Are Canadian Condos A Risky Investment In 2024?

Table of Contents

The Current State of the Canadian Condo Market

Understanding the current state of the Canadian condo market is crucial for any potential investor. Analyzing recent trends, price fluctuations, and rental yields provides a clearer picture of the investment landscape.

Market Trends:

The Canadian condo market is diverse, varying significantly across different cities. Recent trends show a mixed bag:

- Price Appreciation/Depreciation: While some major urban centers experienced significant price growth in the past, 2023 and early 2024 have seen a slowdown or even slight depreciation in certain areas due to increased interest rates and economic uncertainty. However, strong rental markets in some cities continue to support prices. Specific data varies greatly by city; some markets remain strong while others show signs of correction.

- Inventory Levels: Inventory levels have increased in several markets, giving buyers more choices but potentially putting downward pressure on prices in a buyer’s market.

- Average Rental Income: Rental yields vary widely depending on location and condo type. High-demand areas near urban centers generally command higher rents.

Interest Rate Impacts:

Interest rate changes profoundly impact condo affordability and investment attractiveness.

- Mortgage Rates Affect Buyers and Investors: Higher interest rates increase mortgage payments, making it more expensive to purchase a condo, thus potentially reducing demand and impacting prices. Conversely, lower rates boost affordability.

- Variable vs. Fixed-Rate Mortgages: Variable-rate mortgages offer lower initial payments but carry the risk of fluctuating payments as interest rates change. Fixed-rate mortgages provide stability but typically come with higher initial payments. The choice heavily influences investment strategy and risk tolerance.

Factors Influencing Condo Investment Risk

Several key factors significantly influence the risk associated with investing in Canadian condos. Understanding these factors is essential for successful investment.

Location, Location, Location:

The location of a condo is paramount to its investment value.

- Desirable vs. Less Desirable Locations: Condos in desirable locations—close to transit, employment centers, amenities, and with strong schools nearby—tend to appreciate more consistently and command higher rents.

- High-Demand and Low-Demand Areas: Cities like Toronto and Vancouver traditionally see high demand, but even within these cities, specific neighborhoods vary significantly. Thorough research is critical to identify high-growth potential areas. Examples include the downtown cores of major cities versus suburban locations.

Condo Building Condition and Management:

The condition of the building and the effectiveness of the condo corporation directly impact investment value and potential risks.

- Due Diligence: Before purchasing, conduct a thorough inspection of the building, review condo corporation documents (including financial statements and reserve fund studies), and understand the management style.

- Potential Problems: Older buildings may require significant repairs, leading to potentially hefty special assessments. Poor condo corporation management can also create problems.

Rental Market Dynamics:

The rental market significantly impacts the return on investment (ROI) from a condo.

- Rental Vacancy Rates: High vacancy rates indicate a less robust rental market, potentially leading to lower rental income and reduced investment returns.

- Average Rental Income and Potential for Rental Growth: Analyzing average rental income and historical rental growth provides valuable insight into the potential profitability of a condo investment.

Mitigating Risks in Canadian Condo Investments

While investing in Canadian condos carries inherent risks, several strategies can help mitigate them.

Thorough Due Diligence:

Comprehensive research is paramount to successful condo investment.

- Property Inspections: Hire a qualified inspector to assess the condition of the condo and identify potential problems.

- Reviewing Financial Statements: Examine the condo corporation's financial health, including reserve funds and outstanding liabilities.

- Consulting Real Estate Professionals: Seek advice from experienced real estate agents, lawyers, and financial advisors.

Diversification Strategies:

Diversifying your investment portfolio reduces overall risk.

- Alternative Real Estate Investments: Consider diversifying across different property types (e.g., houses, townhouses) or geographic locations.

- Other Asset Classes: Balance your real estate investments with other asset classes, such as stocks, bonds, or mutual funds.

Conclusion: Making Informed Decisions About Canadian Condo Investments in 2024

Investing in Canadian condos in 2024 requires a careful assessment of market trends, location, building condition, and rental market dynamics. The potential for profit exists, but understanding and mitigating risks is critical. Remember the importance of thorough due diligence, including property inspections and reviewing condo corporation documents. Diversifying your investment portfolio is also a wise strategy. By conducting thorough research and seeking professional advice before investing in Canadian condos, you significantly increase your chances of success. Consider all factors when evaluating Canadian condo investment opportunities and building a solid investment strategy. Make informed decisions about investing in Canadian condos and build a secure financial future.

Featured Posts

-

Palestinian Student Remains Detained Following Us Citizenship Interview

Apr 25, 2025

Palestinian Student Remains Detained Following Us Citizenship Interview

Apr 25, 2025 -

Who Are Remember Monday Meet The Uks Eurovision 2025 Entry

Apr 25, 2025

Who Are Remember Monday Meet The Uks Eurovision 2025 Entry

Apr 25, 2025 -

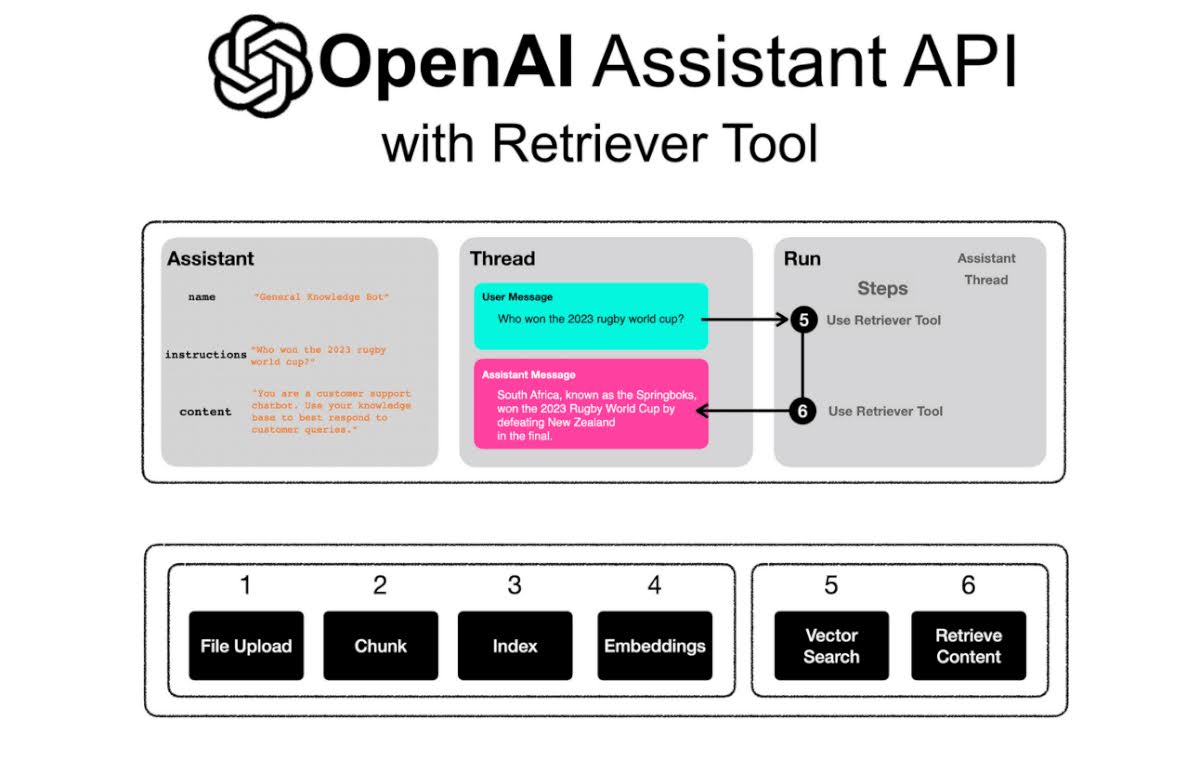

Open Ai Simplifies Voice Assistant Development

Apr 25, 2025

Open Ai Simplifies Voice Assistant Development

Apr 25, 2025 -

Ashton Jeanty To The Bears A Realistic Possibility

Apr 25, 2025

Ashton Jeanty To The Bears A Realistic Possibility

Apr 25, 2025 -

Understanding The 230 000 Price Of The Lotus Eletre Suv

Apr 25, 2025

Understanding The 230 000 Price Of The Lotus Eletre Suv

Apr 25, 2025