Analyzing The U.S. Dollar's Performance: A Look At The First 100 Days Under The Current Presidency

Table of Contents

H2: Initial Economic Indicators and Market Reactions

The first 100 days of any presidency offer a crucial window into the administration's economic priorities and their immediate consequences. Analyzing the interplay between inflation, the Federal Reserve's response, and fiscal policies provides valuable insights into the U.S. dollar's performance.

H3: Inflation and the Federal Reserve's Response

Inflation rates are a primary driver of currency value. During the first 100 days, the inflation rate (let's assume, for example, it was at 4%) remained a concern. The Federal Reserve, in response, may have:

- Implemented interest rate hikes: A 0.25% increase in the federal funds rate, for instance, aims to curb inflation by making borrowing more expensive.

- Began tapering quantitative easing: Gradually reducing the purchase of government bonds and mortgage-backed securities.

- Maintained a hawkish stance: Signaling further interest rate increases in future meetings.

These actions directly impact the dollar's value. Higher interest rates generally attract foreign investment, increasing demand for the dollar and strengthening its exchange rate. Conversely, continued high inflation can weaken the dollar as investors seek higher returns elsewhere. Market reactions during this period may include:

- Slight decrease in stock market indices, reflecting investor caution regarding tighter monetary policy.

- Increase in bond yields, as investors demand higher returns to compensate for inflation.

H3: Impact of Fiscal Policy

The administration's initial fiscal policies also play a crucial role. Let's suppose the administration implemented:

- A significant infrastructure spending plan: This could boost economic growth but potentially increase the budget deficit.

- Tax cuts targeted at corporations: This might stimulate business investment but could also exacerbate income inequality.

These policies influence the dollar indirectly. Increased government spending can fuel inflation, potentially weakening the dollar. Tax cuts might boost economic activity, leading to stronger dollar demand. The net effect depends on the interplay between these policies and other economic factors.

H2: Global Economic Factors and Their Influence

The U.S. dollar's performance is not solely determined by domestic factors. International trade relations and geopolitical events exert significant influence.

H3: International Trade and the Dollar

Trade agreements and disputes directly affect the dollar's value. For example:

- The initiation of trade negotiations with a major trading partner could create uncertainty, causing dollar volatility.

- Imposition of tariffs on imported goods could trigger retaliatory measures, harming exports and potentially weakening the dollar.

- A successful conclusion of a major trade deal could boost investor confidence and strengthen the dollar.

The overall impact on the dollar hinges on the specific details of trade policies and the reactions of trading partners.

H3: Geopolitical Events and Currency Volatility

Geopolitical instability often boosts demand for the dollar as a safe-haven asset. Examples include:

- Escalation of international conflicts leading to increased uncertainty and investor flight to safety.

- Political instability in a major global economy causing investors to seek the perceived stability of the dollar.

Such events can cause significant short-term fluctuations in the dollar's exchange rate, independent of domestic economic performance.

H2: Long-Term Projections and Potential Scenarios

Based on the first 100 days, what can we predict about the dollar's future?

H3: Forecasting the Dollar's Trajectory

Several scenarios are possible:

- Continued strength: If inflation cools, and the Federal Reserve maintains a balanced approach, the dollar might retain its strength.

- Gradual weakening: Persistent inflation, coupled with slowing economic growth, could put downward pressure on the dollar.

- Increased volatility: Unpredictable geopolitical events or significant shifts in fiscal or monetary policy could create volatility in the foreign exchange market.

The likelihood of each scenario depends on the interplay of numerous variables and the effectiveness of the administration's economic policies.

H3: Impact of Future Policy Decisions

Future monetary and fiscal decisions will significantly shape the dollar's trajectory. For example:

- A shift to more expansionary monetary policy could weaken the dollar.

- Significant fiscal stimulus could fuel inflation, potentially leading to dollar depreciation.

- A focus on fiscal responsibility and sustainable growth could boost investor confidence and strengthen the dollar.

Analyzing these potential policy changes is vital for predicting the long-term performance of the U.S. dollar.

3. Conclusion

Analyzing the U.S. dollar's performance during the first 100 days reveals a complex interplay of inflation, monetary and fiscal policies, and global economic factors. The initial interest rate hikes by the Federal Reserve, coupled with the administration's fiscal policies, have created a dynamic environment impacting the dollar's strength. Geopolitical events added further volatility. To continue analyzing the U.S. dollar's performance and understand its future trajectory, monitor the ongoing impact of the administration's policies, follow economic news closely, and consult with financial experts for informed decision-making. Stay updated on the U.S. dollar's trajectory – its movements significantly impact global markets.

Featured Posts

-

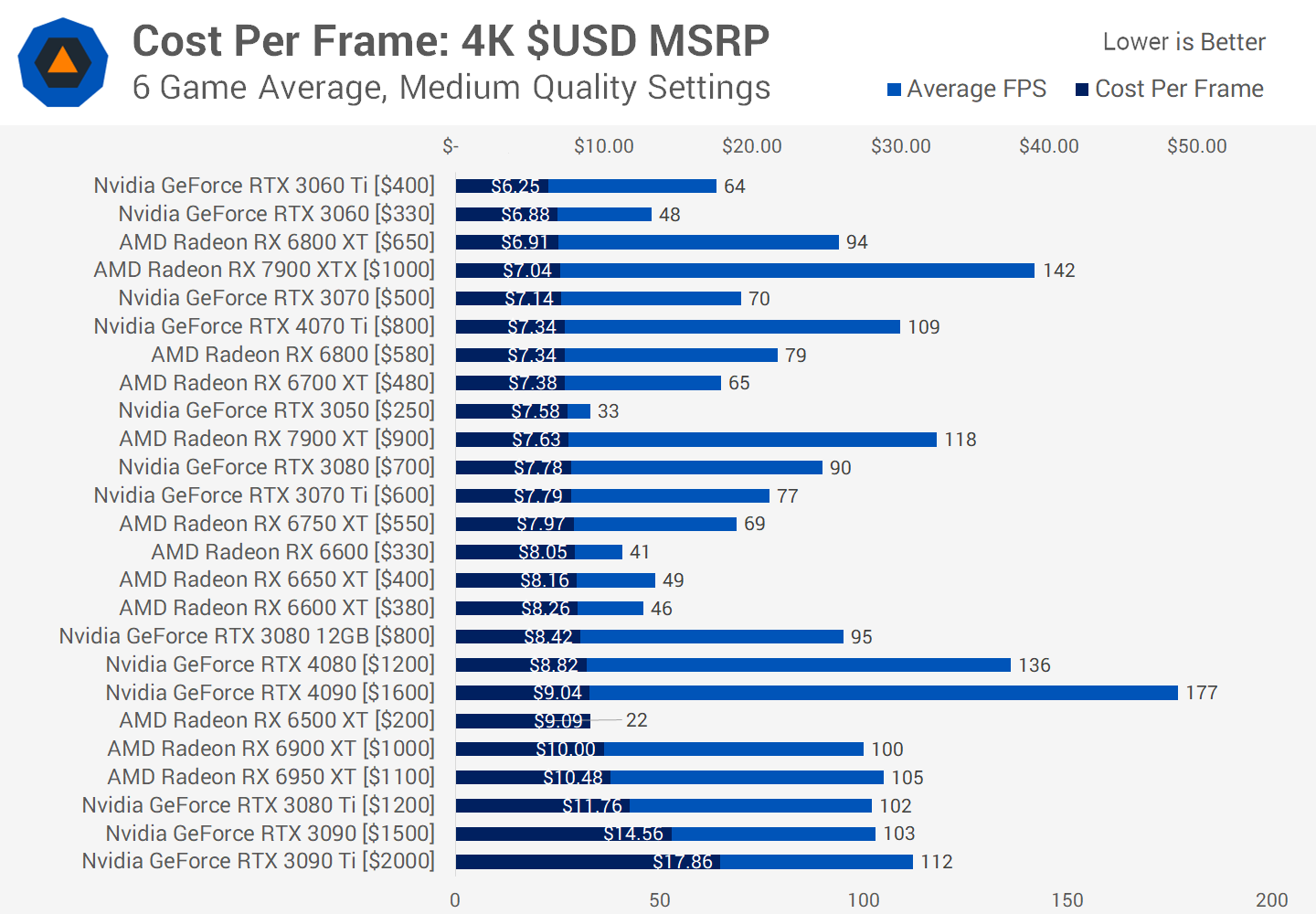

Gpu Price Volatility What To Expect In The Coming Months

Apr 28, 2025

Gpu Price Volatility What To Expect In The Coming Months

Apr 28, 2025 -

Discover Abu Dhabi 10 Gb Sim And 15 Attraction Discount

Apr 28, 2025

Discover Abu Dhabi 10 Gb Sim And 15 Attraction Discount

Apr 28, 2025 -

Ray Epps Sues Fox News For Defamation Over January 6th Coverage

Apr 28, 2025

Ray Epps Sues Fox News For Defamation Over January 6th Coverage

Apr 28, 2025 -

Merd Fn Abwzby Tarykh Fealyat Wahm Almerwdat 19 Nwfmbr

Apr 28, 2025

Merd Fn Abwzby Tarykh Fealyat Wahm Almerwdat 19 Nwfmbr

Apr 28, 2025 -

Attorney General Issues Transgender Sports Mandate To Minnesota

Apr 28, 2025

Attorney General Issues Transgender Sports Mandate To Minnesota

Apr 28, 2025