Ackman's Trade War Prediction: US Vs. China

Table of Contents

Ackman's Stance on US-China Relations

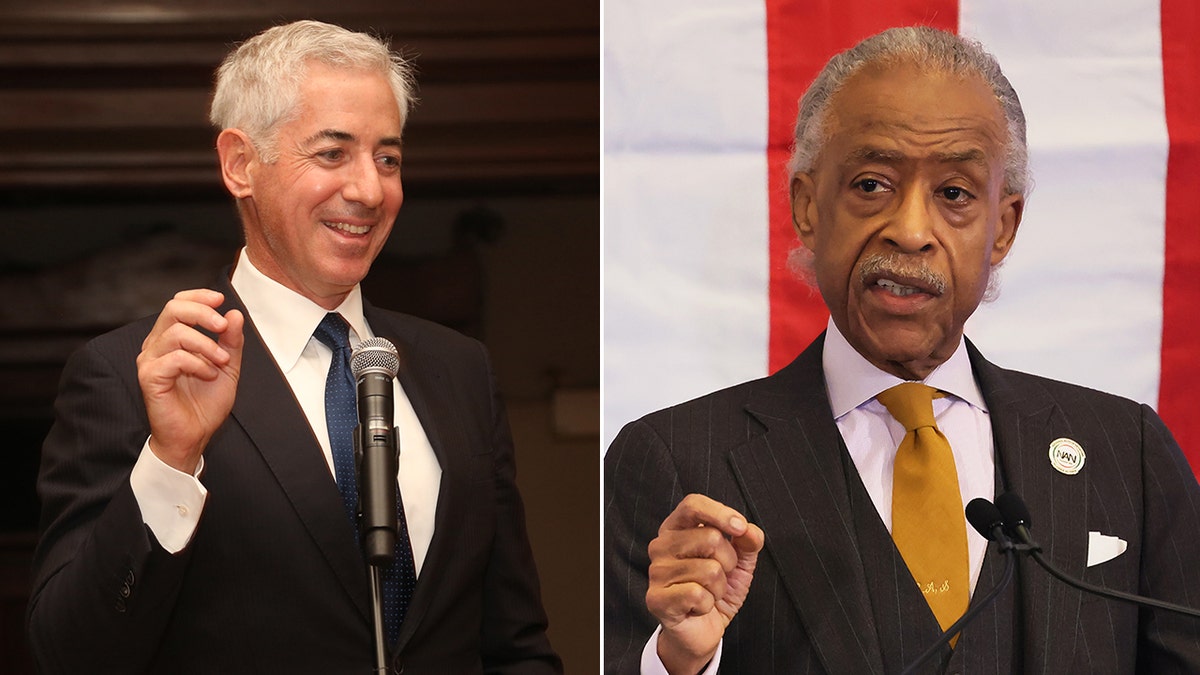

Bill Ackman, the founder and CEO of Pershing Square Capital Management, is known for his bold and often contrarian investment strategies. While his specific predictions regarding a US-China trade war aren't always explicitly stated as a singular, definitive forecast, his investment choices and public comments strongly suggest a cautious, if not pessimistic, outlook on the future relationship between the two economic superpowers. Ackman's stance reflects a growing concern about the potential for further escalation of trade tensions.

- Specific investment strategies: Although Ackman hasn't explicitly stated "I predict a trade war," his investment decisions often reflect a hedging strategy against such an outcome. This might involve reducing exposure to companies heavily reliant on Chinese markets or shorting specific sectors vulnerable to trade disruptions. Analyzing his portfolio adjustments can offer valuable insights into his underlying assessment of US-China relations.

- Key arguments: His arguments likely center on the increasing geopolitical rivalry, technological competition (particularly in semiconductors), and the potential for further decoupling of the two economies. He likely emphasizes the risks associated with over-reliance on any single nation for crucial goods and services.

- Companies/industries impacted: Sectors such as technology (semiconductors, AI), manufacturing, and consumer goods are likely to be highlighted as particularly vulnerable in Ackman's assessment. He might point to the disruption of supply chains and increased costs as significant negative impacts.

Analyzing the Potential for Escalation

Several factors contribute to the potential for increased trade tensions between the US and China, aligning with the underlying concerns informing Ackman's Trade War Prediction.

- Geopolitical events: The situation in Taiwan is a major flashpoint, with potential military conflict posing a significant risk of broader economic repercussions. Any escalation in this area would likely trigger severe trade disruptions.

- Economic indicators: Persistent trade deficits and concerns about China's economic growth and stability contribute to uncertainty and heighten the possibility of protectionist measures by both countries.

- Technological competition: The competition for dominance in crucial technologies like semiconductors and AI fuels a "technological cold war," escalating tensions and leading to potential trade restrictions. This intense competition is a core component of Ackman's Trade War Prediction.

The Economic Impact of Ackman's Predicted Trade War

A significant escalation in trade tensions, as potentially envisioned in Ackman's Trade War Prediction, could have far-reaching economic consequences.

- Impact on global supply chains: Disruptions to global supply chains would be inevitable, leading to shortages, increased prices, and uncertainty for businesses worldwide.

- Inflationary pressures: Trade restrictions and tariffs would contribute to inflationary pressures, impacting consumers and potentially triggering further economic instability.

- Effect on specific industries: The manufacturing and technology sectors would likely experience the most significant negative effects, but the consequences would ripple across various industries globally.

- Potential for market volatility: Increased uncertainty would translate into increased market volatility, leading to significant swings in stock prices and investment flows.

Alternative Perspectives and Counterarguments

While Ackman's Trade War Prediction is a serious consideration, it's crucial to acknowledge alternative perspectives.

- Arguments suggesting de-escalation: Some analysts believe that both countries have too much to lose from a full-scale trade war and will find ways to de-escalate tensions through negotiation and compromise. This perspective suggests that Ackman might be overly pessimistic.

- Economic indicators contradicting Ackman: Some economic indicators, such as ongoing trade between the two countries, might suggest that a complete decoupling or major trade war is less likely than Ackman's prediction.

- Other geopolitical considerations: Factors such as global energy prices, the war in Ukraine, and other international relations could influence the US-China dynamic, making a precise prediction challenging.

Assessing the Accuracy of Ackman's Prediction

Evaluating the accuracy of Ackman's past predictions is essential to assess the reliability of his current assessment. While he has a track record of successful investments, analyzing both his accurate and inaccurate predictions offers a more nuanced perspective on his predictive ability.

- Examples of accurate predictions: [Insert examples of Ackman's successful predictions]

- Examples of inaccurate predictions: [Insert examples of Ackman's less successful predictions]

- Overall assessment: A balanced assessment is crucial. Ackman’s success rate, coupled with current geopolitical and economic indicators, provides a framework for evaluating the likelihood of his Trade War Prediction.

Conclusion: Evaluating Ackman's Trade War Prediction: US vs. China

This article has explored Ackman's Trade War Prediction, examining his stance on US-China relations, the potential for escalation, and the potential economic consequences. While Ackman's concerns are valid, considering alternative viewpoints and assessing his past track record allows for a more balanced perspective. The potential for a major trade war remains a significant risk, but the ultimate outcome will depend on the interplay of many factors. The economic risks and opportunities presented by Ackman's Trade War Prediction are substantial, and warrant close monitoring. Stay informed about developments in US-China relations and continue researching Ackman's Trade War Prediction for further insights into this critical geopolitical and economic issue. Further reading on topics such as US-China trade relations, geopolitical risk analysis, and investment strategies in times of uncertainty are recommended for a deeper understanding.

Featured Posts

-

Pfc Investigation Gensol Promoters Submit Fake Documents Eo W Suspended

Apr 27, 2025

Pfc Investigation Gensol Promoters Submit Fake Documents Eo W Suspended

Apr 27, 2025 -

Nosferatu The Vampyre A Now Toronto Detour Review

Apr 27, 2025

Nosferatu The Vampyre A Now Toronto Detour Review

Apr 27, 2025 -

Unlock Kanopy A Curated List Of Free Movies And Shows

Apr 27, 2025

Unlock Kanopy A Curated List Of Free Movies And Shows

Apr 27, 2025 -

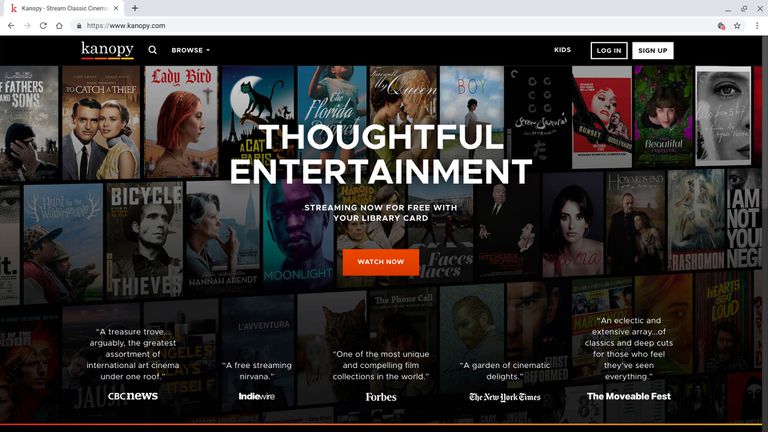

Political Divisions In Canada Albertas Unique Stance On Trump

Apr 27, 2025

Political Divisions In Canada Albertas Unique Stance On Trump

Apr 27, 2025 -

Controversial Appointment Hhs Taps Anti Vaccine Activist To Examine Vaccine Autism Claims

Apr 27, 2025

Controversial Appointment Hhs Taps Anti Vaccine Activist To Examine Vaccine Autism Claims

Apr 27, 2025