intelligence, cloud computing, and renewable energy are among the sectors experiencing explosive growth, contributing significantly to overall market performance.

- Their contributions to overall market performance: These sectors' impressive growth is outpacing the broader market, pulling the average valuation higher and contributing to a generally positive outlook.

- Future growth potential: The long-term growth prospects of these sectors are substantial, justifying, in BofA's view, the higher valuations they command. This long-term potential counteracts concerns of a market bubble.

Addressing Counterarguments: Why Some Remain Skeptical

Despite BofA's optimistic outlook, it's essential to acknowledge the counterarguments and reasons why some remain skeptical of current high stock market valuations.

Historical Comparisons and Valuation Metrics

Many critics point to historical comparisons and valuation metrics, such as the Price-to-Earnings (P/E) ratio and the Cyclically Adjusted Price-to-Earnings Ratio (Shiller PE), to argue that the market is overvalued.

- Present both sides of the argument fairly: While historical data suggests that current valuations are high relative to historical averages, it's important to acknowledge that these metrics don't always accurately predict future market movements. The economic landscape is constantly changing.

- Showing historical data and acknowledging the limitations of solely relying on valuation metrics: Using solely historical data can be misleading, as current economic conditions and technological advancements are significantly different from those of the past. These metrics don't fully encapsulate the impact of technological disruption or accommodative monetary policy.

- Include expert opinions (if available) from those who disagree with BofA's assessment: Acknowledging differing expert opinions is crucial for a balanced view. Some analysts argue that these high valuations are unsustainable in the long term.

Geopolitical Risks and Economic Uncertainty

Geopolitical risks and economic uncertainty represent significant headwinds that could negatively impact the market, even with BofA's optimistic projections.

- List specific geopolitical events or economic indicators that could negatively impact the market: The ongoing Russia-Ukraine conflict, rising inflation, and the potential for a global recession all present considerable risks.

- Analyze how BofA might address these concerns in their analysis: BofA likely incorporates these risks into their models, but the extent to which these factors are considered remains a point of contention. Their analysis might highlight the resilience of the market to absorb these shocks.

Market Volatility and Correction Potential

Even with a positive outlook, market volatility and the potential for a correction are undeniable aspects of investing.

- Explain that even with a positive outlook, corrections are normal and healthy for the market: Corrections are a natural part of market cycles, and the fact that BofA acknowledges a correction possibility highlights a measured approach, rather than unwavering optimism.

- Discuss strategies for managing risk in a volatile market: Diversification, hedging strategies, and a long-term investment horizon are vital for mitigating risk in a volatile market environment, regardless of overall market outlook.

Conclusion

BofA's analysis suggests that strong corporate earnings growth, low interest rates, and technological innovation mitigate concerns about high stock market valuations. Their optimistic outlook is not without caveats, however. Geopolitical risks, economic uncertainty, and the inherent volatility of the market remain significant considerations. While high stock market valuations can be concerning, understanding the nuanced perspective offered by analysts like those at BofA is crucial for informed investment decisions. Learn more about BofA's market analysis and develop your own informed strategy for navigating high stock market valuations. Conduct thorough research and consult with a financial advisor to determine your own approach to investing in the current market environment.

Featured Posts

-

Simkus Ecb Further Interest Rate Cuts On The Horizon Due To Trade Slowdown

Apr 27, 2025

Simkus Ecb Further Interest Rate Cuts On The Horizon Due To Trade Slowdown

Apr 27, 2025 -

Justin Herbert Leads Chargers To Brazil For 2025 Season Debut

Apr 27, 2025

Justin Herbert Leads Chargers To Brazil For 2025 Season Debut

Apr 27, 2025 -

Professional Stylist Behind Ariana Grandes Dramatic Hair And Tattoo Debut

Apr 27, 2025

Professional Stylist Behind Ariana Grandes Dramatic Hair And Tattoo Debut

Apr 27, 2025 -

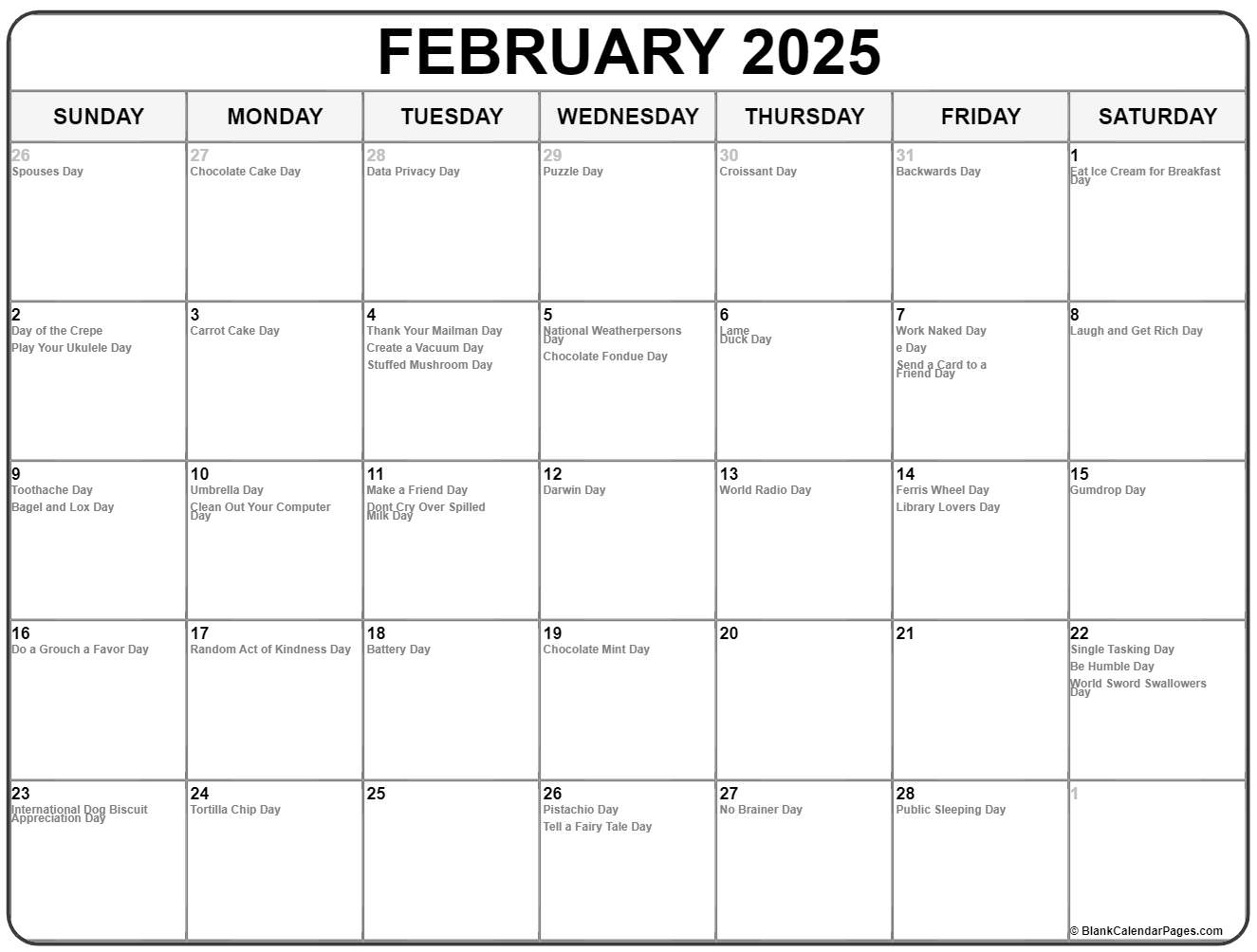

February 20 2025 Ideas For A Happy Day

Apr 27, 2025

February 20 2025 Ideas For A Happy Day

Apr 27, 2025 -

Ariana Grandes Transformation Professional Advice On Hair And Tattoo Care

Apr 27, 2025

Ariana Grandes Transformation Professional Advice On Hair And Tattoo Care

Apr 27, 2025