AbbVie (ABBV) Raises Profit Outlook: Strong Sales Growth From Newer Drugs

Table of Contents

Strong Performance of Newer Drugs: Skyrizi and Rinvoq

AbbVie's newer immunology drugs, Skyrizi and Rinvoq, are the key drivers behind the company's revised, positive profit outlook. These drugs have significantly exceeded sales expectations, demonstrating remarkable market penetration.

-

Skyrizi and Rinvoq's Exceptional Growth: Both Skyrizi and Rinvoq have shown impressive revenue growth, outperforming initial projections. Their success is a testament to AbbVie's R&D efforts and the market need for effective treatments in their respective therapeutic areas. (Note: Specific sales figures and growth percentages would be inserted here in a final, data-rich article).

-

Market Penetration in Dermatology and Rheumatology: Skyrizi and Rinvoq are making substantial inroads in the dermatology and rheumatology markets. Their efficacy and safety profiles are proving compelling to physicians and patients alike, leading to increased prescriptions and market share gains. (Note: Specific market share data would be included here).

-

Mitigating Humira Biosimilar Competition: The success of Skyrizi and Rinvoq is particularly significant given the increased competition from Humira biosimilars. These newer drugs are effectively mitigating the impact of Humira's patent expiration, ensuring AbbVie maintains a strong position in the immunology market.

Market Share Gains and Competitive Landscape

The launch of Humira biosimilars presented a considerable challenge to AbbVie. However, the company has effectively navigated this competitive landscape.

-

Strategic Response to Biosimilar Competition: AbbVie implemented a proactive strategy to counter the impact of biosimilars, focusing on the strong clinical profiles and market positioning of Skyrizi and Rinvoq. This has proven highly effective in maintaining market share and revenue streams. (Note: Specific details of the strategy would be included here).

-

Maintaining Market Leadership: Despite the emergence of biosimilars, AbbVie is maintaining its leadership position in several key therapeutic areas. The impressive sales of Skyrizi and Rinvoq are central to this continued market leadership. (Note: Supporting data would be added).

-

Future Competitive Dynamics: While competition remains a factor, AbbVie's robust pipeline and the continued strong performance of Skyrizi and Rinvoq suggest a sustainable competitive advantage in the coming years. (Note: Further analysis of future competitive landscape would be included).

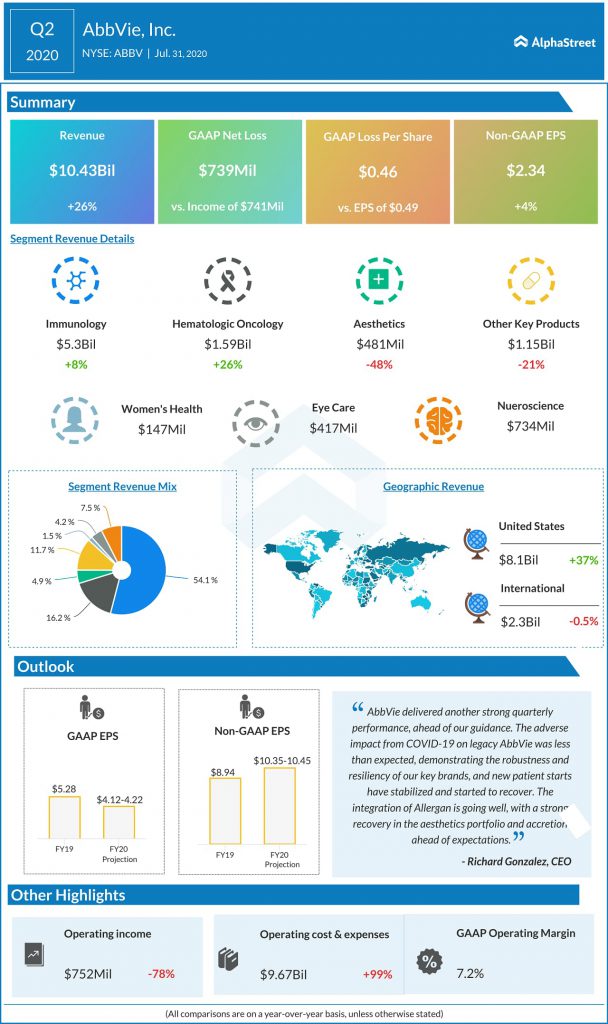

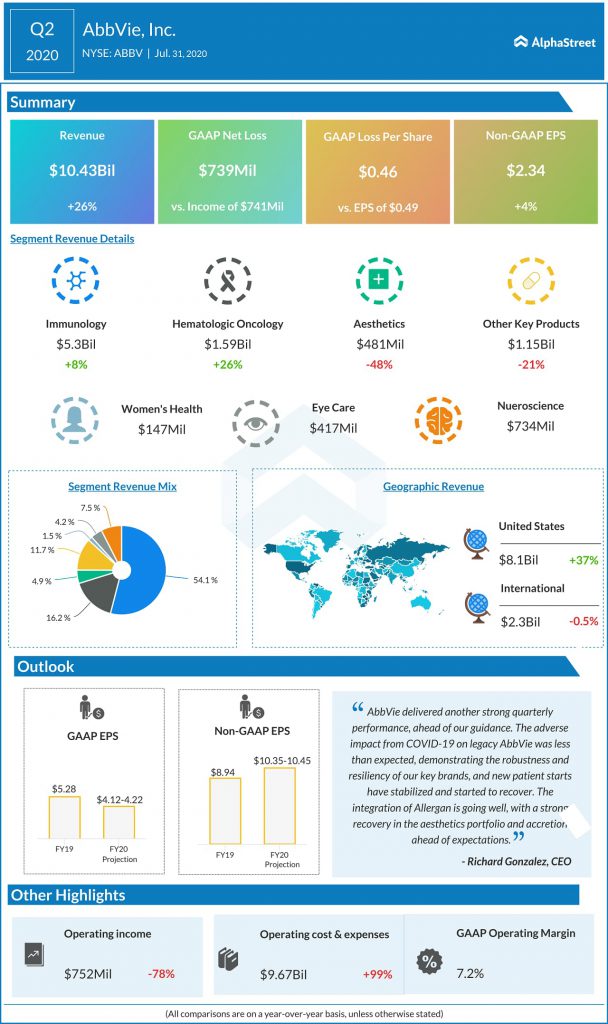

Revised Profit Outlook and Financial Projections

AbbVie's upward revision of its profit outlook underscores its confidence in its future performance. The strong sales of Skyrizi and Rinvoq are directly responsible for this positive shift.

-

Upward Revision of Financial Guidance: The company has increased its earnings per share (EPS) and revenue projections for the year, reflecting the substantial contribution of its newer drugs. (Note: Specific financial figures and details would be inserted here).

-

Investor Confidence: The revised outlook has boosted investor confidence in AbbVie's future prospects. This is reflected in the stock price, which has seen a positive response to the news. (Note: Stock price movement data would be included).

-

Positive Market Reaction: The market has reacted favorably to AbbVie's improved financial guidance, indicating a positive outlook for the company's future performance and highlighting the importance of Skyrizi and Rinvoq’s success. (Note: Market analysis would be included).

Long-Term Growth Strategy and Pipeline

AbbVie's continued investment in research and development (R&D) is a crucial factor in its long-term growth strategy. This commitment ensures a robust pipeline of innovative drugs.

-

Robust R&D Investment: AbbVie's substantial investment in R&D is fueling the development of promising new therapies. This commitment to innovation is key to the company’s continued success. (Note: Details on R&D spending and pipeline would be provided).

-

Promising Drugs in the Pipeline: The company's pipeline includes several promising drugs in various stages of development, with the potential to contribute significantly to future revenue growth. (Note: Specific details on promising drugs in the pipeline would be added).

-

Sustained Growth Potential: AbbVie's long-term growth strategy, underpinned by a strong pipeline and the success of Skyrizi and Rinvoq, positions the company for sustained success in the biopharmaceutical industry.

Conclusion

AbbVie's improved profit outlook is a direct result of the exceptional performance of its newer drugs, Skyrizi and Rinvoq. These drugs are successfully offsetting the impact of Humira biosimilars and are driving significant revenue growth. The company's robust financial projections and continued dedication to research and development further bolster investor confidence.

Call to Action: Stay informed about the latest developments concerning AbbVie (ABBV) stock and its innovative drug portfolio. Follow our updates on AbbVie's financial performance and future prospects to make well-informed investment decisions based on the ongoing success of AbbVie's newer drugs and its overall strategic direction.

Featured Posts

-

Peiling Wijst Uit 59 Steunt Het Nederlandse Koningshuis

Apr 26, 2025

Peiling Wijst Uit 59 Steunt Het Nederlandse Koningshuis

Apr 26, 2025 -

Pogacars Custom Colnago Y1 Rs The Fastest Bike In The Peloton

Apr 26, 2025

Pogacars Custom Colnago Y1 Rs The Fastest Bike In The Peloton

Apr 26, 2025 -

Republican Congressman Criticizes Gavin Newsom For Interviewing Steve Bannon

Apr 26, 2025

Republican Congressman Criticizes Gavin Newsom For Interviewing Steve Bannon

Apr 26, 2025 -

Bof A On High Stock Market Valuations Why Investors Shouldnt Panic

Apr 26, 2025

Bof A On High Stock Market Valuations Why Investors Shouldnt Panic

Apr 26, 2025 -

Stock Market Valuation Concerns Bof A Offers Reassurance

Apr 26, 2025

Stock Market Valuation Concerns Bof A Offers Reassurance

Apr 26, 2025